关于大学生的社会责任感(The Major Social Responsibilities of Being a Student in the 21 century)

Concretely speaking, being a current student,we have the duty to ourselves,to our families,as well as to the society and our country.

The sense of responsibility for nowaday adult has been raising clearly. Though they have the higher standard on the development of self-design, self-realization,self-worth.There are still some problems. Such as unconscious of responsibility for family,love,marriage,work, collectivity,cooperation and other.

In one word, the sense of responsibility is being exalted, but the sense of social duty should be enhanced.

Below is the reason for the students lacking in responsibility:

First,the direct communication between the students and the society is less and less.

Second,the tache of communication between the students and society are not smoothly.

They can not understand the society well through the limited social activities they can get about.Therefore,they can not have the high sense of responsibility to the society.

Third,the sub-culture prevails on the campus. The multicultures and internet cultures are also coming into their own, many of them are literature and movieish production with dark color of individualism and latitudinarianism. Being into contact with them for long, you may get extreme ideology, for

example, thinking too much of idio-success and idio-failure, individual recept, so as to ignore the collective advantage.

Being a current student, you have already been and had to be the responsibility main body. Because you’ve had attainder and civic

consciousness, you must have the duty consciousness and know the relation between the right and the duty.

Being a current university man, you must know what’s success and what’s happiness.

What’s happiness? It’s not concerned how much money you have earned, now it’s not strange that a millionaire suicides.It’s a real happiness for people who has a peaceful and simpatico heart.

And what is success? It’s not becoming a president or a famous star, those are in the minority. where the shoe pinches is that you have a sound constitution , a fine personality and also a career which you are falling over yourself for. The students must have an idea to develop a fine personality. Of

course, there must be many difficulties and problems when you are trying . You need a profound consciousness and strong willpower to face and deal with these problems , difficulties and venture.

责任,从具体的方面来说,既有对自己、对家庭的责任,又有对社会、对国家的责任。

现在的大学生自我责任意识已明显增强,对自我设计、自我实现、自我价值的发展要求也比较高。但同时也存在一些问题,如家庭责任意识不强,爱情、婚姻责任观念比较混乱,职业责任认识比较模糊,他人责任和集体责任观念淡化,合作意识不强等。总体来说,责任意识在提升,但社会责任感还有待增强。 大学生缺乏社会责任感,主要有三个方面的原因:

第一,在校学生与社会的直接沟通越来越少。

第二,在校学生与社会的沟通环节不畅。他们所能参与的社会活动,十分有限,不能使同学们完全地认知这个社会,因而,也就不能树立起强烈的社会责任感。

第三,“亚文化”在校园内大行其道,外来文化和网络文化十分盛行,其中有不少都是具有浓重的个人主义、自由主义色彩的文学、影视作品。长期接触,不免也会沾染其中一些不良思想,如过分看重个人得失、个人感受,从而忽略整体利益。

作为当代大学生,已经成为也必须成为责任主体,因为他已经具备公民权利、公民意识,也必须具备责任意识。要正确认识权利和责任的关系。

作为大学生,首先要正确认识什么是成功,什么是幸福。

什么是幸福?不是你赚了多少钱,现在百万富翁自杀的也不少。心灵的宁静与和谐才是幸福。

什么是成功呢?并不是要成为总统、成为名人,那毕竟是少数,关键在于有一个健康的体魄和完善的人格,有一份自己热爱的事业。大学生要增强健全自己人格的观念。 当然,在实际生活中,这样做会遇到很多问题,关键在于如何去面对和处理这些问题,如何应对风险和困难,这需要有深刻的思想认识,又要有坚强的毅力。

第二篇:responsibility-accounting

CHAPTER 12

Responsibility Accounting and Total Quality ANSWERS TO REVIEW QUESTIONS

12-1 A responsibility-accounting system fosters goal congruence by establishing the

performance criteria by which each manager will be evaluated. Development of performance measures and standards for those measures can help to ensure that managers are striving toward goals that support the organization's overall objectives. 12-2 Goal congruence results when the managers of subunits throughout an organization

strive to achieve objectives that are consistent with the goals set by top management. In order for the organization to be successful, the managers and employees throughout the organization must be striving toward consistent goals.

12-3 Several benefits of decentralization are as follows:

(a) The managers of an organization's subunits have specialized information and skills that enable them to manage their departments most effectively. (b) Allowing managers autonomy in decision making provides managerial training for future higher-level managers. (c) Managers with some decision-making authority usually exhibit greater motivation than those who merely execute the decisions of others. (d) Delegating some decisions to lower-level managers provides time relief to upper-level managers. (e) Delegating decision making to the lowest level possible enables an organization to give a timely response to opportunities and problems. Several costs of decentralization are as follows: (a) Managers in a decentralized organization may have a narrow focus on their own units' performance. (b) Managers may tend to ignore the consequences of their actions on the

organization's other subunits.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-1

(c) In a decentralized organization, some tasks or services may be duplicated

unnecessarily.

12-4 (a) Cost center: A responsibility center, the manager of which is accountable for the

subunit's costs. (An example is a production department in a manufacturing firm.)

(b) Revenue center: A responsibility center, the manager of which is accountable for the subunit's revenue. (An example is a sales district in a wholesaling firm.) (c) Profit center: A responsibility center, the manager of which is accountable for the subunit's profit. (An example is a particular restaurant in a fast-food chain.) (d) Investment center: A responsibility center, the manager of which is accountable

for the subunit's profit and the capital invested to generate that profit. (An example is a commuter airline division of an airline company.)

12-5 It would be appropriate to change a particular hotel from a profit center to an

investment center if the manager of the hotel is given the authority to make significant investment decisions affecting the hotel's resources.

12-6 Flexible budgeting allows a performance report to be constructed in a meaningful

way. The performance report should compare actual expenses incurred with the expenses that should have been incurred, given the actual level of activity. The expenses that should have been incurred given the actual level of activity can be obtained from the flexible budget.

12-7 Under activity-based responsibility accounting, management's attention is directed

toward activities, rather than being focused primarily on cost, revenue, and profit measures of subunit performance. Activity-based responsibility accounting uses the database generated by an activity-based costing system coupled with nonfinancial measures of operational performance for key activities. Such an approach can help management eliminate non-value-added activities and improve the cost effectiveness of activities that do add value to the organization's product or service. 12-8 Attention to the following two factors may yield positive behavioral effects from a

responsibility-accounting system.

(a) When properly used, a responsibility-accounting system does not emphasize

blame. The emphasis should be on providing the individual who is in the best position to explain a particular event or financial result with information to help in understanding reasons behind the event or financial result.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-2 Solutions Manual

(b) Distinguishing between controllable and uncontrollable costs or revenues helps

the individuals who are evaluated under a responsibility-accounting system to

feel as though they are evaluated on the basis of events and results over which

they have some control or influence.

12-9 Rarely does a single individual completely control a result in an organization. Most

results are caused by the joint efforts of several people and the joint impact of several events. Nevertheless, there is usually a person who is in the best position to explain a result or who is in the best position to influence the result. In this sense, performance reports based on controllability really are based on a manager's ability to influence results.

12-10 (a) Cost pool: A collection of costs to be assigned to a set of cost objects. (An

example of a cost pool is all costs related to material handling in a manufacturing

firm.)

(b) Cost object: A responsibility center, product, or service to which a cost is

assigned. (The various production departments in a manufacturing firm provide

examples of cost objects. For example, the material-handling cost pool may be

allocated across the various production departments that use material-handling

services.)

12-11 Cost allocation (or distribution): The process of assigning costs in a cost pool to the

appropriate cost objects. (An example of cost allocation would be the assignment of the costs in the material-handling cost pool to the production departments that use material-handling services. For example, the material-handling costs might be allocated to production departments on the basis of the weight of the materials handled for each department.)

12-12 An example of a common resource in an organization is a computer department. The

resource includes the computer itself, the software, and the computer specialists who run the computer system and assist its users. The opportunity costs associated with one person using the computer resource include the possibility that another user will be precluded from or delayed in using the computer resource. Allocating the cost of the computer services department to the users makes the users aware of the opportunity cost of using the computer.

12-13 A computer system has a limited capacity at any one time. Allocating the cost of

using the service to the user makes the user aware that his or her use of the system may preclude someone else from using it. Thus, the user is made aware of the potential opportunity cost associated with his or her use.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-3

12-14 A cost allocation base is a measure of activity, physical characteristic, or economic

characteristic associated with the responsibility centers, which are the cost objects in the allocation process. One sensible allocation base for assigning advertising costs to the various components of a large theme park is the number of people patronizing the park's various components. Presumably, the number of people attending a certain part of the theme park is an indication of how popular that part of the park is. Notice that in most cases the sales revenue generated by the various components of the theme park is not a viable allocation base, since most theme parks have a single admission fee for the entire park.

12-15 Marketing costs are distributed to the hotel's departments on the basis of budgeted

sales dollars so that the behavior of one department does not affect the costs allocated to the other departments. If, on the other hand, the marketing costs had been budgeted on the basis of actual sales dollars, then the costs allocated to each department would have been affected when only one department's actual sales revenue changed.

12-16 A segmented income statement shows the segment margin for each major segment

of the enterprise.

12-17 Many managerial accountants believe that it is misleading to allocate common costs

to an organization's segments. Since these costs are not traceable to the activities of segments, they can be allocated to segments only on the basis of a highly arbitrary allocation base.

12-18 It is important in responsibility accounting to distinguish between segments and

segment managers, because some costs that are traceable to a segment may be completely beyond the influence of the segment manager. Proper evaluation of the segment as an investment of the company's resources requires that these costs be included with costs associated with the segment. However, in evaluations of the manager's performance, these costs should be excluded, since the manager has no control over them.

12-19 Three key features of a segmented income statement are as follows: contribution

format, identification of controllable versus uncontrollable expenses, and segmented reporting, which shows income statements for the company as a whole and for each of its major segments.

12-20 A common cost for one segment can be a traceable cost for another segment. For

example, the salary of the general manager of a hotel is traceable to that segment of the entire hotel company. However, the salary of the hotel's general manager is a common cost for each of the departments in that hotel, such as the food and beverage department and the hospitality department.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-4 Solutions Manual

12-21 Customer profitability analysis refers to using the concepts of activity-based costing

to determine how serving particular customers causes activities to be performed and costs to be incurred. Examples of activities that can be differentially demanded by customers include order frequency, order size, special packaging or handling, customized parts or engineering, and special machine setups. Such activities can make some customers more profitable than others.

12-22 Four types of quality costs are as follows:

(a) Prevention costs: the costs of preventing defects. (b) Appraisal costs: the costs of determining whether defects exist. (c) Internal failure costs: the costs of repairing defects found prior to product sale. (d) External failure costs: the costs incurred when defective products have been

sold.

12-23 Observable quality costs can be measured and reported, often on the basis of

information in the accounting records. For example, the cost of inspectors' salaries is an observable quality cost. Hidden quality costs cannot easily be measured, reported, or even estimated. For example, the opportunity cost associated with lost sales after a defective product is sold is a hidden quality cost to the company.

12-24 A product's quality of design is how well it is conceived or designed for its intended

use. The product's quality of conformance refers to the extent to which a product meets the specifications of its design.

12-25 A product's grade is the extent of its capability in performing its intended purpose,

viewed in relation to other products with the same functional use. An example in the service industry is airline travel. Airplane seats may be coach class or first class; the difference lies in seat size, comfort, and service. Either class will take you from Los Angeles to Chicago, but not with the same degree of comfort.

12-26 "An ounce of prevention is worth a pound of cure" can be interpreted in terms of

resources expended on various categories of quality costs. A dollar spent on prevention may save many dollars of appraisal, internal failure, or external failure costs.

12-27 A cause and effect diagram shows by means of connected lines all the possible

causes of a particular type of defect in a product or service.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-5

SOLUTIONS TO EXERCISES

EXERCISE 12-28 (10 MINUTES)

The type of responsibility center most appropriate for each of the following organizational subunits is indicated below.

(1) Movie theater: Cost center or profit center.

(2) Radio station: Profit center.

(3) Claims department: Cost center.

(4) Ticket sales division of an airline: Revenue center.

(5) Bottling plant: Cost center.

(6) Orange juice factory: Profit center.

(7) College of engineering at a university: Profit center.

(By designating the college of engineering as a profit center, this subunit is

encouraged to generate research grants and manage its operations most effectively. The term "profit center" is used in a slightly different way here. No subunit in a university really makes a profit. However, treating the college of engineering like a profit center means that this subunit's management will have considerable authority in managing the subunit's revenues and expenses.)

(8) European division of a multinational manufacturing company: Investment

center.

(9) Outpatient clinic in a profit-oriented hospital: Profit center.

(10) Mayor's office of a city: Cost center.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-6 Solutions Manual

EXERCISE 12-29 (10 MINUTES)

The appropriate responsibility-accounting treatment for each of the scenarios is the following:

(1) Since the cost of idle time incurred in Department B was due to the breakdown of

improperly maintained machinery in Department A, the costs of the idle time should be charged to Department A.

(2) If the machinery had been properly maintained, it would be more appropriate not to

charge the cost due to idle time in Department B back to Department A. This cost should be considered a normal cost of operating in a sequential production environment. The managers of Department B should anticipate such normal machine breakdowns and plan their production scheduling to accommodate such events.

EXERCISE 12-30 (10 MINUTES)

The Maintenance Department should not be charged for the excess wages of the skilled employees who are temporarily assigned to the Maintenance Department. Modifications should be made in the responsibility-accounting system as follows: (1) the Maintenance Department should be charged with only the normal wages for maintenance employees, $12 per hour. (2) The additional $10 per hour ($22 – $12) should be charged to a top management level account, since the decision to keep these employees on the payroll was made by top management.

EXERCISE 12-31 (10 MINUTES)

By designating this department as a profit center, the corporation has given the managers of the department an opportunity to manage their operation just like a full-fledged business. These managers have specialized knowledge and skills that make them experts in the area of logistics and distribution. They are in the best position to read the needs of other units to whom they provide logistics services, and are also in the best position to make cost-benefit trade-offs that arise in the provision of logistical services. By treating this service department as a profit center, the organization has given its managers an incentive to control costs and also provide a quality service that meets the needs of its customers.

A profit center such as this might not be free to sell its services outside the company. Moreover, the creation of this profit center suggests the need for an internal pricing structure for services supplied to other subunits.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-7

EXERCISE 12-32 (50 MINUTES)

PERFORMANCE REPORTS FOR MARCH: SELECTED SUBUNITS OF ALOHA HOTELS AND RESORTS (IN THOUSANDS) Flexible Budget* Actual Results* Variance? Year to Year to Year to March Date** March Date** March Date** $ 650 $ 1,910 $ 658 $ 1,923 $ 8 F $ 13 F 1,800 5,550 1,794 5,534 6 U 16 U

$ (253) $ (86) $ (255) $1 U $ 2 U (2,110) (690) (2,111) — 1 U (375) (122) (370) 3 F 5 F (225) (78) (232) 3 U 7 U Food and Beverage Department Banquets & Catering .............. Restaurants ............................ .................................... Kitchen staff wages................ Food ........................................ Paper products ....................... Variable overhead .................. Fixed overhead ....................... Total expense ......................... *Numbers without parentheses denote profit; numbers with parentheses denote expenses. ?F denotes favorable variance; U denotes unfavorable variance. **Year-to-date column equals year-to-date column for February in Exhibit 12-4 in the text plus March amount. For example, $1,910 equals $1,260 plus $650.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc.

12-8 Solutions Manual

EXERCISE 12-33 (30 MINUTES) 1.

Allocation of costs:

Department

and

Allocation Base Admissions (enrollment) Registrar (credit hours)

Liberal Arts $36,000 (1,000/2,500)

Division

Sciences $28,800 (800/2,500)

Business Administration $25,200 (700/2,500)

Total Cost Allocated $90,000 $150,000

$56,250 $52,500 $41,250 (30,000/80,000) (28,000/80,000) (22,000/80,000)

Computer Services $64,000 $128,000 $128,000 $320,000 (courses requiring (12/60) (24/60) (24/60)

computer)

The Admissions Department costs are allocated on the basis of enrollment. The more

students enrolled in a division, the more admissions there are to process. The Registrar's costs are allocated on the basis of credit hours. The greater the

number of credit hours, the more course registrations there are to process. The Computer Services Department's costs are allocated on the basis of the

number of courses requiring computer work. The greater the number of computer-intensive courses, the greater will be the demands placed on the Computer Services Department.

2. The number of courses would probably be a better allocation base for the Registrar's

costs. Costs in this department are driven by processing course registrations, not credit hours. A four-credit course does not require any more registration effort than a three-credit course. The estimated amount of computer time required would probably be a better

allocation base for the Computer Services Department. Two different courses requiring computer work could place vastly different demands on the Computer Services Department.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-9

EXERCISE 12-34 (40 MINUTES)

EXERCISE 12-35 (5 MINUTES)

1.

2.

3.

4.

appraisal cost external failure cost internal failure cost prevention cost SEGMENTED INCOME STATEMENTS: COUNTYWIDE CABLE SERVICES, INC. Countywide Segments of Company Cable Services Metro Suburban Outlying Service revenue ...................... $2,200,000 $1,000,000 $ 800,000 $ 400,000 Variable expenses ................... Segment contribution margin $1,750,000 $ 800,000 $ 650,000 $ 300,000 Less: Fixed expenses controllable by segment manager ................................ Profit margin controllable by segment manager ................. $ 880,000 $ 400,000 $330,000 $ 150,000 Less: Fixed expenses, traceable to segment, but controllable by others .......... Profit margin traceable to segment ................................ $ 360,000 Less: Common fixed expenses Income before taxes ............... $ 265,000 Less: Income tax expense ...... McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-10 Solutions Manual

EXERCISE 12-36 (20 MINUTES)

SAN MATEO CIRCUITRY QUALITY COST REPORT

Prevention costs:

Training of quality-control inspectors....................................... Total ....................................................................................... Appraisal costs:

Inspection of purchased electrical components ...................... Tests of instruments ................................................................... Total ....................................................................................... Internal failure costs:

Costs of rework ........................................................................... Costs of defective parts that cannot be salvaged .................... Total ....................................................................................... External failure costs:

Replacement of instruments already sold ................................ Total ....................................................................................... Total quality costs .........................................................................

EXERCISE 12-37 (10 MINUTES)

Observable quality costs in the airline industry:

Current Month's Costs $12,000 $ 9,000

Percentage

of Total

22.2

12.7 31.7

9.5 6.5 17.4 _____

? Cost of repairing damaged luggage.

? Cost of providing lodging for passengers stranded when a flight is cancelled due to

equipment malfunction.

? Cost of cleaning a passenger's clothing when a flight attendant spills food or

beverages on the passenger.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-11

EXERCISE 12-37 (CONTINUED)

Hidden quality costs in the airline industry:

EXERCISE 12-38 (30 MINUTES)

Answers will vary widely, depending on the company chosen. Some examples are as follows:

Marriott Hotels: Company-owned hotel, profit center

McDonald’s Corporation: Company-owned resaurant, profit center

NationsBank: Regional division of company, investment center

Pizza Hut: Kitchen in an individual restaurant, cost center

Ramada Inn: National reservations center, revenue center

Xerox Corporation: Individual manufacturing department or work center, cost center ? Cost of lost flight bookings when passengers judge in-flight service to be substandard. ? Cost of lost flight bookings when potential passengers are unable to get through to the airline's reservations service. ? Cost of lost flight bookings when passengers react to cancelled or late flights.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-12 Solutions Manual

SOLUTIONS TO PROBLEMS

PROBLEM 12-39 (30 MINUTES)

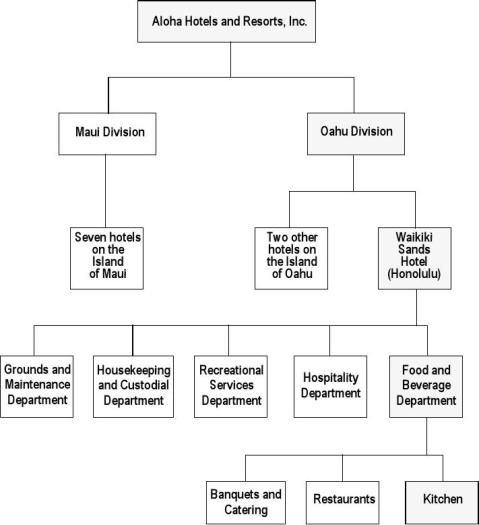

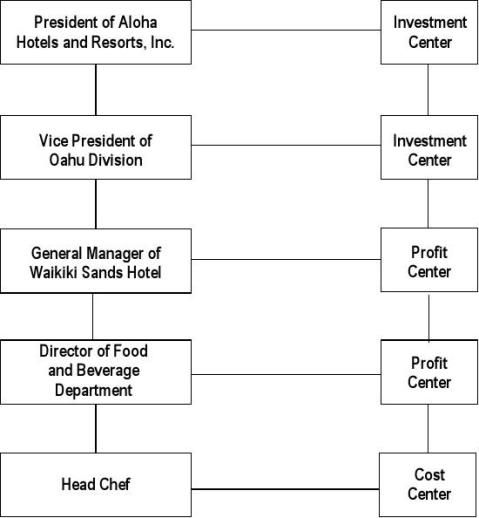

A wide range of possible responses is possible for this problem. The organization chart and companion chart showing responsibility accounting designations should be similar to the charts given for Aloha Hotels and Resorts in Exhibits 12-1 and 12-2, respectively. The letter to stockholders should specify the responsibilities of the managers shown in the charts. Refer to the discussion of Exhibits 12-1 and 12-2 in the text. The charts in Exhibits 12-1 and 12-2 are repeated here for convenience.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-13

PROBLEM 12-39 (CONTINUED)

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-14 Solutions Manual

PROBLEM 12-39 (CONTINUED)

MANAGER RESPONSIBILITY

CENTER

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-15

PROBLEM 12-40 (40 MINUTES)

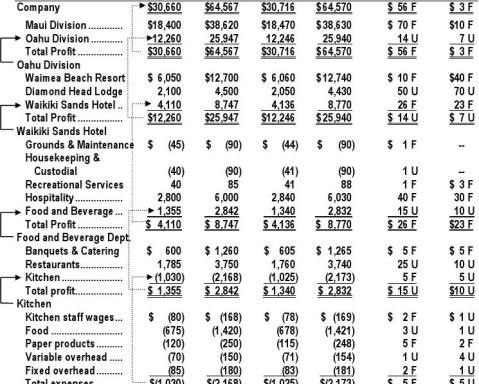

Once again, a wide range of responses is possible, depending on the organization designed in the preceding problem. The format for the performance reports is given in Exhibit 12-4 for Aloha Hotels and Resorts. This exhibit is repeated here for convenience.

PERFORMANCE REPORTS FOR FEBRUARY:

SELECTED SUBUNITS OF ALOHA HOTELS AND RESORTS

(IN THOUSANDS)

Flexible Budget* Year to Actual Results* Year to Variance? Year to

* Numbers without parentheses denote profit; numbers with parentheses denote expenses. ? F denotes favorable variance; U denotes unfavorable variance.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc.

12-16 Solutions Manual

PROBLEM 12-41 (35 MINUTES)

Memorandum

Date: Today

To: Sandy Beach, General Manager of Waikiki Sands Hotel

From: I.M. Student

Subject: Responsibility Centers

The Waikiki Sands Hotel is a profit center as specified by the corporation's top management. The hotel's general manager does not have the authority to make significant investment decisions, so an investment-center designation would be inappropriate for the hotel. The Grounds and Maintenance Department and the Housekeeping and Custodial Department should be cost centers, since these departments do not generate revenue. The Food and Beverage Department should be a profit center, since the department's manager can influence both the costs incurred in the department and the revenue generated. The Food and Beverage Director can determine the menu, set meal prices, and make entertainment decisions, all of which significantly influence the department's revenue.

The Hospitality Department also should be a profit center. The Director of Hospitality has significant influence in setting room rates and making decorating decisions, which affect the department's revenue. The Director also makes hiring and salary decisions for the department's staff, which significantly affect departmental expenses. The Hospitality Department's three subunits (Front Desk, Bell Staff, and Guest Services) should be cost centers, since they do not generate revenue. The managers of these subunits can significantly influence the costs incurred in their units through hiring and salary recommendations, staff scheduling, and use of materials and equipment.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-17

PROBLEM 12-42 (60 MINUTES)

1. Performance Report for August: Selected Subunits of Rocky Mountain General Hospital to to *F denotes favorable variance; U denotes unfavorable variance. to

2.

Arrows are included on the performance report to show the cost relationships.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-18 Solutions Manual

PROBLEM 12-42 (CONTINUED)

3. A variety of responses are reasonable for this question. Since the data given in the

problem do not include the individual variances over several months, it is not possible to condition the investigation on trends. The largest variances in the performance report are the most likely to warrant an investigation. The following variances for August would likely catch the attention of the hospital administrator:

General Medicine Division .......................................................................... $6,000 F Administrative Division ............................................................................... 3,500 U Nursing Department ..................................................................................... 5,000 U Maintenance Department ............................................................................ 7,000 F Food servers' wages .................................................................................... 1,000 U

The $1,000 variance for food servers' wages is smaller than some of the variances

not listed above. However, it is a relatively large variance for only one cost item in the subunit. In contrast, the $1,600 variance for the kitchen is for an entire subunit of the hospital.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-19

PROBLEM 12-43 (45 MINUTES)

1.

Cost Costs Pool Distributed Facilities $ 71,250 38,000 42,750 Utilities $ 8,100 6,000 5,400 General $ 66,000 administration 44,000 44,000 Community $ 20,000 outreach 12,500 7,500 2. An alternative allocation base for community outreach costs is the number of hours

spent by each division's personnel in community outreach activities. This base would be more reflective of the actual contribution of each division to the program.

3. The reason for allocating utility costs to the divisions is so that each division's cost

reflects the total cost of running the division. Since none of the divisions can operate without electricity, heat, water, and so forth, these costs should be reflected in divisional cost reports. By allocating such costs, division managers are made aware of these costs and are able to reflect the costs when pricing services and seeking third-party reimbursements, such as those from insurance companies.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-20 Solutions Manual Allocation Division Base General Medicine .......... 15,000 sq. ft. Surgical ......................... 8,000 sq. ft. Medical Support ............ 9,000 sq. ft. Administrative ............... sq. ft. Total ............................... sq. ft. General Medicine .......... 135,000 cu. ft. Surgical ......................... 100,000 cu. ft. Medical Support ............ 90,000 cu. ft. Administrative ............... cu. ft. Total ............................... cu. ft. General Medicine ....... 30 empl. Surgical ......................... 20 empl. Medical Support ............ 20 empl. Administrative ............... empl. Total ............................... empl. General Medicine .......... $2,000,000 Surgical ......................... 1,250,000 Medical Support ............ 750,000 Administrative ............... Percentage of Total 37.5% 20.0% 22.5% 33.75% 25.00% 22.50% 30.00% 20.00% 20.00% 50.00% 31.25% 18.75%

PROBLEM 12-44 (35 MINUTES)

1. Segmented income statement:

Sales revenue………………………………. Variable operating expenses:

Cost of goods sold…………………… Sales commissions……………………

Total………………………………...

Segment contribution margin……………. Less: Fixed expenses controllable by

segment manager:

Local advertising……………………… Sales manager salary…………………

Total………………………………...

Profit margin controllable by segment

manager………………………………… Less: Fixed expenses traceable to

segment, but controllable by others:

Local property taxes………………….. Store manager salaries………………. Other……………………………………..

Total………………………………...

Segment profit margin…………………….. Less: Common fixed expenses…………. Net income…………………………………...

Show-Off, Inc.

$ 705,000 $ 81,000

$ 12,500 108,000 $ 285,380 Las Vegas

$203,500 $ 11,000

$ 4,500 31,000

Reno

$225,500 $ 22,000

Sacramento

$276,000 $ 48,000

$ 2,000 $ 6,000 39,000 38,000

Calculations:

Sales revenue: Las Vegas, 37,000 units x $12.00; Reno, 41,000 units x

$11.00; Sacramento, 46,000 units x $9.50

Cost of goods sold: Las Vegas, 37,000 units x $5.50; Reno, 41,000

units x $5.50; Sacramento, 46,000 units x $6.00

Sales commissions: Las Vegas, $444,000 x 6%; Reno, $451,000 x 6%;

Sacramento, $437,000 x 6%

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-21

PROBLEM 12-44 (CONTINUED)

2. Sacramento is the weakest segment because of several factors:

? Las Vegas and Reno have much higher markups on cost [118%( $6.50/$5.50) and 100% ($5.50/$5.50), respectively]. However, Sacramento’s markup is only 58% ($3.50/ $6.00).

? Despite being the only store that has a sales manager, and spending considerably more on advertising than Las Vegas and Reno, Sacramento has the lowest gross dollar sales of the three stores. Sacramento’s return on these outlays appears inadequate.

? Sacramento’s ―other‖ noncontrollable costs are much higher than those of Las Vegas and Reno.

3. Show-Off uses a responsibility accounting system, meaning that managers and centers are evaluated on the basis of items under their control. Since this is a personnel-type decision, the decision should be made by reviewing the profit margin controllable by the store (i.e., segment) manager. The segment contribution margin excludes fixed costs under a store manager’s control; in contrast, a store’s segment profit margin would reflect all traceable costs whether controllable or not.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-22 Solutions Manual

PROBLEM 12-45 (35 MINUTES)

1. Warranty costs: External failure

Reliability engineering: prevention

Rework at AT’s manufacturing plant: internal failure

Manufacturing inspection: appraisal

Transportation costs to customer sites: external failure

Quality training for employees: prevention

2&3. Evaluation of quality costs:

No. 165

$ % of Sales

Sales revenue:

$60,000 x 80; $55,000 x 100... Prevention:

Reliability engineering

1,600 hours x $150……… $ 240,000

2,000 hours x $150………

Quality training………………. Total…………………… 5.73% Appraisal (inspection):

300 hours x $50………………. .31%

500 hours x $50………………. Internal failure (rework at AT):

80 units x 35% x $1,900…….. 1.11%

100 units x 25% x $1,600…… External failure:

Warranty costs:

80 units x 70% x $1,200… $ 67,200

100 units x 10% x $400….

Transportation to customers Total…………………… Total quality costs……………….. No. 172 $ % of Sales $ 300,000 6.36% .45% .73% $ 4,000 McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-23

PROBLEM 12-45 (CONTINUED)

Individual quality costs as a % of total quality costs:

No. 165 No. 172

$ % of Total $ % of Total

Prevention……….. $275,000 62.51% $350,000 80.65%

Appraisal ………... 15,000 3.41% 25,000 5.76%

Internal failure …. 53,200 12.09% 40,000 9.22%

External failure…. 21.98% 4.38%

Total ………….

4. Yes, the company is ―investing‖ its quality expenditures differently for the two machines. Advanced is spending more up-front on no. 172 with respect to prevention and appraisal—over 86% of the total quality expenditures. (This figure is approximately 66% for no. 165.) The net result is lower internal and external failure costs and, perhaps more important, lower total quality costs as a percentage of sales (7.89% for no. 172 and

9.16% for no. 165).

This problem illustrates the essence of total quality management systems when compared with conventional quality control procedures. Overall costs are lower with TQM when compared against systems that focus on ―after-the-fact‖ detection and rework.

5. Prevention, appraisal, internal failure, and external failure costs are observable in the sense that such amounts can be measured and reported. When inferior products make it to the marketplace, customer dissatisfaction will often increase, resulting in lost sales of the defective product and perhaps other goods as well. The ―cost‖ of these lost sales is an opportunity cost—a ―hidden‖ cost that is very difficult to measure.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-24 Solutions Manual

PROBLEM 12-46 (75 MINUTES)

1.

SEGMENTED INCOME STATEMENTS: BUCKEYE DEPARTMENT STORES, INC. (IN THOUSANDS) Segments of Company Segments of Columbus Division Buckeye Department Cleveland Columbus Olentangy Scioto Downtown Not Allocated

Stores, Inc. Division Division Store Store Store

Sales revenue ................................................. Variable operating expenses: Cost of merchandise sold ........................ $23,000 $12,000 $11,000 $3,000 $2,000 $6,000 Sales personnel—salaries ....................... 3,050 1,600 1,450 400 300 750 Sales commissions .................................. 380 200 180 50 40 90 Utilities ....................................................... 590 300 290 80 60 150 Other .......................................................... Total variable expenses ........................... Segment contribution margin ........................ Less: Fixed expenses controllable by segment manager:

Depreciation—furnishings ....................... $ 560 $ 290 $ 270 $ 80 $ 50 $ 140 Computing and billing .............................. 405 210* 195 40 30 75 50

Warehouse ................................................ 780 450330 70 60 200

Insurance ................................................... 355 200155 40 25 90

Security ...................................................... _____

Total ................................................................. Profit margin controllable by segment manager ......................................... $9,465 $5,290 $4,175 $1,150 $ (230) $3,305 (50) Less: Fixed expenses, traceable to segment, but controllable by others: ..........

Depreciation—buildings .......................... $ 930 $ 470 $ 460 $ 120 $ 90 $ 250 Property taxes ........................................... 305 170 135 35 20 80 Supervisory salaries ................................. ? Total ................................................................. Profit margin traceable to segment .............. $6,480 Less: Common fixed expenses ..................... Income before taxes ....................................... $6,360 Less: Income tax expense ............................. *$210 = $160 listed in table + $50 not allocated. ?$1,000 = $900 listed in table + $100 not allocated.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc.

Managerial Accounting, 5/e 12-25

PROBLEM 12-46 (CONTINUED)

2. The segmented income statement would help the president of Buckeye Department

Stores gain insight into which division and which individual stores are performing well or having difficulty. Such information serves to direct management's attention to areas where its expertise is needed.

PROBLEM 12-47 (30 MINUTES)

Responsibility-accounting system:

1. At least two potential behavioral advantages if Building Services Co.'s (BSC's) managers accept and participate in the development of budgets are as follows:

? They would be motivated to plan ahead and promote goal congruence.

? They would be pleased to be responsible only for those items they can control.

2. At least two potential problems that could arise if the managers do not accept the change in philosophy are as follows:

? They could resent being measured on an individual basis, since they may be responsible for costs over which they have no control.

? The could focus too much on their own department's goals at the possible detriment to the organization as a whole (suboptimization).

3. If the managers support the new system, and most of the disadvantages pointed out above are avoided, the responsibility-center system will enhance the alignment of organizational and personal goals. Since Commercial Maintenance, Inc. (CMI) took the time to fully explain and communicate the system to BSC's managers, by pointing out the advantages and encouraging their participation, organizational and personal goals will likely become aligned.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-26 Solutions Manual

PROBLEM 12-47 (CONTINUED)

Participatory budgeting system:

1. At least two potential behavioral benefits are the following:

? BSC's managers are likely to accept the system and be motivated to attain the

budget targets, since they were actively involved in setting the goals and know what is expected of them.

? Communication and group cohesiveness would be improved, because the managers

would feel part of a team.

2. At least two potential problems that could arise are as follows:

? The managers could be motivated to "pad" their budgets, putting slack in the plan to

ensure meeting the goals.

? Overemphasis on departmental goals could hurt cross-departmental employee

relations.

3. Participatory budgeting can contribute to an organization’s goals by encouraging buy-in

to the resulting budget and performance evaluation by the organization’s employees. There is no reason to believe that such an approach would not be beneficial for BSC. McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-27

ROBLEM 12-48 (45 MINUTES)

Memorandum

Date: Today

To: Mathew Basler, President of Warriner Equipment Company

From: I. M. Student

Subject: Responsibility-Accounting System

Warriner Equipment Company's critical success factors are as follows:

1. Cost-efficient production: The firm must meet the market price, which implies

producing in a cost-efficient manner.

2. High product quality: Stated by the company president as necessary for success.

3. On-time delivery: Also noted by the company president as critical to the firm's

success.

Note that the product price is not a critical success factor, since it is largely beyond the company's control. The price is determined by the market.

A responsibility-accounting system in which the plants are profit centers is consistent with achieving high performance on the firm's critical success factors. The plant managers are in the best position to influence production cost control, product quality, and on-time delivery.

The sales districts should be revenue centers, in which the sales district managers are accountable for meeting sales projections.

Suppose the plants are cost centers and the sales districts are revenue centers. When a rush order comes in, the plant manager's incentive is to reject it because rush orders tend to increase production costs (due to increased setups, interrupted production, etc.). The sales district manager's incentive is to push rush orders, because accepting a rush order results in a satisfied customer and increased future business. Thus, there is a built-in conflict between the plant managers and the sales district managers.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-28 Solutions Manual

PROBLEM 12-48 (CONTINUED)

If the plants are profit centers, then each plant manager is encouraged to consider both the costs and the benefits of a rush order. The cost is increased production cost, and the benefit is a satisfied customer. Since the plant manager is rewarded for achieving a profit, he or she has an incentive to weigh the cost-benefit trade-off inherent to the rush-order problem.

In conclusion, I recommend that the plants be designated as profit centers and the sales districts be designated as revenue centers.

PROBLEM 12-49 (40 MINUTES)

1. The factors that should be present for an organization's quality program to be

successful include the following:

? Evidence of top management support, including motivational leadership and resource commitments. ? Training of those involved, including employees and suppliers. ? A cultural change leading to a corporate culture committed to the customer and to

continuous, dynamic improvement.

2. From an analysis of the cost-of-quality report, the program appears to have been

successful, because of the following:

? Total quality cost has declined from 23.4 to 13.1 percent of total production costs. ? External failure costs, those costs signaling customer dissatisfaction, have

declined from 8 percent of total production cost to 2.3 percent. These declines in warranty repairs and customer returns should translate into increased sales in the future.

? Internal failure costs have been reduced from 4.6 to 2.3 percent of production

costs, and the overall cost of scrap and rework has gone down by 45.7 percent ($188,000 – $102,000)/$188,000.

? Appraisal costs have decreased by 43.4 percent [($205,000 – $116,000)/$205,000].

Higher quality is reducing the demand for final testing.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-29

PROBLEM 12-49 (CONTINUED)

? Quality costs have shifted to the area of prevention, where problems are solved

before the customer becomes involved. Maintenance, training, and design reviews have increased from 5.8 percent of total production cost to 6 percent and from 24.9 percent of total quality cost to 45.7 percent. The $30,000 increase is more than offset by decreases in other quality costs.

3. Tony Reese's current reaction to the quality improvement program is more favorable

because he is seeing the benefits of having the quality problems investigated and solved before they reach the production floor. Because of improved designs, quality training, and additional preproduction inspections, scrap and rework costs have declined. Production personnel do not have to spend an inordinate amount of time on customer service, because they are now making the product right the first time. Throughput has increased and throughput time has decreased. Work is now moving much faster through the department.

4. To measure the opportunity cost of not implementing the quality program,

management could do the following:

? Assume that sales and market share will continue to decline and then calculate the revenue and income lost. ? Assume that the company will have to compete on price rather than on quality and calculate the impact of having to lower product prices.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-30 Solutions Manual

SOLUTIONS TO CASES

CASE 12-50 (45 MINUTES)

1. Segmented income statement:

CATHY'S CLASSIC CLOTHES: NORTHEAST REGION

Segmented Income Statement

For May

Coastal New Haven

District Store

Sales ................................................................. $1,500,000 $600,000

Less: Cost of goods sold .................................. Gross margin ......................................................

Operating expenses:

Variable selling ....................................... $ 90,000 $ 36,000

Variable administrative .......................... 37,500 15,000

Other direct expenses: ......................................

Store maintenance ................................. 12,600 7,500

Advertising ............................................. 75,000 50,000

Rent and other costs .............................. 150,000 60,000

District general administrative

expenses (allocated) .............................. 180,000 72,000

Regional general and administrative

expenses (allocated) .............................. Total expenses ................................................... Net Income .......................................................... Boston Store $525,000 $ 31,500 13,125 600 5,000 45,000 63,000 McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-31

CASE 12-50 (CONTINUED)

Supporting calculations:

Sales ......................................... Cost of goods sold .................. Variable selling ........................ Variable administrative ............ Maintenance .............................

Advertising ............................... Rent ...........................................

District expenses ..................... 2. 3.

Coastal District Given Given $1,500,000 x .06 $1,500,000 x .025 $7,500 + $600 + $4,500

Given Given Given

New Haven Store

$1,500,000 x .40 $600,000 x .42 $600,000 x .06 $600,000 x .025

Given

($75,000)(2/3)

$150,000 x .40

$180,000 x .40

Boston Store

$1,500,000 x .35 $525,000 x .42 $525,000 x .06 $525,000 x .025

Given

$50,000 x .10 at New Haven $150,000 x .30 for Coastal District $180,000 x .35

The Portland store's net income for May is $12,375 ($156,150 - $52,500 - $91,275).

The impact of the responsibility-accounting system and bonus structure on the

managers' behavior and the effect of this behavior on the financial results for the two stores include the following:

(a) New Haven Store:

? Because the bonus is based on sales over $570,000, the manager has concentrated on maximizing sales and has paid little attention to controllable costs. As a result, the store's net income is less than 9 percent of sales and only 34 percent (rounded) of total net income.

? In an effort to maximize sales, the New Haven store spent 10 times as much as the Boston store on advertising but generated only $75,000 more in sales. Thus the advertising must not have been very effective and should be better controlled.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc.

12-32 Solutions Manual

CASE 12-50 (CONTINUED)

(b) Boston Store:

? Because the manager of the Boston store is motivated to maximize net income, there

appears to be a tendency to cut back on discretionary expenses, such as store

maintenance and advertising. While management is seeking cost control by

implementing a bonus based on net income, the lack of spending on these discretionary items may have an adverse long-term effect.

? The manager of the Boston store will be unhappy with the inclusion of allocated district

and regional expenses in the calculation of net income. These expenses are not likely to be controlled by the store manager and will reduce the bonus received by the manager of the Boston store.

4. The assistant controller's actions violate several standards of ethical conduct for

management accountants, including the following:

Competence

? Prepare complete and clear reports and recommendations after appropriate analysis of

relevant and reliable information.

Integrity:

? Communicate unfavorable as well as favorable information and professional judgements

of opinions.

? Refrain from engaging in any activity that would discredit the profession.

Objectivity:

? Communicate information fairly and objectively.

? Disclose fully all relevant information that could reasonably be expected to influence

and intended user's understanding of the reports, comments, and recommendations presented.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-33

CASE 12-51 (60 MINUTES)

1.

Segmented income statement by geographic areas:

PACIFIC RIM INDUSTRIES

SEGMENTED INCOME STATEMENT BY GEOGRAPHIC AREAS

FOR THE FISCAL YEAR ENDED APRIL 30, 20x0

Geographic Areas

United States Canada Asia Unallocated Sales in unitsa Furniture .................... 64,000 16,000 80,000

Sports ........................ 72,000 72,000 36,000

Appliances .................

Total unit sales .......

Revenueb

Furniture .................... $ 512,000 $ 128,000 $ 640,000

Sports ........................ 1,440,000 1,440,000 720,000

Appliances .................

Total revenue .........

Variable costsc

Furniture .................... $ 384,000 $ 96,000 $ 480,000

Sports ........................ 864,000 864,000 432,000

Appliances .................

Total variable costs

Contribution margin ....

Fixed costs

Manufacturing

overheadd ............... $ 165,000 $ 135,000 $ 200,000

Depreciatione ............. 134,400 96,000 169,600

Administrative and

selling expenses .... Total fixed costs .... Operating income (loss) ............................. Total 160,000 180,000 $1,280,000 3,600,000 $ 960,000 2,160,000 $ 500,000 400,000 McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-34 Solutions Manual

CASE 12-51 (CONTINUED)

SUPPORTING CALCULATIONS

aSales in units

United States

Furniture ............................................. Sports .................................................. Appliances ..........................................

Canada

Furniture ............................................. Sports .................................................. Appliances .......................................... Asia

Furniture ............................................. Sports .................................................. Appliances ..........................................

bRevenue

Total Units ? % of Sales = Units Sold

160,000 .40 64,000 180,000 .40 72,000 160,000 .20 32,000

160,000 .10 16,000 180,000 .40 72,000 160,000 .20 32,000

160,000 .50 80,000 180,000 .20 36,000 160,000 .60 96,000

Units Sold

64,000 72,000 32,000

16,000 72,000 32,000

80,000 36,000 96,000

Unit Price

$ 8.00 20.00 15.00

8.00 20.00 15.00

8.00 20.00 15.00

Revenue

$ 512,000 1,440,000 480,000

128,000 1,440,000 480,000

640,000 720,000 1,440,000

United States

Furniture ................................................... Sports ........................................................ Appliances ................................................

Canada

Furniture ................................................... Sports ........................................................ Appliances ................................................ Asia

Furniture ................................................... Sports ........................................................ Appliances ................................................

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-35

CASE 12-51 (CONTINUED)

cVariable costs

Units Sold (1) 64,000 72,000 32,000

16,000 72,000 32,000

80,000 36,000 96,000

Variable Mfg. Cost/Unit (2) $4.00 9.50 8.25

4.00 9.50 8.25

4.00 9.50 8.25 Area Variable Costs

$1,584,000 1,296,000

United States

Furniture ........................... Sports ................................ Appliances ........................

Canada

Furniture ........................... Sports ................................ Appliances ........................ Asia

Furniture ........................... Sports ................................ Appliances ........................

dManufacturing overhead

Variable Total Selling Variable Cost/Unit Cost (3) (1) ? [(2) + (3)] $2.00 $ 384,000 2.50 864,000 2.25 336,000

2.00 96,000 2.50 864,000 2.25 336,000

2.00 480,000 2.50 432,000 2.25 1,008,000

United States ........................ Canada .................................. Asia ....................................... Total ......................................

Total Manufacturing Overhead

$500,000 500,000 500,000

Proportion Allocated

of Manufacturing total Cost 33% $165,000 27% 135,000 40%

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc.

12-36 Solutions Manual

CASE 12-51 (CONTINUED)

eDepreciation expense

Total Depreciation $400,000 400,000 400,000

Area Units Sold 168,000 120,000

2.

United States………………… Canada………………………... Asia……………………………. Proportion

of Allocated Total Depreciation 33.6% $134,400 24.0% 96,000 42.4% Areas where the company’s management should focus its attention in order to

improve corporate profitability include the following:

? The income statement by product line shows that the furniture product line may

not be profitable. The furniture product line does have a positive contribution. However, the fixed costs assigned to the product line result in a loss. Management should investigate:

—The possibility of increasing the selling price of these products.

—The possibility of increasing volume by cutting prices or increasing advertising, resulting in a larger total contribution margin. —Cutting variable costs associated with this product line.

—Discontinuing the manufacture of furniture and concentrating on the other product lines that are more profitable.

—How much of the fixed costs allocated to furniture are separable (avoidable) if the product line is discontinued.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-37

CASE 12-51 (CONTINUED)

? The income statement by geographic area shows that the Asian market is the least

profitable sales area. In order to improve the profit margin in the Asian market, management should:

— Investigate the selling and administrative expenses in this area as they are considerably higher than those in other areas. — Consider increasing the sales of product lines other than furniture as this product line makes the smallest contribution to profit.

these costs and improve overall profitability. ? Management should review the unallocated expenses in an attempt to reduce

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-38 Solutions Manual

CURRENT ISSUES IN MANAGERIAL ACCOUNTING

ISSUE 12-52

―HOW FORD, FIRESTONE LET THE WARNINGS SLIDE BY AS DEBACLE DEVELOPED: THEIR SEPARATE GOALS, GAPS IN COMMUNICATION GAVE RISE TO RISKY SITUATION," THE WALL STREET JOURNAL, SEPTEMBER 6, 2000, TIMOTHY AEPPEL, CLARE ANSBERRY, MILO GEYELIN AND ROBERT I. SIMISON.

1. Firestone should have been more aggressive in keeping an eye out for defects since

it previously had a major problem with tread peeling off its tires. Ford should have kept its own records of tire performance instead of depending on Firestone's reassurances.

2. The value chain is a set of business functions that add value to the products or

services of an organization. The value chain includes functions such as the following: research and development: design of products, services, or processes; production; marketing; distribution; and customer service. In this scenario, Ford and Firestone are each part of the other’s value chain.

ISSUE 12-53

―MANAGER'S JOURNAL: ANOTHER JACK WELCH ISN'T GOOD ENOUGH," THE WALL STREET JOURNAL, NOVEMBER 22, 1999, MICHAEL ALLEN.

The next leader of GE will need to have even bigger ideas and imagination than today's CEO. He or she must have the vision and foresight to anticipate what the enterprise will need to become over the next 20 years. He or she will need to lead leaders and have the political skills to deal with challenges from outside the company.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. Managerial Accounting, 5/e 12-39

ISSUE 12-54

―HERB KELLEHER HAS ONE MAIN STRATEGY: TREAT EMPLOYEES WELL," THE WALL STREET JOURNAL, AUGUST 31, 1999, HAL LANCASTER.

1. Build a culture with an esprit de corps.

2. Structure training exercises so that everyone has to contribute to complete them

successfully.

3. Give people the license to be themselves and motivate others in that way. Give

each person the opportunity to be a maverick.

4. Allow and encourage people to take pride in what they're doing.

5. Fight bureaucracy and hierarchy.

6. Recognize that people are still the most important part of an organization. How

management treats its employees determines how they treat people outside the company.

McGraw-Hill/Irwin ? 2002 The McGraw-Hill Companies, Inc. 12-40 Solutions Manual