Contract No.: (2015) X.F. D. Zi. No. 81****9

Mortgage Loan

(Applicable for Natural Person)

Exclusively Used for Outbound Financing

CHINA CITIC BANK

Instructions

I. The contract shall be filled out with blue-black or black signing pen or pen.

II. The contract shall be completed legibly and neatly.

III. The monetary currency shall be filled out in Chinese instead of with currency symbol. The monetary amounts in words shall be added with the Chinese name of the currency, while those in figures shall be added with currency symbol.

IV. The redundant blank spaces or the blank spaces not to be filled in this contract shall be treated by drawing broken line or oblique line or stamping with “blank below” seal or filling in words of “blank below”.

Mortgage Loan

Mortgagor: W* (hereinafter referred to as Party A)

Certificate type: ID Card

Certificate No.: 42**

Address: ***, Chaoyang District, Beijing

Post code: 100101

Work unit: ***Company

Contact number: 13***

E-mail:

Mortgagee: China Citic Bank Corporation Limited, operation & business Department (hereinafter referred to as Party B)

Address: Tower A, Investment Square, No. A27, Jinrong Street, Xicheng District, Beijing

Post code: 100033

Contact person: ZHU Jialin

Contact number: 95558

Fax:

E-mail:

Legal representative/principal: ZHU Jialin

Signing place of the contract: China CITIC Bank Beijing Fengtai Sub-branch

Signing date of the contract: October 23, 2015

To ensure the performance of the Mortgage Loan (hereinafter referred to as the “master contract”) numbered 811***9 that is signed by and between Party B and W*** (hereinafter referred to as the “debtor of the master contract”), and to guarantee the realization of Party B’s obligatory rights, Party A is willing to provide mortgage guarantee with his/her property for all the obligatory rights enjoyed by Party B over the debtor of the master contract in accordance with the master contract, and Party B agrees to accept the mortgage guarantee provided by Party A. To this end, according to the Contract Law of the People’s Republic of China, the Property Law of the People’s Republic of China, and the Guarantee Law of the People’s Republic of China, as well as other related laws and regulations, Party A and Party B have entered into the following agreement through equal consultation:

Article 1 Types of obligatory rights secured by mortgage and amount of the major obligatory rights

1.1 The major obligatory rights secured by Party A under this contract are all the obligatory rights enjoyed by Party B over the debtor of the master contract in accordance with the master contract.

1.2 The amount of the principal of the obligatory rights secured by Party A under this contract is: (currency) (amount in words)Three million six hundred thousand Yuan only.

1.3 The “principal” in Item 1.2 of this Article refers to the principal of the obligatory rights enjoyed by Party B under the master contract over the debtor of the master contract, including but not limited to the domestic and foreign currency loan principal that is repayable by the debtor of the master contract, the face amount of the banker's acceptance bill that is opened through application, the issuing amount of letter of credit, and the amount of letter of guarantee.

Article 2 Range of mortgage guarantee

2.1 The mortgage guarantee under this contract includes the principal of the major obligatory rights under the master contract, interest, interest penalty, compound interest, liquidated damages, damage awards and the expenses for realizing the obligatory rights and the mortgage (including but not limited to legal cost, arbitration fee, lawyer fee, travel expense, appraisal cost, transfer fee, maintenance cost, announcement fee, and execution fee, among which, the lawyer fee shall be limited to not more than 50% of the total amount of the major obligatory rights.), as well as all of other expenses payable.

Article 3 Term of fulfilling debts by the debtor of the master contract

3.1 The term of fulfilling debts by the debtor of the master contract is subject to the stipulations of the master contract. However, if the debts become due early according to laws, regulations, rules or stipulations of the master contract or through negotiation by the parties to the master contract, or if the parties to the master contract reach an agreement on extending the fulfillment of the debts which is approved by Party A, the early maturity date or the extended maturity date is the expiration date of the fulfillment of the debts. If the master contract stipulates that the debtor shall repay the debts in installments, the maturity date of each debt shall be the expiration date of the fulfillment term of the debt.

3.2 If the business under the master contract is letter of creditor or banker’s acceptance bill, Party B takes the date of the advances with the letter of credit or the banker’s acceptance bill as the expiration date of fulfilling the debts by the debtor under the master contract.

If the business under the master contract is letter of guarantee, Party B takes the date when the letter of guarantee actually fulfills the guarantee responsibility as the expiration date of fulfilling the debts by the debtor under the master contract.

If the business under the master contract is factoring business, the payment date of the repurchase price stipulated in the factoring contract is the expiration date of fulfilling the debts by the debtor under the master contract.

If the business under the master contract is other contingent liability business, the actual payment date of Party B is the expiration date of fulfilling the debts by the debtor under the master contract.

Article 4 Mortgaged property and exercise period of the mortgage right

4.1 Party A mortgages the property listed in the appendix of this contract, the List of the Mortgaged Property to Party B, and Party B enjoys the mortgage right according to the laws and regulations as well as the sitpulations of this contract. The effectiveness of the mortgage right extends to the mortgaged property’s accessory things, secondary right, appurtenance, addendum, natural and legal fruits, and subrogation of the mortgaged property, as well as the insurance benefit, compensation and indemnity incurred from damage to or loss or expropriation of the mortgaged property.

4.2 If the mortgaged property needs to be appraised in advance, the appraisal shall be conducted by a qualified appraising agency that is recognized by Party B, and the current appraisal value is (currency) RMB (amount in words) Thirteen million three hundred sixty seven thousand eight hundred eighty Yuan only . The appraisal value of the mortgaged property described in this contract does not act as the appraisal basis for Party B to dispose of the mortgaged property in accordance with the provisions of the contract, nor does it constitute any limitation to Party B when it exercises the mortgage right. In the valid period of this contract, if the value of the mortgaged property reduces due to any reason, Party A is obligated to take remedial measures that are approved by Party B to reach or restore the aforesaid value of the mortgaged property.

4.3 When Party B gives up other guarantee rights it enjoys for any reason (no matter whether the guarantee is provided by the debtor or a third party) or changes the sequence or content of the aforesaid guarantee rights, which results in loss or reduction of the priority right for claim of Party B under the aforesaid guarantee rights, Party A promises that the mortgage guarantee responsibility he/she assumes toward Party B will not be exempted or reduce accordingly.

4.4 The subsidiary certificates of the mortgaged property and the related materials shall be kept by Party B after mutual confirmation by both Party A and Party B, unless it is otherwise stipulated by laws and regulations.

4.5 The mortgage right shall be exercised during the limitation of action of the major obligatory rights.

Article 5 Special provisions on floating mortgage

5.1 Where Party A provides mortgage with the existing or future production equipment, raw materials, semi-finished products or products, the mortgaged property shall be confirmed when one of the following circumstances happens:

5.1.1 After expiration of the debt fulfillment period, Party B’s obligatory rights are not realized;

5.1.2 The circumstances of Party B realizing the mortgage right as described in Article 12.1 of this contract happen;

5.1.3 Other circumstances seriously affecting the realization of Party B’s obligatory rights happen.

5.2 Where Party A provides mortgage guarantee for Party B with the abovementioned property, in addition to the provisions in this Article, other provisions in this contract are also applicable.

5.3 Where Party A provides mortgage guarantee for Party B with the abovementioned property, in the valid period of this contract, Party A shall not provide pledge or mortgage guarantee for any third party with the property.

5.4 Where Party A provides mortgage guarantee for Party B with the abovementioned property, under the premise that the circumstances stipulated in Article 5.1 do not happen, Party A may dispose of the abovementioned property at reasonable price when undertaking normal production and operational activities and shall not dispose of the mortgaged property maliciously by means of false purchase and sale. In case of occurrence of the circumstances of exercising the mortgage right as stipulated in Article 12.1 of this contract, Party A shall not dispose of the mortgaged property in any way, or Party A shall assume the compensation liability for the losses thus incurred to Party B.

Article 6 Party A’s representations and warranties

6.1 Party A is a natural person having the necessary capacity for civil rights and conducts of signing and performing the contract according to the laws of the People’s Republic of China, is able to bear civil liability independently, has no bad credit record such as overdue loan, debit interest or credit card malicious overdraft, has no criminal record, and satisfies all conditions that the mortgagor shall have according to laws and regulations.

6.2 Party A has fully understood and agrees with all clauses of the master contract, and recognizes the authenticity of the transactions related to the master contract. Party A is willing to provide guarantee for the debtor under the master contract, and all the representations of him/her under the master contract are true. Party A promises that he/she will still bear the guarantee liability in accordance with the provisions of this contract, even if the practical use of the credit fund by the debtor under the master contract is not in compliance with the provisions of the master contract (including but without limitation the circumstance of repaying loan with loan).

6.3 Party A setting up the mortgage with the mortgaged property will not be restricted or prohibited, and will not cause any illegal circumstances.

6.4 Party A has the complete, effective and legal ownership or disposition right over the mortgaged property under this contract, the mortgaged property that needs to obtain the ownership certificate has got the complete ownership certification documents, and the mortgaged property is free from any dispute or any ownership flaw and is not pledged or mortgaged to any third party and not sealed up according to law, detained, supervised and controlled, mortgaged or under other compulsory measures. If there are other joint co-owners or co-owners by shares on the mortgaged property, Party A has got all necessary consent and approval of the co-owners.

6.5 All materials and information in relation to the mortgaged property and performance of this contract that are provided by Party A for Party B are legal, true, accurate and complete. Except for the circumstances disclosed to Party B in writing, Party A does not have any other liabilities (including contingent liabilities) that may affect the performance of this contract, breaches, litigation, arbitration matters or other significant matters influencing his/her assets that have not been disclosed to Party B.

6.6 Party A promises that: when the debtor under the master contract does not fulfill the due debts or is under the stipulated circumstsances of realizing the mortgage right, no matter whether Party B has other guarantee (including but without limitation the guarantee, warranty, letter of guarantee, standby letter of credit and other guarantee methods provided by the debtor under the master contract and/or a third party) for the obligatory rights under the master contract, Party B is entitled to directly require Party A to bear the guarantee liability within his/her guarantee scope without exercising other guarantee rights in advance (including but without limitation diposing of the material guarantee provided by the debtor under the master contract and/or a third party first); if there are multiple obligatory rights in the guarantee scope of this contract, Party B is entitled to decide on the clearing sequence and proportion of the obligatory rights.

6.7 If the mortgaged property provided by Party A for Party B is a house or other movable property, Party A shall guarantee that the property provided is not the necessary residential house and living goods of Party A and the family members supported by him/her.

Article 7 Party A’s rights and obligations

7.1 In the valid period of this contract, when the enterprise for which Party A works as the controlling shareholder or actual controller undergoes the circumstances that have incurred or may incur negative effects on the mortgage right, including without limitation share transfer, restructuring, combination, split-up, shareholding reform, joint stock, cooperating, joint operation, contracting, leasing, change in business scope and registered capital, and transfer of major assets, Party A shall give a thirty days’ written notice to Party B.

7.2 In the valid period of this contract, if the enterprise for which Party A works as the controlling shareholder or actual controller undergoes the circumstances that may affect his/her guarantee capability, including without limitation closing down, discontinuation of business, applying for or being declared bankruptcy, dissolution, being revoked business license, being revoked, deterioration of financial status or involving litigation, arbitration, criminal, civil or administrative punishment and economic disputes, Party A shall give a written notice to Party B within three days since the date when the foregoing circumstances happen or may happen.

7.3 In the valid period of this contract, if Party A undergoes the circumstances that may affect his/her guarantee capability, including but without limitation change of nationality, change of domicile, change of marital status, unemployment, invalidism, serious disease, deterioration of financial status or involving any litigation, arbitration, criminal, civil or administrative punishment and economic disputes, Party A shall give a written notice to Party B within three days since the date when the foregoing circumstances happen or may happen.

7.4 In the valid period of this contract, if Party A changes his/her name (full name), domicile, contact information, Party A shall notify Party B in written form within three days after the change.

7.5 In the valid period of this contract, if Party A undergoes any of the circumstances stipulated in Items 7.1, 7.2, 7.3 of this Article, Party A shall guarantee to properly fulfill all the guarantee liabilities under this contract according to Party B’s requirements and shall provide the specific plan of fulfilling the guarantee liabilities.

7.6 Party A promises that the representations and warranties made by him/her are true, effective and complete. In the valid period of this contract, if Party A has any breach of the circumstances specified in Article 6 of this contract, Party A shall guarantee to properly fulfill all the guarantee liabilities under this contract according to Party B’s requirements and shall provide the specific plan of fulfilling the guarantee liabilities.

7.7 Where Party B and the debtor under the master contract reached an agreement on modifying the master contract, except for extending the period or increasing the amount of the obligatory rights, there is no need to ask for Party A’s approval separatel, and Party A shall continue to bear the guarantee liability for the obligatory rights under the modified master contract according to the provisions of this contract.

If the extension of period or increase of the amount of the obligatory rights is not approved by Party A, Party A shall continue to bear the guarantee liability for the master contract before the modification according to the provisions of this contract.

7.8 In the valid period of this contract, without prior written consent of Party B, Party A shall not transfer, lease, remortgage, donate, trust, significantly modify, supplement or dispose in any other ways of whole or partial of the mortgaged property. If Party B agrees with Party A to dispose of the mortgaged property, Party A agrees that Party B is entitled to choose the following methods to dispose of the fund from disposal of the mortgaged property and agrees to assist in handling the relevant formalities:

7.8.1 Clearing or clearing in advance the principal and interest of the debts under the master contract and the related expenses;

7.8.2 Transferring to fixed deposit, with the deposit receipt being pledged or directly deposited into the margin account opened by Party A with Party B to continue providing pledge guarantee for the debts under the master contract.

7.8.3 Drawing to the third party appointed by Party B;

7.8.4 After providing new guarantee that meets Party B’s requirements and is recognized by Party B, Party A can dispose of the fund from disposal of the mortgaged property freely.

7.9 In the valid period of this contract, Party A shall report the status of the mortgaged property (including but without limitation whether the mortgaged property has been damaged, sealed up, detained, transferred, auctioned, modified or expanded) to Party B in written form regularly. If the mortgaged property is sealed up, detained, retained or undergoes other compulsive measures or ownership disputes, suffers or may suffer infringement from any third party, or the safe or complete status of it suffers or may suffer negative effects, Party A shall notify Party B in written form immediately and provide other guarantee recognized by Party B according to the requirements of Party B. For the losses thus incurred to Party B, Party A shall bear the compensation liability within the scope of the mortgage guarantee.

7.10 If Party A has leased the mortgaged property, Party A shall inform the leasee of the mortgage matters in written form before signing this contract, and shall provide Party B with the written agreement signed by Party A and the leasee and/or the written explanation on the lease situation.

7.11 In the valid period of this contract, if Party A learns about the information that the mortgaged house will be removed, he/she shall notify Party B in written form timely, or Party A will bear the breach liability incurred from not performing the duty to inform in time; both parties agree that Party B is entitled to choose the following methods to dispose of such removed house:

7.11.1 If the removal of such mortaged house is compensated by means of property swap, Party B is entitled to require that:

(1) Party A shall reset mortgage on the obtained house and sign a new mortgage agreement, and when the original mortgaged house is removed but the house on which mortgage is reset has not undergone the mortgage registration completely, Party A shall provide new guarantee that is recognized by Party B; or

(2) Party A shall provide other guarantee that is recognized by Party B.

7.11.2 If the removal of such mortaged house is compensated by means of compensatory funds, Party B is entitled to require that:

(1) Party A shall deposit the compensatory funds for removal of such house into the special margin account appointed by Party B as the pledge guarantee for the obligatory rights under the master contract; or

(2) Party A shall pledge the compensatory funds for removal of such house to Party B in the form of fixed deposit receipt as the pledge guarantee for the obligatory rights under the master contract; or

(3) Party A shall provide other guarantee that is recognized by Party B.

7.11.3 If the removal of such mortgaged house is not compensated with the methods specified in Item 7.11.1 or Item 7.11.2, or if there are unaccomplished matters except for the contents stipulated in Item 7.11.1 or Item 7.11.2, Party A and Party B shall decide on the relevant subsequent matters of such removed house.

7.12 If the business under the master contract is domestic letter of credit, buyer financing under domestic letter of credit, import letter of credit or import documentary credit/import paying service business, if the buyer or the person designated or authorized by the buyer, or the confirming bank or negotiation bank of the letter of credit has made external payment or has performed other payment acts, Party A shall bear incontestable mortgage guarantee obligation, and Party A shall not propose liability exemption or raise a plead due to the reason that any judicial office or administrative institution releases stop-payment order or restraining order to the payment obligation under the letter of credit or takes the measures of sealing up, detaining, or freezing the property related to the letter of credit or similar measures, or that the documents is not in conformity to the provisions of the letter of credit.

7.13 Under delivery guarantee, endorsement of bill of lading, and authorized delivery business, Party A does not propose liability exemption or raise a plead due to the reason that the debtor under the master contract refuses to make payment for the funds of the corresponding letter of credit.

7.14 In the valid period of this contract, where Party B transfers the obligatory rights under the master contract, Party A agrees to continue bearing the guarantee liability to the transferree of the obligatory rights in accordance with the provisions of this contract, and aids in settling the corresponding formalities for mortgage right transfer and modification registration.

7.15 Party A agrees to authorize Party B to enquire Party A’s credit record to the financial credit information basic database and the credit information service approved by People’s Bank of China, and agrees Party B to provide the credit information related to Party A for the financial credit information basic database and the credit information service approved by People’s Bank of China.

7.16 After the debtor under the master contract clears off all the debts under the master contract, Party A is entitled to require cancelling the mortgage under this contract.

Article 8 Party B’s rights and obligations

8.1 Where the debtor under the master contract fails to fulfill all or part of the debts as agreed on the expiration date of the fulfillment term of the debts under the master contract, Party B is entitled to dispose of the mortgaged property in accordance with the provisions of this contract.

8.2 Where the income from disposal of the mortgaged property by Party B is insufficient to clear off all the debts in the mortgage guarantee scope under this contract, Party B is entitled to claim the insufficient part from the debtor under the master contract according to law; if there is surplus after settlement of the debts under the master contract, Party B shall return the surplus to Party A.

8.3 If the value of the mortgaged property may reduce, Party B is entitled to require Party A to provide corresponding guarantee; if Party A does not provide such guarantee, Party B is entitled to dispose of the mortgaged property and uses the proceeds from the disposal to clear off the obligatory rights guaranteed in advance, or draw or deposit the proceeds into the margin account opened by Party A with Party B to continuously provide pledge guarantee for the debts under the master contract.

8.4 After the debtor under the master contract clears off all the debts under the master contract, Party B shall assist Party A in settling the formalities for mortgage cancellation registration at the mortgage registration department, and return the mortgage right certificate and the valid certification documents that are safekept by Party B to Party A.

8.5 Party B shall keep confidential the materials, documents and information related to Party A that are provided by Party A , but except for those that should be enquired or disclosed according to laws, regulations, rules or the requirements of the competent authorities.

Article 9 Safeguard and use of the mortgaged property

9.1 In the valid period of this contract, Party A shall safeguard the mortgaged property properly in appropriate and effective ways, keep the intact and good condition of the mortgaged property, occupy, use, manage and operate the mortgaged property legally and appropriately, and pay the relevant taxes and dues according to law. Party A shall accept Party B’s checking the condition of the mortgaged property at any time.

9.2 Except for Item 7.11 of this contract, in the valid period of this contract, if the value of the mortgaged property may reduce, Party A shall notify Party B in time and restore the value of the mortgaged property according to the requirements of Party B or provide other guarantee equivalent to the reduced value and that is approved by Party B. Otherwise, Part B is entitled to exercise the mortgage right in advance, and Party A shall bear the compensation liability for the reduced part of the value of the mortgaged property.

Article 10 Insurance of the mortgaged property

10.1 Party A shall buy insurance for the mortgaged property based on the insurance type, insurance period and insured amount designated by Party B, and Party B shall be the payee of priority for compensation (the first beneficiary) of the mortgaged property insurance. Without written approval of Party B, Party A shall not change the payee of priority for compensation (the first beneficiary) without permission and shall not cancel the insurance. There should be no provisions restricting Party B’s rights and interests in the insurance policy. The insurance policy and renewal policy for the mortgaged property shall be kept by Party B.

10.2 If Party A does not buy insurance or pay insurance premium in accordance with the provisions of the preceding Item of this Article, Party B is entitled to directly buy insurance or renew the insurance and pay the insurance premium for Party A as Party A’s agent, and Party A shall repay the insurance expenses Party B has paid for him/her.

10.3 In the valid period of this contract, in case of any circumstances like loss or damage of the mortgaged property, Party B shall be repaid in priority with the insurance benefit, indemnity or compensatory payment.

10.4 In the valid period of this contract, if Party A does not handle the insurance or renew the insurance for the mortgaged property in accordance with the provisions of this contract, in case the mortgaged property suffers any damage attributable to the insurance scope of the mortgaged property, or the mortgaged property suffers loss or damage due to behavior of a third party, Party A does not obtain compensatory payment for the damage from the third party or Party A has handled mortgaged property insurance, but the reason for the loss is one of the causes for which the insurance company is exempted from bearing any liability according to the insurance contract, the provisions of Item 8.3 of this contract shall apply.

10.5 As for the insurance compensation obtained for the mortgaged property, Party B is entitled to dispose of it with the following methods, and Party A shall assist it in handling the relevant formalities:

10.5.1 Upon approval by Party B, using it for repairing the mortgaged property to restore the value of the mortgaged property.

10.5.2 Clearing or clearing in advance the principal and interest of the debts under the master contract and the relevant expenses;

10.5.3 Transferring to fixed deposit, with the deposit receipt being pledged or directly deposited into the margin account opened by Party A with Party B to continue providing pledge guarantee for the debts under the master contract.

10.5.4 After providing new guarantee that meets Party B’s requirements, Party A can dispose of it freely.

Article 11 Mortgage registration

11.1 Party A and Party B shall go through the formalities for registration of the mortgaged property at the legal registration authority of the mortgaged property within 180 days since the signing date of this contract, and hand in original copies of the other right certificate and mortgage registration certification documents and/or the original copy of the ownership certificate of the mortgaged property to Party B within three days after settling the registration formalities.

11.2 In the valid period of this contract, in case of transfer or modification of the ownership over the mortgaged property or any right with prior written approval by Party B, or in case of occurrence of any matter that should undergo mortgage right modification registration according to law, the parties concerned shall settle the modification registration in the statutory period.

Article 12 Realization of the mortgage right

12.1 In the valid period of this contract, under any of the following circumstances, Party B is entitled to exercise the mortgage right immediately:

12.1.1 The fulfillment term of the debts under the master contract expires (including early maturity) while Party B is not paid off, or the debtor under the master contract violates other stipulations of the master contract;

12.2 Party A or the debtor under the master contract is under one of the circumstances such as closing down, discontinuation of business, deterioration of financial status, applying for bankruptcy, accepting bankruptcy application, being declared bankruptcy, dissolution, being revoked business license, or being revoked;

12.1.3 Party A violates the stipulations of Item 7.5 and Item 7.6 of this contract and does not fulfill all the guarantee liability under this contract or the specific plan of fulfilling the guarantee liability it provides are not satisfactory to Party B;

12.1.4 Where Party A is incapable of maintaining the intact and good condition of the mortgaged property, or causes of damaging the value of the mortgaged property that are specified in Item 9.2 of this contract happen, while Party A refuses to provide guarantee in accordance with the provisions in Item 9.2 of this contract;

12.1.5 Where Party A violates provisions in Item 5.4 of this contract and disposes of the mortgaged property that has already been set up movable property floating mortgage maliciously in the ways like false purchase and sale or not following the principle of fair transaction in the production and operation process, or disposes of the mortgaged property without permission under the circumstance of prohibiting to dispose of the mortgaged property;

12.1.6 Cross default. Party A violates contract under other debt documents and does not correct in the applicable period of grace, and causes any of the following circumstances therefore, and also constitutes breach of this contract, which is cross default:

(1) The debts under other debt documents are declared or can be declared accelerated maturity;

(2) The debts under other debt documents are not under the circumstances where they are declared or can be declared accelerated maturity, but there is default of payment;

12.1.7 Occurrence of other events endangering, damaging or that may endanger and damage Party B’s rights and interests.

12.2 Realization methods of the mortgage right

Party A agrees Party B to choose any kind of the following methods to realize the mortgage right. If the currency of the obligatory rights under the master contract is different from that of the proceeds from realization of the mortgage right, it shall be translated and compensated at the list price published on the date when Party B gets the funds from disposal of the mortgaged property:

12.2.1 Realizing the mortgage right by means of discount on the mortgaged property. Party B can negotiate with Party A to get paid at the agreed price; Party B can also get paid at the price appraised according to law by the corresponding qualified appraisal agency as agreed by both parties hereunder, and both parties have agreed to accept the appraisal price. The appraisal agency agreed by both parties is:

12.2.2 Realizing the mortgage right by means of selling off the mortgaged property. Party B can transfer the mortgaged property voluntarily or authorize Party A or an intermediary agency to transfer the mortgaged property. For the determination of the selling price, the provisions of the preceding Item of this Article shall apply.

12.2.3 Realizing the mortgage right by means of auction. Party B is entitled to authorize the following auction enterprise that is incorporated in China and has the corresponding qualification to auction the mortgaged property according to law. Party B can propose the auction reserve price based on the total amount of the unpaid debts under the master contract or at the rate of not less than 100 % of that amount, and does not propose the auction reserve price. If no transaction is concluded in the auction, Party B is entitled to authorize the auction enterprise or other auction enterprises to reauction or realize the mortgage right using the aforesaid methods of discount or auction. The auction enterprise agreed by both parties is:

12.2.4 Party B directly requests People’s Court to auction or sell off the mortgaged property without legal proceedings according to law.

12.3 When Party B disposes of the mortgaged property according to this contract, Party A shall not set up any hindrance (including intervention from any third party) or adopt any action that may hinder or delay Party B’s acts of disposal of the mortgaged property according to this contract. Party A undertakes to assist actively according to the requirements of Party B, so that Party B can realize the mortgage right as soon as possible.

12.4 The proceeds from the realization of the mortgage right under this contract shall be used to clear the debts in the following sequence:

(1) To pay the fees payable, liquidated damages, damage awards as stipulated in this contract and the master contract and the relevant laws and regulations;

(2) To pay the interest penalty and compound interest payable under the master contract;

(3) To pay the interest payable under the master contract;

(4) To pay the principal payable under the master contract.

Where the proceeds from the realization of the mortgage right under this contract is insufficient to repay or pay all funds in the same sequence, Party B is entitled to choose the proportion and sequence of repaying the funds.

Article 13 Summation of rights

13.1 Party B’s rights under this contract are summative, which does not impact on and eliminate any right that Party B can enjoy to Party A according to law and other contracts. Unless Party B indicates in written form, Party B’s not, partial and/or delay in exercising any of its rights do not constitute its waiver of or partial waiver of such rights, nor do it impact on, deter or hinder Party B’s performing such rights continuously or performing any other rights of it.

Article 14 The continuity of obligations

14.1 All obligations of Party A under this contract and the joint and several obligations are continuous, which have complete binding on the inheritor, receiver, transferee and the subjects after the merger, split-up, restructuring, stock system reform and rename, which are not impacted by any disputes, claims for compensation and legal proceedings, any orders of superior units, and any contracts and documents signed by the debtor under the master contract and any natural person or legal person, and which will not change at all due to the debtor under the master contract going bankrupt, being incapable of repaying the debts, losing the enterprise qualification, changing the Articles of Association and having any essential modification.

Article 15 Other agreed matters

If the provisions of this Article are in conflict with provisions of other Articles, the provisions of this Article shall prevail.

Article 16 Effectiveness, alteration and cancellation of the contract

16.1 This contract shall come into force upon signing and stamping (signing or stamping the name seal) by Party A and his/her authorized agent and signing and stamping (signing or stamping the name seal) by Party B’s legal representative/principal or authorized agent and stamping with the common seal or the special seal for contract.

16.2 After effectiveness of this contract, unless it is already stipulated in the contract, neither of Party A or Party B shall alter or cancel this contract without permission; if this contract really needs to be altered or cancelled, a written agreement shall be concluded through negotiation by both parties.

Article 17 Effectiveness of the contract

17.1 This contract is an accessory contract of the master contract, and if the master contract is invalid, it does not affect the effectiveness of this contract.

17.2 If a clause of this contract or some content of a clause becomes or will become in valid, the invalid clause or the invalid part does not affect the effectiveness of this contract and other clauses of this contract or other content of this clause.

Article 18 Breach liability

18.1 After effectiveness of this contract, Party A and Party B shall fulfill the obligations prescribed in this contract. If either party fails to perform or incompletely performs the obligations prescribed in this contract, the default party shall bear the corresponding breach liabilities and make compensation for the losses caused to the counterparty.

18.2 If the representations and warranties made by Party A in Article 6 of this contract are untruthful, inaccurate, incomplete or misleading on purpose, which causes loss to Party B, Party A shall make compensation.

18.3 If this contract become invalid due to fault of Party A, Party A shall compensate all Party B’s losses within the original mortgage guarantee scope.

Article 19 Applicable laws

19.1 This contract is governed by the laws of the People’s Republic of China (for the purpose of this contract, excluding the laws of Hong Kong, Macao and Taiwan).

Article 20 Resolution of disputes

20.1 As for all the disputes arising out of and related to this contract, both parties may settle them through negotiation; if the negotiation fails, both parties agree to adopt the __2_ method (Note: the method of resolution selected must be in line with the master contract and other related contracts):

(1) To apply for arbitration to Arbitration Committee, and apply the existing valid arbitration rules of the committee when applying for arbitration;

(2) To file a lawsuit to the competent people’s court at the place of Party B.

Article 21 Others

21.1 For the matters not accomplished in this contract, both parties may enter into a written agreement separately as an appendix of this contract. All the appendixes, revisions or supplements to this contract constitute integral parts of this contract and have equal legal force with this contract.

21.2 All the matters related to this contract, such as notarization, registration, identification, appraisal, safeguard, transfer, drawing shall be handled by the applicant of the related matters or handled according to law.

21.3 Notice and service

21.3.1 The notices and requirements under this contract, the legal documents of debts collection or litigation (arbitration) involved in this contract, or other letters can be delivered or sent to the address or contact ways stipulated in the first part of this contract.

21.3.2 As for any notice, requirement, debts collection letter or any other letter given by Party B to Party A under this contract, the telex, telephone, fax and email will be deemed as having been served to Party A as soon as they are sent; the postal letters will be deemed as having been served to Party A on the third day after the day of posting; if they are delivered by appointed personnel, the date when Party A sign for them will be deemed as date of service, and if Party A rejects them, the delivery personnel can record the delivery process by means of photographing and video recording and retain the documents, and they are also deemed as having been served.

21.3.3 When a judicial office or arbitration institution sends the relevant (legal) documents to Party A according to the address and contact ways as stipulated in this contract, if nobody signs for the documents or if Party A rejects the documents, the date when the (legal) documents are returned will be deemed as the date of service; if they are delivered to Party A directly while Party A rejects them, the delivery personnel can record the delivery process by means of photographing and video recording and retain the (legal) documents, and they are also deemed as having been served. Where Party A provides false contact ways or fails to notify the altered contact ways in time, which makes the (legal) documents not served or returned, the date when the (legal) documents are returned will be deemed as the date of service.

21.3.4 If the said contact ways provided by Party A are changed, Party A shall notify Party B in written form within three days after the change; after the debts under this contract enter the litigation or arbitration stage, Party A shall notify the trial authority in written form. Otherwise, the notices or other documents issued according to the original contact ways will be deemed as having been served, even if the party making such changes does not receive them.

21.4 This contract is made in quadruplicate original copies, two copies for Party A, and _two_ copies for Party B.

21.5 Party B has drawn Party A’s attention to the clauses of exemption or limiting his/her responsibilities under this contract by means of overstriking, blackening, highlighting and other reasonable methods, and has given full description on the relevant clauses according to Party A’s requirements; Party A and Party B do not have any objections on the understanding of all clauses of this contract.

(No Text Below)

(This page does not have any text and is the signature page of the Mortgage Contract numbered 811***69 )

Party A:

Personal/Authorized Agent Signature: W**

Party B (Common Seal for Special Seal for Contract):

Special Seal for Personal loan contract of China Citic Bank Corporation Limited, operation & business department (Seal)

Legal Representative/Principal:

(Or Authorized Agent): Shan Tianwen (Signature)

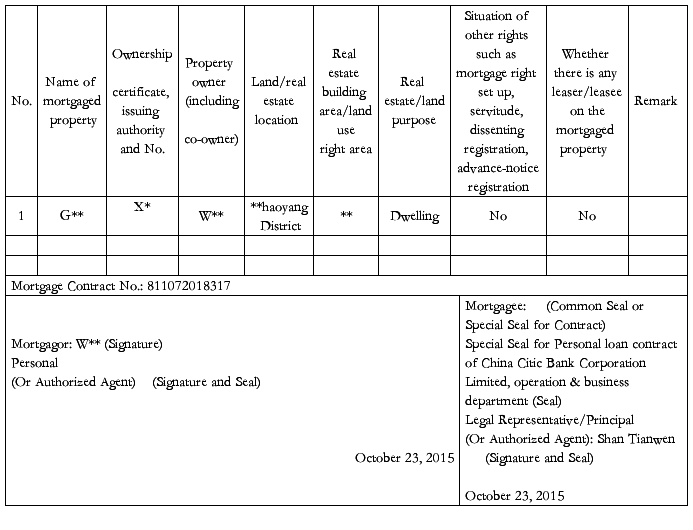

Appendix:

List of (Real Estate) Mortgaged Property

(Tips: For all the specific factors of the mortgaged property that are applicable for the content of this list, please fill out the corresponding content or accurate names carefully, and cross out the inapplicable content with oblique lines)

The Mortgagor undertakes that the contents of the mortgaged property recorded in the list above are true, effective and legal.