JP Morgan的Prime Brokerage仍然是为以对冲基金为主的机构客户服务,帮助它们建立更高效的业务并为其投资者创造更多价值。

业务包括股份融资、证券借贷、结算和资产服务以及主要保管和优化保证金解决方案。

JP Morgan的Broker-Dealer业务包括:

客户端服务——

提供持续的服务和解决方案,定制适合每个客户的独特需求。一个团队的客户服务代表(CSR公司)将提供每天的日常个性化的服务,运营支持和响应问题的解决。

清算服务——

为客户提供最高水平的专业技术和平台。通过ALERT和OASYS连接,涉及国内和国际股票、期权、共同基金和广泛的固定收益产品。

执行服务——

包括执行多种选择,如多产品咨询台,提供高触感执行服务,由经验丰富的交易专家,以及一系列的电子解决方案,包括Neovest,FIX连接到许多第三方的交易系统直接市场接入(DMA)和算法交易

科技和报告——

我们的基于Web的工作站,MORCOM,采用了最新的技术,提供了一套强大的功能,包括详细的账户信息、性能报告、费计费、贸易、汇款直通、文件存档、风险分析、投资规划和统一的访问资产配置。 MORCOM通过平滑的整合与共享,在一个广泛的功能和产品信息,帮助用户实现更高的效率和规模在他们的业务。

JP摩根多种方式支持您的报告需要。我们提供的解决方案,集成到我们的工作站的性能报告。可自定义的数据文件能够及时和有效地提供信息给客户。此外,我们已经建立了合作关系,并连接到领先的第三方提供业绩报告。

技术培训的专家提供基于Web和现场培训,以确保我们的系统的能力,并最大限度地提高我们的能力值。我们的技术支持团队处理日常技术支持。

融资及证券借贷——

JP摩根的客户端可以访问我们的利润,有限制的证券和贷款团队。我们的贷款需求,满足各种阵列的能力和专业知识。我们支持一系列的保证金解决方案,有专业知识,清除限制的证券,并提供独家证券借贷组合。

财富管理解决方案——

我们提供长期的专业知识和广泛的创新解决方案,以支持现有产品提供。我们的托管帐户的解决方案,可以定制,以满足贵公司的个性化需求。产品范围从单独的帐户平台的开放式架构,以交钥匙的咨询解决方案。

我们做一个浩瀚的宇宙中为客户选择通过FundCIRCUIT?,我们NTF的程序,包括负载,无负载,无交易费资金的国内和海外共同基金。再加上使用工具,这有助于使共同基金选择

及招股章程遵从更容易,我们的共同基金平台,使我们作为一个行业中的佼佼者。

除了我们的综合解决方案,我们已经建立了合作关系,并连接到领先的第三方提供业绩报告。我们还提供了一个规划,资产配置,建议系统,包含一套先进的制度性风险的测量和规划方法。

行政服务——

我们的客户有机会获得全方位的行政服务。我们的现金及短期的现金管理,流动性管理团队提供创新的解决方案。这一综合性的金融市场平台提供货币市场基金,证券借贷方案和替代性流动性的投资选择。特权基金会是一个慈善给Foundation源代码?是一家领先的私人基金会的行政服务供应商提供的解决方案通过。

客户端解决方案——

我们为您的客户提供积极的解决方案:

在线帐户访问——

投资专业的客户端访问一个私人标签网站品牌与贵公司的名称,这将节省您的员工时所赋予你的客户确认书,报表,表格1099,余额,交易历史成本为基础,税收大量和收益/亏损的信息。

现金管理帐户——

特权访问?为您的客户提供完整的现金管理服务,包括支票,借记卡,网上账单支付和投资能力在一个帐户中。

月结单——

易于阅读的每月报表都烙上你的商标。这些报表提供全面的投资组合持有的意见和帐户活动,在您的自由裁量权的成本为基础的报告。综合帐目摘要可为客户谁希望看到的自己的账户联系在一起的综合月结单邮寄一份两页的概要。

第二篇:KPMG The Prime Brokerage Industry

The prime brokerage industry: An exploration of evolving standards –

operational accountability, internal controls, and transparency

kpmg.com

Contents

The prime brokerage industry: an exploration of

evolving standards – Operational accountability,

internal controls, and transparency ..........................................1

Background ...............................................................................1

Regulators, clients, and investors demand

robust internal controls .............................................................1

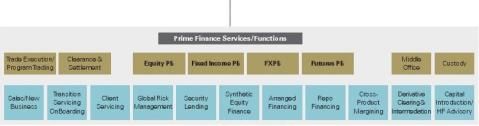

Prime brokerage market participant

process/transaction flow ..........................................................2

Expansion of prime brokerage services

in response to recent regulatory changes ...............................3

Key risks ....................................................................................4

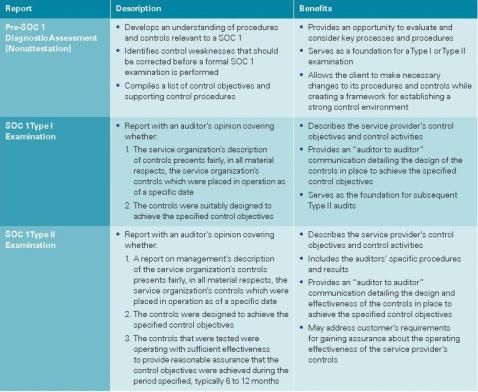

How a SOC 1 examination (legacy SAS 70)

demonstrates internal control transparency ............................5

Overview of SOC 1 services: Pre SOC 1

diagnostic review and SOC 1

examination reports ..................................................................6

KPMG’s SOC 1 services ...........................................................7

Updates to the current SAS 70 attestation standard ...............7

KPMG: The right choice ..........................................................10

Leadership serving the prime brokerage industry .................10

Appendix A: KPMG service offerings for the

prime brokerage industry ..........................................................11

Appendix B: Overview of the types of

globally recognized services in which

prime brokers can engage ........................................................13

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

1 | The prime brokerage industry

An exploration of evolving standards –

Operational accountability, internal controls, and transparency

As key stakeholders in the prime brokerage industry

demand higher standards for operational accountability and governance, KPMG’s depth of experience in performing Service Organization Control Report (“SOC,” formerly known as SAS 70 Reports) examinations can help prime brokers deliver on these expectations.

Background

The financial services industry has experienced drastic changes over the past few years. The global financial crisis has resulted in massive government interventions, uncovered major frauds, and caused uncertainty among consumers,

investors, intermediaries, and regulators. The failures of several significant financial institutions have put greater focus on the important role that prime brokers play in the primary capital markets and the importance of enhanced transparency, strong custody, and internal risk management controls at prime brokers. Over the course of the financial crisis, the dangers that funds face when their assets are rehypothecated became painfully clear. Funds that tried to reclaim rehypothecated

assets found themselves in the queue of general creditors, and usually received only a portion of their money back. Even those funds that had insisted that their assets not be rehypothecated had to endure long waits to get back securities they thought had been held in segregated client accounts.

These events have resulted in more scrutiny from investors, regulators, and auditors. The results of a recent global survey conducted by KPMG’s Investment Management practice

indicate that trust in the investment management industry has suffered greatly.1 As the investment management community’s demand for prime brokerage services increases, prime brokers must focus on restoring this trust, and they can do so in part through a strong risk management and governance framework.Regulators, clients, and investors demand robust internal controls

With the demand for greater transparency, oversight, and regulation, prime brokers are faced with increasing pressures to obtain assurance over internal controls:

???The International Organization of Securities Commissions’ (IOSCO) Technical Committee recently released suggested “guiding principles” for securities regulators in providing

effective oversight to the investment management community. These principles also address the relevant

regulatory and systemic risks linked to this industry. In turn, investment managers will be looking to their servicers to address risk management and internal controls.

???Regulatory demands include curbing short selling, enhancing custody control requirements, and improving transparency, all of which necessitate a strong risk management framework.???In addition to increased regulation, prime brokers should expect increased scrutiny from their external auditors. There has been renewed focus on issues such as safety of client assets (custody, rehypothecation, segregation, and management of clients’ unencumbered assets), which has driven the need for improved transparency and risk and collateral management processes. Prime brokers will need to rethink the control environment that governs their operations and system platforms.???Additionally, underlying investors want to learn more about both the funds and their administrators before they invest capital. In order to respond effectively to investor inquiries, investment managers are seeking servicers who can demonstrate strong operational practices.???The increasing complexity of investment management

products and services is also driving the need for enhanced operational control to facilitate effective information flow and

on-demand reporting between funds and their servicers.

1

KPMG’s Investment Management Global Thought Leadership Release, June 30, 2009: Renewing The Promise: Time to Mend Relationships in Investment Management

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

The prime brokerage industry | 2

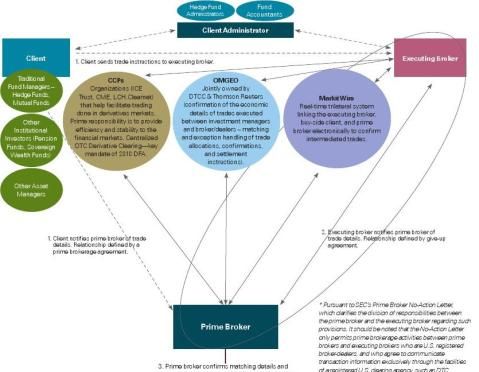

Prime brokerage market participant process/transaction flow*

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

Expansion of prime brokerage services in response to recent regulatory changes

The derivatives market is now estimated to be over the

$600 trillion. Banks now hold $234 trillion of the insurance-like contracts, which derive their value from another asset, like a foreign exchange rate or a package of mortgages. Four of the nation’s largest financial institutions—JPMorgan Chase, Citigroup, Bank of America, and Goldman Sachs—account for more than 90 percent of the banking industry’s activity in derivatives. In a June 2, 2009 letter to the Federal Reserve Bank of New York, the banking industry committed to a December 15, 2009 goal of providing customer access to

interest rate swap (IRS) and credit default swap (CDS) clearing solutions, through either direct central counterparty (CCP) membership or customer clearing.

On July 21, 2010, President Obama signed into law the

Dodd-Frank Wall Street Reform and Consumer Protection Act. In addition to assigning regulatory authority of security-based swaps to the Securities and Exchange Commission (SEC) and swaps to the Commodity Futures Trading Commission (CFTC), this law mandates the central clearing of “standardized” swaps. IRS and CDSs are considered “swaps” within the legislation and will be regulated by the CFTC and cleared accordingly.

The prime brokerage industry is ever expanding, and another key focus has now become the derivatives clearing business. The derivatives clearing business has been shaped by rapidly evolving industry forces in response to these political and regulatory pressures to centralize the clearing of over-the-counter (OTC) derivatives for dealer-to-dealer and for dealer-customer business. One of the most widely used types of credit derivatives is the CDS, which has emerged as a

powerful force in world markets. CDSs are bilateral contracts between the protection buyer and seller that

can be customized along any dimensions to meet the needs of the particular counterparties in any given transaction.

In the past, virtually all CDSs were negotiated OTC; however, given the recent regulatory reforms, CDSs are now offered through third-party central clearing counterparties (ICE Trust, CME, LCH, etc.). The SEC has taken multiple actions designed to help foster the prompt development of CDS CCPs including granting temporary conditional exemptions from certain provisions of the federal securities laws. In a release dated November 29, 2010, the SEC stated that each clearing member, in reliance on this exemption, receives or holds customer funds or securities for the purpose of purchasing, selling, clearing, settling, or holding. Cleared CDS positions for any other person must annually provide to ICE Trust a self-assessment of its compliance with certain conditions enumerated in the Order.

CDSs are not retail transactions. Most CDSs are in the

$10–$20 million range with maturities between 1 and 10 years. Given the complex nature of these transactions across the industry, prime brokers have surfaced as a third-party player connecting clients with CCPs. These central clearinghouses will require margin from all participants and additional

guaranty funds will be required from clearing members (prime brokers) to provide enhanced systematic protection. This is an improvement to existing non-clearing practices where many clients posted no initial margin. Rules will generally require clearing members to segregate the clearinghouse minimum for each client. Through Cross-Product Margining, clients of prime brokers will be able to benefit more fully from holding balance portfolios, as well as mitigate risks through cleared and uncleared transactions using a variety of methods.

Printed in the U.S.A.

The prime brokerage industry | 4

Prime brokers are now offering derivatives clearing as well as derivative intermediation to meet clients’ requirements and expectations. The solution is designed to provide client access to clearing by providing nonparticipants with initial margin

segregation and portability. The Dealer Founding Member (DFM) participants (Barclays Capital, Bank of America, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JP Morgan Chase & Co., Nomura, UBS) plan on providing client clearing as agent via these entities.

Key risks

So what are the key risks that the investment management community sees in its prime brokers? Based on the events of 2008, rehypothecation of clients’ unencumbered assets and prime broker insolvency (or, broadly speaking, Counterparty Credit Risk) would have to be the foremost.

Prime brokers are self-funding businesses that need very little access to the balance sheet of their parent bank, due to hedge fund cash kept on deposit and the rehypothecation of client assets. The prime brokerage model is built on this practice of rehypothecation, i.e., a proportion of assets used to back loans can usually be “rehypothecated” into the prime broker’s name, so the broker can use those assets to raise cash. This cash is then used to fund lending to funds for leveraged purposes and to support the borrowing of stock the prime broker can then lend to other funds that want to go short.

A prime broker’s legal entity structure greatly affects the risk its insolvency poses to its customers. U.S. prime brokers are required to register as broker-dealers under the Securities Exchange Act of 1934, as amended (34 Act) and to join, and comply with the rules of, self-regulatory organizations. For U.S. prime brokers, segregation of customer assets, rehypothecation, securities possession/control, and minimum net equity are all regulated under the 34 Act. Customers of U.S. prime brokers holding assets in the United States may be protected by the Securities Investor Protection Act of 1979, as amended (SIPA), which established the Securities Investor Protection Corporation (SIPC).

Generally, in an SIPC proceeding, customers of the insolvent party obtain priority over general unsecured creditors to

recover from the prime brokers’ pool of customer property on a pro rata basis with other customers. A hedge fund customer would be an unsecured creditor to the extent of any shortfall. The protections of the U.S. regulatory bodies do not generally apply to non-U.S. affiliates of U.S. prime brokers or to assets

held outside the United States. U.S. prime brokers commonly rely on such unregulated affiliates for margin lending or securities lending and/or to act as custodians in non-U.S. jurisdictions. This was the main reason why Lehman Brothers’ clients’ unencumbered assets were held up during the bankruptcy proceedings.

In response to demand from the investment management community, most prime brokers have started developing and rolling out prime custody products in conjunction with custodians like BNY Mellon, creating tri-party (prime broker – asset manager – custodian) agreements for pledged assets, and keeping unpledged assets with noncredit counterparties. All of these products are tailored to make client assets safe from a bank collapse by blocking rehypothecation and preventing counterparty claims altogether. In fact, multiprime relationships, increasing use of tri-party relationships with external custodians, and creation of prime brokerage houses with integrated custody capabilities have changed the marketplace.

In the derivative clearing business, the prime broker in essence becomes agent to a transaction between the non-participant and clearinghouse. Although the PB acts as agent for nonparticipant clearing clients, as is the case with futures clearing, it also has direct obligations to the clearinghouse to meet margin calls pursuant to its clearing agreement. As a result, the PB has what in effect is direct risk to nonparticipant clearing clients. That risk is expected to be mitigated by the PB’s security interest over client margin and their ability to impose position or margin level limits on nonparticipant clients. However, this risk remains, and adequate internal risk management safeguards and monitoring mechanisms are required to ensure exposure is adequately managed.

In order to gain advantage in such a competitive environment and attract new clients, prime brokers need to demonstrate a strong framework of internal controls. One of the most significant elements of this framework is transparency.

Transparency has joined the top-five list of manager-selection criteria.2 “Historically, investors have indicated the ‘3Ps’: Performance, Philosophy, and Pedigree to be the most

important characteristics when selecting a manager. However, this year Risk Management has displaced Philosophy as the second most important criteria and Transparency is now fourth, pushing Manager Pedigree to fifth place.” This opinion was represented by a strong majority, as “78 percent of investors specified Risk Management as the second most important factor when selecting a manager.”3

23

2009 Alternative Investment Survey – Deutsche Bank

2009 Alternative Investment Survey – Deutsche Bank

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

5 | The prime brokerage industry

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

The prime brokerage industry | 6

Please see Appendix B for an overview of the globally recognized services in which prime brokers can engage.Overview of SOC 1 services: Pre-SOC 1 diagnostic review and SOC 1 examination reports? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

KPMG’s SOC 1 services

KPMG’s professionals have extensive knowledge and

experience in delivering SOC 1 (formerly known as SAS 70) services within the financial services industry, particularly in regards to prime brokerage. Our experience includes

SAS 70 examinations performed for leading prime brokerage clients over each relevant aspect of their business processes, operations, and IT.

KPMG has leveraged years of experience in serving global audit clients to align our legacy SAS 70 and new SOC 1 methodologies with the needs of our clients’ user organization auditors and external regulators. Based on our experience as external

auditors, we have developed a repository of control objectives and control activities to guide clients through the process of identifying those objectives and activities that typically meet auditors’ and regulators’ needs. Furthermore, we have developed a globally consistent methodology and an automated SOC 1 engagement management tool to assist with increasing the efficiency of SOC 1 engagement delivery and reporting.KPMG was the first, Big four firm to issue SAS 70 Type II (now known as SOC 1 Type II) reports for a global prime brokerage firm. Below we have described this work in detail:

???In March 2007, KPMG was engaged to devise a solution to address the growing number of client requests for an independent review of a Top 5 global prime broker’s control environment. KPMG quickly assembled a team of industry leaders and regulatory subject matter specialists to assist management, and within the next month, conducted a series of interviews with every function within the prime finance business. Our SAS 70 engagement commenced in May 2007 and by November 1, KPMG had issued the

first SAS 70 report for the industry. The report now provides coverage over prime brokerage services over all asset classes, product types, and geographies.

???KPMG has subsequently been engaged by a large majority of the Top 10 global prime brokerage firms for various attestation and advisory engagements given our demonstrated expertise in this field. Refer to Appendix A for KPMG service offerings for the prime brokerage industry.Updates to the current SAS 70 attestation standard

In December 2009, the International Auditing and Assurance Standards Board issued a new international standard on Assurance Engagements: ISAE 3402, Assurance Reports on Controls at a Service Organization. In April 2010, the AICPA Auditing Standards Board published Statement on Standards for Attestation Engagements—SSAE 16, Reporting on Controls at a Service Organization—that is similar to the international standard and will supersede the SAS 70 standard. Both standards are effective for reports for periods ending on or after June 15, 2011, with early adoption permitted. While both standards must be implemented by 2011, firms considering a SOC 1 should understand the impact the changes will have on how they prepare their reports.

Technical standards of SSAE 16 will focus on Service

Organization Controls reports, which will be identified simply as SOC 1, SOC 2s, and SOC 3s. SOC 1 is related only to

Internal Controls over Financial Reporting (ICOFR) which will be significantly similar to the focus of SAS 70 reports. SOC 2s and SOC 3s, however, will be related to controls at the service organization that relate to operations and compliance.

Printed in the U.S.A.

ditional coverage

outside of the

o consider and

ill be the most

t a public

related to

is assertion

cally on the

d by a member

ates the service

for the description

ent of the

system.

w standards, a

of its system

tem” has many

definition is

nd infrastructure

Controls are only

the control

e auditor is

identified by

isks to achieving

ard, this

tion. Management

t the controls in

or the impact of

in the report.

ave been obtaining

stakeholders

nsparency in

ing to satisfy both

ch prime brokers

s. Moreover,

efficiencies

heir processes

issued a

e external

report, it

ommunity,

wed as

ngly

orts,

d

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

The prime brokerage industry | 10

KPMG can provide independent and objective advice

to your organization as you look to gain efficiencies

and differentiate your business. We work hand in

hand with members of your senior management

team as you seek to make informed decisions, taking

into account the associated costs and benefits. We

possess the professional attributes you expect from

an auditor:

???Objectivity and impartiality

???Global breadth, local knowledge

???Deep knowledge and experience in financial,

regulatory, IT, risk, and control

???Experience serving market-leading clients across

industry segments

As key stakeholders demand higher standards of

operational accountability and governance within the

prime brokerage industry, KPMG, with the depth of

our experience in performing global SOC 1s for prime

brokers, can help you deliver on these expectations.

Given the breadth and depth of our industry and

functional experience, KPMG can provide an array

of services in addition to SOC 1 services: please

see Appendix B for some examples of these. Note:

Certain services are not permissible for audit clients.

Leadership serving the prime brokerage

industry

Global Financial Services

For decades, KPMG’s Global Financial Services

practice has been recognized for its presence in

and its commitment to the industry. Through our

international network, we have the global reach and

experience to serve clients anywhere in the world. Our strength in the marketplace is why 73 of the 100 largest financial services companies have chosen KPMG as their professional services provider. Worldwide, KPMG International member firms serve more than 20,000 financial organizations: more than half of these financial organizations are U.S.-based. Our global team of professionals has extensive experience with all market participants supporting the investment management community and leverages the firms’ industry knowledge and resources in order to best serve clients’ needs.Banking and FinanceKPMG’s Banking and Finance practice is the firm’s largest industry practice. Our more than 4,500 experienced industry professionals, including 400 partners, help provide audit services to 50 percent of the top 10 banks, as ranked by American Banker, and 40 percent of the world’s largest 500 banks. Our expansive client base and close working relationships with industry leaders enable our professionals to provide insights and perspective to address the key challenges affecting the industry.Alternative InvestmentsKPMG has dedicated considerable resources to become one of the leading providers of audit, tax, and business advisory services to the alternative investments industry. Globally, the Alternative Investments segment includes approximately 1,800 Audit, Tax, and Advisory professionals (including 160 partners) from KPMG International member firms dedicated to alternative investments such as hedge funds, fund of funds, private equity, venture capital, infrastructure funds, structured products, commodity pools, and hybrid products.

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

11 | The prime brokerage industry

Appendix A

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

The prime brokerage industry | 12

Appendix A: KPMG service offerings for the prime brokerage industry

KPMG provides an array of services to financial services companies, including assistance with the challenges associated with emerging market trends and developments.Our core competencies include the following offerings:

???Perform and issue SOC 1 internal control reports on the effectiveness of internal controls???Perform internal audit

???Design business, IT, and operations strategy to support expansion of service offerings???Create future-state operating models, including middle-office services???Streamline operations master data management architecture???Provide spreadsheet management and enhancement*

???Develop information security strategy, architecture, and testing

???Provide access and procedure analysis for credit, market, liquidity, and counterparty risk management???Develop policies, procedures, and supervisory controls

???Assess technology providers and advise on selection (e.g., risk, collateral management providers)???Provide regulatory and compliance advice???Analyze exposures to failed financial institutions

???Review internal control policies and procedures over collateral management and safekeeping/custody of client assets

Note: Certain services are not permissible for audit clients.

Other areas: Administrators/Liquidators of LBHI bankruptcy in Asia

KPMG in* Hong Kong was appointed administrators of the Lehman Brothers Holdings Inc. (LBHI) bankruptcy and liquidation in Asia Pacific, in charge of managing the estate of the Hong Kong–based hub of the bank. In addition to valuing and quantifying the billions of dollars of claims that the Lehman companies owed each other that had arisen from the highly complex trading and financing structures operating across

borders, KPMG’s role specifically encompassed unwinding the prime brokerage clients’ positions, settling claims, and reuniting HF clients with their assets.

Other areas: Self-Assessments of dealer founding members for OTC derivative clearing business

KPMG continues to work with our large banking/swap dealer clients to formulate a global systematic approach to addressing

Dodd-Frank implications. One of the biggest areas of impact with these new regulations will be moving all OTC derivative clearing to CCPs. Clearing will be mandated for standardized swaps as determined by the CFTC and SEC. Clearing members are now required to provide an annual self-assessment on each of is CCPs (ICE, CME, LCH, etc.). KPMG is leading the audit industry’s response to these needs: through our chairmanship of the AICPA Broker-Dealer Expert Panel, we lead the

industry’s response to these newly required SEC annual self-assessments for all our CCP DFM clients. We have used our expansive knowledge of the financial services industry to help our clients formulate their response and maintain compliance with the recent and continuing political/regulatory reforms in this space.

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

13 | The prime brokerage industry

Appendix B

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

The prime brokerage industry | 14

Appendix B: Overview of the types of globally recognized services in which prime brokers can engage

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

15 | The prime brokerage industry

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

The prime brokerage industry | 16

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

Contact us

For more information about how KPMG can help you,

please contact one of the following KPMG professionals:

Jerry Jones

Partner, U.S. Lead

IT Attestation & Audit

T: 212-872-6647

E: jerryjones@kpmg.com

James Suglia

Principal, U.S. Lead

Investment Management Advisory

T: 617-988-5607

E: jsuglia@kpmg.com

Howard Margolin

Partner, U.S. Lead

Operations Risk Management

T: 212-954-7863

E: hmargolin@kpmg.com

Dimitriy Goloborodskiy

Partner, Financial Services IT Advisory

T: 212-872-2180

E: dgoloborodskiy@kpmg.com

Rahul A. Jadhav

Senior Manager, Financial Services

IT Advisory

T: 212-872-5851

E: rjadhav@kpmg.com

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

? 2011 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A. The KPMG name, logo and “cutting through complexity” are registered trademarks or trademarks of KPMG International. 24275NSS