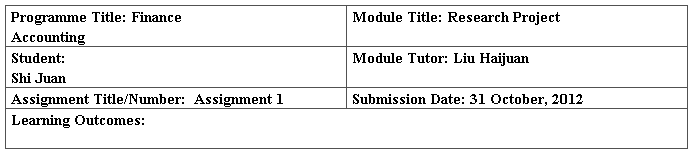

Higher Education Programme Feedback Sheet

Title

Chinese and foreign accounting report compare and enlightenment

Background

The accounting report was developed on the basis of the accounting standards, to help investors, creditors, and other users of accounting reports evaluate the enterprise's operational and financial activities of the past and predict the future financial position of the enterprise. 2007, the Ministry of Finance introduced new accounting regulations and corporate accounting standards are still differences with international guidelines. After China's accession to the WTO, now accounting reports international trade operator is unable to meet the requirements of the quality of its information. Although China has made ??a lot of improvements in accounting standards, the Ministry of Finance, is still not sufficient to meet all the requirements, accounting reports should be further extended, should be increased to more non-monetary information.

By at least for the current reporting system In the following defects:

(1) Can not understand the transactions of the middle raw uncertain matters and matters Impact;

(2) Of the stick form can not be sufficiently heavy Depending on the economic substance; (3) accounting serious endless Whole;

(4) Can not meet the reporting objectives reflect by Camp responsibility system to the decision-making useful changes;

(5) Is losing its relevance.

Research objective

At understanding between China and the international norms, and in accordance with China's

Specific national conditions and make the appropriate adjustments to the investors and other users of accounting reports

With the reliability, relevance, accounting reports easier to understand, and promote China's market economy

Further development.

Method

In this paper, two of the company's annual report, for example, China's accounting reports from the accounting statements and related notes, and should be disclosed in the financial report information about other aspects of foreign compare and make some suggestions. By comparison of accounting reports with the international financial reporting results reveal: China's accounting report, there are still many deficiencies, the need to further standardize and improve our accounting reports.

Timescale

September 1-2:Review of literature

September 3-13:To collect first-hand data

September 14-20:Collection of secondary data

September 21-25:Analysis of primary data

September 26-30:Comparison of first-hand data and secondary data

October 1-3:Conclusion analysis recommendations

October 4-18:Finishing suggestions

October 19-23:Complete project report

October 24-28:Final writing of project report

Resources

I have access to the computer hardware and so fewer .Some care about people voluntarily provide some help. Following consultations, the three companies willing to fund and provide data.

References

1. http://www.cnki.net/kcms/detail/detail.aspx?dbcode=cjfq&dbname=cjfq2012&filename=shng201204038&uid=WEEvREcwSlJHSldRa1FhcXZVeDJaV1cvQmVHSExrWmRSTDNHcmowbCtmVVMzOFE3YXJ3OGdvZHRwWXRnSGJJPQ==&p=

2. http://www.cnki.net/kcms/detail/detail.aspx?dbcode=cjfq&dbname=cjfq2011&filename=xdby201114147&uid=WEEvREcwSlJHSldRa1Fhak0vaU5PblZUb2F0bzdHcDZQNEFUWjJZZERwaU96cWs1TXRtdy85eEhvUC84Zmd3PQ==&p=

3. http://www.cnki.net/kcms/detail/detail.aspx?dbcode=cjfq&dbname=cjfq2009&filename=zkjs200910026&uid=WEEvREcwSlJHSldRa1Fhak0vaU5PblZUb2F0bzdHcDZQNEFUWjJZZERwaU96cWs1TXRtdy85eEhvUC84Zmd3PQ==&p=

Chinese and foreign accounting report compare and enlightenment

Shi Juan

Abstract

Financial report is culmination of financial accounting. Corporate financial information is also the main carrier and the output form. Financial and accounting reports are more and more concern by business operators and information users. States or international organizations also make specific provisions on the financial report. However, according to the actual situation of different countries, the systems and content of accounting reporting are different too. This report from the accounting concept, lists the composition and substance of national accounting report and the purpose of the preparation of accounting reports to comparative and analysis the inadequacies of the accounting report of China. We try to intend to further improve our financial and accounting reports and improve the quality of information in international transactions.

Keywords: accounting reports International Comparison Inspiration

Table of contents

Chapter Ⅰ Financial Reporting………………….…..…6

1.1 Financial Accounting Report Definition………6

1.2Composed of financial accounting reports……..6

1.3 financial accounting reports role………...…….6

Chapter II comparison of Chinese and foreign financial report………………………………………………...….8

2.1 Financial Reporting comparison…………...….8

2.2 financial statements format differences compared with…………………………………………10

2.3 Comparison of the substance of the financial report…………………………………………………..11

2.4 Comparison of financial reporting information disclosure differences………………………………….12

2.5 Differences in the financial statements of goals

Chapter III our financial reporting problems………….15

Chapter IV Revelation of our financial reporting……..17

Bibliography ..................................................................22

Chapter Ⅰ Financial Reporting

1.1Financial Accounting Report Definition

The financial report reflecting the financial position and operating results of the written documents, including balance sheet, income statement, cash flow statement, changes in equity table (new accounting standards require disclosure in the annual report), Schedule and Financial Statements and financial situation. General international or regional accounting standards for financial reporting expertise of independent criteria. Financial Reporting "from the international point of view is a more general term, but the term financial accounting reports in the current relevant laws and administrative regulations. In order to maintain the consistency of the legal system for the basic norms still useless terminology of financial accounting reports, but at the same time the introduction of financial reporting terms, and pointed out that the financial and accounting reports, "also known as" financial reporting ", which defied solution based convergence of national conditions and international issues.

1.2Composed of financial accounting reports

The financial report includes the financial statements and should be disclosed in the financial report information and data. Among them, the financial statements of the report itself and its notes of two parts, the notes are an integral part of the financial statements; the report should at least include a balance sheet, income statement and statement of cash flows and other statements.

The financial statements of the core content of the financial report, but in addition to outside the financial statements, financial reports should also include other relevant information, specifically in accordance with the provisions of relevant laws and regulations and information needs of external users. If the companies can be disclosed in the financial reports of its commitment to social responsibility, contribution to community capacity for sustainable development, and other information, this information is also relevant for the user's decisions, despite belonging to the non-financial information, and can not be included in the financial statements, but if regulations or user demand, corporate financial reporting should be disclosed, sometimes companies can voluntarily disclose relevant information in the financial reports.

1.3 financial accounting reports role

Financial statements is the main part of the financial reporting, accounting information it provides an important role, mainly reflected in the following aspects:

1.Comprehensive system to reveal the financial position of the enterprise in a certain period, operating results and cash flows, conducive to the operation and management personnel who understand the indicator of the completion of the tasks of the unit, the operating results of the evaluation and management personnel, in order to identify problems and adjust the business direction, develop measures to improve the management level, improve economic efficiency, to provide the basis for economic forecasting and decision-making.

2. Conducive to the country's economic management departments to understand the health of the national economy. Summary and analysis of financial statements information provided by the various units, to understand and master the various industries, the economic development of the regional economic situation, in order to macro-control economic operation, optimizing the allocation of resources to ensure the sustainable development of the national economy stable.

3.Conducive to investors, creditors and other parties concerned to grasp the enterprise's financial position, operating results and cash flows, and then analyzes corporate profitability, solvency, investment income, and development prospects for their investment, loans and trade basis for decision making.

4. Help meet the financial, tax, business, audit and other departments to oversee the business management. Through financial statements can check and monitor whether enterprises to comply with the national laws, regulations and systems, whether the behavior of tax evasion.

Chapter II comparison of Chinese and foreign financial report

2.1 Financial Reporting comparison

(1) Statement of Cash Flows: the base of the four countries

Division of state-owned accounting situation in the statements of changes

The other three countries, while the United States has been accounting

The situation changes in the table instead cash flow statement. Our reference

This approach has been formally accounting situation changes in the table to change

For the cash flow statement. Accounting reports in Japan, though not package

Including accounting changes in circumstances (Cash Flow Statement), but

The accounting profession is very great importance to research in this area.

(2) U.S. accounting and reporting features: In addition to the three base

In the statements, the united States relative to other countries pay more attention to

Shareholders' equity of changes in circumstances. This is because in the U.S.

AG occupies an important position in the country's economy, wide

The large change in the interests of investors to its own company

That are extremely important.

(3) Japanese accounting reporting features: in Japan

Accounting reporting system, supplemental schedules as

A separate part and have dedicated to

Requirements. The provisions of the Commercial Code of Japan, the company needs to filer

The schedule contents of including capital and reserves increased

Less changes, the acquisition and processing of fixed assets and

Detail of depreciation charges, the company and the subsidiary claims

Details of subsidiary stock held copies

For details of the amount, the asset-backed, there are special

The fixed reserve the calculation paid to directors and supervisors reported

Pay, as well as to directors, supervisors and dominant shareholders

To full information.

(4) characteristics of the French accounting reports: France in

Its accounting reporting system, in particular, are listed Same

Divisions, with other countries, it is the most important point is not

The same, which reflects the master of social welfare in the French society

Righteous tendencies.

(5) Statements Note: with the United States, Japan and

France compared to China's accounting reporting system Notes

Part, far less than other countries, rich in content, side

Law and diverse. Our comment section including accounting

Statements and accounting affairs of two parts within

Yung. Among them, the notes to the financial statements include only the accounting side

Law changes, important items of information disclosure, the very items

Description of several elements.

2.2 financial statements format differences compared with

(1) The format of the balance sheet: Japan

Prepared by the United States has two formats, account type and reported

Report type and flow column before, China is also flowing column

Before more emphasis on the solvency of the enterprise;

France only allow the use of account-fixed column before

Description more emphasis on the production capacity of enterprises in France.

(2) the format of the income statement: up from the format

Look at China and the United States is basically the same, but our operating profit Fan

Circumference smaller than the United States. In addition, the regulation of our income statement items

More stringent than the range and the United States. Japan and France, the grid

In similar account or report type, reflecting within

Capacity is more detailed.

(3) Changes in accounting status table: At present, China

And the United States have been changed in the cash flow statement. In the United States

The practical application of the indirect method is more popular. Of

"Accounting Standards for Business Enterprises - Cash Flow Statements" requires

Preparation directly Law.

2.3 Comparison of the substance of the financial report

1, United States

U.S. financial reporting requirements to comply with generally accepted accounting principles, the basic starting point is to protect the interests of investors and potential investors for decision-making to provide investors with objective and fair accounting information. Is a major feature of the U.S. financial reporting statements Notes to become an important part of the system of financial statements, its entries more often occupy much space, for breach of consistency, the the comparability principle of the matter, comments also pre-order to reveal. The American Accounting stressed fully reveal the principles.

2, the United Kingdom

UK financial reporting requirements to comply with the "true and fair", the main objective is to protect the company interests of bondholders, shareholders, creditors. The high degree of openness of the British financial statements to fully provide financial information for shareholders investors, creditors, and by the constraints of the audit objectives. Accounting reports in the United Kingdom company law strictly require data prompt the extent, the quality of accounting information properties, measurement attributes and units of measurement, report type and format requirements, fully embodies the transparency of the financial statements, the authenticity.

3, France

To ensure that the state's tax, so that the financial statements comply with the requirements of the tax law. The financial statements of the French style, as unlike the United States requires the largest possible representation, on the contrary only required to do a minimum representation. French financial report is not very concerned about the interests and needs of the investors, the stock market is affected by the impact of the company's financial position is also smaller. The French financial report to comply with the EC Directive No. 4 and No. 7 instruction. In the 4th Directive before release, the French financial statements almost no notes, the report is limited to the filling: List of subsidiaries and associated companies, sub-industry sales revenue calculation, Changes in fixed assets and receivables payable Ageing analysis of accounts table. The adoption of the 4th Directive "Statements

4, China

In 1992, China's accounting reports by the traditional socialist program mode is very large, the financial statements for the purpose to serve the government, under the conditions of the planned economy, to provide the necessary information to enhance program management. However, after the reform and opening up, the original financial statements mode is difficult to meet the needs of the users. After the reform of the accounting system by the United States, but the capitalist market in China is far from the United States developed the program and information disclosed in the notes to the financial statements far less than the United States.

2.4 Comparison of financial reporting information disclosure differences

1. Comparison of the laws and regulations:

Major U.S. Securities Act and the Securities Exchange Act provides that the accounting information disclosure of listed companies. The American emphasis on three areas: accounting information disclosure mandatory disclosure mandatory audit liability.

Our country over the principles set forth in the Company Law and the Securities Law constraint, also SFC information disclosure rules and the Ministry of Finance, Accounting Standards legally binding. China also stressed mandatory disclosure mandatory audit, legal responsibility for the contents of the three. However, China has not yet provisions the information disclosure timeliness civil liability, as well as some of the responsibility too abstract and principles, not to facilitate the specific operation of the judicial.

Predictive Financial Information Disclosure:

2.Predictive Financial Information listed companies under the corporate environment for the development and operation of foreign public disclosure about the company's future financial position, operating results and cash flow forecasts and judgment, is a forward-looking financial information the disclosure of the management of the company's future development, important part of the external financial reporting.

The U.S. accounting profession and the securities industry has long specialized research on the predictability financial information disclosure issues experienced during the evolution prohibits the publication of the policy to encourage non-mandatory disclosure. U.S. listed companies to provide investors with the predictability of financial information have been very popular and the relative lack of predictive financial information disclosure system generally.

3. Information the disclosure of off-balance sheet:

The balance-sheet information refers to the provider of the financial statements can not or inconvenience reflected in the statutory accounting statements, but it can help users of financial statements to a comprehensive and correct understanding of the accounting statements, the financial situation of enterprises, or issues and the future development of important information, it is a supplement and description of the accounting statements.

U.S. financial reporting full use of off-balance sheet information disclosed in this form will not be able to express the information in the table, by the balance sheet disclosure of information to report human resources information, information on natural resources, is difficult to measure derivative financial instruments, information, etc., to make the investment and bonds more fully, so that the decision-making. China is not involved in this regard.

2.5 Differences in the financial statements of goals

1,The objective of financial reporting, the final outcome of most accounting, it directly reflects the goal of accounting.

Provisions of the International Accounting Standards:

The objective of financial statements is to provide help in economic decision-making in a series of user data on the change in the enterprise's financial position, results of operations and financial condition. The financial report also reflects the outcome of the custody of the work or accounting work of the business managers of the resources entrusted to it.

2, Provisions of the Financial Accounting Standards:

The financial report should provide useful information and potential investors, creditors and other users. In order to make reasonable investment credit decisions. Financial report information to help them following expected source of cash income, to measure the amount of time and chance, dividends or interest, sale or selling securities resulting maturity securities is settled. Should provide the following information and financial reporting, economic riches, those riches rights, as well as the changes caused by the financial resources of the riches on rights transactions, events and circumstances.

3,Provisions of the Financial Accounting Standards in the United Kingdom:

The goal of the financial and accounting reporting disclosure of the management resources and obligations of financial and non-financial information to help the user to control the company, to make appropriate decisions.

4.The provisions of the Financial Accounting Standards:

Chinese accounting standards and is not clearly stated accounting objectives, just accounting principles as target, that the accounting information should be consistent with the requirements of the national macro-economic management, to meet all parties understand the business operating results and financial position, allow enterprises to strengthen internal management .

Chapter III our financial reporting problems

3.1 The report target overemphasis on national macro-economic management and regulation of services

By contrast more than the countries financial accounting report specific expression of Financial Accounting report the presence of the following problems:

The accounting information provided in financial reports shall conform to the requirements of the national macro-economic management. Financial reporting countries the primary means of financial and taxation and price policy and an important basis for this report mode arising under the planned economy, the main function is to serve the government's macroeconomic management. Today, the socialist market economy has improved steadily, enterprises have become independent operators, the self-financing of the economic entity, investment entities gradually showing the pattern of a wide range of financial reporting objectives should shift, such as investors, creditors and the public and corporate have a direct interest in the relationship between the information needs of the relevant group. External users of financial reports generally include creditors, shareholders, government administration, staff, operators, and other economic and business stakeholders, and potential external users, due to their own decision-making goals inconsistent between different external users of financial reports information constitute specific requirements are not identical. Financial reporting information for external users, reflecting the company's future financial trends compared to the financial report reflects the financial situation of the corporate history information, the greater the former on their decision-making role. Therefore, the financial report provides decision-making related to external users of financial information is incomplete.

3.2 Incomplete information disclosure

Information disclosure is incomplete, Schedule, Statements and Financial Fact Sheet contains too little information, and can not meet the needs of information users and social aspects. Can not meet the requirements of the revelation of the intangible assets of financial information, and can not meet the problem of the recognition, measurement and reporting of derivative financial instruments, can not meet the information needs of prospective fulfillment, not fully reflect the corporate social responsibility, and also does not reflect the corporate social contribution and contribution to the allocation problem. The lack of human resources information disclosure, the lack of the enterprise background information and forward-looking information disclosure and pays little attention to the impact of corporate environmental information disclosure does not reveal the enterprise consumption of natural resources.

3.3 Too much emphasis on the reliability of information

The current financial reporting is expressed enterprises have certainty of transactions and events. Low correlation of information required for the user decision-making, is basically a summary table of historical accounting data, a backward-looking financial statements. Most of the reliability of financial reporting from historical data, generated at historical cost financial information, with high credibility, but it can not meet the needs of decision usefulness. Throughout the financial reporting system, accounting for the proportion of the vast majority of the historical information. So many that reflects the company's future prospects, useful to the users of cash flow projections are excluded from the financial statements even outside of the financial report.

3.4 Unable to meet the different needs of the users of the information

Users of accounting information, there are a large number of different stakeholders, including government departments, social sector, company employees, business partners, vendors, suppliers, etc., in addition to investors and creditors. Different accounting information users demand more and more reports. So companies tend to disclose more critical information for the future operation and development. The current financial reporting in the confirmation mainly limited to the monetary measures, the disclosure of the history of economic activity is largely confined to the disclosure, which can reflect the future prospects of the financial report excluded, very useful information to users.

Chapter Ⅳ Revelation of our financial reporting

Through the above comparison, we should actively learn from international experience to improve and perfect our amount of financial accounting reports

4.1 Further improve the reporting system as the core of the three financial statements

1, Balance sheet: insist on the basis of historical cost measurement attributes complement measured at market value and the current value of property. Specific approach can be used as shown in the Schedule supplementary statements or Statements about assets and liabilities at fair value, and to provide more relevant financial information. In addition, for certain items, such as inventory, fixed assets, should make it specific, more detailed disclosure of the information.

2, Income Statement: the preparation of the profit and loss account should be replaced with the concept of balance revenue and expense outlook, asset preservation and appreciation of the visual information, the use of alternative operating and non-operating and non-recurring standard often marked on the level of financial results to be divided to meet investors, creditors' demand for information.

3. Statement of Cash Flows: as soon as possible continue to improve and perfect statement of cash flows, to play its due role. In addition, the profit and loss account and cash flow statement should provide three years of data and information to facilitate the users to make decisions.

Statements: expand a report annotated information capacity, increase the level of detail of the information disclosed, the current accounting measured in monetary terms, it will reveal the information about the scope of restrictions in can be measured using the currency of the scope of the non-monetary information, such as the enterprise in which the economic environment, competitive advantage in the market are excluded. So, we want to focus on the non-disclosure of financial information.

4.2 Appropriate to increase the number of new financial statements

1, Forecast financial report:

Some large companies, especially listed companies, according to their preparation of projected financial statements, and the forecast financial statements included in the formal accounting reporting system to full reflect enterprise forecast information. The forecast financial statements is also a need for internal management. The financial forecast information is clearly different from the historical financial statements of the listed company's future financial position and operating results of the forecast financial statements can provide information, its better to make investment decisions. As long as the financial forecast information is reliable, such information is far more effective and practical financial statements provide information. With the development and improvement of China's capitalist market, investors and potential investors of the urgent needs of the enterprise business trends, forecast financial statements included in the financial reporting has become an inevitable trend.

The predicting financial statements narrative report-style combination of text and data, or predict the balance table type can be used to forecast the income statement or forecast cash flow statement style.

2. Changes in Equity:

With the growing development of China's joint-stock reform and improve the gradual increase of joint-stock enterprises and listed companies, investors and creditors are increasingly concerned about the changes in the distribution of income and shareholders' equity of the enterprise. Changes in Equity in the near future will also be included in the system of financial statements.

3. Statement of comprehensive income:

Statement of comprehensive income is caused by changes in the net assets of the enterprise transactions or events outside of the enterprise with the owners in the reporting period. Comprehensive income should include two parts, has confirmed and has achieved a net profit or loss, and has confirmed that the two parts but did not realize other gains and losses. In our country today, the disclosure of comprehensive income has important practical significance can comprehensive response to the corporate income situation is conducive to effective decision-making for investors and creditors, and can effectively curb manipulate profits and performance, is more realistic accounting information .

Preparation of comprehensive income can learn from the experience of foreign countries, such as the expansion of the income statement, separate preparation of comprehensive income, combined with the statement of changes in equity.

4, Value-added table:

Comprehensive measure of value-added tables to create value for society as a whole and the contribution of the statements. Income statement only reaction to the net profit of the investors, and do not reflect the results of operations of the enterprise. Compared the value-added table a comprehensive response enterprises operating results, coordination between employers and employees, capital providers, as well as corporate and social, national government relations, to resolve the conflict in the distribution of benefits, conducive to the country to understand the contribution of corporate social and value created, but also conducive to the formulation of the scientific national macro-control policies to promote economic development. Income statement helps enterprises to strengthen micro-management, value-added child table is linked microscopic accounting and macro accounting ties, coordinating corporate economic and social goals. The two complementary co-exist, to strengthen macro-control of the national economy. China already has the theoretical and practical conditions of use of value-added sheet, should actively promote the preparation.

Value-added preparation of the table can be divided into two parts. On the part of the value added calculation illustrates the lower part of the allocation of the value added in each income recipients.

5, Expansion of the information capacity of the report notes:

The current accounting measured in monetary terms, which can reveal information that is currency quantitative information. Were excluded for non-monetary information outside of the financial report. Developed country in Accounting, Financial Statements length is almost five times the report itself, where you can see the status of note. The current financial statements is still at the stage of the main contents of the statements for the. Should raise awareness of the importance of the information on the table outside so appropriate increase Statements, increase balance sheet information disclosure forms, to expand the capacity of the statements annotation information, the disclosure of non-financial information.

Of the comment in the statements should be at least disclose the following information: description of the change of accounting policy approach, the very description of the project, the statements in the description of the project, associated enterprises and their description of the transaction, the disclosure of uncertain project Merger the statutory obligations sponsored description, a description of the major late matters, other significant events. With the emergence of financial instruments and innovation, as well as the emergence of a variety of soft assets, current financial accounting and financial accounting reports should also be adjusted, the current financial report should be a corresponding increase in the Schedule or reflected in the notes to the financial statements .

6 Social Responsibility Report:

Performance to reflect the social responsibility of enterprises in vocational training, community welfare, equal employment, energy utilization and environmental protection, enterprises need to prepare and provide the social responsibility report, to regulate corporate social responsibility.

The preparation of the Social Responsibility Report can smell narrative or assets balance sheet and social income statement type.

4.3 The basic goal of improving our financial reporting

1. Primary goal

China in line with the country's macroeconomic management as the primary objective of accounting, also showed significant differences of China and foreign accounting. Although China is a socialist market economic system, state-owned enterprises dominate the government not only managers but also to investors, but not enough to make it a primary goal of our accounting. Second, when the government appears as administrator, enterprises should also provide relevant reports to the tax authority, and the related statements of listed companies to the Securities and Futures Commission and the Stock Exchange. Again, the government from direct management to macro-control, adjustment of objects from enterprise to market, market information and no longer is the financial information. Foreign accounting does not have the function of macro-control, it does not there is a fundamental difference between the Chinese and foreign. Therefore, enterprises simply provide the relevant financial information to investors, creditors, government tax and securities administration authorities do not need to provide to the government, private enterprises is particularly true.

2 second target

Meet the parties to understand the needs of the enterprise's financial position and operating results of the second target is also inappropriate. Reference to the practice of other countries, investors and creditors are the main users of financial information, should be highlighted. Second, in addition to understanding the needs of the enterprise's financial position and operating results of, should also include understanding the needs of corporate cash flow or financial changes, because the users of accounting information currently pay more attention to the changes in cash flow, and in the international context, the financial position of changes in the table has been turned to the cash flow statement. Finally, it is unable to meet the corporate users of accounting information about the needs of the economic decision-making. These elements should be reflected in our accounting.

3. Third goal

The third accounting objectives are: to meet the needs of enterprises to strengthen internal management and administration. This national provisions of the International Accounting Standards, basically contains no such provision, with the gradual deepening of China's socialist market economic system, a variety of joint-stock company or enterprise can flourish, and investors in order to check the performance of business management, inevitably require accounting provide enterprise managers perform management of information in order to meet their needs. So, this goal should not become the target of China's financial accounting.

Above comparative analysis, drawing on international experience of financial accounting objectives should be improved: reflecting the financial position, operating results and cash flows and other financial information for corporate investors, creditors, and other accounting information users provide to economic decision-making. Also provided to reflect the managers operating management responsibility for the implementation of the amount of financial information.

Bibliography

1. http://baike.baidu.com/view/628866.htm

2. http://blog.tianya.cn/blogger/post_read.asp?BlogID=3655760&PostID=33096961

3. http://zhidao.baidu.com/question/324169315.html

4. http://www.cnki.net/kcms/detail/detail.aspx?dbcode=cjfq&dbname=cjfq2012&filename=shng201204038&uid=WEEvREcwSlJHSldRa1FhcXZVeDJaV1cvQmVHSExrWmRSTDNHcmowbCtmVVMzOFE3YXJ3OGdvZHRwWXRnSGJJPQ==&p=

5. http://www.cnki.net/kcms/detail/detail.aspx?dbcode=cjfq&dbname=cjfq2011&filename=xdby201114147&uid=WEEvREcwSlJHSldRa1Fhak0vaU5PblZUb2F0bzdHcDZQNEFUWjJZZERwaU96cWs1TXRtdy85eEhvUC84Zmd3PQ==&p=

6. http://www.cnki.net/kcms/detail/detail.aspx?dbcode=cjfq&dbname=cjfq2009&filename=zkjs200910026&uid=WEEvREcwSlJHSldRa1Fhak0vaU5PblZUb2F0bzdHcDZQNEFUWjJZZERwaU96cWs1TXRtdy85eEhvUC84Zmd3PQ==&p=