学会计学的感想

学院:

专业:

班级:

姓名:

学号:

在大一的下半学年,我开始了会计学的学习。在学习会计学之前,我对会计学没有深度的认识,和大多数没接触会计学的人一样,以为会计学就是写写、算算,记记账、算算账。在经过了这几周比较系统的学习与接触之后,对会计学有了更进一步的了解。

会计学是一门极其细致的学科,要想真正掌握每一章节的内容,必须要做到的首先就是自己做好课前预习,大体了解一下课堂上要学习的内容,在课堂上紧跟老师的思路走,在做好笔记的同时能够及时思考相关问题在实际情况中的应用,并快速理解老师所给出的例子,不懂的地方一定要及时记录下来,不要在一知半解的时候就进行更深入的学习或者练习,这些问题可以在课上提出也可以下课后找老师单独讲解,总之一定不能遗留问题。然后一定要结合课本上的案例来理解并巩固掌握所学内容,这些案例应该尽量自己独立做一遍再对照答案找出不太准确的地方来加以理解改正并记忆。其次就是充分利用好各种资源来进行学习与巩固,如:老师的课件、同步辅导教程、老师发在公邮中的题目还有一些网上的资料文献等等,增加对会计学的认识和理解,将所学的知识进一步巩固一下。

我们现在正处于打基础的阶段,因此应该做到每一章节的内容循序渐进地来学习,切忌跳过某一章节去学习另一章节。比如:我们需要先对会计学有一个整体的了解,了解会计学的概述、会计对象、会计要素以及会计的方法,这便是第一章的学习;只有掌握这些,我们才能在第二章中运用会计核算的方法来处理一般的经济业务,从而对会计科目和账户做具体的了解和学习;掌握了这些之后,我们才能进入记账法的学习,然后用记账法去进行企业基本业务的核算,这便是三四章的内容。这四章是整个会计学的基础,只有将这四章的知识牢牢掌握,才能进入后面更深入的学习中去。

学习了会计学之后,我深深地体会到了活学活用才是会计学的实质。首先,对课程内容不要理解过死,比如在做一笔会计分录时,并不是一成不变、只有一种方法的,有的可以用两种甚至多种方法来记录,另外还要用权责发生制定期调整账户的记录,使各账户能正确反映实际情况。当然活学活用的前提还是要打好基础、深入了解原理,只有这样,才能举一反三、融会贯通。还有就是会计学本身是一门实践性很强的学科,与实际生活联系紧密,所以我们不仅要掌握基本原理和方法体系,更应在学习中联系实际,方便与掌握应用。

会计学本身可以说是一门比较枯燥的学科吧,可能有的同学学起来兴趣不太足,我觉得老师可以在提高同学们的学习兴趣上多多考虑一下,可以实行教学形式多样化,如采用启发式、案例式、讨论式、互动式教学,从而提高我们的参与意识和学习能力,比如一开始用的柠檬汽水摊的案例就非常生动易懂,效果不错。另外,老师可以对学过的内容或者作业进行小小的检查,毕竟监督的效果会更好一些嘛。

总之会计学的学习需要我们付出努力,但前提是我们必须要对它产生足够的兴趣,这样学起来才不会感觉到很吃力。会计学作为我们的专业课,我们必须要认真学习,趁着现在先打好基础,避免在更深入的学习时再回来记忆原理,这样不仅浪费我们的时间,还会越落越多,失去学习的兴趣。我相信,只要我们拿出自己学习的热情,紧跟老师的思路,不断巩固学过的知识,就一定能将这门科目学好的!

第二篇:会计学第10章答案

Chapter 10 Accounting for Plant Assets and Intangibles

Multiple Choice Quiz

1. b

Land: $326,000×[175,000÷(175,000+70,000+105,000)]=326,000×50%=$163,000 Land Improvements: $326,000×70,000/350,000=$326,000×20%=$65,200

Building: $326,000×105,000/350,000=$326,000×30%=$97,800

2. c

(35,000-1,000)÷4=$8,500

3. c

Depreciation for the year 2013: $10,800,000×20%=$2,160,000

Depreciation for the year 2014: $(10,800,000-2,160,000)×20%=$1,728,000

4. c

Book value $150,000 (250,000-100,000) , vs. selling price $120,000

Quick Study

QS 10-2

The total recorded cost of the automatic scorekeeping equipment:

$190,000+20,000+4,000+13,700=$227,700

QS 9-3

$(65,800-2,000)÷4=$15,950

QS 10-4

Depreciation for per concert: $(65,800-2,000)÷200=$319

Depreciation for the year 2013: $319×45=$14,355

QS 10-5

The revised annual depreciation for both the second and third year is equal.

$(65,800-15,950-2,000)÷2=$23,925

QS 10-6

2013: $830,000×25%=$207,500

2014: $(830,000-207,500)×25%=$155,625

2015: $(830,000-207,500-155,625)×25%=$116,718,75

QS 10-7

When an asset is found impaired, which means the fair market value has been lower than its book value, an impairment expense should be charged and an impairment provision be accrued. Dr: Impairment Expense-equipment 1,250

1

Cr: Impairment Provision-equipment 1,250

QS 10-8

a. capital expenditure

Dr:Refrigeration System 40,000

Cr: Cash 40,000

b. revenue expenditure

Dr: Repair Expense 200

Cr: Cash 200

c. revenue expenditure

Dr: Repair Expense 175

Cr: Cash 175

d. capital expenditure

Dr: Office Building 225,000

Cr: Cash 225,000

QS 10-9

(1) Dr: Cash 47,000

Accumulated Depreciation-equipment 40,800

Cr: Equipment 76,800 Gain on Disposal of Equipment 11,000

(2) Dr: Cash 36,000

Accumulated Depreciation-equipment 40,800

Cr: Equipment 76,800

(3) Dr: Cash 31,000

Loss on Disposal of Equipment 5,000

Accumulated Depreciation-equipment 40,800

Cr: Equipment 76,800

QS 10-12

Dr: Leasehold Improvement 105,000

Cr: Cash 105,000 Dr: Amortization Expense 13,125

Cr: Accumulated Amortization-leasehold improvement 13,125

Exercises

Exercise 10-1

Cost of Plant Asset: $12,500×(1-2%)+360+895+475+40=$14,020

2

Exercise 10-2

Dr: Land 470,500 (280,000+110,000+33,500+47,000) Building 1,452,200

Land Improvements 87,800

Cr: Cash 2,010,500

Note: Land purchased as a building site sometimes includes structures that must be removed. In such cases, the total purchase price is charged to the Land account as is the cost of removing the structures, less any amounts recovered through sale of salvaged materials. See the relative paragraph about Land in our textbook.

Exercise 10-3

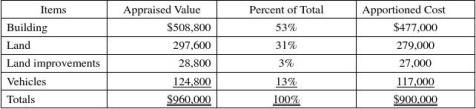

Total cost paid in this lump-sum purchase: $395,380 (375,280+20,100) .

The share allocated to Land: 157,040/(157,040+58,890+176,670)=40%

The share allocated to Land Improvements: 58,890/392,600=15%

The share allocated to Building: 176,670/392,600=45%

Dr: Land 158,152 (395,380×40%)

Land Improvements 59,307 (395,380×15%)

Building 177,921 (395,380×45%)

Cr: Cash 395,380

Exercise 10-4

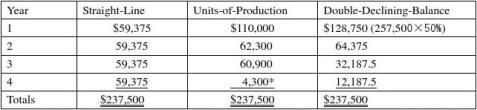

Second year’s depreciation under straight-line method:

$(43,500-5,000)÷10=$3,850

Exercise 10-5

Second year’s depreciation under units-of-production method:

$(43,500-5,000)÷385,000×32,500=$3,250

Exercise 10-6

Second year’s depreciation under DDB method:

Book value at the beginning of Year 2: $43,500-43,500×20%=$34,800

Depreciation for Year 2: $34,800×20%=$6,960

Exercise 10-7

(1) book value at the end of Year 2: $23,860-[(23,860-2,400)÷4×2]=$13,130

(2) depreciation for each of the final three years:

$(13,130-2,000)÷3=$3,710

Exercise 10-8

Depreciation for each year under straight-line method:

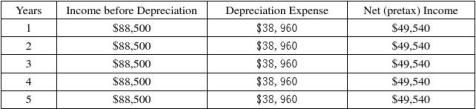

$(238,400-43,600)÷5=$38,960

3

Exercise 10-9

Exercise 10-10

1. Under the straight-line depreciation method, by dividing the annual depreciation from its

accumulated depreciation, we can conclude the building’s age. $429,000÷(572,000÷20)=15 Years depreciated 2. Dr: Building 68,350

Cr: Cash 68,350

3. The new book value of the building is $211,350 ($572,000-429,000+68,350). 4. Dr: Depreciation Expense 21,135

Cr: Accumulated Depreciation-building 21,135 Exercise 10-11

1. Dr: Equipment 22,000

Cr: Cash 22,000 2. Dr: Repair Expense 6,250

Cr: Cash 6,250 3. Dr: Equipment 14,870

Cr: Cash 14,870

Exercise 10-12

1. Dr: Loss on Disposal of Machine 68,000 Accumulated Depreciation-machine 182,000

Cr: Machine 250,000 2. Dr: Cash 35,000 Loss on Disposal of Machine 33,000 Accumulated Depreciation-machine 182,000

Cr: Machine 250,000

4

3. Dr: Cash 68,000 Accumulated Depreciation-machine 182,000

Cr: Machine 250,000

4. Dr: Cash 80,000 Accumulated Depreciation-machine 182,000

Cr: Machine 250,000 Gain on Disposal of Machine 12,000

Exercise 10-13

Partial-year depreciation on July 1, 2017: $105,000÷7×6/12=$7,500 Dr: Depreciation Expense-machine 7,500

Cr: Accumulated Depreciation-machine 7,500

Accumulated depreciation till the date of disposal: $15,000×4+7,500=$67,500 (1) Dr: Cash 45,500 Accumulated Depreciation-machine 67,500

Cr: Machine 105,000 Gain on Disposal of Machine 8,000 (2) Dr: Cash 25,000 Accumulated Depreciation-machine 67,500 Loss of Disposal of Machine 12,500

Cr: Machine 105,000

Exercise 10-15

Jan. 1, 2013 Dr: Intangible Asset-Copyright 418,000

Cr: Cash 418,000

Dec. 31, 2013 Dr: Amortization Expense-Copyright 41,800 [$418,000/10] Cr: Accumulated Amortization-Copyright 41,800

Exercise 10-16

1. The amount recognized to record goodwill in this case is $700,000 ($2,500,000-

1,800,000).

2. Robinson should do asset impairment test for the year ended December 31, 2013.

3. Robinson should not record or recognize a goodwill asset generated inside the company.

Problem 10-1A

5

Dr: Building 477,000

Land 279,000

Land Improvements 27,000

Vehicles 117,000

Cr: Cash 900,000

2. Depreciation expense for year 2013 on building: $(477,000-27,000)÷15=$30,000

3. Depreciation expense for year 2013 on land improvements:

$27,000×40%=$10,800

4. Refute. The total taxes payment under the accelerated depreciation method is the same as under other depreciation methods, since the total depreciable cost does not changed. The entity could pay less taxes during the earlier periods while pay much during the later periods due to the larger depreciation expenses deducted and the smaller charges later.

Problem 10-2A

2012

Jan.1 Dr: Loader 300,600 ($287,600+11,500+1,500)

Cr: Cash 300,600

Jan. 3 Dr: Loader 4,800

Cr: Cash 4,800

Dec. 31 Dr: Depreciation Expense 70,850[(300,600+4,800-20,600-1,400)/4] Cr: Accumulated Depreciation-Loader 70,850

2013

Jan. 1 Dr: Loader 5,400

Cr: Cash 5,400

Feb. 17 Dr: Repair Expense 820

Cr: Cash 820

Dec. 31 Annual depreciation expense:

(300,600+4,800+5,400-22,000-70,850)/(3+2)=$43,590

Dr: Depreciation Expense 43,590

Cr: Accumulated Depreciation-Loader 43,590

Problem 10-3A

折旧费用为8,600×$0.5=$4,300.

6

Problem 10-4A

1. Jan. 2 Dr: Machine 180,840

Cr: Cash 180,840

Jan. 3 Dr: Machine 1,160

Cr: Cash 1,160

2. depreciation for first and disposal year in operations:

($180,840+1,160-14,000)/6=$28,000

Dr: Depreciation Expense 28,000 (a)/(b)

Cr: Accumulated Depreciation-Machine 28,000

3. book value on the date of disposal: $182,000-28,000×5=$42,000 (a) Dr: Cash 15,000

Accumulated Depreciation-Machine 140,000

Loss on Disposal of Machine 27,000

Cr: Machine 182,000 (b) Dr: Cash 50,000

Accumulated Depreciation-Machine 140,000

Cr: Machine 182,000 Gain on Disposal of Machine 8,000 (c) Dr: Cash 30,000

Loss from Fire 12,000

Accumulated Depreciation-Machine 140,000

Cr: Machine 182,000

Problem 10-6A

1. (a) Dr: Leasehold 200,000

Cr: Cash 200,000

(b) Dr: Prepaid Rent 80,000

Cr: Cash 80,000

(c) Dr: Leasehold Improvement 130,000

Cr: Cash 130,000

2. (a) Dr: Amortization Expense 10,000 ($200,000÷10×6/12) Cr: Accumulated Amortization-Leasehold 10,000 (b) Dr: Amortization Expense 6,500 ($130,000÷10×6/12)

Cr: Accumulated Amortization-Leasehold Improvement 6,500 (c) Dr: Rent Expense 40,000 ($80,000×6/12)

Cr: Prepaid Rent 40,000

7