保利房地产(集团)股份有限公司

(600048)股票分析

基本面分析

一、我国宏观经济情况

据我国国家统计局初步核算数据显示,20##年第一至第三季度国内生产总值(GDP)为268660.2亿元(人民币),按可比价格计算同比增长10.6%。按照第一至第三季度国内生产总值的趋势,国家统计局预计,全年国内生产总值的增长速度将会保持在10%左右,消费者物价指数(CPI)涨幅全年将不超过3.5%,固定资产投资率将增长24%,国民经济出现克由回升向好向平稳较快增长的转变,经济运行完全符合宏观调控政策的要求,出现一个高增长、低通胀、高效益的良好形势。且针对工业增加值在本年上半年有了下滑趋势,以避免大起大落为宗旨的政府,应当会对宏观经济政策进行微调,以保证GDP的健康增长。

综合判断我国发展仍处于可以大有作为的重要战略机遇期,既面临难得的历史机遇,也面对诸多可以预见和难以预见的风险挑战。从国内看,工业化、信息化、城镇化、市场化、国际化深入发展,人均国民收入稳步增加,经济结构转型加快,市场需求潜力巨大,资金供给充裕便会有越来越多资金充裕的投资者会转变投资方向,尤其对股票证券市场的前景保持乐观的态度。因此,目前我国的宏观经济对股票市场发展的影响是正面的。

二、房地产行业情况

目前我国的房地产行业已经到了高速增长阶段。房地产行业占我国GDP比重逐年增长,作为我国的支柱产业的地位不容置疑,现有的房地产市场内部竞争激烈,但是进入该行业的门槛比较高,潜在进入者比较少,由于中国老百姓安土重迁的思想,房地产行业的需求量很大,并且没有替代品,由此看来房地产行业未来前景看好;但目前我国的房地产行业发展制度尚不完善,存在着很多投机行为,房地产泡沫严重,所以房地产行业虽然前景看好,但是近期内的起伏很大,甚至可能出现的极端问题。为遏制房价过快上涨的势头,20##年1~4月国家连续出台楼市调控政策。20##年4月17日,国务院又出台了新“国十条”,“遏制部分城市房价过快上涨,切实解决部分城市居民住房问题。” 这些都说明国家目前正出于整个国民经济发展的角度打压房价,房价过高,刚性需求得不到满足的同时投机者却大获其利,中国目前房地产行业的发展可以说是非常不健康的。 .

从中期角度看,房地产泡沫没有得到实质性抑制前,政策难以放松.随着未来半年楼市供应量的明显上升, 和需求在政策抑制下回归理性,楼市供需状况将从供不应求变为供大于求. 大公司促销现象在明年可能会扩大;另外根据资料数据,大部分房地产企业负债严重,60家大房企资金链, 三成负债率超70%,房地产行业又极易受货币调控影响,,宏观政策导致的向下的风险更大。

三、公司情况

公司基本介绍

保利房地产(集团)股份有限公司成立于1992年,是中国保利集团控股的大型国有房地产企业,也是中国保利集团房地产业务的主要运作平台,国家一级房地产开发资质企业,国有房地产企业综合实力榜首,并连续四年蝉联央企房地产品牌价值第一名。20##年,公司品牌价值达90.23亿元,为中国房地产"成长力领航品牌"。20##年7月,公司股票在上海证券交易所上市(代码(600048),20##年获评房地产上市公司综合价值第一名,并入选"20##年度中国上市公司优秀管理团队",20##年公司实现销售签约433.82亿元,截至20##年一季度,公司总资产已超千亿。

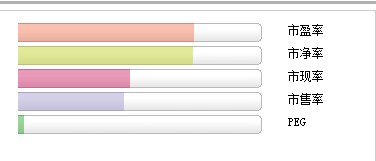

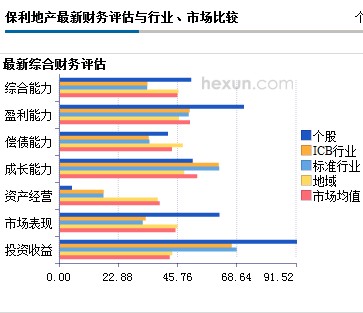

保利地产(600048)个股价值评估

综上所述,该股股票值得投资。

技术方面

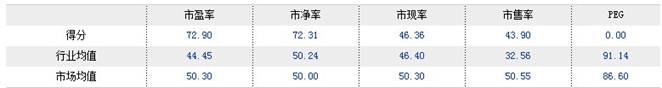

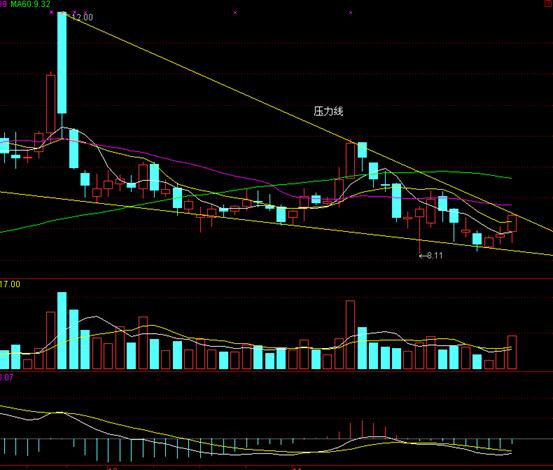

(图1)

如上图所示,保利地产形成一个M头跟头肩顶,不过都在颈线处得到支撑,所以该股的股价有力最有力支撑价为6.6元。

(图2)

该图显示股票正好处于一个下降楔形中,提供一个警号——市势正在逆转中,但新的回落浪较上一个回落浪波幅更小,说明沽售力量正减弱中,加上成交量在这阶段中的减少可证明市场卖压的减弱。同时结合移动平均背驰指标(MACD),在下跌行情里绿色柱体在缩短。股价上升超过压力线时,上升趋势就基本可以确定。

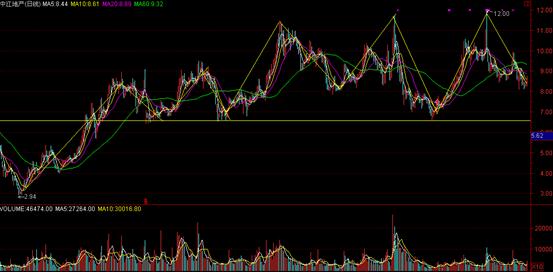

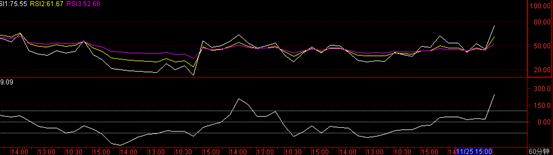

(图3)

(图4)

图3、4将分析周期调整为60分钟,在11.23的15:00时macd指标出现背离,11.26的13:00obv能量潮指标突破下降趋势线,RSI在11.26收盘时突破50压力线,预示短期股价会有机会上升,进一步考虑到obv能量潮大小,假如能突破A、B、C三个高度,这证明此次上升趋势可以确立,因为股价上涨往往伴随能量的增长,而且股价突破楔形上行(压力)线,那么就会出现一波上升行情。不过留意CCI指标现在处于超买阶段,注意出现背离及时离场。

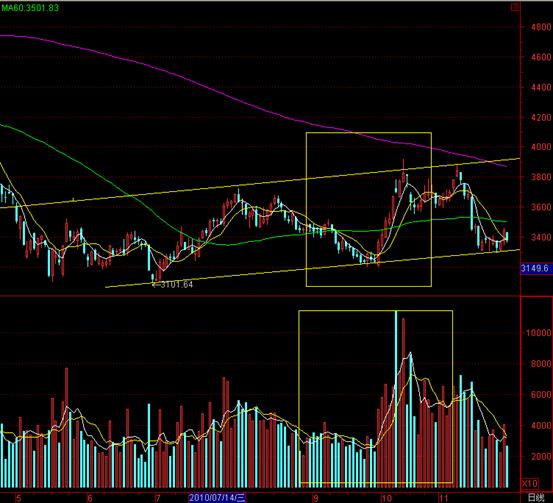

(图5)

图5为上证房地产指数,形成了一个变形下降旗行,在黄色框内量突然放大,企图突破形态的上行线,不过还是走不出空头走势中的整理阶段。

投资建议

保利地产5 月份实现签约面积61.73 万平米,签约金额为74.06 亿,同比增长31.71%和132.09%,今年年初至今合计签约243.31 万平米,签约金额281.04 亿,同比分别增长22.81%和82.37%。5 月新增2 块用地,土地款合计为7.6 亿。 5月,保利的推盘量超过70 亿,全月销售率超过70%,基本和上月持平,显示市场本身并无太多的变化,公司销售较好主要得益于自身供货量显著提升,另外本月销售均价接近12000 元,远高于去年的均价9600 元,主要原因是去年下半年开始,公司推货主要集中在09 年新增土地上,这部分土地项目区域位置明显更好,由此,公司销售均价将回归到正常的水平,预计全年均价在11000-12000 附近。

预计后续供货量将持续增加,供货充足已经略领先于同行使得公司销售实现的概率更大,维持全年800 亿的销售目标。截至目前,保利已经完成的销售额达到281 亿,若销售与去年同期持平,后续每个月仅需要完成54 亿的销售额,按照我们的预计,若实现800 亿的销售额,公司每月完成的量为74 亿,从目前的供货节奏来看,包括6 月的供货量就可能超过100 亿,我们认为,公司销售达到800 亿的既定目标还是很有希望的。

投资者没必要担心业绩大幅下调的风险,建议积极增持,公司为6 月份我们组合里面大股票中的首推。按照700 亿的销售额,12%的净利润率水平,公司每股创造的利润在1.4 左右(悲观假设),因此,而公司1 季度末账面预收款已经达到620 亿,投资者没必要太过于担忧业绩大幅下调的风险。维持20##年和2012 年1.18 元和1.68 元的盈利预测,目前股价对应2011 年的PE 不到8 倍,建议投资者积极增持。

第二篇:投资学 房地产和保利股票分析

Investment

姓 名:黄靖 彭聃

学 号:40903641 40903629

A.management

The real estate market to keep back situation,Investment held steady growth fell back,New commenced area grow lowly ,Home sales decline continues to expand,The real estate loan growth continue to fall back,Housing price fell,Down the number of city more than rise compared to the number of the city。

From the management policy ,Divided into several aspects of the management:

In the first place,management of Housing policy 。From 20## till 2012,Solve the problems of housing difficulties of low-income urban basic existing family housing 。Improve the real match rent and rental subsidy combination of low-rent housing system in Further ,In the key to speed up the housing system construction,Perfect the relevant land and Tax and credit support policies。

Next will be personal housing transfer business tax by 2 years time limit newly-built recovery to 5 years,Contain Chao Fang phenomenon。Business tax preferential cancelled,deed tax、Individuals to buy or sell stamp duty、Personal sold to maintain the land value added tax also。The last is to continue to support people live and improve the type of housing consumption,Inhibition of speculative investment purchase。Increase the differentiation credit policy enforcement prevent all types of housing mortgages loan risk。

Second,The management of the land policy。First to speed up the establishment and revision of 20## to 20## this year and affordable housing land supply plan,Classification to determine the construction of low-rent housing,forest zone、reclamation area and Mining area reconstruction shanty towns,Those rural reconstruction in three kinds of supportability project of the supply of land living standards and scale。

In the second place,In order to promote new urban construction land to the timely and effective supply and can be fully used,To further strengthen the construction land management,Correction and curb illegal in accordance with the use of rural collective land, etc,Required local governments to strengthen the supervision of construction land after,According to crack down on behavior。

Third,For the real estate business management。Strengthen to the real estate development enterprise purchase and financing of supervision。Special campaigns and clean up strength increasing,Strict laws and land idle and Fried to behavior,And restrictions have illegal enterprise newly that purchased the land 。Real estate development enterprises in the participation in land auction and development process,The shareholders shall not violate compasses to provide the loan guarantee or other related Zhuan Dai financing facilities。It is strictly prohibited to the real estate industry of state-owned and state holding enterprises to participate in the commercial land development and real estate business 。Commercial Banks to strengthen enterprise development of real estate mortgage loan and credit management review before after。To the existing land idle and Fried to the behavior of the real estate development enterprises,Commercial Banks shall not extend new development project loans,Securities regulatory department suspended approval for its listed refinancing and material assets reorganization。

Four,Market management system。Improving the real estate market information disclosure system。To the public housing construction plan and housing land supply plan year。Statistics department released study can reflect the different location、Different types of housing price change information。Increase the market transaction order supervision。In strict accordance with the declared price plain code marks a price foreign sales。Urban and rural construction and housing department to open to booking licence issued the commodity housing project to clean up,To the existing bidding up the prices of the behavior such as real estate development enterprise, the sanctions, the problem serious to cancel business qualification。

B.develop

As can be seen from the graph,As the control policy implementation and the national real estate market conditions change,The real estate loans outstanding growth began to fall back since May 20## ,Long-term aspects of the growth in real estate is a drop in the trend,But from 20## in the third quarter to 2012,Can see that in the short term is upward trend,But relatively small range。

The long term investment in real estate development held steady fall back,And because the real estate lending growth at the back,So the real estate development will continue falling trend。in addition,The national policy promulgation and implementation,Need to carry out the construction of room in security,So affordable housing development loan will quickly grow,Thus in the new commenced area will be growth low 。Because of the influence of growth policies,Low speed is due to the real estate business more really commodity house construction and development,Not many developers and policy implementation in the construction development guarantee room。In selling,Home sales decline continues to expand,This is because in the development,Demand is far greater than supply,Demand has been in the state,Although the new real estate development face down,But because of the high demand for a short time,Sales will still be in a rising trend。last, the rise of New commodity room house price may continue to fall。In growth,From the data shows up down the number of city for the first time rose more than the number of city。This is also suggests new commodity room house was really a great influence on the policy,in the state of Fell,In the future development,in shot time it is continue to fall 。But from the point of the development of long-term,the Construction of New commodity room house is also just short-term drop,Long-term will rise,This is from stimulation of the requirements of the demand trend,If sustained decline,The demand is bound to lead to continue to rise greatly,Want to or develop new commodity house,And keep prices rise is basically impossible of achievement,It is against the principle of economics。

C.Equity Analysis

1.Poly Real Estate(600048)

Poly real estate (group) Co., LTD. Is China poly group holdings of large state-owned real estate enterprise,Is China poly group cooperation estate business operation platform,National level of real estate development enterprise qualification 。July 31, 2006,The company stock on the Shanghai stock exchange listing,Be in after the reform of non-tradable shares,Restart the IPO market of the first listed the first real estate enterprise。

2.financial analysis

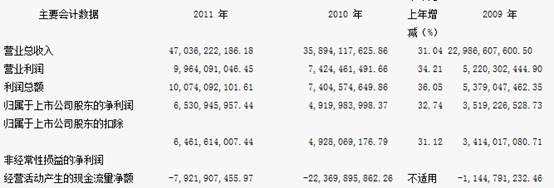

A .The major accounting data

From the data we can see that,the total business income is the highest in 20## year,With an increase of 31.04%,And operating profit in 20## is the highest。From the table we can see clearly,Overall growth is considerable,And in relegated to the shareholders of a listed company in the net profit,32.74% of the growth is also a larger,Can be summed up in the size of the company is growing,And also can see its profitability is more outstanding。

B .The major accounting data

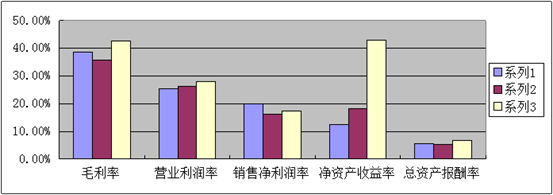

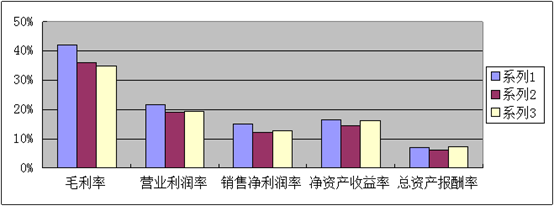

Poly

Poly

Wanke

Through the collection of data,Poly wanke to a series of data analysis。As can be seen from the graph。Poly gross margin and China wanke is basically the same,Operating Profit Margin and Sales profit margin is basically similar。But the total assets of the return rate than the average low poly wanke to 2%,And the net assets yield contrast to see。Poly is much higher than China wanke,It also shows that the earning power is poly than China wanke very much,Profit ability is stronger。

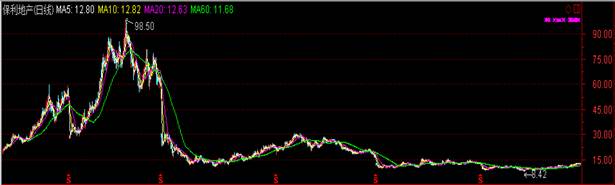

3.Poly K chart analysis

From the graph that,November 2007,Poly real estate to the highest bidder 98.5 a share,By 2008, however began to drop dramatically,And then in 20## once again the drop dramatically。

The cause of the rise in can be divided into two points,first: a bursting of the china house price bubble ,Too many people buying stock,Cause the stock has been surging。second:Bidding up the prices,Cause real estate strong reaction,Bring the highly profitable real estate business,high return,From essentially promoted stock prices。

The causes for the deterioration of the also can be divided into two points,first the 20## financial crisis to bring global financial impact,China's securities market all suffer,General decline。second:National policies many restrictions,Prevent overheating in housing prices,Inhibition of real estate recovery and continued development。So there two a boom and two slump。

But now,Real estate stock price is still in a recession,Poly real estate is the lowest to fluctuations。42 yuan per share,to this day,Poly real estate and most other real estate,In low state。Not too big or main reasons for fluctuation of the country is also being macroeconomic policy。

In November 2007, rise continuously K line, to 98.5, followed a cross, and then is the first crash to 65.72, short-term concussion wave after, change is a slump。

Now,The investment value has been underestimated badly,The future is valuable recursive likelihood。The risk from the current state and see,Message in a low risk,Central Line are in the low risk。But at present due to the risk in moderate,So go against short line operation。See chart from K,Now at a sideways suck raise stage,Short line volatility will exist,But in the long term is a rising trend。Recent data from the report can be informed,Signed on April realize company covers an area of 71.9 square,Signing amount of 9.148 billion yuan,Year-on-year growth of 45%, respectively and 37,Sales amount for the third month of historical high;Before April 24.014 billion yuan accumulated realize signing, an increase of 16。taking one with another,At present short line is not suitable for operation, but long term can consider poly real estate。

4.Comprehensive stock analysis

The company business analysis:Sales area and sales amount double keeping。In the first half of the sales contract amount is 21.76 billion yuan, covers an area of 267.1 square meters sales,Year-on-year growth of 5.8%, respectively, and 3.3。In the "wanbao zhaojin" four leading room in enterprises,Sales of positive growth in the first half of the poly real estate only one,Company sales ability is more outstanding。Actively give land, expand the land reserve。The company remains active in the first half of the expansion,In the new development 15 projects,Rights building area of 506 square meters,Still more radical than counterparts。The final report,The company consists of aiming project under construction in 115,Covers an area of 2640 square meters,Volume rate area reaches 4400 square meters。

The profit forecast and investment advice。The company in the next two years should be able to continue to keep the growth rate of faster,The company is expected to 20## to 20## years in earnings per share of 2.06 3.39 yuan,,From history valuation levels and see,The dynamic obviously low valuations。But on March the housing sector overall rally to a larger extent,The current market environment makes us more attention to short-term adjustment risks。Poly real estate is leading real estate enterprise listed in growth and robustness of both varieties,Both strong power scholars from renmin background,And have good performance support, while maintaining a high Speed development momentum,still is currently in real estate enterprise at the strategic allocation of good varieties。Considering The Comprehensive ,Still maintain the early stage of the company "increasing" rating。

5.Positive Analysis

In Europe and America, under the background of the stock market rebound sharply,The A share market also started strong rebound。In spite of brokers and real estate two big weight plate's lead,But because the quantity are suffering,The strength of the rebound do not look good。Although in many of the policy suppressed,In this year's market performance property counters were instead appears unusually bright beautiful。Perhaps is depressive time too long,Real estate leading performance stability and strong,So a line with property in performance this year especially well。Among,Poly Real Estate(600048)Repeated stock record high since this year。Poly real estate's share price has risen this year for 38%。A total of 94 million yuan net inflows the stock funds,The net inflow of capital city ranked two 11,,Push the stock rose 5.42,And drive the housing sector collective rebound。Real estate sector index rose 2.32 yesterday,Inflows into the in front,Most property counters were all appear to rise。As state-owned assets supervision and control of the real estate company scholars from renmin eventually,Poly real estate agency funds has been the focus of attention。Since from April,Brokers research institutions for the research report released in 30 more than a poly real estate for further comment,Rating are buying and recommend。Poly real estate in the first four months of this year, total realize subscribe amount of 30 billion yuan,Year-on-year growth of 41,Main products for just need to improve and first type needs;The company determined to be 20% a year to 30% of the earnings growth。In view of the company paln quarter sales sales structure for the mainstream market expansion amount, etc。

参考文献:

1.《房地产经济学(21世纪房地产经营管理系列教材)》董藩,丁宏,陶斐斐 编著/20##-03-01/清华大学出版社

2.《中国房地产项目开发全程指引》李海峰编/20##-01-01/中信出版社

3.《商业房地产开发与管理实务(第2版)》杨宝民,江禾 著/20##-07-01/清华大学出版社

4.《房地产管理信息系统》张所地主编/20##-02-01/东北财经大学出版社

5.《中华人民共和国城市房地产管理法(案例注释版)》

6.《中国房地产投资策略分析》张健著,彼得·万克斯曼首席 顾问/20##-04-01/上海财经大学

7.《中国房地产统计年鉴.20##-2006》国家统计局 编/20##-10-01/经济管理出版社

8.《中国房地产发展》牛凤瑞 主编/20##-04-01/社会科学文献出版社

9.《股票K线战法》(美)尼森(Nison,S.) 著/20##-04-01/中国宇航出版社

10.《股票大作手回忆录》(美)爱德温·李费佛 著,芝麻 译/20##-07-01/地震出版社

11.《股票买卖定式》曾巍著/20##-04-01/上海社会科学院出版社有限公司

12.《股票投机原理》(美)尼尔森 著,美信翻译公司 译/20##-01-01/天津社会科学院出版社