国际结算知识点总结(单选25,判断15,实务60)

一、 三次作业

1、Please draw a draft according to the following material:

Native Product Imp.and Exp. Corporation Jiangsu branch sold some goods valued GBP54,000.00 to Polar Furs LID,London. For settlement ,the exporter drew a draft on the importer on Feb 20, 2010, asking the latter to pay 100% of the proceeds to the order of exporter 30 days after the date of issue. According to the instruction of the importer, the draft will be paid actually at Barclays Bank, PLC, London.

Exchange for GBP54,000.00 Jiangsu 20th Feb. 2010

at 30 days after date pay to the order of Native Products Imp.and Exp. Corporation, Jiangsu the sum of Pounds Fifty Four Thousand only

To Polar Furs LID,London For Native Products

Payable by Barclays Bank, PLC, Imp.and Exp. Corporation,

London Jiangsu

authorized signature

2、 Read the following draft and give your answer to each of the following questions.

Exchange for USD50,000.00 Jan 15,2010

At 60 days after date pay this first bill (Second unpaid) to the order of Bank of china the sum of Fifty Thousand U S Dollars only.

To: ABC company For China National Crafts

New York Import &Export Corporation, Shanghai Branch.

(signed)

1.Who is the drawer?China National Crafts Import &Export Corporation, S.B.

2.Who is the drawee?ABC company New York

3.Who is the payee?The order of Bank of china

4.Is this a demand draft or a tenor draft? A tenor draft

5.Is this a solo bill or a bill of exchange in two sets?A bill of exchange in two sets

6.Where is the bill drawn?Shanghai

7.When is the bill drawn?Jan 15,2010

8.On which date will the bill mature? Mar 16,2010

3、 Please complete the following sentence with proper contents according to the following draft.

Exchange for US$100,000.00 New York , 10th Aug, 2010

At 60 days after sight pay to Brown & Thomas Inc. N.Y. or order

the sum of U.S.dollars one hundred thousand only

To : Irving Trust company

London For George Anderson Inc.

New York

authorized signature

the bill for US$100,000.00(the sum of U.S.dollars one

hundredthousand only )is drawn byGeorge Anderson Inc. New York

on Irving Trust company London payable at60 days after sight

to Brown & Thomas Inc. N.Y. or order dated 10th Aug, 20##

4、 The above bill is transferred to Citibank N.Y. for collection. It is then accepted on 20th Aug, 2010, and guaranteed by Barclays bank, PLC, London on 21st Aug, 2010.

Please make endorsement, acceptance, guarantee accordingly, and calculate the due date

Endorsement

pay to CitiBank N.Y. for collection

For Brown & Thomas Inc. N.Y.

Signature

Acceptance

Accepted

20th Aug., 2010

For Irving Trust Company, London

Signature

Due date: Oct. 19, 2010

Guarantee

Per Aval

For a/c of Irving Trust Company, London

21st Aug., 2010

For Barclays Bank PLC, London

signature

5、On Feb.15, 2010, Citibank N.A. New York (SWIFT code CITIUS33), at the request of its customer ---ABC Co. New York, sends a payment order numbered TT-201035 through SWIFT to Agricultural Bank of China, Jiangsu branch (SWIFT code ABOCCNBJ100) with the amount of USD25000 in payment of the proceeds under S/C No. 4321.The funds are to be credited to the a/c No. 143258 of XYZ Co. Jiangsu and valued on Feb.15, 2010. For reimbursement, the former bank credits the latter bank’s vostro account with the funds remitted, less USD50 as remitting bank’s charges because all bank charges are to be borne by the exporter.

Please complete the following message according to the material given above.

CUSTOMER CREDIT TRANSFER

DATE : 100215

SENDER: CITIUS33

MT: 103

RECEIVER: ABOCCNBJ100

20: SENDER’S REF:TT-201035

23B: BANK OPERATION CODE: CRED

32A: VALUE DATE/CUR /INTERBANK SETTLED AMT: 100215USD24950,00

33B: CURRENCY/INSTRUCTED AMOUNT: USD25000,00

50K: ORDERING CUSTOMER: ABC CO. NEW YORK

59: BENEFICIARY CUSTOMER: /143258

XYZ CO. JIANGSU

70: REMITTANCE INFORMATION: S/C NO.4321

71A: DETAILS OF CHARGES: BEN

71F: SENDER’S CHARGES: USD50,00

72: BANK TO BANK INFORMATION:

IN COVER, WE HAVE CREDITED YOUR A/C WITH US

二、 信用证内容、条款、样式

内容:Items on the credit itself;Items on draft;Items on goods,shipping documents and transport;Other items.(开证行是谁,金额是多少等等,填写信用证分析表)

1. Basic clauses(基本条款)2. Transportation clauses(运输条款)

3. Commodity clauses(货物条款)4. Documentation clauses(单据条款)

5. Other clauses(其他条款)

样式

SENDER: BOFAUS6SYXXX

*BANK OF AMERICA

*SAN FRANCISCO, CA

RECEIVER: BKCHCNBJ940

*BANK OF CHINA

*JIANGSU BR

MT: 700 ISSUE OF A DOCUMENTARY CREDIT

27: SEQUENCE OF TOTAL: 1/2

40A: FORM OF DOCUMENTARY CREDIT:

IRREVOCABLE

20: DOC.CREDIT NUMBER: 1010573

31C: DATE OF ISSUE: 080910

40E: APPLICABLE RULES: UCP LATEST VERSION

31D: EXPIRY DATE: 081030

PLACE: IN CHINA

50: APPLICANT: SENG-CHO INTERNATIONAL, LTD.

3283 LAKE SHORE AVE SUITE 203

OAKLAND, CA 94610

59: BENEFICIARY: LIANYUNGANG METALS MINERALS

AND MACHINERY I/E CORP,

JUN GONG ROAD, XUGOU,

LIANGYUNGANG,JIANGSU, CHINA

32B: CURRENCY CODE, AMOUNT: USD 45000,00

41A: AVAILABLE WITH /BY: ANY BANK IN CHINA

BY NEGOTIATION

42C: DRAFTS AT: 90 DAYS AFTER SHIPMENT DATE

42A: DRAWEE: BOFAUS6SYXXX

43P: PARTIAL SHIPMENTS: ALLOWED

43T: TRANSSHIPMENT: ALLOWED

44E: PORT OF LOADING: ANY PORT IN CHINA

44F: PORT OF DISCHARGE: OAKLAND PORT, CA

44C: LATEST DATE OF SHIPMENT: 080930

45A: DESCRIPTION OF GOODS:

CRAWFISH MEAT ( FROZEN ) 1500KG AT USD30 PER KG , CIF OAKLAND PORT, CA

46A: DOCUMENTS REQUIRED:

+ ORIGINAL AND 2 COPIES OF SIGNED COMMERCIAL INVOICE

+ FULL SET OF CLEAN MARINE BILL OF LADING ‘ON BOARD’ THE NAMED VESSEL, CONSIGNED TO THE ORDER OF SHIPPER, BLANK ENDORSED, MARKED ‘FREIGHT PREPAID’, INDICATING NOTIFY APPLICANT.

+ INSURANCE POLICY OR CERTIFICATE IN DUPLICATE FOR 110% OF INVOICE VALUE COVERING ALL RISKS.

+ ORIGINAL AND 1 COPY OF PACKING LIST

47A: ADDITIONAL CONDITIONS:

71B: DETAILS OF CHARGES:

ALL BANK CHARGES OTHER THAN THOSE OF THE ISSUING BANK, ARE FOR THE ACCOUNT OF THE BENEFICIARY.

48: PRESENTATION PERIOD:

DOCUMENTS MUST BE PRESENTED AT PLACE OF EXPIRY WITHIN 30 DAYS AFTER SHIPMENT AND WITHIN VALIDITY OF CREDIT.

49: CONFIRMATION INSTRUCTION: WITHOUT

78:INSTRUCTION TO THE PAYING / ACCEPTING / NEGOTIATING BANK:

THE AMOUNT OF EACH DRAFT MUST BE ENDORSED ON THE REVERSE OF THIS DOCUMENTARY CREDIT BY THE NEGOTIATING BANK.

UPON RECEIPT OF CONFORMING DOCUMENTS AT OUR COUNTERS WE UNDERTAKE TO REIMBURSE AS YOU INSTRUCTED

72: SENDER TO RECEIVER INFORMATION:

ADVISE THROUGH YR LIANYUNGANG SUB BR., CHINA

SENDER: BOFAUS6SYXXX

*BANK OF AMERICA

*SAN FRANCISCO, CA

RECEIVER: BKCHCNBJ940

*BANK OF CHINA

*JIANGSU BR

MT: 701 ISSUE OF A DOCUMENTARY CREDIT

27: SEQUENCE OF TOTAL: 2/2

20: DOC. CREDIT NUMBER: 1010573

45B: DESCRIPTION OF GOODS:

46B: DOCUMENTS REQUIRED:

47B: ADDITIONAL CONDITIONS:

UNLESS OTHERWISE STIPULATED ALL DOCUMENTS SHOULD BE ISSUED IN ENGLISH LANGUAGE. OTHERWISE THEY MAY BE DISREGARDED.

AN ADDITIONAL HANDLING FEE OF USD60 WILL BE DEDUCTED FROM PROCEEDS FOR DOCUMENTS PRESENTED WITH DISCREPANCIES.

( Mandatory Optional )

三、 信用证审核(课本129页——139页)

问题条款共20处,粗体字显示。(是否有问题条款,为什么有问题,如矛盾条款,不利条款)

SALES CONTRACT

Contract No.: 08SGQ468001

Date: APR.22, 20##

Seller: GUANGDONG LIGHT ELECTRICAL APPLANCES CO., LTD

Address: 52 DEZHENG ROAD SOUTH, GUANGZHOU, CHINA

Buyer: ABC CORP.

Address: AKEDSANTERINK AUTO P.O. BOX 9, FINLAND

This S/C is made by and between the Seller and the Buyer, whereby the Seller agrees to sell and the Buyer agrees to buy the under-mentioned goods according to the terms and conditions stipulated below:

Packing : 12PCS IN A CARTON

Delivery from GUANGZHOUto HELSINKI

Time of Shipment: Within 30 days after issue date of L/C allowing transshipment and partial shipment

Terms of Payment:

By 100% Confirmed irrevocable Letter of Credit in favor of the Seller to be available by sight draft. L/C should be opened and reach China before MAY 1, 20## and remain valid in China until the 15th day after the foresaid time of shipment. L/C must mention this contract number. L/C should be advised by BANK OF CHINA, GUANGZHOU BRANCH.

Insurance: To be effected by Seller for 110% of full invoice value covering ALL RISKS up to HELSINKI

The Seller The buyer

(authorized sign.) (authorized sign.)

Documentary Credit issued by telex

Issuing bank: METITA BANK LTD., FINLAND

Advising bank: BANK OF CHINA, GUANGZHOU BRANCH

Doc. credit form: REVOCABLE(1)

Credit number: LRT0702457

Date of issue: MAY 4,2008(2)

Expiry: DATE MAY 25,2008 (3)

PLACE FINLAND(4)

Applicant: ABC CO.(5)

AKEKSANTERINK(6) AUTO P.O. BOX 9, FINLAND

Beneficiary: GUANGDONG LIGHT ELECTRICAL APPLANCES CO., LTD

52 DEZHENG ROAD SOUTH, GUANGZHOU, CHINA

Amount: USD36400,00 (SAY U S DOLLARS THIRTY SIX THOUSAND FOUR HUNDRED ONLY) (7)

Available with/by: ANY BANK IN CHINA BY NEGOTIATION

Draft at..: AT 20 DAYS SIGHT(8) FOR FULL INVOICE VALUE

Drawee: APPLICANT(9)

Partial shipments: NOT ALLOWED(10)

Transshipment: ALLOWED

Loading in charge: ANY PORT IN CHINA

For transport to: HELSINKI

Shipment period: AT THE LATEST: MAY 20,2008(11)

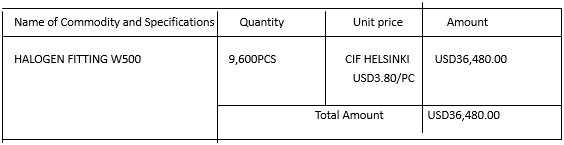

Description of goods: 960PCS (12)OF HALOGEN FITTING W500, USD3,80 PER PC AS PER SALES CONTRACT NO.08SG468001(13) DATED 22 APR. 20## CIF HESINKI(14)

Documents required: *COMMERCIAL INVOICE 1 SIGNED ORIGINAL AND 5 COPIES

*PACKING LIST 1 SIGNED ORIGINAL AND 5 COPIES

*FULL SET OF CLEAN ON BOARD MARINE BILLS OF LADING, MADE OUT TO ORDER, MARKED “FREIGHT PREPAID”,AND NOTIFY APPLICANT

*CERTIFICATE OF ORIGIN, CERTIFYING GOODS OF ORIGIN IN CHINA, ISSUED BY COMPETENT AUTHORITIES

*INSURANCE POLICY /CERTIFICATE COVERING ALL RISKS AND WAR RISKS(15) OF PICC UP TO FINAL DESTINATION AT HELSINKI, FOR AT LEAST 120PCT (16)OF FULL INVOICE VALUE.

Presentation period: 10 DAYS(17) AFTER ISSUANCE DATE OF SHIPPING DOCUMENTS

Charges: ALL BANK CHARGES ARE FOR BENEFICIARY’S ACCOUNT.(18)

Confirmation: WITHOUT(19)

Instructions: UPON RECEIPT OF THE DRAFTS AND DOCUMENTS IN ORDER, WE WILL TRANSFER THE PROCEEDS AS INSTRUCTED BY THE NEGOTIATING BANK

Applicable rules: UCP600(20)(原信用证中不含此项,此项一定要标明)

四、 信用证条款

Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.

信用证意指一项约定,无论其如何命名或描述,该约定不可撤销并因此构成开证行对于相符提示予以兑付的确定承诺。

UCP600 Art.2

Complying presentation means a presentation (of documents) that is in accordance with the terms and conditions of the credit, the applicable provisions of these rules and international standard banking practice.

相符提示意指与信用证中的条款及条件、本惯例中所适用的规定及国际标准银行实务相一致的(单据)提示。

* A presentation including one or more original transport documents subject to articles 19, 20, 21, 22, 23, 24 or 25 must be made by or on behalf of the beneficiary not later than 21 calendar days after the date of shipment as described in these rules, but in any event not later than the expiry date of the credit.

提示若包含一份或多份按照本惯例第19条、20条、21条、22条、23条、24条或25条出具的正本运输单据,则必须由受益人或其代表按照相关条款在不迟于装运日后的二十一个日历日内提交,但无论如何不得迟于信用证的到期日。

* If there is no indication in the credit of the insurance coverage required, the amount of insurance coverage must be at least 110% of the CIF or CIP value of the goods.

如果信用证对投保金额未作规定,投保金额须至少为货物的CIF或CIP价格的110%。

* At least one original of each document stipulated in the credit must be presented.

信用证中规定的各种单据必须至少提供一份正本。

UCP600 Art.2

Honour means:

a. to pay at sight if the credit is available by sight payment.

b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment.

c. to accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance.

兑付(承付)意指:

a. 对于即期付款信用证即期付款。

b. 对于延期付款信用证发出延期付款承诺并到期付款。

c. 对于承兑信用证承兑由受益人出具的汇票并到期付款。

UCP600 Art.2

Negotiation means the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank.

议付意指被指定银行在其应获得偿付的银行日或在此之前,通过向受益人预付或者同意向受益人预付款项的方式对相符提示项下的汇票(汇票付款人为被指定银行以外的银行)及/或单据做出的购买行为。

an unconditional order in writing , addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a sum certain in money, to or to the order of a specified person, or to bearer.

(the UK Bills of Exchange Act of 1882 )

汇票是一人给另一人的书面无条件命令,由给出命令的人签发,要求接受命令的人即期、定期或在可确定的将来时间支付确定的货币金额给一个指明的人,或指明人的指定人,或来人。

a.Collection should not contain bills of exchange payable at a future date with instruction that commercial documents are to be delivered against payment.

托收不应含有远期汇票而又同时规定商业单据要在付款时才交付。

五、 结算方式流程(中英文均可)

信用证

applicant(申请人/进口商)

beneficiary(受益人/出口商)

issuing bank(开证行/进口地银行)

advising bank(通知行)(检验真伪,无审证责任)

nominated bank/claiming bank(被指定银行/索偿行)

paying bank (付款行)

accepting bank (承兑行)

negotiating bank (议付行)

reimbursing bank(偿付行)(无审单责任)

confirming bank (保兑行)

Step 1(签订合同)

Step 2(申请开证)

Step 3(开立信用证)

Step 4(通知信用证)

Step 5(审证发货)

Step 6(签发提单)

Step 7(提交单据)

Step 8(审单兑付)

Step9(寄单索汇)

Step 10(审单偿付)

Step 11(单到通知)

Step 12(付款赎单)

Step 13(交付单据)

Step 14(提示提单)

Step 15(交付货物)

汇款

remitter (汇款人/进口商)

remitting bank(汇出行)

paying bank(汇入行/解付行)

payee (beneficiary) (收款人/出口商)

信汇流程

1、 汇款人提交汇款申请、款项、支付佣金

2、 汇出行向汇款人提供回执

3、 汇出行通过信汇方式向汇入行发出支付命令或通知,指示汇入行向收款人支付款项

4、 接到支付命令并核对、认证,通知收款人

5、 收款人提供收据

6、 支付

7、 汇入行发送借记报单、收据给汇出行

托收

principal (委托人/出票人/出口商)

drawee (付款人/受票人/进口商)

remitting bank(托收行)

collecting bank (代收行)

presenting bank (提示行)

case-of-need (需要时代理)

1、 签订销售合同

2、 出口商发货,获取运输单据,向进口商签发汇票

3、 出口商将单据和汇票交给托收行进行托收

4、 托收行将单据、汇票以及托收指示发给代收行

5、 代收行或提示行通知进口商

6、 进口商支付或承兑

7、 代收行将单据交给进口商

8、 代收行向托收行支付款项

9、 托收行贷记出口商账户

保函

1. the principal (applicant) and the beneficiary sign a underlying contract specifying a L/G to be issued.(签订合同)

2. the principal applies for issuing a direct L/G or a counter L/G(申请保函或反担保函)

3. the principal’ bank issues a direct L/G or a counter L/G(开立直接保函或反担保函)

4. the beneficiary’s bank advises the direct L/G or issues a L/G against the counter L/G to the beneficiary (通知或开立保函)

5. the beneficiary claims payment by presenting a written demand together with required docs to the beneficiary’s bank (交单索付)

6. the beneficiary’s bank transmits the docs to the principal’s bank for payment or effects payment to the beneficiary and claims reimbursement from the principal’s bank (寄单索付或付款后索偿)

7. the principal’s bank effects payment to the beneficiary through the beneficiary ’bank or reimburses to the beneficiary ’s bank(付款或偿付)

8. the principal’s bank asks for reimbursement from the principal (向申请人索偿)

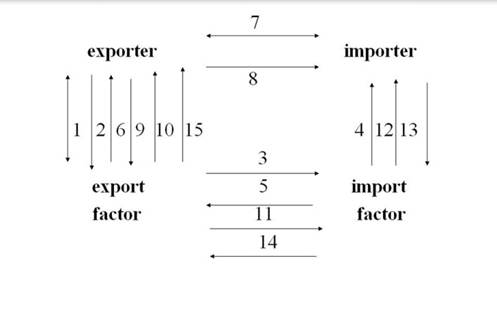

保理

- Overall agreement of factoring between the exporter and factor(签订保理总协议)

- Applying for importer’s credit line(申请买方信用额度)

- Request of credit approval(委托批准信用额度)

- Investigation of importer’s credit and approving the credit line(100% credit risk protection)(信用调查和额度批准)

- Notification of the credit line (within 10 days)(通知额度)

- Notification of the credit line accordingly (通知额度)

- S/C signed between the exporter and importer (sales scale within the credit line)(签订销售合同)

- Delivering goods and sending documents(发货寄单)

9. Sending copy of invoice and applying for finance(提交发票副本并申请融资)

10. Providing funds normally without recourse and normally not exceeding 80% of the credit line (提供融资)

11. Sending copy of invoice (寄送发票)

12. Asking for payment several days before due date(到期前催款)

13. Payment on due date (到期付款)

14. Payment not later than the 90th day after maturity(完成支付)

15. Paying the balance (支付余款)

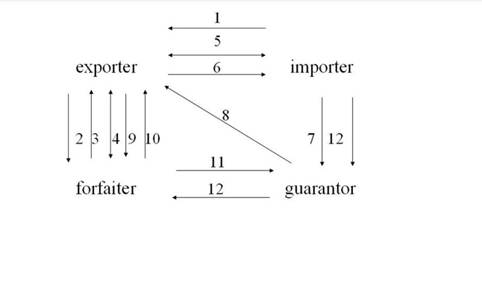

福费廷

- Ordering to buy capital goods with payment in installments(发出订单)

- Request for forfaiting quotation(包买询价)

- Providing a forfaiting proposal(包买报价)

- Concluding a forfaiting agreement(签订包买协议)

- Negotiating a S/C(签订销售合同)

- Delivering goods and sending docs (including a series of drafts)(发货寄单)

- Accepting drafts and applying for guarantee(承兑并申请担保)

- Sending the guaranteed drafts (寄送汇票)

- Presenting drafts together with required docs (提示单据要求贴现)

- Discounting without recourse(无追索权贴现)

- Sending each draft for payment several days before maturity(寄送到期汇票要求付款)

- Making payment on due date (到期付款)