XXXXXX有限公司章程

为适应社会主义市场经济的要求,发展生产力,依据《中华人民共和国公司法》(以下简称《公司法》)及其他有关法律、行政法规的规定,由徐琳、赵志国、谭双 共三个股东共同出资设立人人汽车租赁有限公司。特制定本章程。

第一章 公司名称和住所

第一条 公司名称:长沙市人人汽车租赁有限公司(以下简称公司)

第二条 公司地址:湖南省长沙市芙蓉区马王堆北路泰禹公馆南栋323

第二章 公司经营范围

第三条 公司经营范围: 小车租赁,大巴租赁,自驾,代驾,电子商务。

第三章 公司注册资本

第四条 公司注册资本:人民币20万元。股东以认缴资本承担有限责任。

公司增加或减少注册资本,必须召开股东会并由全体股东通过并作出决议。公司减少注册资本,应当在报纸上登载公司减少注册资本公告,并自公告之日起45日后依法向登记机关办理变更登记手续。

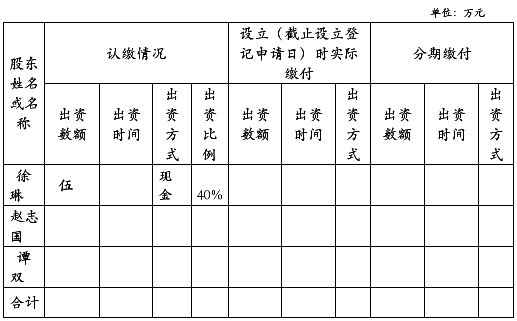

第四章 股东的名称、出资方式、认缴额

第五条 股东名称、出资方式、出资额、出资比例及出资时间如下:

第六条 公司成立后,应当向股东签发出资(或首期出资)证明书。

第五章 公司注册资本约定

第七条 公司注册资本约定如下:

(一)股东以其认缴的出资额为限对公司承担责任。

(二)股东应当按期足额缴纳各自所认缴的出资额,股东不按照规定缴纳出资的,除应当向公司足额缴纳外,还应当向已按期足额缴纳出资的股东承担违约责任。

(三)股东滥用股东权利给公司或者其他股东造成损失的,应当依法承担赔偿责任。股东滥用公司法人独立地位和股东有限责任,逃避债务,严重损害公司债权人利益的,应当对公司债务承担连带责任。

第六章 股东的权利和义务

第八条 股东享有如下权利:

⑴ 参加或推选代表参加股东会并根据其出资比例行使表决权;

⑵ 了解公司经营状况和财务状况;

⑶ 选举和被选举为执行董事和监事;

⑷ 依照法律、法规和公司章程的规定获取股利;

⑸ 优先购买其他股东转让的出资;

⑹ 优先购买公司新增的注册资本;

⑺ 公司终止后,依法分得公司的剩余财产;

⑻ 有权查阅股东会会议记录和公司财务报告。

第九条 股东承担以下义务:

⑴ 遵守公司章程;

⑵ 按期缴纳所认缴的出资;

⑶ 依其所认缴的出资额为限承担公司债务;

⑷ 在公司办理登记注册手续后,股东不得抽回投资。

第七章 股东转让出资的条件

第十条 股东之间可以相互转让其全部或者部分出资。

第十一条 股东转让出资由股东会讨论通过。股东向股东以外的人转让其出资时,必须经全体股东一致同意;不同意转让的股东应当购买该转让的出资,如果不购买该转让的出资,视为同意转让。

第十二条 股东依法转让其出资后,由公司将受让人的名称、住所以及受让的出资额记载于股东名册。

第八章 公司的机构及其产生办法、职权、议事规则

第十三条 股东会由全体股东组成,是公司的权力机构,行使下列职权:

⑴ 决定公司的经营方针和投资计划;

⑵ 选举和更换执行董事,决定有关执行董事的报酬事项;

⑶ 选举和更换由股东代表出任的监事,决定有关监事的报酬事项;

⑷审议批准执行董事的报告;

⑸ 审议批准监事的报告;

⑹ 审议批准公司的年度财务预算方案、决算方案;

⑺ 审议批准公司的利润分配方案和弥补亏损的方案;

⑻ 对公司增加或者减少注册资本作出决议;

⑼ 对股东向股东以外的人转让出资作出决议;

⑽ 对公司合并、分立、变更公司形式,解散和清算等事项作出决议;

⑾修改公司章程;

⑿聘任或解聘公司经理。

第十四条 股东会的首次会议由出资最多的股东召集和主持。

第十五条 股东会会议由股东按照出资比例行使表决权。

第十六条 股东会议分定期会议和临时会议,并应当于会议召开十五日以前通知全体股东。定期会议应每半年召开一次,临时会议由代表四分之一以上表决权的股东或者监事提议方可召开。股东出席股东会议也可书面委托他人参加股东会议,行使委托书中载明的权力。

第十七条 股东会会议由执行董事召集并主持。执行董事因特殊原因不能履行职务时,由执行董事书面委托其他人召集并主持,被委托人全权履行执行董事的职权。

第十八条 股东会会议应对所议事项作出决议,决议应由全体股东表决通过,股东会应当对所议事项的决定作出会议记录,出席会议的股东应当在会议记录上签名。

第十九条 公司不设立董事会,设执行董事X人,执行董事为公司的法定代表人,对公司股东会负责,由股东会选举产生。执行董事任期叁年,任期届满,可连选连任。执行董事在任期届满前,股东会不得无故解除其职务。

第二十条 执行董事对股东会负责,行使下列职权:

⑴ 负责召集和主持股东会会议,检查股东会会议的落实情况,并向股东会报告工作;

⑵ 执行股东会决议;

⑶ 决定公司经营计划和投资方案;

⑷ 制订公司的年度财务方案、决算方案;

⑸ 制订公司的利润分配方案和弥补亏损方案;

⑹ 制订公司增加或者减少注册资本的方案;

⑺ 拟订公司合并、分立、变更公司形式、解散的方案;

⑻ 决定公司内部管理机构的设置;

⑼ 提名公司经理人选,根据经理的提名,聘任或者解聘财务负责人,决定其报酬事项。

⑽ 制定公司的基本管理制度;

⑾、代表公司签署有关文件;

⑿、在发生战争、特大自然灾害等紧急情况下,对公司事务行使特别裁决权和处置权,但这类裁决权和处置权必须符合公司利益,并在事后向股东会报告;

第二十一条 公司设经理X名,由股东会聘任或解聘,经理对股东会负责。

第二十二条 经理行使下列职权:

⑴主持公司的生产经营管理工作;

⑵组织实施公司年度经营计划和投资方案;

⑶拟定公司内部管理机构设置方案;

⑷拟定公司的基本管理制度;

⑸制定公司的具体规章;

⑹提请聘任或者解聘公司财务负责人;

⑺聘任或者解聘除应由执行董事聘任或者解聘以外的负责管理人员。

第二十三条 公司设立监事X人,由公司股东会选举产生。监事对股东会负责,监事任期为三年,任期届满,可连选连任。监事行使下列职权:

①检查公司财务;

②对执行董事、经理执行公司职务时违反纪律、法规或者公司章程的行为进行监督;

③当执行董事、经理的行为损害公司的利益时,要求执行董事、经理予以纠正;

④提议召开临时股东会;

监事列席股东会会议。

第二十四条 公司执行董事、经理、财务负责人不得兼任公司监事。

第九章 财务、会计、利润分配及劳动用工制度

第二十五条 公司应当依照法律、行政法规和国务院财政主管部门的规定建立本公司的财务、会计制度,并应在每一会计年度终了时制作财务会计报告,并应于第二年三月三十一日送交各股东。

第二十六条 公司利润分配按照《公司法》及有关法律、行政法规、国务院财务主管部门的规定执行。

第二十七条 劳动用工制度按国家法律、法规及国务院劳动部门的有关规定执行。

第十章 公司的解散事由与清算办法

第二十八条 公司营业期限N年,从《营业执照》签发之日起计算。

第二十九条 公司有下列情形之一的可以解散:

⑴ 公司章程规定的营业期限届满或者公司章程规定的其他解散事由出现时;

⑵股东会决议解散;

⑶因公司合并或者分立需要解散的;

⑷公司违反法律、行政法规被依法责令关闭的;

⑸因不可抗力事件致使公司无法继续经营时;

⑹宣告破产。

第三十条 公司解散时,应依《公司法》的规定成立清算组对公司债权债务进行清算。清算结束后,清算组应当制作清算报告,报股东会或者有关主管机关确认,并报送公司登记机关,申请注销公司登记,公告公司终止。

第十一章 股东认为需要规定的其他事项

第三十一条 公司根据需要或涉及公司登记事项变更的可修改公司章程,修改后的公司章程不得与法律、法规相抵触,修改公司章程应由全体股东表决通过。修改后的公司章程应送原公司登记机关备案,涉及变更登记事项的,同时应向公司登记机关做变更登记。

第三十二条 公司章程的解释权属于股东会。

第三十三条 公司登记事项以公司登记机关核定的为准。

第三十四条 公司章程条款如与国家法律、法规相抵触的,以国家法律、法规为准。

第三十五条 本章程经各方出资人共同订立,自公司设立之日起生效。

第三十六条 本章程一式四份,公司留存一份,并报公司登记机关备案一份。

全体股东签字(盖章):

年 月 日

第二篇:香港公司章程范本20xx(英文)_Sample_B

Explanatory Notes to Sample B

MODEL ARTICLES OF ASSOCIATION

FOR

PRIVATE COMPANIES LIMITED BY SHARES

This Model Articles of Association is the Model Articles prescribed in Schedule 2 of the Companies (Model Articles) Notice (Cap. 622H) for private companies limited by shares. Companies or their officers should consult their professional advisors on any matters which may affect them relating to or arising out of the adoption of this Model Articles.

The mandatory articles that are required under sections 81, 83, 84 and 85(1) of the Companies Ordinance (Cap. 622) are added before the contents of the Model Articles.

THE COMPANIES ORDINANCE (CHAPTER 622)

Private Company Limited by Shares

ARTICLES OF ASSOCIATION

OF

[ENGLISH COMPANY NAME] [CHINESE COMPANY NAME]

Part A Mandatory Articles 1. Company Name

The name of the company is

“[ENGLISH COMPANY NAME] [CHINESE COMPANY NAME]”

2. Members’ Liabilities

The liability of the members is limited.

3. Liabilities or Contributions of Members

The liability of the members is limited to any amount unpaid on the shares held by the members.

4. Share Capital and Initial Shareholdings (on the company’s formation)

The total number of shares that the company proposes to issue

The total amount of share capital to be subscribed by the company’s founder members

(i) The amount to be paid up or to be regarded as

paid up

(ii) The amount to remain unpaid or to be regarded

as remaining unpaid

[HKD20,000]

[HKD20,000]

[HKD0]

[20,000]

Class of Shares

The total number of shares in this class that the company proposes to issue

The total amount of share capital in this class to be subscribed by the company’s founder members (i) The amount to be paid up or to be regarded as

paid up

(ii) The amount to remain unpaid or to be regarded

as remaining unpaid

Class of Shares

The total number of shares in this class that the company proposes to issue

The total amount of share capital in this class to be subscribed by the company’s founder members (i) The amount to be paid up or to be regarded as

paid up

(ii) The amount to remain unpaid or to be regarded

as remaining unpaid

[Ordinary]

[10,000] [HKD10,000]

[HKD10,000]

[HKD0]

[Preference]

[10,000] [HKD10,000]

[HKD10,000]

[HKD0]

I/WE, the undersigned, wish to form a company and wish to adopt the articles of association as attached, and I/we respectively agree to subscribe for the amount of share capital of the Company and to take the number of shares in the Company set opposite my/our respective name(s).

Name(s) of Founder Members

[English name]

[Chinese name]

Number of Share(s) and Total Amount of Share Capital [5,000] [Ordinary] shares [HKD5,000]

[5,000]

[Preference] shares

[HKD5,000]

[English name]

[Chinese name]

[5,000] [Ordinary] shares [HKD5,000]

[5,000]

[Preference] shares

[HKD5,000]

Total:[10,000]

[Ordinary] shares

[HKD10,000]

[10,000]

[Preference] shares

[HKD10,000]

Part B Other Articles

Contents

Article

Part 1

Interpretation

1. Interpretation

Part 2

Private Company

2. Company is private company

Part 3

Directors and Company Secretary

Division 1—Directors’ Powers and Responsibilities

3. Directors’ general authority

4. Members’ reserve power

5. Directors may delegate

6. Committees

Division 2—Decision-taking by Directors

7. Directors to take decision collectively

8. Unanimous decisions

9. Calling directors’ meetings 10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21. Participation in directors’ meetings Quorum for directors’ meetings Meetings if total number of directors less than quorum Chairing of directors’ meetings Chairperson’s casting vote at directors’ meetings Alternates voting at directors’ meetings Conflicts of interest Supplementary provisions as to conflicts of interest Validity of acts of meeting of directors Record of decisions to be kept Written record of decision of sole director Directors’ discretion to make further rules

Division 3—Appointment and Retirement of Directors

22.

23. Appointment and retirement of directors Retiring director eligible for reappointment

24. Composite resolution

25. Termination of director’s appointment

26. Directors’ remuneration

Article

27. Directors’ expenses

Division 4—Alternate Directors

28.

29.

30. Appointment and removal of alternates Rights and responsibilities of alternate directors Termination of alternate directorship

Division 5—Directors’ Indemnity and Insurance

31. Indemnity

32. Insurance

Division 6—Company Secretary

33. Appointment and removal of company secretary

Part 4

Decision–taking by Members

Division 1—Organization of General Meetings

34. General meetings

35.

36.

37.

38.

39.

40.

41. Notice of general meetings Persons entitled to receive notice of general meetings Accidental omission to give notice of general meetings Attendance and speaking at general meetings Quorum for general meetings Chairing general meetings Attendance and speaking by non-members

42. Adjournment

Division 2—Voting at General Meetings

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53. General rules on voting Errors and disputes Demanding a poll Number of votes a member has Votes of joint holders of shares Votes of mentally incapacitated members Content of proxy notices Execution of appointment of proxy on behalf of member appointing the proxy Delivery of proxy notice and notice revoking appointment of proxy Effect of member’s voting in person on proxy’s authority Effect of proxy votes in case of death, mental incapacity, etc. of member appointing the

proxy

54. Amendments to proposed resolutions

Article

Division 3—Application of Rules to Class Meetings

55. Class meetings

Part 5

Shares and Distributions

Division 1—Issue of Shares

56.

57. All shares to be fully paid up Powers to issue different classes of shares

Division 2—Interests in Shares

58. Company only bound by absolute interests

Division 3—Share Certificates

59.

60. Certificates to be issued except in certain cases Contents and execution of share certificates

61. Consolidated share certificates

62. Replacement share certificates

Division 4—Transfer and Transmission of Shares

63.

64.

65. Transfer of shares Power of directors to refuse transfer of shares Transmission of shares

66. Transmittees’ rights

67.

68. Exercise of transmittees’ rights Transmittees bound by prior notices

Division 5—Alteration and Reduction of Share Capital, Share Buy-backs and Allotment of Shares 69.

70. Alteration of share capital Reduction of share capital

71. Share buy-backs

72. Allotment of shares

Division 6—Distributions

73.

74.

75. Procedure for declaring dividends Payment of dividends and other distributions No interest on distributions

76. Unclaimed distributions

77. Non-cash distributions

78. Waiver of distributions

Division 7—Capitalization of Profits

79. Capitalization of profits

Part 6

Article

Miscellaneous Provisions

Division 1—Communications to and by Company

80. Means of communication to be used

Division 2—Administrative Arrangements

81. Company seals

82. No right to inspect accounts and other records

83. Auditor’s insurance

84. Winding up

Part 1

Interpretation

1. Interpretation

(1) In these articles—

alternate (候補者) and alternate director (候補董事) mean a person appointed by a director

as an alternate under article 28(1);

appointor (委任者)—see article 28(1);

articles (本《章程細則》) means the articles of association of the company;

associated company (有?繫公司) means—

(a) a subsidiary of the company; (b) a holding company of the company; or (c) a subsidiary of such a holding company;

distribution recipient (分派對象) means, in relation to a share in respect of which a dividend

or other sum is payable—

(a) the holder of the share; (b) if the share has 2 or more joint holders, whichever of them is named first in the register of members; or (c) if the holder is no longer entitled to the share by reason of death or bankruptcy or

otherwise by operation of law, the transmittee;

fully paid (已繳足款), in relation to a share, means the price at which the share was issued

has been fully paid to the company;

holder (持有人), in relation to a share, means the person whose name is entered in the

register of members as the holder of the share;

mental incapacity (精神上無?為能?) has the meaning given by section 2(1) of the Mental

Health Ordinance (Cap. 136);

mentally incapacitated person (精神上無?為能?者) means a person who is found under

the Mental Health Ordinance (Cap. 136) to be incapable, by reason of mental incapacity, of managing and administering his or her property and affairs;

Ordinance (《條?》) means the Companies Ordinance (Cap. 622);

paid (已繳) means paid or credited as paid;

proxy notice (代表通知書)—see article 49(1);

register of members (成員登記冊) means the register of members of the company;

transmittee (承傳人) means a person entitled to a share by reason of the death or bankruptcy

of a member or otherwise by operation of law.

(2) Other words or expressions used in these articles have the same meaning as in the Ordinance as in force on the date these articles become binding on the company. (3) For the purposes of these articles, a document is authenticated if it is authenticated in

any way in which section 828(5) or 829(3) of the Ordinance provides for documents or

information to be authenticated for the purposes of the Ordinance.

Part 2

Private Company

2.

Company is private company (1) The company is a private company and accordingly— (a) a member’s right to transfer shares is restricted in the manner specified in this article; (b) the number of members is limited to 50; and (c) any invitation to the public to subscribe for any shares or debentures of the company is prohibited. (2) The directors may in their discretion refuse to register the transfer of a share. (3) In paragraph (1)(b)— member (成員) excludes— (a) a member who is an employee of the company; and (b) a person who was a member while being an employee of the company and who continues to be a member after ceasing to be such an employee. (4) For the purposes of this article, 2 or more persons who hold shares in the company jointly

are to be regarded as 1 member.

Part 3

Directors and Company Secretary

Division 1—Directors’ Powers and Responsibilities

3.

4.

5.

Directors’ general authority (1) Subject to the Ordinance and these articles, the business and affairs of the company are managed by the directors, who may exercise all the powers of the company. (2) An alteration of these articles does not invalidate any prior act of the directors that would have been valid if the alteration had not been made. (3) The powers given by this article are not limited by any other power given to the directors by these articles. (4) A directors’ meeting at which a quorum is present may exercise all powers exercisable by the directors. Members’ reserve power (1) The members may, by special resolution, direct the directors to take, or refrain from taking, specified action. (2) The special resolution does not invalidate anything that the directors have done before the passing of the resolution. Directors may delegate (1) Subject to these articles, the directors may, if they think fit, delegate any of the powers that are conferred on them under these articles— (a) to any person or committee;

(b) by any means (including by power of attorney); (c) to any extent and without territorial limit; (d) in relation to any matter; and (e) on any terms and conditions. (2) If the directors so specify, the delegation may authorize further delegation of the directors’ powers by any person to whom they are delegated. (3) The directors may— (a) revoke the delegation wholly or in part; or (b) revoke or alter its terms and conditions.

6. Committees

(1) The directors may make rules providing for the conduct of business of the committees to which they have delegated any of their powers. (2) The committees must comply with the rules.

Division 2—Decision-taking by Directors

7.

Directors to take decision collectively (1) A decision of the directors may only be taken— (a) by a majority of the directors at a meeting; or (b) in accordance with article 8. (2) Paragraph (1) does not apply if— (a) the company only has 1 director; and (b) no provision of these articles requires it to have more than one director. (3) If paragraph (1) does not apply, the director may take decisions without regard to any of

the provisions of these articles relating to directors’ decision-taking.

8. Unanimous decisions

(1) A decision of the directors is taken in accordance with this article when all eligible

directors indicate to each other (either directly or indirectly) by any means that they share

a common view on a matter.

(2) Such a decision may take the form of a resolution in writing, copies of which have been

signed by each eligible director or to which each eligible director has otherwise indicated

agreement in writing.

(3) A reference in this article to eligible directors is a reference to directors who would have

been entitled to vote on the matter if it had been proposed as a resolution at a directors’

meeting.

(4) A decision may not be taken in accordance with this article if the eligible directors would

not have formed a quorum at a directors’ meeting.

Calling directors’ meetings

(1) Any director may call a directors’ meeting by giving notice of the meeting to the directors

or by authorizing the company secretary to give such notice.

(2) Notice of a directors’ meeting must indicate—

10.

(a) its proposed date and time; and (b) where it is to take place. (3) Notice of a directors’ meeting must be given to each director, but need not be in writing. Participation in directors’ meetings (1) Subject to these articles, directors participate in a directors’ meeting, or part of a

directors’ meeting, when— 9.

11.

12. (a) the meeting has been called and takes place in accordance with these articles; and (b) they can each communicate to the others any information or opinions they have on any particular item of the business of the meeting. (2) In determining whether directors are participating in a directors’ meeting, it is irrelevant where a director is and how they communicate with each other. (3) If all the directors participating in a directors’ meeting are not in the same place, they may regard the meeting as taking place wherever any one of them is. Quorum for directors’ meetings (1) At a directors’ meeting, unless a quorum is participating, no proposal is to be voted on, except a proposal to call another meeting. (2) The quorum for directors’ meetings may be fixed from time to time by a decision of the directors and unless otherwise fixed it is 2. Meetings if total number of directors less than quorum

If the total number of directors for the time being is less than the quorum required for directors’ meetings, the directors must not take any decision other than a decision—

13.

(a) to appoint further directors; or (b) to call a general meeting so as to enable the members to appoint further directors. Chairing of directors’ meetings (1) The directors may appoint a director to chair their meetings. (2) The person appointed for the time being is known as the chairperson. (3) The directors may terminate the appointment of the chairperson at any time. (4) If the chairperson is not participating in a directors’ meeting within 10 minutes of the time

at which it was to start or is unwilling to chair the meeting, the participating directors may

appoint one of themselves to chair it.

Chairperson’s casting vote at directors’ meetings

(1) If the numbers of votes for and against a proposal are equal, the chairperson or other

director chairing the directors’ meeting has a casting vote.

(2) Paragraph (1) does not apply if, in accordance with these articles, the chairperson or

other director is not to be counted as participating in the decision-making process for

quorum or voting purposes.

Alternates voting at directors’ meetings

A director who is also an alternate director has an additional vote on behalf of each appointor who— 14. 15.

16.

(a) is not participating in a directors’ meeting; and (b) would have been entitled to vote if he or she were participating in it. Conflicts of interest (1) This article applies if—

(a) a director is in any way (directly or indirectly) interested in a transaction,

arrangement or contract with the company that is significant in relation to the

company’s business; and

(b) the director’s interest is material.

(2) The director must declare the nature and extent of the director’s interest to the other directors in accordance with section 536 of the Ordinance. (3) The director and the director’s alternate must neither— (a) vote in respect of the transaction, arrangement or contract in which the director is so

interested; nor

(b) be counted for quorum purposes in respect of the transaction, arrangement or contract.

(a) voting in respect of the transaction, arrangement or contract on behalf of another

appointor who does not have such an interest; and

(b) being counted for quorum purposes in respect of the transaction, arrangement or

contract. (4) Paragraph (3) does not preclude the alternate from—

(5) If the director or the director’s alternate contravenes paragraph (3)(a), the vote must not be counted. (6) Paragraph (3) does not apply to— (a) an arrangement for giving a director any security or indemnity in respect of money

lent by the director to or obligations undertaken by the director for the benefit of the

company;

(b) an arrangement for the company to give any security to a third party in respect of a

debt or obligation of the company for which the director has assumed responsibility

wholly or in part under a guarantee or indemnity or by the deposit of a security;

(c) an arrangement under which benefits are made available to employees and

directors or former employees and directors of the company or any of its

subsidiaries, which do not provide special benefits for directors or former directors;

or

(d) an arrangement to subscribe for or underwrite shares.

(7) A reference in this article (except in paragraphs (6)(d) and (8)) to a transaction,

arrangement or contract includes a proposed transaction, arrangement or contract.

(8) In this article—

arrangement to subscribe for or underwrite shares (認購或包銷股份安排) means—

(a) a subscription or proposed subscription for shares or other securities of the company; (b) an agreement or proposed agreement to subscribe for shares or other securities of the company; or (c) an agreement or proposed agreement to underwrite any of those shares or

securities.

17.

Supplementary provisions as to conflicts of interest (1) A director may hold any other office or position of profit under the company (other than

the office of auditor and if the company has only 1 director, the office of company

secretary) in conjunction with the office of director for a period and on terms (as to

remuneration or otherwise) that the directors determine.

(2) A director or intending director is not disqualified by the office of director from contracting

with the company—

(a) with regard to the tenure of the other office or position of profit mentioned in paragraph (1); or (b) as vendor, purchaser or otherwise.

(3) The contract mentioned in paragraph (2) or any transaction, arrangement or contract

entered into by or on behalf of the company in which any director is in any way interested

is not liable to be avoided.

(4) A director who has entered into a contract mentioned in paragraph (2) or is interested in a

transaction, arrangement or contract mentioned in paragraph (3) is not liable to account

to the company for any profit realized by the transaction, arrangement or contract by

reason of—

(a) the director holding the office; or (b) the fiduciary relation established by the office.

(5) Paragraph (1), (2), (3) or (4) only applies if the director has declared the nature and

extent of the director’s interest under the paragraph to the other directors in accordance

with section 536 of the Ordinance.

(6) A director of the company may be a director or other officer of, or be otherwise interested

in—

(a) any company promoted by the company; or (b) any company in which the company may be interested as shareholder or otherwise.

(7) Subject to the Ordinance, the director is not accountable to the company for any

remuneration or other benefits received by the director as a director or officer of, or from

the director’s interest in, the other company unless the company otherwise directs.

Validity of acts of meeting of directors

The acts of any meeting of directors or of a committee of directors or the acts of any person acting as a director are as valid as if the directors or the person had been duly appointed as a director and was qualified to be a director, even if it is afterwards discovered that—

(a) there was a defect in the appointment of any of the directors or of the person acting as a director; (b) any one or more of them were not qualified to be a director or were disqualified from being a director; (c) any one or more of them had ceased to hold office as a director; or (d) any one or more of them were not entitled to vote on the matter in question.

Record of decisions to be kept

The directors must ensure that the company keeps a written record of every decision taken by the directors under article 7(1) for at least 10 years from the date of the decision. 18. 19.

20.

21.

Written record of decision of sole director (1) This article applies if the company has only 1 director and the director takes any decision that— (a) may be taken in a directors’ meeting; and (b) has effect as if agreed in a directors’ meeting. (2) The director must provide the company with a written record of the decision within 7 days after the decision is made. (3) The director is not required to comply with paragraph (2) if the decision is taken by way of a resolution in writing. (4) If the decision is taken by way of a resolution in writing, the company must keep the resolution for at least 10 years from the date of the decision. (5) The company must also keep a written record provided to it in accordance with paragraph (2) for at least 10 years from the date of the decision. Directors’ discretion to make further rules Subject to these articles, the directors may make any rule that they think fit about— (a) how they take decisions; and (b) how the rules are to be recorded or communicated to directors.

Division 3—Appointment and Retirement of Directors

22.

Appointment and retirement of directors (1) A person who is willing to act as a director, and is permitted by law to do so, may be appointed to be a director— (a) by ordinary resolution; or (b) by a decision of the directors.

(2) Unless otherwise specified in the appointment, a director appointed under paragraph (1)(a) holds office for an unlimited period of time. (3) An appointment under paragraph (1)(b) may only be made to— (a) fill a casual vacancy; or

(b) appoint a director as an addition to the existing directors if the total number of

directors does not exceed the number fixed in accordance with these articles.

(a) retire from office at the next annual general meeting following the appointment; or

(b) if the company has dispensed with the holding of annual general meetings or is not

required to hold annual general meetings, retire from office before the end of 9

months after the end of the company’s accounting reference period by reference to

which the financial year in which the director was appointed is to be determined.

Retiring director eligible for reappointment

A retiring director is eligible for reappointment to the office. (4) A director appointed under paragraph (1)(b) must— 23.

24. Composite resolution

(1) This article applies if proposals are under consideration concerning the appointment of 2

or more directors to offices or employments with the company or any other body

corporate.

(2) The proposals may be divided and considered in relation to each director separately.

(3) Each of the directors concerned is entitled to vote (if the director is not for another reason

precluded from voting) and be counted in the quorum in respect of each resolution except

that concerning the director’s own appointment.

Termination of director’s appointment

A person ceases to be a director if the person—

(a) ceases to be a director under the Ordinance or the Companies (Winding Up and

Miscellaneous Provisions) Ordinance (Cap. 32) or is prohibited from being a director

by law;

(b) becomes bankrupt or makes any arrangement or composition with the person’s

creditors generally;

(c) becomes a mentally incapacitated person;

(d) resigns the office of director by notice in writing of the resignation in accordance with

section 464(5) of the Ordinance;

(e) for more than 6 months has been absent without the directors’ permission from

directors’ meetings held during that period; or

(f) is removed from the office of director by an ordinary resolution of the company. 25.

26. Directors’ remuneration

(1) Directors’ remuneration must be determined by the company at a general meeting. (2) A director’s remuneration may— (a) take any form; and (b) include any arrangements in connection with the payment of a retirement benefit to or in respect of that director. (3) Directors’ remuneration accrues from day to day.

27. Directors’ expenses

The company may pay any travelling, accommodation and other expenses properly incurred by directors in connection with—

(a) their attendance at— (i) meetings of directors or committees of directors;

(ii) general meetings; or (iii) separate meetings of the holders of any class of shares or of debentures of the company; or (b) the exercise of their powers and the discharge of their responsibilities in relation to

the company.

Division 4—Alternate Directors

28.

Appointment and removal of alternates (1) A director (appointor) may appoint as an alternate any other director, or any other person approved by resolution of the directors. (2) An alternate may exercise the powers and carry out the responsibilities of the alternate’s

appointor, in relation to the taking of decisions by the directors in the absence of the

alternate’s appointor.

(3) An appointment or removal of an alternate by the alternate’s appointor must be

effected—

(a) by notice to the company; or (b) in any other manner approved by the directors. (4) The notice must be authenticated by the appointor. (a) identify the proposed alternate; and (b) if it is a notice of appointment, contain a statement authenticated by the proposed

alternate indicating the proposed alternate’s willingness to act as the alternate of the

appointor.

(6) If an alternate is removed by resolution of the directors, the company must as soon as

practicable give notice of the removal to the alternate’s appointor.

Rights and responsibilities of alternate directors

(1) An alternate director has the same rights as the alternate’s appointor in relation to any

decision taken by the directors under article 7(1).

(2) Unless these articles specify otherwise, alternate directors—

30.

(a) are deemed for all purposes to be directors; (b) are liable for their own acts and omissions; (c) are subject to the same restrictions as their appointors; and (d) are deemed to be agents of or for their appointors. (3) Subject to article 16(3), a person who is an alternate director but not a director— (a) may be counted as participating for determining whether a quorum is participating (but only if that person’s appointor is not participating); and (b) may sign a written resolution (but only if it is not signed or to be signed by that person’s appointor). (5) The notice must— 29. (4) An alternate director must not be counted or regarded as more than one director for determining whether— (a) a quorum is participating; or (b) a directors’ written resolution is adopted. (5) An alternate director is not entitled to receive any remuneration from the company for serving as an alternate director. (6) But the alternate’s appointor may, by notice in writing made to the company, direct that any part of the appointor’s remuneration be paid to the alternate. Termination of alternate directorship (1) An alternate director’s appointment as an alternate terminates—

(a) if the alternate’s appointor revokes the appointment by notice to the company in writing specifying when it is to terminate; (b) on the occurrence in relation to the alternate of any event which, if it occurred in

relation to the alternate’s appointor, would result in the termination of the appointor’s

appointment as a director;

(c) on the death of the alternate’s appointor; or

(d) when the alternate’s appointor’s appointment as a director terminates.

(2) If the alternate was not a director when appointed as an alternate, the alternate’s appointment as an alternate terminates if— (a) the approval under article 28(1) is withdrawn or revoked; or (b) the company by an ordinary resolution passed at a general meeting terminates the

appointment.

Division 5—Directors’ Indemnity and Insurance

31. Indemnity

(1) A director or former director of the company may be indemnified out of the company’s

assets against any liability incurred by the director to a person other than the company or

an associated company of the company in connection with any negligence, default,

breach of duty or breach of trust in relation to the company or associated company (as

the case may be).

(2) Paragraph (1) only applies if the indemnity does not cover—

(a) any liability of the director to pay— (i) a fine imposed in criminal proceedings; or (ii) a sum payable by way of a penalty in respect of non-compliance with any requirement of a regulatory nature; or (i) in defending criminal proceedings in which the director is convicted; (ii) in defending civil proceedings brought by the company, or an associated company of the company, in which judgment is given against the director; (iii) in defending civil proceedings brought on behalf of the company by a member

of the company or of an associated company of the company, in which

judgment is given against the director;

(iv) in defending civil proceedings brought on behalf of an associated company of

the company by a member of the associated company or by a member of an

associated company of the associated company, in which judgment is given

against the director; or

(v) in connection with an application for relief under section 903 or 904 of the

Ordinance in which the Court refuses to grant the director relief. (b) any liability incurred by the director—

(3) A reference in paragraph (2)(b) to a conviction, judgment or refusal of relief is a reference to the final decision in the proceedings. (4) For the purposes of paragraph (3), a conviction, judgment or refusal of relief—

(a) if not appealed against, becomes final at the end of the period for bringing an appeal; or (b) if appealed against, becomes final when the appeal, or any further appeal, is

disposed of.

(a) it is determined, and the period for bringing any further appeal has ended; or

(b) it is abandoned or otherwise ceases to have effect. (5) For the purposes of paragraph (4)(b), an appeal is disposed of if—

32. Insurance

The directors may decide to purchase and maintain insurance, at the expense of the company, for a director of the company, or a director of an associated company of the company, against—

(a) any liability to any person attaching to the director in connection with any negligence,

default, breach of duty or breach of trust (except for fraud) in relation to the company

or associated company (as the case may be); or

(b) any liability incurred by the director in defending any proceedings (whether civil or

criminal) taken against the director for any negligence, default, breach of duty or

breach of trust (including fraud) in relation to the company or associated company

(as the case may be).

Division 6—Company Secretary

33.

Appointment and removal of company secretary (1) The directors may appoint a company secretary for a term, at a remuneration and on conditions they think fit. (2) The directors may remove a company secretary appointed by them.

Part 4

Decision-taking by Members

Division 1—Organization of General Meetings

34. General meetings

(1) Subject to sections 611, 612 and 613 of the Ordinance, the company must, in respect of

each financial year of the company, hold a general meeting as its annual general meeting

in accordance with section 610 of the Ordinance.

(2) The directors may, if they think fit, call a general meeting.

(3) If the directors are required to call a general meeting under section 566 of the Ordinance,

they must call it in accordance with section 567 of the Ordinance.

(4) If the directors do not call a general meeting in accordance with section 567 of the

Ordinance, the members who requested the meeting, or any of them representing more

than one half of the total voting rights of all of them, may themselves call a general

meeting in accordance with section 568 of the Ordinance.

Notice of general meetings

(1) An annual general meeting must be called by notice of at least 21 days in writing.

(2) A general meeting other than an annual general meeting must be called by notice of at

least 14 days in writing.

(3) The notice is exclusive of—

(a) the day on which it is served or deemed to be served; and (b) the day for which it is given. (a) specify the date and time of the meeting; (b) specify the place of the meeting (and if the meeting is to be held in 2 or more places, the principal place of the meeting and the other place or places of the meeting); (c) state the general nature of the business to be dealt with at the meeting; (d) for a notice calling an annual general meeting, state that the meeting is an annual general meeting; (e) if a resolution (whether or not a special resolution) is intended to be moved at the

meeting— 35. (4) The notice must—

(i) include notice of the resolution; and (ii) include or be accompanied by a statement containing any information or

explanation that is reasonably necessary to indicate the purpose of the

resolution;

(f) if a special resolution is intended to be moved at the meeting, specify the intention and include the text of the special resolution; and (g) contain a statement specifying a member’s right to appoint a proxy under section 596(1) and (3) of the Ordinance. (a) notice has been included in the notice of the meeting under section 567(3) or 568(2) of the Ordinance; or (b) notice has been given under section 615 of the Ordinance. (6) Despite the fact that a general meeting is called by shorter notice than that specified in this article, it is regarded as having been duly called if it is so agreed— (a) for an annual general meeting, by all the members entitled to attend and vote at the meeting; and (b) in any other case, by a majority in number of the members entitled to attend and

vote at the meeting, being a majority together representing at least 95% of the total

voting rights at the meeting of all the members.

Persons entitled to receive notice of general meetings

(1) Notice of a general meeting must be given to— (5) Paragraph (4)(e) does not apply in relation to a resolution of which— 36.

(a) every member; and

(b) every director.

(2) In paragraph (1), the reference to a member includes a transmittee, if the company has been notified of the transmittee’s entitlement to a share. (3) If notice of a general meeting or any other document relating to the meeting is required to

be given to a member, the company must give a copy of it to its auditor (if more than one

auditor, to everyone of them) at the same time as the notice or the other document is

given to the member.

Accidental omission to give notice of general meetings

Any accidental omission to give notice of a general meeting to, or any non-receipt of notice of a general meeting by, any person entitled to receive notice does not invalidate the proceedings at the meeting.

38.

Attendance and speaking at general meetings (1) A person is able to exercise the right to speak at a general meeting when the person is in

a position to communicate to all those attending the meeting, during the meeting, any

information or opinions that the person has on the business of the meeting.

(2) A person is able to exercise the right to vote at a general meeting when—

(a) the person is able to vote, during the meeting, on resolutions put to the vote at the meeting; and (b) the person’s vote can be taken into account in determining whether or not those

resolutions are passed at the same time as the votes of all the other persons

attending the meeting. 37.

(3) The directors may make whatever arrangements they consider appropriate to enable those attending a general meeting to exercise their rights to speak or vote at it. (4) In determining attendance at a general meeting, it is immaterial whether any 2 or more

members attending it are in the same place as each other.

(5) Two or more persons who are not in the same place as each other attend a general

meeting if their circumstances are such that if they have rights to speak and vote at the

meeting, they are able to exercise them.

Quorum for general meetings

(1) Two members present in person or by proxy constitute a quorum at a general meeting.

(2) No business other than the appointment of the chairperson of the meeting is to be

transacted at a general meeting if the persons attending it do not constitute a quorum.

Chairing general meetings

(1) If the chairperson (if any) of the board of directors is present at a general meeting and is

willing to preside as chairperson at the meeting, the meeting is to be presided over by

him or her.

(2) The directors present at a general meeting must elect one of themselves to be the

chairperson if—

(a) there is no chairperson of the board of directors; (b) the chairperson is not present within 15 minutes after the time appointed for holding the meeting; (c) the chairperson is unwilling to act; or (d) the chairperson has given notice to the company of the intention not to attend the

meeting.

(3) The members present at a general meeting must elect one of themselves to be the

chairperson if—

(a) no director is willing to act as chairperson; or (b) no director is present within 15 minutes after the time appointed for holding the

meeting. 39. 40.

41.

(4) A proxy may be elected to be the chairperson of a general meeting by a resolution of the company passed at the meeting. Attendance and speaking by non-members (1) Directors may attend and speak at general meetings, whether or not they are members of the company. (2) The chairperson of a general meeting may permit other persons to attend and speak at a general meeting even though they are not— (a) members of the company; or (b) otherwise entitled to exercise the rights of members in relation to general meetings.

42. Adjournment

(1) If a quorum is not present within half an hour from the time appointed for holding a general meeting, the meeting must— (a) if called on the request of members, be dissolved; or (b) in any other case, be adjourned to the same day in the next week, at the same time

and place, or to another day and at another time and place that the directors

determine.

(2) If at the adjourned meeting, a quorum is not present within half an hour from the time

appointed for holding the meeting, the member or members present in person or by proxy

constitute a quorum.

(3) The chairperson may adjourn a general meeting at which a quorum is present if—

(a) the meeting consents to an adjournment; or (b) it appears to the chairperson that an adjournment is necessary to protect the safety

of any person attending the meeting or ensure that the business of the meeting is

conducted in an orderly manner.

(4) The chairperson must adjourn a general meeting if directed to do so by the meeting. (5) When adjourning a general meeting, the chairperson must specify the date, time and place to which it is adjourned. (6) Only the business left unfinished at the general meeting may be transacted at the adjourned meeting. (7) If a general meeting is adjourned for 30 days or more, notice of the adjourned meeting must be given as for an original meeting. (8) If a general meeting is adjourned for less than 30 days, it is not necessary to give any

notice of the adjourned meeting.

Division 2—Voting at General Meetings

43.

General rules on voting (1) A resolution put to the vote of a general meeting must be decided on a show of hands unless a poll is duly demanded in accordance with these articles. (2) If there is an equality of votes, whether on a show of hands or on a poll, the chairperson

of the meeting at which the show of hands takes place or at which the poll is demanded,

is entitled to a second or casting vote.

(3) On a vote on a resolution on a show of hands at a general meeting, a declaration by the

chairperson that the resolution—

(a) has or has not been passed; or (b) has passed by a particular majority,

is conclusive evidence of that fact without proof of the number or proportion of the votes

recorded in favour of or against the resolution.

(4) An entry in respect of the declaration in the minutes of the meeting is also conclusive

evidence of that fact without the proof.

44. Errors and disputes

(1) Any objection to the qualification of any person voting at a general meeting may only be

raised at the meeting or adjourned meeting at which the vote objected to is tendered, and

a vote not disallowed at the meeting is valid.

(2) Any objection must be referred to the chairperson of the meeting whose decision is final. Demanding a poll

(1) A poll on a resolution may be demanded—

46.

(a) in advance of the general meeting where it is to be put to the vote; or (b) at a general meeting, either before or on the declaration of the result of a show of hands on that resolution. (2) A poll on a resolution may be demanded by— (a) the chairperson of the meeting; (b) at least 2 members present in person or by proxy; or (c) any member or members present in person or by proxy and representing at least 5% of the total voting rights of all the members having the right to vote at the meeting. (3) The instrument appointing a proxy is regarded as conferring authority to demand or join in demanding a poll on a resolution. (4) A demand for a poll on a resolution may be withdrawn. Number of votes a member has (1) On a vote on a resolution on a show of hands at a general meeting— (a) every member present in person has 1 vote; and 45.

47.

48.

(b) every proxy present who has been duly appointed by a member entitled to vote on the resolution has 1 vote. (2) If a member appoints more than one proxy, the proxies so appointed are not entitled to vote on the resolution on a show of hands. (3) On a vote on a resolution on a poll taken at a general meeting— (a) every member present in person has 1 vote for each share held by him or her; and (b) every proxy present who has been duly appointed by a member has 1 vote for each share in respect of which the proxy is appointed. (4) This article has effect subject to any rights or restrictions attached to any shares or class of shares. Votes of joint holders of shares (1) For joint holders of shares, only the vote of the most senior holder who votes (and any proxies duly authorized by the holder) may be counted. (2) For the purposes of this article, the seniority of a holder of a share is determined by the order in which the names of the joint holders appear in the register of members. Votes of mentally incapacitated members (1) A member who is a mentally incapacitated person may vote, whether on a show of hands

or on a poll, by the member’s committee, receiver, guardian or other person in the nature

of a committee, receiver or guardian appointed by the Court.

(2) The committee, receiver, guardian or other person may vote by proxy on a show of hands

or on a poll.

Content of proxy notices

(1) A proxy may only validly be appointed by a notice in writing (proxy notice) that— 49.

(a) states the name and address of the member appointing the proxy; (b) identifies the person appointed to be that member’s proxy and the general meeting in relation to which that person is appointed; (c) is authenticated, or is signed on behalf of the member appointing the proxy; and (d) is delivered to the company in accordance with these articles and any instructions

contained in the notice of the general meeting in relation to which the proxy is

appointed.

(2) The company may require proxy notices to be delivered in a particular form, and may

specify different forms for different purposes.

(3) If the company requires or allows a proxy notice to be delivered to it in electronic form, it

may require the delivery to be properly protected by a security arrangement it specifies.

(4) A proxy notice may specify how the proxy appointed under it is to vote (or that the proxy

is to abstain from voting) on one or more resolutions dealing with any business to be

transacted at a general meeting.

(5) Unless a proxy notice indicates otherwise, it must be regarded as—

(a) allowing the person appointed under it as a proxy discretion as to how to vote on any

ancillary or procedural resolutions put to the general meeting; and

(b) appointing that person as a proxy in relation to any adjournment of the general

meeting to which it relates as well as the meeting itself.

Execution of appointment of proxy on behalf of member appointing the proxy

If a proxy notice is not authenticated, it must be accompanied by written evidence of the authority of the person who executed the appointment to execute it on behalf of the member appointing the proxy. 50.

51. Delivery of proxy notice and notice revoking appointment of proxy

(1) A proxy notice does not take effect unless it is received by the company—

(a) for a general meeting or adjourned general meeting, at least 48 hours before the time appointed for holding the meeting or adjourned meeting; and (b) for a poll taken more than 48 hours after it was demanded, at least 24 hours before

the time appointed for taking the poll.

(2) An appointment under a proxy notice may be revoked by delivering to the company a

notice in writing given by or on behalf of the person by whom or on whose behalf the

proxy notice was given.

(3) A notice revoking the appointment only takes effect if it is received by the company—

(a) for a general meeting or adjourned general meeting, at least 48 hours before the time appointed for holding the meeting or adjourned meeting; and (b) for a poll taken more than 48 hours after it was demanded, at least 24 hours before

the time appointed for taking the poll.

Effect of member’s voting in person on proxy’s authority

(1) A proxy’s authority in relation to a resolution is to be regarded as revoked if the member

who has appointed the proxy—

(a) attends in person the general meeting at which the resolution is to be decided; and (b) exercises, in relation to the resolution, the voting right attached to the shares in

respect of which the proxy is appointed. 52.

(2) A member who is entitled to attend, speak or vote (either on a show of hands or on a poll)

at a general meeting remains so entitled in respect of the meeting or any adjournment of

it, even though a valid proxy notice has been delivered to the company by or on behalf of

the member.

Effect of proxy votes in case of death, mental incapacity, etc. of member appointing the proxy

(1) A vote given in accordance with the terms of a proxy notice is valid despite—

(a) the previous death or mental incapacity of the member appointing the proxy; (b) the revocation of the appointment of the proxy or of the authority under which the appointment of the proxy is executed; or (c) the transfer of the share in respect of which the proxy is appointed.

(2) Paragraph (1) does not apply if notice in writing of the death, mental incapacity,

revocation or transfer is received by the company—

(a) for a general meeting or adjourned general meeting, at least 48 hours before the time appointed for holding the meeting or adjourned meeting; and (b) for a poll taken more than 48 hours after it was demanded, at least 24 hours before

the time appointed for taking the poll.

Amendments to proposed resolutions

(1) An ordinary resolution to be proposed at a general meeting may be amended by ordinary

resolution if—

(a) notice of the proposed amendment is given to the company secretary in writing; and (b) the proposed amendment does not, in the reasonable opinion of the chairperson of

the meeting, materially alter the scope of the resolution.

(2) The notice must be given by a person entitled to vote at the general meeting at which it is

to be proposed at least 48 hours before the meeting is to take place (or a later time the

chairperson of the meeting determines).

(3) A special resolution to be proposed at a general meeting may be amended by ordinary

resolution if—

(a) the chairperson of the meeting proposes the amendment at the meeting at which the

special resolution is to be proposed; and 53. 54.

(b) the amendment merely corrects a grammatical or other non-substantive error in the special resolution. (4) If the chairperson of the meeting, acting in good faith, wrongly decides that an

amendment to a resolution is out of order, the vote on that resolution remains valid unless

the Court orders otherwise.

Division 3—Application of Rules to Class Meetings

55. Class meetings

The provisions of these articles relating to general meetings apply, with any necessary modifications, to meetings of the holders of any class of shares.

Part 5

Shares and Distributions

Division 1—Issue of Shares

56. All shares to be fully paid up

No share is to be issued unless the share is fully paid.

57.

Powers to issue different classes of shares (1) Without affecting any special rights previously conferred on the holders of any existing shares or class of shares, the company may issue shares with— (a) preferred, deferred or other special rights; or (b) any restrictions, whether in regard to dividend, voting, return of capital or otherwise, that the company may from time to time by ordinary resolution determine. (2) Subject to Division 4 of Part 5 of the Ordinance, the company may issue shares on the

terms that they are to be redeemed, or liable to be redeemed, at the option of the

company or the holders of the shares.

(3) The directors may determine the terms, conditions and manner of redemption of the

shares.

Division 2—Interests in Shares

58.

Company only bound by absolute interests (1) Except as required by law, no person is to be recognized by the company as holding any share on any trust. (2) Except as otherwise required by law or these articles, the company is not in any way to

be bound by or recognize any interest in a share other than the holder’s absolute

ownership of it and all the rights attaching to it.

(3) Paragraph (2) applies even though the company has notice of the interest.

Division 3—Share Certificates

59.

60. Certificates to be issued except in certain cases (1) The company must issue each member, free of charge, with one or more certificates in respect of the shares that the member holds, within— (a) 2 months after allotment or lodgment of a proper instrument of transfer; or (b) any other period that the conditions of issue provide. (2) No certificate may be issued in respect of shares of more than one class. (3) If more than one person holds a share, only 1 certificate may be issued in respect of it. Contents and execution of share certificates

61.

(1) A certificate must specify— (a) in respect of how many shares and of what class the certificate is issued; (b) the fact that the shares are fully paid; and (c) any distinguishing numbers assigned to them. (a) have affixed to it the company’s common seal or the company’s official seal under section 126 of the Ordinance; or (b) be otherwise executed in accordance with the Ordinance. Consolidated share certificates (1) A member may request the company, in writing, to replace— (a) the member’s separate certificates with a consolidated certificate; or

(b) the member’s consolidated certificate with 2 or more separate certificates

representing the proportion of the shares that the member specifies. (2) A certificate must—

62.

(2) A consolidated certificate must not be issued unless any certificates that it is to replace have first been returned to the company for cancellation. (3) Separate certificates must not be issued unless the consolidated certificate that they are to replace has first been returned to the company for cancellation. Replacement share certificates (1) If a certificate issued in respect of a member’s shares is defaced, damaged, lost or

destroyed, the member is entitled to be issued with a replacement certificate in respect of

the same shares.

(2) A member exercising the right to be issued with a replacement certificate—

(a) may at the same time exercise the right to be issued with a single certificate, separate certificates or a consolidated certificate; (b) must return the certificate that is to be replaced to the company if it is defaced or damaged; and (c) must comply with the conditions as to evidence, indemnity and the payment of a

reasonable fee that the directors decide.

Division 4—Transfer and Transmission of Shares

63.

Transfer of shares (1) Shares may be transferred by means of an instrument of transfer in any usual form or any

other form approved by the directors, which is executed by or on behalf of both the

transferor and the transferee.

(2) No fee may be charged by the company for registering any instrument of transfer or other

document relating to or affecting the title to any share.

(3) The company may retain any instrument of transfer that is registered.

(4) The transferor remains the holder of a share until the transferee’s name is entered in the

register of members as holder of it.

Power of directors to refuse transfer of shares

(1) Without limiting article 2(2), the directors may refuse to register the transfer of a share if—

(a) the instrument of transfer is not lodged at the company’s registered office or another place that the directors have appointed; (b) the instrument of transfer is not accompanied by the certificate for the share to which

it relates, or other evidence the directors reasonably require to show the transferor’s

right to make the transfer, or evidence of the right of someone other than the

transferor to make the transfer on the transferor’s behalf; or

(c) the transfer is in respect of more than one class of shares. 64.

(2) If the directors refuse to register the transfer of a share under paragraph (1) or article 2(2)— (a) the transferor or transferee may request a statement of the reasons for the refusal;

and

(b) the instrument of transfer must be returned to the transferor or transferee who

lodged it unless the directors suspect that the proposed transfer may be fraudulent.

(3) The instrument of transfer must be returned in accordance with paragraph (2)(b) together

with a notice of refusal within 2 months after the date on which the instrument of transfer

was lodged with the company.

(4) If a request is made under paragraph (2)(a), the directors must, within 28 days after

receiving the request—

(a) send the transferor or transferee who made the request a statement of the reasons for the refusal; or (b) register the transfer.

Transmission of shares

If a member dies, the company may only recognize the following person or persons as having any title to a share of the deceased member—

(a) if the deceased member was a joint holder of the share, the surviving holder or holders of the share; and (b) if the deceased member was a sole holder of the share, the legal personal

representative of the deceased member. 65.

66. Transmittees’ rights

(1) If a transmittee produces evidence of entitlement to the share as the directors properly

require, the transmittee may, subject to these articles, choose to become the holder of

the share or to have the share transferred to another person.

(2) The directors have the same right to refuse or suspend the registration as they would

have had if the holder had transferred the share before the transmission.

(3) A transmittee is entitled to the same dividends and other advantages to which the

transmittee would be entitled if the transmittee were the holder of the share, except that

the transmittee is not, before being registered as a member in respect of the share,

entitled in respect of it to exercise any right conferred by membership in relation to

meetings of the company.

(4) The directors may at any time give notice requiring a transmittee to choose to become

the holder of the share or to have the share transferred to another person.

(5) If the notice is not complied with within 90 days of the notice being given, the directors

may withhold payment of all dividends, bonuses or other moneys payable in respect of

the share until the requirements of the notice have been complied with.

Exercise of transmittees’ rights

(1) If a transmittee chooses to become the holder of a share, the transmittee must notify the

company in writing of the choice.

(2) Within 2 months after receiving the notice, the directors must—

(a) register the transmittee as the holder of the share; or (b) send the transmittee a notice of refusal of registration. (3) If the directors refuse registration, the transmittee may request a statement of the reasons for the refusal. (4) If a request is made under paragraph (3), the directors must, within 28 days after receiving the request— (a) send the transmittee a statement of the reasons for the refusal; or (b) register the transmittee as the holder of the share. 67.

(5) If the transmittee chooses to have the share transferred to another person, the transmittee must execute an instrument of transfer in respect of it. (6) All the limitations, restrictions and other provisions of these articles relating to the right to

transfer and the registration of transfer of shares apply to the notice under paragraph (1)

or the transfer under paragraph (5), as if the transmission had not occurred and the

transfer were a transfer made by the holder of the share before the transmission.

Transmittees bound by prior notices

If a notice is given to a member in respect of shares and a transmittee is entitled to those shares, the transmittee is bound by the notice if it was given to the member before the transmittee’s name has been entered in the register of members. 68.

Division 5—Alteration and Reduction of Share Capital, Share Buy-backs and

Allotment of Shares

69. Alteration of share capital

The company may by ordinary resolution alter its share capital in any one or more of the ways set out in section 170(2)(a), (b), (c), (d), (e) and (f)(i) of the Ordinance, and section 170(3), (4),

(5), (6), (7) and (8) of the Ordinance applies accordingly.

70. Reduction of share capital

The company may by special resolution reduce its share capital in accordance with Division 3 of Part 5 of the Ordinance.

71. Share buy-backs

The company may buy back its own shares (including any redeemable shares) in accordance with Division 4 of Part 5 of the Ordinance.

72. Allotment of shares

The directors must not exercise any power conferred on them to allot shares in the company without the prior approval of the company by resolution if the approval is required by section 140 of the Ordinance.

Division 6—Distributions

73.

Procedure for declaring dividends (1) The company may at a general meeting declare dividends, but a dividend must not exceed the amount recommended by the directors. (2) The directors may from time to time pay the members interim dividends that appear to the directors to be justified by the profits of the company. (3) A dividend may only be paid out of the profits in accordance with Part 6 of the Ordinance. (4) Unless the members’ resolution to declare or directors’ decision to pay a dividend, or the

terms on which shares are issued, specify otherwise, it must be paid by reference to each

member’s holding of shares on the date of the resolution or decision to declare or pay it.

(5) Before recommending any dividend, the directors may set aside out of the profits of the

company any sums they think fit as reserves.

(6) The directors may—

(a) apply the reserves for any purpose to which the profits of the company may be properly applied; and (b) pending such an application, employ the reserves in the business of the company or invest them in any investments (other than shares of the company) that they think fit. (7) The directors may also without placing the sums to reserve carry forward any profits that

they think prudent not to divide.

74.

Payment of dividends and other distributions (1) If a dividend or other sum that is a distribution is payable in respect of a share, it must be paid by one or more of the following means— (a) transfer to a bank account specified by the distribution recipient either in writing or as

the directors decide;

(b) sending a cheque made payable to the distribution recipient by post to the

distribution recipient at the distribution recipient’s registered address (if the

distribution recipient is a holder of the share), or (in any other case) to an address

specified by the distribution recipient either in writing or as the directors decide;

(c) sending a cheque made payable to the specified person by post to the specified

person at the address the distribution recipient has specified either in writing or as

the directors decide;

(d) any other means of payment as the directors agree with the distribution recipient

either in writing or as the directors decide.

specified person (指明人士) means a person specified by the distribution recipient either in

writing or as the directors decide. (2) In this article—

75. No interest on distributions

The company may not pay interest on any dividend or other sum payable in respect of a share unless otherwise provided by—

(a) the terms on which the share was issued; or (b) the provisions of another agreement between the holder of the share and the

company.

76. Unclaimed distributions

(1) If dividends or other sums are payable in respect of shares and they are not claimed after

having been declared or become payable, they may be invested or made use of by the

directors for the benefit of the company until claimed.

(2) The payment of the dividends or other sums into a separate account does not make the

company a trustee in respect of it.

(3) A distribution recipient is no longer entitled to a dividend or other sum and it ceases to

remain owing by the company, if—

(a) 12 years have passed from the date on which the dividend or other sum became due for payment; and (b) the distribution recipient has not claimed it.

77. Non-cash distributions

(1) Subject to the terms of issue of the share in question, the company may, by ordinary

resolution on the recommendation of the directors, decide to pay all or part of a dividend

or other distribution payable in respect of a share by transferring non-cash assets of

equivalent value (including, without limitation, shares or other securities in any company).

(2) For paying a non-cash distribution, the directors may make whatever arrangements they

think fit, including, if any difficulty arises regarding the distribution—

78.

(a) fixing the value of any assets; (b) paying cash to any distribution recipient on the basis of that value in order to adjust the rights of recipients; and (c) vesting any assets in trustees. Waiver of distributions (1) Distribution recipients may waive their entitlement to a dividend or other distribution

payable in respect of a share by executing to the company a deed to that effect.

(2) But if the share has more than one holder or more than one person is entitled to the

share (whether by reason of the death or bankruptcy of one or more joint holders, or

otherwise), the deed is not effective unless it is expressed to be executed by all the

holders or other persons entitled to the share.

Division 7—Capitalization of Profits

79.

Capitalization of profits (1) The company may by ordinary resolution on the recommendation of the directors capitalize profits. (2) If the capitalization is to be accompanied by the issue of shares or debentures, the

directors may apply the sum capitalized in the proportions in which the members would

be entitled if the sum was distributed by way of dividend.

(3) To the extent necessary to adjust the rights of the members among themselves if shares

or debentures become issuable in fractions, the directors may make any arrangements

they think fit, including the issuing of fractional certificates or the making of cash

payments or adopting a rounding policy.

Part 6

Miscellaneous Provisions

Division 1—Communications to and by Company

80.

Means of communication to be used (1) Subject to these articles, anything sent or supplied by or to the company under these

articles may be sent or supplied in any way in which Part 18 of the Ordinance provides for

documents or information to be sent or supplied by or to the company for the purposes of

the Ordinance.

(2) Subject to these articles, any notice or document to be sent or supplied to a director in

connection with the taking of decisions by directors may also be sent or supplied by the

means by which that director has asked to be sent or supplied with such a notice or

document for the time being.

(3) A director may agree with the company that notices or documents sent to that director in

a particular way are to be deemed to have been received within a specified time of their

being sent, and for the specified time to be less than 48 hours.

Division 2—Administrative Arrangements

81. Company seals

(1) A common seal may only be used by the authority of the directors. (2) A common seal must be a metallic seal having the company’s name engraved on it in legible form. (3) Subject to paragraph (2), the directors may decide by what means and in what form a

common seal or official seal (whether for use outside Hong Kong or for sealing securities)

is to be used.

(4) Unless otherwise decided by the directors, if the company has a common seal and it is

affixed to a document, the document must also be signed by at least 1 director of the

company and 1 authorized person.

(5) For the purposes of this article, an authorized person is—

(a) any director of the company; (b) the company secretary; or (c) any person authorized by the directors for signing documents to which the common

seal is applied.

(6) If the company has an official seal for use outside Hong Kong, it may only be affixed to a

document if its use on the document, or documents of a class to which it belongs, has

been authorized by a decision of the directors.

(7) If the company has an official seal for sealing securities, it may only be affixed to

securities by the company secretary or a person authorized to apply it to securities by the

company secretary.

No right to inspect accounts and other records

A person is not entitled to inspect any of the company’s accounting or other records or documents merely because of being a member, unless the person is authorized to do so by— (a) an enactment;

(b) an order under section 740 of the Ordinance; (c) the directors; or (d) an ordinary resolution of the company. 82.

83. Auditor’s insurance

(1) The directors may decide to purchase and maintain insurance, at the expense of the

company, for an auditor of the company, or an auditor of an associated company of the

company, against—

(a) any liability to any person attaching to the auditor in connection with any negligence,

default, breach of duty or breach of trust (except for fraud) occurring in the course of

performance of the duties of auditor in relation to the company or associated

company (as the case may be); or

(b) any liability incurred by the auditor in defending any proceedings (whether civil or

criminal) taken against the auditor for any negligence, default, breach of duty or

breach of trust (including fraud) occurring in the course of performance of the duties

of auditor in relation to the company or associated company (as the case may be).

(2) In this article, a reference to performance of the duties of auditor includes the

performance of the duties specified in section 415(6)(a) and (b) of the Ordinance.

84. Winding up

(1) If the company is wound up and a surplus remains after the payment of debts proved in the winding up, the liquidator— (a) may, with the required sanction, divide amongst the members in specie or kind the

whole or any part of the assets of the company (whether they consist of property of

the same kind or not) and may, for this purpose, set a value the liquidator thinks fair

on any property to be so divided; and

(b) may determine how the division is to be carried out between the members or

different classes of members.

(2) The liquidator may, with the required sanction, vest the whole or part of those assets in

trustees on trust for the benefit of the contributories that the liquidator, with the required

sanction, thinks fit, but a member must not be compelled to accept any shares or other

securities on which there is any liability.

(3) In this article—

required sanction (規定認許) means the sanction of a special resolution of the company and

any other sanction required by the Ordinance.