1.

2.

3.

4.

5.

6. NOTES This certificate is valid only if completed with the date of issue, signature of physician and the official stamp of the Entry-Exit Inspection and Quarantin authorities of the People’s Republic of China. The validity of this certificate shall extend for a period of one year starting date of issue. The owner must always keep this certificate with himself against inspection on departing from or arriving in a country or at his place residing. The “Normal” status in the certificate is valid only as of when the examinee took the exams. The certificate shows the examinee has had the medical exams, and it records the medical results accurately, which only indicates the health condition of the examinee when the exams were taken. Any amendment of this certificate, or erasure, or misuse by other person, may render it

invalid.

No.

Surname: Given Names:

Sex: Date of Birth:

Nationality: CHINESE Blood Type:

Address of lssue:

General check

Height: cm Weight : kg Pulse rate: times/min

BP: mmHg Temperature: ℃

Medicine & Surgery

Skin, Sclera, Lymph Nodes: Normal

Head & Neck: Normal

Chest & Lungs: Normal

Heart: Auscultation heart : Normal

Abdomen: Normal

Spine & Extremities: Normal

Neuropsychiatric System: Normal

Genitourinary System: Normal

E.E.N.T.

Innc.Vision: Left Right Corr. Vision: Left Right

Color Sense:

Hearing: Left Normal Right Normal

Eyes, Ears, Nose, Throat: Normal

ECG

Abdomen Ultrasound (Liver, Gallbladder, Spleen, Kidney)

Liver, gallbladder, spleen, double kidney , echo camer no abnormal findings.

Chest X-ray

No abnormal findings of heart lungs and diaphragm.

Laboratory Tests

Anti-HIV: Negative

Syphilis Serology: Negative

HBsAg: Negative

Anti-HCV: Negative

ALT(GPT): (Normal: 5-40)

Blood Routine

WBC:

RBC:

PLT:

HGB:

NEUT%:

LYM%:

Laboratory Tests

Urine Routine

GLU:

PRO:

ERY:

LEU:

Others: ********

General Comments

None of diseases or disorders found endangering the public order and security. Name of doctor in charge:

Signature of doctor in charge:

Date of issue:

Official stamp

Id card:

第二篇:05第一部分(英文)

Basel Committee on Banking Supervision Consultative Document The New Basel Capital Accord Issued for comment by 31 July 2003 April 2003

Table of Contents

Part 1: Scope of Application .......................................................................................

A. Introduction ............................................................................................................

B. Banking, securities and other financial subsidiaries ...................................................

C. Significant minority investments in banking, securities and other financial entities ....

D. Insurance entities ...................................................................................................... E. Significant investments in commercial entities ........................................................... F. Deduction of investments pursuant to this part .......................................................... Part 2: The First Pillar - Minimum Capital Requirements .......................................... I. Calculation of minimum capital requirements ............................................................ II. Credit Risk - The Standardised Approach .................................................................

A. The standardised approach - general rules ...........................................................

1. Individual claims ............................................................................................ (i) Claims on sovereigns ............................................................................ (ii) Claims on non-central government public sector entities (PSEs) .......... (iii) Claims on multilateral development banks (MDBs) ............................... (iv) Claims on banks ................................................................................... (v) Claims on securities firms ..................................................................... (vi) Claims on corporates ............................................................................ (vii) Claims included in the regulatory retail portfolios .................................. (viii) Claims secured by residential property ................................................. (ix) Claims secured by commercial real estate ............................................ (x) Past due loans ...................................................................................... (xi) Higher-risk categories ........................................................................... (xii) Other assets ......................................................................................... (xiii) Off-balance sheet items ........................................................................

2. External credit assessments .......................................................................... (i) The recognition process ........................................................................ (ii) Eligibility criteria ....................................................................................

3. Implementation considerations ....................................................................... (i) The mapping process ........................................................................... (ii) Multiple assessments ............................................................................ (iii) Issuer versus issues assessment .......................................................... (iv) Domestic currency and foreign currency assessments ......................... (v) Short term/long term assessments ........................................................ (vi) Level of application of the assessment ................................................. (vii) Unsolicited ratings ................................................................................

B. The standardised approach - credit risk mitigation ................................................

1. Overarching issues ........................................................................................ (i) Introduction ........................................................................................... (ii) General remarks ................................................................................... (iii) Legal certainty ......................................................................................

2. Overview of Credit Risk Mitigation Techniques .............................................. (i) Collateralised transactions .................................................................... (ii) On-balance sheet netting ...................................................................... (iii) Guarantees and credit derivatives ......................................................... (iv) Maturity mismatch ................................................................................. (v) Miscellaneous .......................................................................................

3. Collateral ....................................................................................................... (i) Eligible financial collateral ..................................................................... 1 1 1 2 2 4 4 6 6 6 6 7 7 8 8 9 10 10 11 11 12 12 13 13 13 14 14 14 15 15 15 15 16 16 17 17 17 17 17 18 18 19 19 21 21 21 22 22 22

(ii) The comprehensive approach ............................................................... (iii) The simple approach ............................................................................ (iv) Collateralised OTC derivatives transactions ...........................................

4. On-balance sheet netting ...............................................................................

5. Guarantees and credit derivatives .................................................................. (i) Operational requirements ...................................................................... (ii) Range of eligible guarantors/protection providers ................................. (iii) Risk weights .......................................................................................... (iv) Currency mismatches ........................................................................... (v) Sovereign guarantees ...........................................................................

6. Maturity mismatches ...................................................................................... (i) Definition of maturity ............................................................................. (ii) Risk weights for maturity mismatches ...................................................

7. Other items related to the treatment of CRM techniques ................................ (i) Treatment of pools of CRM techniques ................................................. (ii) First-to-default credit derivatives ........................................................... (iii) Second-to-default credit derivatives ...................................................... III. Credit Risk - The Internal Ratings-Based Approach ..................................................

A. Overview ..............................................................................................................

B. Mechanics of the IRB Approach ............................................................................

1. Categorisation of exposures ........................................................................... (i) Definition of corporate exposures .......................................................... (ii) Definition of sovereign exposures ......................................................... (iii) Definition of bank exposures ................................................................. (iv) Definition of retail exposures ................................................................. (v) Definition of qualifying revolving retail exposures .................................. (vi) Definition of equity exposures ............................................................... (vii) Definition of eligible purchased receivables ...........................................

2. Foundation and advanced approaches .......................................................... (i) Corporate, sovereign, and bank exposures ........................................... (ii) Retail exposures ................................................................................... (iii) Equity exposures .................................................................................. (iv) Eligible purchased receivables ..............................................................

3. Adoption of the IRB approach across asset classes .......................................

4. Transition arrangements ................................................................................ (i) Parallel calculation for banks adopting the advanced approach ............ (ii) Corporate, sovereign, bank, and retail exposures ................................. (iii) Equity exposures ..................................................................................

C. Rules for Corporate, Sovereign, and Bank Exposures ..........................................

1. Risk-weighted assets for corporate, sovereign, and bank exposures ............. (i) Formula for derivation of risk weights .................................................... (ii) Firm-size adjustment for small and medium-sized entities (SME) ......... (iii) Risk weights for specialised lending ......................................................

2. Risk components ........................................................................................... (i) Probability of Default (PD) ..................................................................... (ii) Loss Given Default (LGD) ..................................................................... (iii) Exposure at Default (EAD) .................................................................... (iv) Effective Maturity (M) ............................................................................

D. Rules for Retail Exposures ....................................................................................

1. Risk-weighted assets for retail exposures ...................................................... (i) Residential mortgage exposures ........................................................... (ii) Qualifying revolving retail exposures ..................................................... (iii) Other retail exposures ...........................................................................

2. Risk components ........................................................................................... 23 31 32 32 33 33 35 35 36 36 37 37 37 37 37 38 38 38 38 39 39 39 41 41 41 42 43 45 46 46 47 47 47 47 48 48 48 49 49 50 50 50 51 52 52 52 56 58 59 59 60 60 60 61

(i) Probability of default (PD) and loss given default (LGD) ....................... (ii) Recognition of guarantees and credit derivatives .................................. (iii) Exposure at default (EAD) .................................................................... E. Rules for Equity Exposures ................................................................................... 1. Risk weighted assets for equity exposures ..................................................... (i) Market-based approach ........................................................................ (ii) PD/LGD approach ................................................................................ (iii) Exclusions to the market-based and PD/LGD approaches .................... 2. Risk components ........................................................................................... F. Rules for Purchased Receivables ......................................................................... 1. Risk-weighted assets for default risk .............................................................. (i) Purchased retail receivables ................................................................. (ii) Purchased corporate receivables .......................................................... 2. Risk-weighted assets for dilution risk ............................................................. (i) Treatment of purchased discounts ........................................................ (ii) Recognition of guarantees .................................................................... G. Recognition of Provisions ..................................................................................... H. Minimum Requirements for IRB Approach ............................................................ 1. Composition of minimum requirements .......................................................... 2. Compliance with minimum requirements ........................................................ 3. Rating system design ..................................................................................... (i) Rating dimensions ................................................................................ (ii) Rating structure .................................................................................... (iii) Rating criteria ........................................................................................ (iv) Assessment horizon .............................................................................. (v) Use of models ....................................................................................... (vi) Documentation of rating system design ................................................ 4. Risk rating system operations ........................................................................ (i) Coverage of ratings ............................................................................... (ii) Integrity of rating process ...................................................................... (iii) Overrides .............................................................................................. (iv) Data maintenance ................................................................................. (v) Stress tests used in assessment of capital adequacy ........................... 5. Corporate governance and oversight ............................................................. (i) Corporate governance .......................................................................... (ii) Credit risk control .................................................................................. (iii) Internal and external audit ..................................................................... 6. Use of internal ratings .................................................................................... 7. Risk quantification .......................................................................................... (i) Overall requirements for estimation ...................................................... (ii) Definition of default ............................................................................... (iii) Re-ageing ............................................................................................. (iv) Treatment of overdrafts ......................................................................... (v) Definition of loss - all asset classes ....................................................... (vi) Requirements specific to PD estimation ................................................ (vii) Requirements specific to own-LGD estimates ....................................... (viii) Requirements specific to own-EAD estimates ....................................... (ix) Minimum requirements for assessing effect of guarantees and credit derivatives ............................................................................................ (x) Minimum requirements for estimating PD and LGD (EL)......................... 8. Validation of internal estimates ...................................................................... 9. Supervisory LGD and EAD estimates ............................................................ (i) Definition of eligibility of CRE and RRE as collateral ............................... (ii) Operational requirements for eligible CRE/RRE ...................................... (iii) Requirements for recognition of financial receivables ..............................

61

61 61 62 62 62 63 64 64 65 65 65 65 67 67 67 68 69 69 70 70 70 71 72 73 73 74 75 75 75 76 76 77 77 77 78 78 79 79 79 80 81 82 82 82 83 84 86 87 89 90 90 91 92

10. Requirements for recognition of leasing ......................................................... 11. Calculation of capital charges for equity exposures ........................................ (i) The internal models market-based approach ........................................ (ii) Capital charge and risk quantification .................................................... (iii) Risk management process and controls ............................................... (iv) Validation and documentation ............................................................... 12. Disclosure requirements ................................................................................ 94 94 94 95 96 97 99 99 99 100 100 IV. Credit Risk - Securitisation Framework ...................................................................... A. Scope and definitions of transactions covered under the securitisation framework B. Definitions ............................................................................................................. 1. Different roles played by banks ...................................................................... (i) Investing bank ....................................................................................... (ii) Originating bank .................................................................................... 2. General terminology ....................................................................................... (i) Clean-up call ......................................................................................... (ii) Credit enhancement .............................................................................. (iii) Early amortisation ................................................................................. (iv) Excess spread ...................................................................................... (v) Implicit support ...................................................................................... (vi) Special purpose entity (SPE) ................................................................ C. Operational requirements for the recognition of risk transference ......................... 1. Operational requirements for traditional securitisations .................................. 2. Operational requirements for synthetic securitisations .................................... 3. Operational requirements and treatment of clean-up calls .............................. D. Treatment of securitisation exposures ................................................................... 1. Minimum capital requirement ......................................................................... (i) Deduction .............................................................................................. (ii) Implicit support ...................................................................................... 2. Operational requirements for use of external credit assessments .................. 3. Standardised approach for securitisation exposures ...................................... (i) Scope .................................................................................................... (ii) Risk weights .......................................................................................... (iii) Exceptions to general treatment of unrated securitisation exposures .... (iv) Credit conversion factors for off-balance sheet exposures .................... (v) Recognition of credit risk mitigants ........................................................ (vi) Capital requirement for early amortisation provisions ............................ (vii) Determination of CCFs for controlled early amortisation features .......... (viii) Determination of CCFs for non-controlled early amortisation features ... 4. Internal ratings-based approach for securitisation exposures ......................... (i) Scope ................................................................................................... (ii) Definition of KIRB .................................................................................... (iii) Hierarchy of approaches ....................................................................... (iv) Maximum capital requirement ............................................................... (v) Rating Based Approach (RBA) .............................................................. (vi) Supervisory Formula (SF) ..................................................................... (vii) Liquidity facilities .................................................................................... (viii) Eligible servicer cash advance facilities ................................................. (ix) Recognition of credit risk mitigants ......................................................... (x) Capital requirements for early amortisation provisions ........................... V. Operational Risk ........................................................................................................ A. Definition of operational risk .................................................................................. B. The Measurement methodologies ......................................................................... 1. The Basic Indicator Approach ........................................................................ 2. The Standardised Approach ...........................................................................

100 100 101 101 101 101 101 101 102 102 102 103 103 104 104 104 104 104 105 105 105 106 107 108 109 110 111 112 112 113 113 114 114 116 119 119 119 120 120 120 120 121 122

3. Advanced Measurement Approach (AMA) ..................................................... C. Qualifying criteria ................................................................................................... 1. General criteria .............................................................................................. 2. Standardised approach ................................................................................... 3. Advanced measurement approaches .............................................................. (i) Qualitative standards ............................................................................. (ii) Quantitative standards ........................................................................... (iii) Risk mitigation ....................................................................................... D. Partial use.............................................................................................................. 123 123 123 124 125 125 126 129 130

131

131 VI. Trading book issues .................................................................................................. A. Definition of the trading book ................................................................................

B. Prudent valuation guidance ..................................................................................

1. Systems and controls .....................................................................................

2. Valuation methodologies ................................................................................ (i) Marking to market ................................................................................. (ii) Marking to model .................................................................................. (iii) Independence price verification ............................................................

3. Valuation adjustments or reserves .................................................................

C. Treatment of counterparty credit risk in the trading book .......................................

D. Trading book capital treatment for specific risk under the standardised

methodology .........................................................................................................

1. Specific risk capital charges for government paper ........................................

2. Specific risk rules for unrated debt securities .................................................

3. Specific risk capital charges for positions hedged by credit derivatives ..........

4. Add-on factor for credit derivatives ................................................................. Part 3: The Second Pillar - Supervisory Review Process .........................................

A. Importance of supervisory review .........................................................................

B. Four key principles for supervisory review ............................................................

C. Specific issues to be addressed under the supervisory review process ................

D. Other aspects of the supervisory review process .................................................. Part 4: The Third Pillar - Market Discipline .................................................................

A. General considerations .........................................................................................

1. Disclosure requirements ................................................................................

2. Guiding principles ..........................................................................................

3. Achieving appropriate disclosure ...................................................................

4. Interaction with accounting disclosures ..........................................................

5. Materiality ......................................................................................................

6. Frequency .......................................................................................................

7. Proprietary and confidential information ..........................................................

B. The disclosure requirements ..................................................................................

1. General disclosure principle ............................................................................

2. Scope of application ........................................................................................

3. Capital ............................................................................................................

4. Risk exposure and assessment ...................................................................... (i) General qualitative disclosure requirement ............................................ (ii) Credit risk .............................................................................................. (iii) Market risk ............................................................................................. (iv) Operational risk ...................................................................................... (v) Interest rate risk in the banking book ..................................................... Annex 1 The 15% of Tier 1 Limit on Innovative Instruments.......................................... Annex 2 Standardised Approach - Implementing the Mapping Process ........................ Annex 3 Illustrative IRB risk weights ............................................................................. 132 132 132 132 133 133 134 134 135 135 135 136 137 138 138 139 145 151 154 154 154 154 154 155 155 156 156 156 156 157 158 159 160 160 167 168 168 169 170 174

Annex 4 Supervisory Slotting Criteria for Specialised Lending ...................................... 176 Annex 5 Illustrative Examples : Calculating the Effect of Credit Risk Mitigation

under Supervisory Formula ............................................................................. 195 Annex 6 Mapping of Business Lines ............................................................................. 199 Annex 7 Detailed loss event type classification ............................................................. 202 Annex 8 Overview of Methodologies for the Capital Treatment of Transactions Secured by Financial Collateral under the Standardised and IRB Approaches .............. 204 Annex 9 The Simplified Standardised Approach ........................................................... 206

Acronyms

ABCP ADC AMA ASA CCF CDR CF

CRM EAD ECA ECAI EL

FMI

HVCRE IPRE

IRB approach LGD M

MDB NIF

OF

PD

PF

PSE RBA RUF SF

SL

SME SPE UCITS UL

Asset-backed commercial paper Acquisition, development and construction Advanced measurement approaches Alternative standardised approach Credit conversion factor Cumulative default rate Commodities finance Credit risk mitigation Exposure at default Export credit agency External credit assessment institution Expected loss Future margin income High-volatility commercial real estate Income-producing real estate Internal ratings-based approach Loss given default Effective maturity Multilateral development bank Note issuance facility Object finance Probability of default Project finance Public sector entity Ratings-based approach Revolving underwriting facility Supervisory formula Specialised lending Small- and medium-sized enterprise Special purpose entity Undertakings for collective investments in transferable securities Unexpected loss

Part 1: Scope of Application

A. Introduction

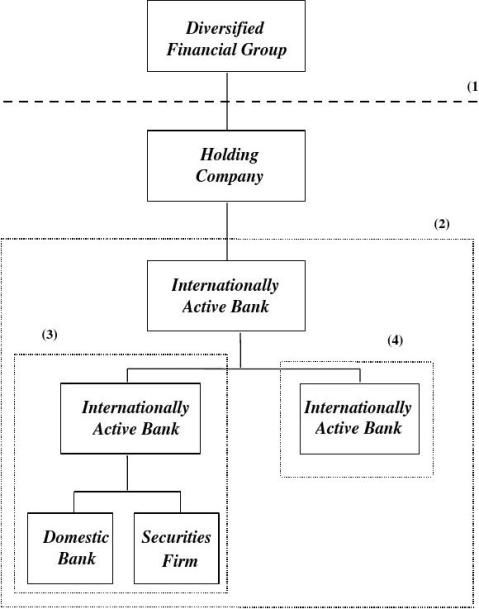

1. The New Basel Capital Accord (the New Accord) will be applied on a consolidated basis to internationally active banks. This is the best means to preserve the integrity of capital in banks with subsidiaries by eliminating double gearing.

2. The scope of application of the Accord will be extended to include, on a fully consolidated basis, any holding company that is the parent entity within a banking group to ensure that it captures the risk of the whole banking group.1 Banking groups are groups that engage predominantly in banking activities and, in some countries, a banking group may be registered as a bank.

3. The Accord will also apply to all internationally active banks at every tier within a banking group, also on a fully consolidated basis (see illustrative chart at the end of this section).2 A three-year transitional period for applying full sub-consolidation will be provided for those countries where this is not currently a requirement.

4. Further, as one of the principal objectives of supervision is the protection of depositors, it is essential to ensure that capital recognised in capital adequacy measures is readily available for those depositors. Accordingly, supervisors should test that individual banks are adequately capitalised on a stand-alone basis.

B. Banking, securities and other financial subsidiaries

5. To the greatest extent possible, all banking and other relevant financial activities3 (both regulated and unregulated) conducted within a group containing an internationally active bank will be captured through consolidation. Thus, majority-owned or-controlled banking entities, securities entities (where subject to broadly similar regulation or where securities activities are deemed banking activities) and other financial entities4 should generally be fully consolidated.

6. Supervisors will assess the appropriateness of recognising in consolidated capital the minority interests that arise from the consolidation of less than wholly owned banking, 1 A holding company that is a parent of a banking group may itself have a parent holding company. In some

structures, this parent holding company may not be subject to this Accord because it is not considered a parent of a banking group.

As an alternative to full sub-consolidation, the application of the Accord to the stand-alone bank (i.e. on a basis that does not consolidate assets and liabilities of subsidiaries) would achieve the same objective, providing the full book value of any investments in subsidiaries and significant minority-owned stakes is deducted from the bank's capital.

In Part 1, “financial activities” do not include insurance activities and “financial entities” do not include insurance entities.

Examples of the types of activities that financial entities might be involved in include financial leasing, issuing credit cards, portfolio management, investment advisory, custodial and safekeeping services and other similar activities that are ancillary to the business of banking. 234

1

securities or other financial entities. Supervisors will adjust the amount of such minority interests that may be included in capital in the event the capital from such minority interests is not readily available to other group entities.

7. There may be instances where it is not feasible or desirable to consolidate certain securities or other regulated financial entities. This would be only in cases where such holdings are acquired through debt previously contracted and held on a temporary basis, are subject to different regulation, or where non-consolidation for regulatory capital purposes is otherwise required by law. In such cases, it is imperative for the bank supervisor to obtain sufficient information from supervisors responsible for such entities.

8. If any majority-owned securities and other financial subsidiaries are not consolidated for capital purposes, all equity and other regulatory capital investments in those entities attributable to the group will be deducted, and the assets and liabilities, as well as third-party capital investments in the subsidiary will be removed from the bank’s balance sheet. Supervisors will ensure that the entity that is not consolidated and for which the capital investment is deducted meets regulatory capital requirements. Supervisors will monitor actions taken by the subsidiary to correct any capital shortfall and, if it is not corrected in a timely manner, the shortfall will also be deducted from the parent bank’s capital.

C. Significant minority investments in banking, securities and other

financial entities

9. Significant minority investments in banking, securities and other financial entities, where control does not exist, will be excluded from the banking group’s capital by deduction of the equity and other regulatory investments. Alternatively, such investments might be, under certain conditions, consolidated on a pro rata basis. For example, pro rata consolidation may be appropriate for joint ventures or where the supervisor is satisfied that the parent is legally or de facto expected to support the entity on a proportionate basis only and the other significant shareholders have the means and the willingness to proportionately support it. The threshold above which minority investments will be deemed significant and be thus either deducted or consolidated on a pro-rata basis is to be determined by national accounting and/or regulatory practices. As an example, the threshold for pro-rata inclusion in the European Union is defined as equity interests of between 20% and 50%.

10. The Committee reaffirms the view set out in the 1988 Accord that reciprocal cross-holdings of bank capital artificially designed to inflate the capital position of banks will be deducted for capital adequacy purposes.

D. Insurance entities

11. A bank that owns an insurance subsidiary bears the full entrepreneurial risks of the subsidiary and should recognise on a group-wide basis the risks included in the whole group. When measuring regulatory capital for banks, the Committee believes that at this stage it is, in principle, appropriate to deduct banks’ equity and other regulatory capital investments in insurance subsidiaries and also significant minority investments in insurance entities. Under this approach the bank would remove from its balance sheet assets and liabilities, as well as third party capital investments in an insurance subsidiary. Alternative approaches that can be 2

applied should, in any case, include a group-wide perspective for determining capital adequacy and avoid double counting of capital.

12. Due to issues of competitive equality, some G10 countries will retain their existing risk weighting treatment5 as an exception to the approaches described above and introduce risk aggregation only on a consistent basis to that applied domestically by insurance supervisors for insurance firms with banking subsidiaries.6 The Committee invites insurance supervisors to develop further and adopt approaches that comply with the above standards.

13. Banks should disclose the national regulatory approach used with respect to insurance entities in determining their reported capital positions.

14. The capital invested in a majority-owned or controlled insurance entity may exceed the amount of regulatory capital required for such an entity (surplus capital). Supervisors may permit the recognition of such surplus capital in calculating a bank’s capital adequacy, under limited circumstances.7 National regulatory practices will determine the parameters and criteria, such as legal transferability, for assessing the amount and availability of surplus capital that could be recognised in bank capital. Other examples of availability criteria include: restrictions on transferability due to regulatory constraints, to tax implications and to adverse impacts on external credit assessment institutions’ ratings. Banks recognising surplus capital in insurance subsidiaries will publicly disclose the amount of such surplus capital recognised in their capital. Where a bank does not have a full ownership interest in an insurance entity (e.g. 50% or more but less than 100% interest), surplus capital recognised should be proportionate to the percentage interest held. Surplus capital in significant minority-owned insurance entities will not be recognised, as the bank would not be in a position to direct the transfer of the capital in an entity which it does not control.

15. Supervisors will ensure that majority-owned or controlled insurance subsidiaries, which are not consolidated and for which capital investments are deducted or subject to an alternative group-wide approach, are themselves adequately capitalised to reduce the possibility of future potential losses to the bank. Supervisors will monitor actions taken by the subsidiary to correct any capital shortfall and, if it is not corrected in a timely manner, the shortfall will also be deducted from the parent bank’s capital.

5 For banks using the standardised approach this would mean applying no less than a 100% risk weight, while

for banks on the IRB approach, the appropriate risk weight based on the IRB rules shall apply to such investments.

Where the existing treatment is retained, third party capital invested in the insurance subsidiary (i.e. minority interests) cannot be included in the bank’s capital adequacy measurement.

In a deduction approach, the amount deducted for all equity and other regulatory capital investments will be adjusted to reflect the amount of capital in those entities that is in surplus to regulatory requirements, i.e. the amount deducted would be the lesser of the investment or the regulatory capital requirement. The amount representing the surplus capital, i.e. the difference between the amount of the investment in those entities and their regulatory capital requirement, would be risk-weighted as an equity investment. If using an alternative group-wide approach, an equivalent treatment of surplus capital will be made. 67

3

E. Significant investments in commercial entities

16. Significant minority and majority investments in commercial entities which exceed certain materiality levels will be deducted from banks’ capital. Materiality levels will be determined by national accounting and/or regulatory practices. Materiality levels of 15% of the bank’s capital for individual significant investments in commercial entities and 60% of the bank’s capital for the aggregate of such investments, or stricter levels, will be applied. The amount to be deducted will be that portion of the investment that exceeds the materiality level.

17. Investments in significant minority- and majority-owned and controlled commercial entities below the materiality levels noted above will be risk weighted at no lower than 100% for banks using the standardised approach. For banks using the IRB approach, the investment would be risk weighted in accordance with the methodology the Committee is developing for equities and would not be less than 100%.

F. Deduction of investments pursuant to this part

18. Where deductions of investments are made pursuant to this part on scope of application, the deductions will be 50% from Tier 1 and 50% from Tier 2.

19. Goodwill relating to entities subject to a deduction approach pursuant to this part should be deducted from Tier 1 in the same manner as goodwill relating to consolidated subsidiaries, and the remainder of the investments should be deducted as provided for in this part. A similar treatment of goodwill should be applied, if using an alternative group-wide approach pursuant to paragraph 11.

20. The issuance of the final Accord will clarify that the limits on Tier 2 and Tier 3 capital and on innovative Tier 1 instruments will be based on the amount of Tier 1 capital after deduction of goodwill but before the deductions of investments pursuant to this part on scope of application (see Annex 1 for an example how to calculate the 15% limit for innovative Tier 1 instruments).

4

ILLUSTRATION OF NEW SCOPE OF APPLICATION OF THE ACCORD

(1) Boundary of predominant banking group. The Accord is to be applied at this level on a consolidated basis, i.e. upto holding company level (paragraph 2)..

(2), (3) and ( 4): the Accord is also to be applied at lower levels to all internationally active banks on a consolidated basis.

5