1 What is international taxation 什么是国际税收

In a narrow sense : Many tax law related to the multinational income and transaction

从某一国家角度 :一国对纳税人相关的跨国收入和事务的税收法律

In a broad sense: international taxation refers to tax phenomena and tax issues brought about by the conflicts or difference in tax law between countries in the open economy that taxpayer's economic activities extend abroad.

广义 :国际税收是指开放经济下,纳税人的经济活动扩展到海外以及在各国之间不同税法所带来的冲突或税务问题

税务现象。

The Basic Elements of International Taxation

Subject of Taxation:Transnational Natural Person and Legal Entity

自然人和法人

Object of taxation 课税对象

concerning with income tax: 1.Transnational general constant income 固定收入

根据所得税 2.Transnational capital gains 资本收益

3.Transnational other income 其他收入

concerning with property tax: 1.Transnational general property value on dynamism 一般动产

根据财产税 2.Transnational general property value on stationary 一般不动产 The Scope of International Tax 税收范围

① cross-border manufacturing by a multinational enterprise 跨国制造业

② cross-border investment by individuals or investment funds 跨国投资

③ the taxation of individuals who work or do business outside the reside country 在居住地以外工作 ④ the income tax aspects of cross-border trade in goods and services 跨国贸易所得

Two Dimensions of International Tax 两个尺度

outbound transaction:the taxation of resident individuals and corporations on income arising in foreign 对外事务 countries (taxation of foreign income) 居民/企业境外所得征税

inbound transaction: the taxation of nonresidents on income arising domestically (taxation of

对内事物 nonresidents) 非本国居民境外所得征税

The essence of international taxation 国际税收的实质

Revenue distribution among different countries 不同国之间的收入分配

Revenue coordination among different countries 不同过之间的收入协调

In the designing of its international tax rules, a country should seek to advance the following four goals: 国际税收规则的目标

1. getting its fair share of revenue from cross border transactions 从跨境交易中取得合理份额的税收收入

2. promoting fairness 促进公平

3. enhancing the competitiveness of the domestic economy 提高国内经济的竞争力

4. capital-export and capital-import neutrality 资本输出和输入中性

The principle of fairness 公平原则The fairness and efficiency of income taxation

Distribution equity 公平分配

Equity of tax burden 平等的课税负担

The principle of efficiency 效率原则

Neutrality Principle 中性原则

Efficiency Principle 效率原则

Major topics of international taxation国际税收的重要议题

1. Jurisdictions to Tax 辖区税收

2. International Double Taxation

3. International Tax Avoidance 避税

4. International Tax Convention 国际税收协定

5. Emerging Issues 新型问题

2 What is Tax Jurisdiction 税收管辖权

A country has the power to levy or impose taxes, including power of tax legislation, power of tax administration 一国政府有权决定对哪些人征哪些税以及征多少

Types of Tax Jurisdiction 管辖权分类

Jurisdiction over citizens 公民身份

Residence Jurisdiction 居民身份

Source Jurisdiction 来源地

Defining Residence of Individuals 个人居民身份认定标准

Domicile Criterion 住所标准

Residence Criterion 居所标准

The Criterion of Presence Period 停留时间

Willingness or desire criterion 意愿标准

Determining rules for legal entities 法人居民身份认定标准

Criterion of the place of incorporation 注册地成立

Criterion of the place of effective management and control 实际管理与控制中心所在地

Criterion of the place of Head office 总机构所在地

Criterion of the Criterion of holding 控股权

Criterion of the place of main business 主营业务地

·Defining Source Jurisdiction 来源地管辖权

(1)Business income: Criterion of transaction place 交易地

营业收入 Criterion of permanent establishment 常设机构

(2) service income 劳务收入

(3)Investment income 投资收入

(4) Property income 财产收入

Defining International Double Taxation 国际双重征税

The imposition of comparable income (property) taxes by two or more sovereign countries on the same item of income (including capital gains or property value)of the same taxable person for the same taxable period.两个或以上的国家或地区,对同一纳税人的同一征税对象同时征收同一类型的税.

International Juridical Double Taxation 国际法律性双重征税

Different objects of taxing power levy on the identical taxpayer or object according to law

两个或以上征税主体对同一纳税人的同一课税对象同时行使不同的征税权力

International Economic Double Taxation国际经济性双重征税

The same income of different taxpayers is levied ,which embodies kinds of economic relationship in the society 两个或以上征税主体对不同纳税人的同一课税对象同时征税

Causes of International Double Taxation 导致因素

Residence-source conflicts. 居民和来源地税收管辖权的冲突

Citizen-source conflicts. 公民和来源地税收管辖权的冲突

citizen-residence conflicts. 公民和居民税收管辖权的冲突

overlapping of the same jurisdiction 同种的重叠

The impact of IDT 国际双重征税的影响

hinders global economic development. 阻碍国际经济发展

has some negative effects on the individual’s or legal entities’ enthusiasm of cross-border investment and cooperation. 打击了跨国投资和合作的积极性

Hinders the goods, service, talents, technology and capital to move freely around the world.

阻碍了商品\劳务\人才\技术\和资本在国际上的自由流动.

cause contradictions or interest conflicts among different countries. 导致有关国家之间的矛盾或利益冲突

3 Basic ways of IDT relief 减除方式(不是方法)由居住国实施

Unilateral way单边方式 (domestic law国内法)

Bilateral way 双边方式 (bilateral tax treaty双边税收协定)

Multilateral way 多边方式 (multilateral tax treaty多边税收协定)

要点!

a country has the primary right to tax income that has its source in that country .来源国优先征税 Residence country takes methods of deduction/exemption/credit to its resident foreign income. 居住国对本国居民境外所得采取扣除法\免税法\抵免法等措施

Two countries sign treaties to define the income source, the resident status, also the methods to relieve IDT according to OECD Model Convention and UN Model Convention.

两国根据OECD \UN协定范本来签署协定明确所得来源\居民身份和减除国际双重征税的方法

Rules to constrain residence tax jurisdiction自然人双重居民身份约束/依次判定

1. Permanent home (永久性住所)

2. Centre of vital interest (重要利益中心)

3. Habitual adobe (习惯性居所)

4. Nationality (国籍)

5. Mutual agreement (协商解决)

Rules to constrain source tax jurisdiction法人双重居民身份的约束规范

1.If a legal entity is a resident of both States, it shall be deemed to a resident only of the State in which its place of effective management is situated. 根据跨国法人的实际管理机构所在地标准来认定居民身份.

2.Mutual agreement (双方协商)

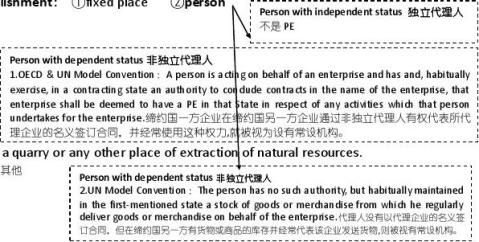

Rules to constrain source tax jurisdiction 来源地税收管辖权约束规范

(1) Business income

-1.Permanent Establishment常设机构PE

a fixed place of business through which the business of an enterprise is wholly or partly carried on.

-3.PE includes especially:

A place of management A branch 分支机构 An office 办事处 A factory 工厂 A workshop 车间

开发自然资源的场所 -4.PE not includes:关键词

Delivery、Processing、Purchasing、Collecting information、Preparatory or auxiliary、辅助以上 加工 采购 收集情报 从事准备or辅助性活动

-5.根据UN

A building site or construction or installation project constitutes a PE only if it lasts more than six months. 建筑工地、建筑、装配或安装工程,持续时间在6个月以上被视为常设机构

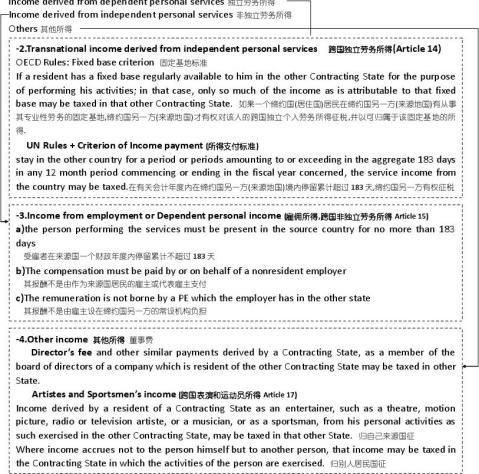

4 (2)1.Service income劳务所得

5

(3)Investment income投资所得:Interest and dividend利息和股息、royalty特许权使用费、Rent租金

1.The principle of Tax sharing 税收分享原则 OECD & UN Model (Article 10,11,12):The Contracting State and the other Contracting State can both tax on dividend, interest and royalties.

对于股息\利息\特许权使用费缔约国双方都有权征税

Dividend: The tax so charged shall not exceed 5% of the gross amount of the dividends if the

beneficial owner is a company (other than a partnership) which holds directly at least 25% of the capital of the company paying the dividends

如果受益所有人是直接持有支付股息公司至少25%资本的公司(非合伙企业),不应超过股息总额的5%

15% of the gross amount of the dividends in all other cases 其他情况为15%

Interest: Shall not exceed 10% of the gross amount of the interest. 来源国征税不能超过利息总额的10% Royalties: Royalties arising in a Contracting State and beneficially owned by a resident of the other Contracting State shall be taxable only in that other State.

发生在缔约国一方并支付给另一方居民的特许权使用费,仅在居民国征税.

Such royalties may also be taxed in the Contracting State in which they arise and according to the

laws of that State, but if the beneficial owner of the royalties is a resident of the other Contracting State, the tax so charged shall not exceed …. Percent of the gross amount of the royalties.

特许权使用费也可以在其发生的缔约国,按照该国法律纳税.但若收款人是收益所有人,所征税款不能超过总额的一定百分比.

(4)1.Property income财产所得

1 Income from immovable property不动产所得: Income derived by a resident of a Contracting State ○

from immoveable property (including income from agriculture or forestry) situated in the other Contracting State may be taxed in that other State

缔约国一方居民从位于缔约国另一方的不动产取得的所得,可以在另一国征税.

2 Gains from Property transfer 财产收益: ○

from the alienation of immovable property 转让位于其在缔约国另一方境内的不动产收益 Gains

Derived from the alienation of movable property forming part of the business of property of a PE 缔约国一方居民 转让常设机构或固定基地的动产取得的收益

from the alienation of ships or aircrafts or boats

转让从事运输的船只或附属于上述经营的飞机和船只等动产取得的收益

from the alienation of shares(percentage limitation) 转让股票股权的收益(限定百分比内)征税

6

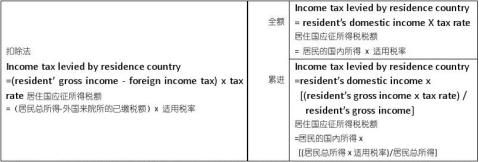

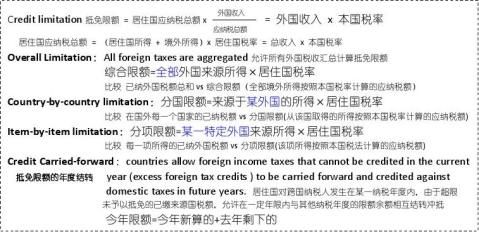

抵免法- The residence country provides its taxpayers with a credit against taxes otherwise payable for income taxes paid to a foreign country.居民国允许纳税人将支付给外国政府的所得税冲抵本国纳税义务

- The credit method could completely eliminate IDT of the residence source type. 可以完全消除Income tax levied by residence country居住国应征所得税税额

= Resident’s gross income X applicable tax rate - foreign income tax allowed as a credit

居民总所得

x 适用税率 -- 允许抵免的外国来源所得已缴税率

直接抵免法(Full credit & Limited credit)

foreign taxes paid by a resident taxpayer on foreign-source income directly reduce domestic taxes payable by amount of the foreign tax.

居住国用本国居民直接向来源国缴纳的or应由其直接缴纳的所得税,冲抵其在本国应缴纳的所得税

The scope of direct credit: 1.transnational individuals 直接纳税人 2.branches 分公司 3.withholding tax 代扣所得税 4.2.Indirect Credit 间接抵免法

本国公司可以抵免其外国关联公司所支付的外国所得税。当国内公司从其国外关联公司取得所分配的股息时即可获得该项抵免。抵免额为支付股息的所得所承担的由外国关联公司支付的外国税收。

7 Allocation of Expenses 费用分摊

rules for allocating a proper portion of the expenses incurred by its taxpayers between their

foreign-source gross income and their domestic-source gross income

免税法和抵免法都无法完全消除IDT,合理分摊纳税人取得的外国来源所得&本国来源所得 所发生的费用

1.Tracing approach 追溯法:据实查询费用与外国来源所得的联系

2.Apportionment approach 分摊法:1.据实分摊法

2.公式分摊法:算比重. 国外资产/总资产 or 国外总收入(含税)/全部收入(含税)

Tax Sparing Credit 税收饶让抵免

定义:A tax sparing credit is a credit granted by the residence country for foreign taxes that for some reason were not actually paid to the source country but that would have been paid under the country’s normal tax rules.居民国对 根据来源国一般税收法规 本应缴纳但实际没有缴纳的税收 给予抵免

1.按正常税率计算抵免额,在其他国家没交的税视同交了

2.Applicable scope适用范围:

Withholding tax preferences预提税收优惠

Tax preferences For business income 营业收入优惠

others

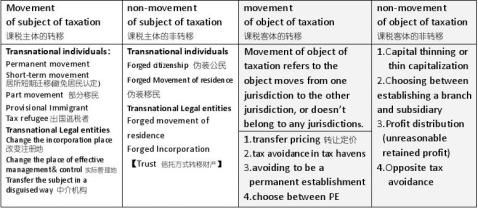

International Tax Avoidance

1.Defining tax evasion and avoidance 什么是逃税和避税

Tax evasion:taxpayer fails to pay or underpays the amount of tax payable 不缴或少缴应纳税款

Illegal非法 Criminal means 犯罪Punishments on the taxpayer惩罚

tax avoidance:transactions or arrangements entered into by a taxpayer in order to minimize the amount of tax payable in a lawful fashion 纳税人为了在合法范围内最大限度地减少应纳税所得额而做出的交易或安排 Legal合法Acceptable tax planning税收筹划 Improvements on tax laws修补税法漏洞

2. the effect of tax evasion and avoidance:影响

Reduce fiscal revenue减少财政收入Distort tax equity破坏税收平衡Reduce foreign investment降低国外投资

3.International tax evasion 国际逃税

transnational taxpayer reduces his tax liability by illegal means or tax frauds纳税人利用非法手段逃避纳税义务 International tax avoidance 国际避税

A transnational taxpayer arranges his financial affairs by making use of the differences, loopholes, anomalies and deficiencies among tax laws and treaties so that he only pays the minimum amount of tax required by law.纳税人利用国与国之间的税制差异及国际税法中的漏洞在跨国活动中通过合法手段规避或减小纳税义务

4.Causes of international tax avoidance 成因

Different tax jurisdiction 税收管辖权差异

Different tax system税制差异

The network of tax treaties 大量税收协定

【Trust信托: the settler, based on his faith in trustee, entrusts his property rights to the trustee and allows the trustee to, according to the will of the settler and in the name of the trustee, administer or dispose of such property in the interest of a beneficiary or for any intended purposes.

所有者将财产委托给信任的机构代为管理,指定受益人对财产享有权利

To create a trust, there must be definite property under the trust, and such property must be the property lawfully owned by the settler. 托管人必须是财产的合法拥有者】

8

1转让定价 It is the pricing between related or affiliated companies.关联公司之间确定的价格

定义:a price set by a taxpayer when selling to, buying from, or sharing resources with a related person.

2Avoiding to be a PE 避免被认定为常设机构 ○

The profits of an enterprise shall be taxable unless the enterprise carries on business in some country through a permanent establishment situated therein.非常设机构利润不征税(information center)

3Transfer objects between PEs ○

All the objects, including business assets, goods, income, interests, dividends and other expenses, losses could be transferred between PEs. The transfer also happen between the head office and its PEs.

1Capital thinning or thin capitalization 见P11资本弱化条例 4.2.○

when the capital is made up of a much greater proportion of debt than equity, ie. its gearing is too high.

资本结构中债务融资比重远超股权融资,财务杠杆过高。

Advantage:the distribution of interest on the debts may be deducted by the corporation as interest, whereas distribution on stock are nondeductible dividends.债务融资利息被扣除,算入股本,不扣税

disadvantage:consumers and creditors bear the solvency risk of the company, which has to repay the bulk of its capital with interest; and revenue authorities, who are concerned about abuse by excessive interest deductions.消费者和债权人承担偿还风险,税收机构担心滥用利息扣除

2Choosing between establishing a branch and subsidiary选择有利的公司组织形式 ○

A branch分公司 is simply a part, division, or section of an entity that is set apart to undertake certain responsibilities or tasks.与总公司是同一法人实体,统一计算盈亏,可冲销总公司盈利

A subsidiary 子公司has a separate legal and corporate existence. it is not part of a larger entity, but is a separate entity of which at least 50% of its share capital is owned by a parent or holding company. 独立纳税实体,母公司拥有至少50%股权,且不能分摊亏损

3Profit distribution (unreasonable retained profit:超比例保留利润)利润分配 ○

After-tax profit = dividend + retained profit.税后利润=股息+净利润

4Opposite tax avoidance逆向避税 ○

taxpayers move to the jurisdiction with higher tax and avoid the jurisdiction with lower tax. It will pursuing their maximum benefits. 从低税国向高税国转移,战争时,保证资产

5.Abuse of Treaty (Treaty Shopping) 滥用税收协定

a person who is not a resident of either country seeks certain benefits under the income tax treaty between the two countries.一个第三国居民利用其它两国之间签订的国际税收协定获取其本不应得到的税收利益

9

6. How to determine a tax haven:

1.No or only nominal taxes

2.Protection of personal financial information

3. Lack of transparency

7. How to be a tax haven:(避税地非税特征)

Low tax jurisdiction with disparities

Economic and Political Stability

Geographically close to developed countries

Convenient transportation

Good communication facilities

A double monetary control system

An easily convertible currency or linked to an easily convertible one

Tax treaty network

8. How to avoid tax in tax havens:

Personal residency、Asset holding、Trading and other business activity、Financial intermediaries Trade company

Financial Company

Shipping company:The term flag of convenience describes the business practice of registering a

merchant ship in a sovereign state different from that of the ship's owners, and flying that state's civil ensign on the ship. Ships are registered under flags of convenience to reduce operating costs or avoid the regulations of the owner's country

Defining related company : Associated Enterprise 关联企业 两个条件符合其一即可

A)an enterprise of a Contracting State participates directly or indirectly in the management, control or capital of an enterprise of the other Contracting State缔约国一方企业直接过间接参与另一方企业的管理

B)the same persons participate directly or indirectly in the management, control or capital of an enterprise of a Contracting State and an enterprise of the other Contracting State

同一人直接或间接参与两方企业的管理、控制或资本

How to determine related company

Management:经营管理权 Control:有权任命高层 Capital:拥有一定股本

10 Transfer pricing:

Sales of tangible personal property

Loans or advances(预付款)

Use of tangible property

Use of transfer intangible property

Performance of services

Principles of adjustment调整法:公平交易法/公式分配法

1.Arm’s Length Principle正常交易原则:

if a taxpayer sets its transfer prices in its dealings with related persons so that those prices are the same as the prices used in comparable dealings with unrelated persons.纳税人在于关联人的交易中制定的转让价格应当相当于在可比的非关联交易中所制定的价格

Arm’s Length Principle: 1.Traditional Methods: CUP、RPM、CPLM

2.Additional Methods: CPM、PSM、TNMM

determine the total profit

1Comparable Uncontrolled Price Method 1Profit-Split Method: split the profit between the parties

2Resale Price Method: (合理毛利) 2Transactional net Margin Method

Arm’s length price = resale price-normal markup

3Cost Plus Method 3Comparable Profit Method

Arm’s Length Price = cost + cost x profit rat of cost Sale of goods - Tangibles CUP, CPM, RPM, PSM, TNMM

Provision of services CUP, CPM, TNMM

Financing (loans, deposits, guarantees) CUP, PSM, TNMM

Transfer of intangibles (technology, brand, know –how) CUP, CPM, PSM

2.Principle of Global Apportionment全球利润分配原则:(Formulary Apportionmentaffiliated entities engaged in a common enterprises are taxed as if they were a single corporation. 关联实体作为一个公司被征税

The worldwide income of the enterprises is attributed by a predetermined formula among all of the countries where the enterprise engages in meaningful economic activity.

按预定公式将企业全球所得,在企业有实际经济活动的国家之间进行分配

main features of FA 公式分配法主要特点

FA is more easily to enforces and it also avoids some of the difficult audit problems.易实施,避免困难审计 The arbitrariness of the predetermined formulas makes it difficult to reflect the particular

circumstances of each multinational enterprises.预先确定的公式很难反映每个跨国企业的特定情况

It relies heavily on access to foreign-based information. 严重依赖从国外获取信息

Substantial cooperation among governments would be needed to solve these problems.

需要政府间大量合作来解决问题

ALP & FA对比

ALP is likely to continue to be the internationally accepted and the most objective approach for resolving transfer pricing issues except in special circumstances.继续是国际所接受的解决转让定价问题的方法 FA is used by some subnational jurisdictions, notably by the provinces of Canada or USA. And it is likely to continue to be an important part of the international tax scene.

在比国家低一级的管辖区内使用,加拿大的省+美国的洲,可能继续成为国际税收的重要成分

11 Thin Capitalization Rules资本弱化条例 P8资本弱化

1.Interest is deductible by the payer in computing income unless there are special rules to the contrary. 支付人可以在计算所得时扣除利息支出

2.Dividends paid by a resident corporation generally are not deductible.居民公司支付的股息一般不予抵扣

3.under these rules, the deduction for interest by a resident corporation to a nonresident shareholders is denied to the extent that the corporation is financed excessively by debt.

居民公司的资本过度依赖负债时,其支付给非居民股东的利息就不允许扣除

4.适用于:Nonresident lenders非居民债权人

Domestic entities 国内实体

Determination of excessive interest超额利息的确定

Computation of a debt 负债与权益比率的计算

Imputation system: 归集抵免制

the tax paid by a corporation on its income is imputed to the shareholders and treated as a credit against the tax payable by shareholders on dividends.

公司就其所得缴纳的税收将归集给股东,并从股东取得的股息征收的应纳税款中抵免

Administrative guidelines or practices

General anti-avoidance rules

Controlled Foreign Corporation Rules 受控外国公司法 见书

tax treaty 税收协定

Legal nature and effect 特征A treaty is an international agreement (in one or more instruments, whatever called) concluded between states and governed by international law.

协定是国家间达成的并受国际法约束的国际协议(不管采取一个或多个不同名称)

basic principle基本原则:the treaty should prevail in the event of a conflict between the provisions of domestic law and a treaty.在协定与国内法的规定发生冲突的情况下协定优先

Objectives目的:The objective of tax treaties is to facilitate cross-border trade and investment by eliminating the tax impediments to these cross-border flows. 通过消除税收障碍促进跨国贸易和投资 ① The most important operational objective is the elimination of double taxation .消除双重征税 ② The prevention of fiscal evasion 防止偷漏税

③ Elimination of discrimination against foreign nationals and nonresidents 消除对外籍和非居民的税收歧视 ④ The exchange of information缔约国之间情报交换

OECE & UN的主要区别

The UN Model Treaty imposes fewer restrictions on the tax jurisdiction of the source country. UN较少限制所得来源地国家的税收管辖权

Content s of a typical tax treaty 典型税收协定的内容

1. Coverage, scope and legal effect 范围和法律效力

2. Business income 经营所得

3. Employment and personal services income受雇和个人劳务所得

4. Income and gains from immovable property不动产所得和收益

5. Reduced withholding rates on certain investment income 以降低了的税率对某些投资所得征收预提税

6. Other typed on income其他所得

Special treaty issues 特殊协定问题

1. Nondiscrimination 无差别待遇

2. Treaty shopping 协定的滥用

3. Resolution of disputes争议的解决 APA

4. Administrative cooperation 征管合作

Advance Pricing Agreement APA

an agreement between a multinational enterprise and the tax authorities of one or more countries approving the transfer pricing method to be used by the enterprise in future tax years

跨国企业和一个或多个税务主管当局就允许企业在今后年度采用的转让定价的方法所达成的协议

12 Emerging Issues

Harmful Tax Competition 有害税收竞争

Hybrid Entity双性实体

Electronic Commerce 电子商务

辨析 Conception analysis

? National Taxation

? Taxation Concerning Foreigners

? Taxation in Foreign Countries

全额累进税率

就纳税人全部课税对象按与之相适应的级距的税率计算纳税 全部课税对象都适用相应的最高税率

超额累进税率

应交所得税=应税所得*适用税率-速算扣除数应税所得额 每一段按其对应的税率计算出该段应交的税额

只超过部分按高一级税率计算