虚假财务报告的后果

1.欺诈和欺诈性财务报告

从广义上讲,欺诈可能被定义为故意以不正当行为或非法手段获得的增益以及优势。这可能包括:(鲁宾G . A .,2007)财务报告舞弊;挪用资产(在内部或外部的系统中做出,如:贪污,工资欺诈和盗窃等行为);获得非法资产或进行不道德的活动(如:利用过度的客户结算或欺诈性的销售行为);用于非法目的的费用(商业和公共贿赂以及其他不正当支付系统);欺瞒获得的收入或有意回避成本(在系统实体中对员工或第三方欺诈,或当一个实体通过一定手段故意避免成本,如收入税和销售税);对公司的欺诈行为(例如假冒生产者故意侵犯知识产权)。可以通过对该部门机构的制度的完整性的认识来调查它的欺诈行为。它在调查了世界银行集团和银行的融资项目后,指控了他们的欺诈和腐败行为,认定了哪些行为可以被认为行为是在银行系统中的欺诈或腐败行为:(Banca银行,蒙迪艾尔.2009)拍卖欺诈,在拍卖中理解所有的参与者,在合同执行中的欺诈,避免对合同执行的审计,做出不适当的价格和伙伴关系,让审计人员误判合同中的成本和工作,并对审计人员进行贿赂,错误地使用世界银行的资金或自己的立场,这就是在运动,偷窃和欺骗的情况下的欺诈。虽然所有类别的欺诈都可以说是主要的和值得辩论,但是只有财务报告舞弊才是影响最大的和最值得研究的。(鲁宾G . A .,2007)

在财务报告中欺诈行为的基础是肇事者(董事,审计人员,员工等)错误地提出了现实的自觉意图。但错误地提出现实的自觉意图的原因可能是欺诈财务报告中任何一项不当资产的回收。因此,“欺诈性报告仅指故意歪曲,包括遗漏大量财务信息旨在误导财务报表的使用者”也可译为(波帕一人,铝。罗斯·,2009):操纵,伪造,伪造或更改文件或证明文件,错误或遗漏的事件、交易或信息,故意滥用会计原则与价值、分类、方式介绍或信息传递,虚拟条目记录(年底)操纵结果或达到其他目标,调整不正确的假设和判断来估计帐户余额,遗漏、发展或拖延承认事件或交易发生在报告所述期间,隐瞒或保密的事实可能影响的数量记录在财务报表,在改变记录或条件的重大交易中;进行复杂的交易旨在歪曲实体的财务状况或性能。关注不当资产回收,反对虚假财务报告包括(Popa I., Man Al. Rus A., 2009):过去为收回收入(收入来自无担保债权人);盗窃实物资产或产权,用没有进入会计账户的商品或服务支付给虚拟供应商;使用个人资产(包括个人贷款担保),假记录来弥补亏损。这些行为往往是次要的,通常是由员工虽然有时,经理人自己参与此类活动。侵占资产也可能包括的费用用于非法目的,在形式上的贿赂,是判断是否是为商业或公务目的。虽然不当取得资产往往是不显着的财务报表,。它可能继续造成组织的重大损失。(苏丹湾,2008)

2.提高财务报告舞弊的因素

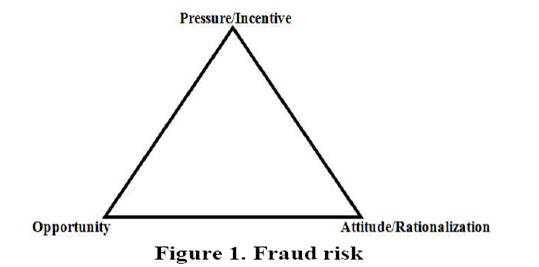

根据国家委员会进行的研究报告指出金融欺诈者(或特雷德韦委员会)的财务报告舞弊的发生通常存在者某些环境和机遇,机构或个人的力量。这些力量的消涨增加企业的财务压力和扰乱了企业的奖励措施,鼓励了个人和公司从事欺诈性财务报告。当正确的力量对比达成时,它已经让企业产生了虚假的财务报告(虚假财务报告全国委员会的报告,1987)。从1950起,教授唐纳德·克雷西就开始研究导致企业犯下欺诈行为的三因素。根据他的研究,他得出当欺诈行为的发生,有三个因素共同行动:意图(预谋),机会和压力,称为欺诈三角的结论。”(见图1)。

虽然以上因素形成的“欺诈三角”,这些因素是足够表达一个发生在任何时间的欺诈。但是这些因素却并不能说明他们对于欺诈行为的作用顺序是怎样的,从而达到了解欺诈行为的发生。(苏丹湾,2008)

机会或压力是第一影响因素,个人发生欺诈行为是一般是因为过度的压力,实现财务目标的奖励的诱导下,为了实现财务目标,把不切实际的乐观消息发布在年度报告。此外,一个公司可能受到威胁和压力,因为激烈的竞争,因为市场饱和或突然的变化,因为企业的并购(兼并),从而需要进行融资或使得企业的现金流出现问题。从而产生了甚至让诚实的人都会进行诈骗的环境中。

机会是指那些使得欺诈更加的容易发生,而且让他做出欺诈的决定所面临的困难更少(Hooper J. M., Forneli C. M, 2010)。因此,无效的控制或无控制主张欺诈意图。这些因素可以直接相关的监管不力的管理或无效的董事会和审计委员会监督报告和内部控制。

态度或预谋是触发欺诈行为的重要因素,它是指行为人必须具有一个将要进行诈骗行为的心态。检测危险因素决定董事会成员,管理,员工倾向于这样的意图可能是相当困难的。所以当一个公司监控和过程阻止和发现欺诈行为,它必须遵循三方面,因为欺诈涉及奖励或压力犯下欺诈行为,认为这样做的机会,和一些推理(苏丹B .,2008)。

3.是谁编制的虚假财务报告以及如何编制虚假财务报告

据报道美国国家委员会所研究的大多数的虚假财务报告中,公司的管理者,如行政总裁,总裁和首席财务官,都是虚假财务报告编制的参与者,都可以被称为欺诈者。因为在一般情况下,他们都能够发现企业是否故意虚假披露会计文件和伪造的记录。此外,委员会的研究还表明,虽然虚假财务报告的作者在作虚假财务报告时都采用了不同的方式,但是他们行动的目的都总是为了夸大公司其资产或高估或平滑收益。此外,虚假财务报告并不总是在一开始就公开扭曲财务报表,并且能够让人一下辨认出来。在许多情况下,财务报告舞弊行为发生的峰值点都是在一些旨在解决经营困难的财务指标上。最初,财务报告在峰值点只是可能成为虚假财务报告的问题点,但他们让可能成为虚假财务报告的问题点成为了现实,特别是在企业的管理当局允许或鼓励这种欺诈活动时,这就使得欺诈性财务报告产生了。因此,我们可以说,参与欺诈性财务报告潜在罪犯的人员基本上集中于高级管理层和员工之间的中层人员。在描述如何在犯下欺诈行为的虚假财务报表的一本书中(Zabihollah R., 2005))使用的一个专业术语。财务报告舞弊特征或称为”盈余管理”(阮光,2008)。然而“盈余管理”并不一定就指的是非法行动。根据会计政策(美国公认会计准则)或其他会计准则(国际财务报告准则)作出的关于如何区别合法和非法收益的相关规定。在他们的财务报表中所提交的财务信息是真实的,并且其处理是按照适用的会计准则所做的,我们就认为企业从事的是合法的盈余管理。同时我们也可以说,盈余管理是一个在虚假财务报告中,“涉及不当收益所产生的收入,资产高估或低估负债”( Zabihollah R., 2005)以达到操纵盈余的目的,管理人员使用不同的激进会计技术,已经成为影响人为地增加或减少的收入,利润,或每股盈余。他们使用这些策略,以应付压力,市场上。一般来说,公司是最经常所感到压力中,其一是从事证券分析的人士期望他们公布尽可能多的财务信息,其二是股东的期望,期望根据企业的投资,能在在很短的时间内为股东赢得更大的利润。如果投资者未能获得预期的股息时,因此企业的每股收益可能会无法满足投资者,从而导致公司的股票下跌。因此。盈余管理的动机可能是来自企业的各种压力以及投资者利益最大化的愿望。然而,管理者也不总是进行以高估收益为手段的舞弊。他们也有可能会在相反的情况下,减少这些收益,其这样做的目的是逃避支付费用。

一个涉嫌欺诈财务报表实际案例中一种被叫做“时间化”的技术(亚力山大,2007)。这项技术是指管理人员通过一定的财务报表编制方法,将业绩不好的一段时间的财务信息隐藏起来。这种方法是通过操纵盈余,使得财务报告显示出企业的盈余有一个随着时间的推移稳步增加的趋势。由于投资者对于企业盈利的降低会有消极的反应,会让他们认为这样的企业是不安全和危险的。因此企业的财务报告显示企业盈余随时间的推移稳步增加的情况,才会让投资者最终满意,并让企业股票保持在较高的价格上。

另一种形式的欺诈行为被称为 “大坑 ”(Hooper J. M., Forneli C. M, 2010),就是在编制虚假财务报告时,企业通过操纵损益,使得企业在国家形势非常好的情况下,让企业的收益显得比实际情况要糟。使得投资者会认为企业遭到了重大损失,他们就会认为国家的大好形势会提高企业的收益。由于这一造假,会使得企业财务报告未来的成本降低和利润增加更加的自然。换句话说,公司需要一个坑洞。“在一年就可以表明,未来利润必然是会增加的。”

Zabihollah Rezaee研究表明(2005)了最常见的欺诈性财务报表编制所使用的方法,80%的财务报表舞弊都是通过一定的方法造成资产的夸大收入,而剩下的20%则是由于低估了负债和费用。

4.欺诈性财务报告的受害者

财务报表的编制至少一年一次的目的是满足一些潜在用户的共同的信息需求。对于许多的投资者来说,财务报表是作为企业财务信息的主要来源,因此对于投资者的决策具有极大的影响。(参见图2)

投资者当然是虚假财务报告第一个受害者。如果公司盈利被夸大了,使得投资者购买该企业的股票,那就可以算是被欺诈了,如果公司的收益是被低估了,那么投资者的利益就是被公司隐瞒而失去的。然而,他们并不是唯一被虚假财务报告影响的。受害者还包括其他依赖公司的财务报告信息的公司,如:银行和其他提供资金给该公司的金融机构,对于会因为公司业绩影响的供应商和客户,合作伙伴,提供投资咨询有关信息的金融分析师和证券发行人,律师和可能因为发布在保险公司的索赔。为了避免因为受害者地位的而使得受害者受到虚假财务报告的影响。任何用户,无论是金融家,借款人,保险公司,投资者或股东,都可以观看企业的总的财务报告让大家可以仔细分析企业的财务报告从而发现企业的财务报告欺诈,或者确定下列可以被视为欺诈的情形(Weir J.,2009):公司报告利润却不是很好,现金流量很大,毛利水平仍然很高,即使该公司面临来自稳定物价的市场压力;债务水平上升,而销售则是不变或下降;本公司是接近或违背银行的协定;有一个明显的年末调整;存在大量的对于高管的奖金。

结论

虽然实现财务报告所谓的“欺诈行为”是指短期成果“盈余”,但是通过他们作用我们可以得出以下后果:虚假财务报告会破坏信誉,质量,透明度和完整的财务报告程序;危害审计职业特别是审计和审计事务所的完整性和客观性;削弱了资本市场的信心,以及和财务信息的可靠性;降低了资本市场效率;不利影响经济增长;产生了巨大的诉讼费用;破坏人的职业参与欺诈财务报表;他们因为破产或重大经济损失涉及公司财务报表欺诈;削弱了公众的信心和信任,。

THE CONSEQUENCES OF FRAUDULENT FINANCIAL REPORTING

Lecturer PhD. Mariana VLAD

Faculty of Economics and Public Administration, .tefan cel Mare” University of Suceava, Romania

marianav@seap.usv.ro

Associate Professor PhD. Mihaela TULVINSCHI

Faculty of Economics and Public Administration, .tefan cel Mare” University of Suceava, Romania

mihaelat@seap.usv.ro

Assistant PhD. Student Irina CHIRI..

Faculty of Economics and Public Administration, .tefan cel Mare” University of Suceava, Romania

irinachirita@seap.usv.ro

1. FRAUD AND FRAUDULENT FINANCIAL STATEMENTS

Broadly speaking, fraud may be defined as an intentional act to gain an advantage by an unfair or unlawful gain. It may include: (Rubin G. A., 2007) fraudulent financial reporting; misappropriation of assets (inside or outside the system, such as: embezzlement, payroll fraud and theft); revenue or assets acquired from illegal or unethical activities (excessive customer billing or fraudulent sales practices); costs for illicit purposes (commercial and public bribery as well as other improper payment systems); income received fraudulently or intentionally avoided costs (systems in which an entity commits fraud against its employees or to third parties, or when an entity intentionally avoided costs such as income taxes and sales taxes); fraud against the company (e.g. counterfeit producers knowingly violates intellectual property rights). The Department for Institutional Integrity, which investigates allegations of fraud and corruption within the World Bank Group and the Bank’s financed projects, specifies the actions that might be considered fraud or corruption in the banking system: (Banca Mondial., 2009) auction fraud, understandings among participants in the auction, fraud during the execution of the contract, audit avoidance, setting inappropriate prices and partnerships, miscalculation of costs and work, acceptance of gifts or bribes, soliciting or receiving bribes, incorrectly using the World Bank funds or its positions, fraud in the case of movements, theft and deception. Although all categories of fraud are major and worthy to be debated, only fraudulent financial reporting is handled in the following sections. (Rubin G. A., 2007)

Fraud in financial reporting is based on conscious intent of the perpetrator (directors, auditors, employees, etc.) to wrongfully present the reality. But the intended act to wrongfully presenting the reality may be the cause of either fraudulent financial reporting either of undue assets reclaims. Therefore, “fraudulent reporting only refers to intentional misrepresentation, including omissions of amounts designed to mislead the users of the financial statements” can be translated as (Popa I., Man Al. Rus A., 2009): manipulation, forgery, counterfeit or alteration of records or supporting documentation, misstatements/omissions regarding events/transactions/information, intentional misapplication of accounting principles related to values/classification/manner of presentation/delivery of information, fictitious entries records (towards the end of the year) tomanipulate operating results or achieve other objectives, improper adjustments of the assumptions and changing in judgments used to estimate account balances, omissions/advances/delays in recognition of events/transactions that occurred during the reporting period, concealment or nondisclosure of facts that could affect the amounts recorded in the financial statements, engaging in complex transactions designed to distort the entity's financial position or performance; changing the records or conditions of significant transactions. Opposed to fraudulent financial reporting, an undue asset reclaims concern (Popa I., Man Al. Rus A., 2009): revenue dilapidation (revenue coming from unwarranted claims / diverting income), theft of physical assets or intellectual property, payments to fictitious suppliers, without the entry of goods / services, use of assets in personal interest (including also personal loan guarantees), false records to cover the deficit. These abuses are often minor and are usually committed by employees, although sometimes, the managers themselves are involved in such activities. Misappropriation of assets may also include expenses incurred for illicit purposes, in the form of bribery, whether for commercial or official purposes. Although improperly acquiring assets often is not significant for financial statements, .it may continue to result in substantial losses for the organization. (Soltani B., 2008)

2. FACTORS THAT ENHANCED FRAUDULENT FINANCIAL REPORTING

According to studies conducted by the National Commission on Reporting Financial Fraudster in America (or Treadway Commission) fraudulent financial reporting usually occurs as a result of certain environmental forces and opportunities, institutional or individual. These forces and opportunities add pressures and incentives that encourage individuals and companies to engage in fraudulent financial reporting. When the right mix of forces and opportunities is reached, it can produce fraudulent financial reporting (Report of the National Commission on Fraudulent Financial Reporting, 1987). Ever since 1950, Professor Donald R. Cressey, has studied the factors that lead to committing fraudulent acts. According to his studies, he concluded that when fraud does occur, there are three factors that act together: intent (premeditation), opportunity and pressure, known as the .fraud triangle” (see Figure 1).

Although the factors above are forming the "fraud triangle", it’s sufficient that one to take place at a time, for fraud to occur. The sequence steps in order to exercise the act of fraud are recounted below (Soltani B., 2008)

Incentives or pressures are the first factors that influence individuals to commit fraud and it refers to excessive pressure to achieve financial targets, to induce optimistic and unrealistic messages in annual reports. In addition, a firm may be threatened and pressured also by intense competition, by market saturation or sudden changes, acquisitions (mergers), the financing need or cash flow problems. Even otherwise honest individuals can commit fraud in an environment that imposes such threats.

Opportunity refers to those factors that enable "fraud to be more easily committed and detection less probable (Hooper J. M., Forneli C. M, 2010).Therefore, ineffective controls or absence of control favors fraud intentions. These factors can be related directly to inadequate monitoring by management or the ineffectiveness of the board of directors or of the audit committee to oversee the reporting and the internal control.

Attitude or premeditation is the trigger factor of the fraud act and refers to the fact that the perpetrator must have a mindset that would justify or premeditate the act of fraud. Detection of risk factors that determine board members, management, employees to be predisposed to such intent may be quite difficult. So when a company monitors people and processes to discourage and detect fraud, it must follow the three aspects, because fraud involves incentives or pressure to commit a fraudulent act, a perceived opportunity to do so, and some reasoning.(Soltani B., 2008)

3. WHO AND HOW COMMITS FRAUDULENT FINANCIAL STATEMENTS

According to the Report of the USA National Commission on Fraudster Financial Reporting in the majority of the studied cases, the company’s management, such as chief executive, president and chief financial officer, were the fraudulent perpetrators. In some cases, it was found that there were made intentional false disclosures from the accountant throughout falsified documents and records Furthermore, the committee studies have shown that while the authors of fraudulent financial reporting have used different means, the effect of their actions is almost always consist of overestimating or smoothing earnings in order to exaggerate the company or its assets. In addition, fraudulent financial reporting does not always begin with an openly recognizable act of distortion of the financial statements. In many cases, fraudulent financial reporting is the peak point of a number of acts intended to address operational difficulties. Initially, the activities may not be fraudulent, but in time they may become probable, especially when the tone set by management permits or encourages such activities in order to have fraudulent financial reporting. Thus, we can say that potential criminals involved in fraudulent financial reporting can be both in senior management and among mid-level employees, but we can think also on organized criminal organizations for this purpose. To describe ways in which fraud is committed on the financial statements, the literature (Zabihollah R., 2005) uses the term .fraudulent financial reporting schemes” or .earnings management” (Nguyen K., 2008). However the term “earnings management" does not always refer to an illegitimate action. The accounting policies (U.S. GAAP) or other accounting standards (IFRS) make the difference between legitimate and illegitimate gains. When companies engage in legitimate administration of earnings management within their financial statements, they are submitted as true and are treated in accordance with applicable accounting standards. We can say that earnings management is a fraud when it “involves gains arising from improper revenue recognition, overstating of assets or undervaluation of liabilities” (Zabihollah R., 2005). In order to manipulate the earnings, managers use different aggressive accounting techniques, which have as effect the artificially increase or decrease in revenues, profits, or earnings per share. They use these tactics, hoping to cope with the pressures that are on the market. In general, companies that are traded most often feel the pressure, either from securities analysts who expect them to disclose as much information as possible, either from shareholders who expect, based on their investments, for companies to obtain bigger profits in a short period of time. Failure to obtain expected dividends by investors and hence earnings per share can cause a significant decline in the capitalization of a company. Therefore .earnings management” may be motivated by the pressure or the desire to maximize performance based payments. However, managers do not always aim for the purpose of overestimating management earnings. They are also interested in the opposite situation, to reduce these gains, especially when the intention is that of evading the payment of fees.

A practical case of committing fraud in financial statements is .time uniformization of revenue”(Alexander D., 2007). This technique is used by managers to hide some bad periods and involve a manipulation of earnings to show that there was a steady increase over time, although not stated by facts. Given the fact that investors react negatively to the earnings of companies which they perceive as unsafe and risky, standardization of revenue finally meets the satisfaction of investors and maintains a high price of the shares.

Another form of fraud known as “big bath behavior” (Hooper J. M., Forneli C. M, 2010), occurs when companies manipulate the profit and loss account, to make the years in which the situation has been very good to seem worse than it really is. Therefore, taking into account the significant losses, they hope to consolidate and to wipe them all at once. As a result of this action, future costs are reduced and natural profits implicitly increased. In other words, the company takes a .big bath” in one year so it can show that the profit will be increasing in the future. Handling can cause either an increase in the prices of stocks or an increase in performance bonuses for management.

4. VICTIMS OF FRAUDULENT REPORTING

Financial statements are prepared and presented at least once a year and aim to meet the information needs common to a number of potential users. Many visitors take the financial statements presented as the main source of financial information and therefore a misrepresentation may affect decisions. (See figure 2)

Investors are of course the first victims of fraudulent financial reporting. If company earnings are overstated, investors who buy are deceived and if earnings are understated, the buyers are those who will lose. However they are not the only ones that bear the immediate and harmful effects. The victim list includes others who rely on information from the company's financial reports: banks and other financial institutions lend funds to the company, suppliers, customers seeking to make performance on the company’s contracts, partners, financial analysts providing investment advice about the issuer and its securities, lawyers for the issuer and probably for the issued insurance companies issuing insurance for directors and officers trust and then large claims. To avoid the victim position of fraudulent financial reporting, any user, whether a financier, a borrower, an insurer, investor or shareholder, can make a fraudulent statement when one asks himself around the possibility of achieving or identification of one of the following situations (Weir J.,2009): company reported profit but is not very good on cash flows; gross profit levels remain high, even if the company faces pressure from the market to stabilize prices; receivable accounts, debt and inventory accounts levels are rising, while sales are steady or declining; the company is close to breaching banking pacts; there is a significant year-end adjustments; there is substantial bonuses for top executives.

CONCLUSIONS :

Although the achievement of financial reporting by so-called "fraudulent scheme" refers to short-term achievement of "management earnings ", they may draw the following consequences in time: undermines the credibility, quality, transparency and integrity of financial reporting process; endangers the integrity and objectivity of the auditing profession, especially auditors and audit firms; diminishes the confidence in the capital markets, as well as in market participants and in the reliability of financial information; makes capital markets less efficient; adversely affects economic growth; huge lawsuit costs; destroys the careers of people involved in fraudulent financial statements; they cause bankruptcy or substantial economic losses for companies involved in financial statement fraud; encourages regulatory intervention; erodes public confidence and trust in accounting and auditing profession.