Contents:

Introduction……………………………………………………………………………2

Discussion on internal expansion

a). Impact of issuing debt on Shareholders………………………………………...… 2

b). Profitability Ratio Analysis………………………………………………………..4

c). Discussion on Capital Structure……………………………………………………4

d). Modigliani and Miller’s Propositions I and II…………………………………..…6

Discussion on dividend policy

f). Suggestion on Stop Paying Dividend………………………………………………7

e). Dividend Calculation under Different Capital Structure Scenarios………………..8

g). Residual Dividend Policy Accompanied by a Repurchase of Stock……………….9

Suggestion on the takeover of Productos Reunidos

h). Reasons For and Against Takeover………………………………………………..9

i). Relative P/E game…………………………………………………………………10

j). Maximum offer price……………………………………………………………...11

k). Cash versus Stock Acquisition……………………………………………………12

l). Discussion on Firm TE’s Share Price Affected by the Acquisition……………….13

m). Diversification Benefits………………………………………………………….13

Recommendations…………………………………………………………………....14

Reference……………………………………………………………………………..16

Introduction

This report aims to discuss two alternative investment strategies, the internal expansion or the external takeover, for Firm Tyneside Electronics Plc’s future growth. Also, it will find the more advanced investment approach by assessing the capital structure, dividend policy and takeover plan. The discussion will fall into three parts. Firstly, I will analyze the capital structure planning under the assumption of choosing the internal expansion project. According to Modigliani and Miller’s theory and trade-off theory, it calculates and demonstrates that the Weighted Average Cost of Capital (WACC) can be reduced by increasing the debt ratio, and there is an optimal debt to equity ratio which maximise the firms value. However, the internal expansion plan was rejected due to the negative debt influence on the firm’s financial leverage, shareholders’ value, and the financial flexibility. The second part of the discussion will focus on the dividend policy. Based on both empirical literatures and our current dividend policy, I believe that we should process a residual dividend policy accompany by a repurchase of stock, which can not only balance the residual earnings between shareholders and investment, but also avoid the signalling problem. The third part will discuss the takeover plan which involved relative P/E ratio discussion, maximum offer price, payment method, influence on our share price, and the diversification benefits. With above discussion, I believe that the stock acquisition is the best deal for our company’s growth plan. Additionally, the recommendations can be referenced as the board of directors’ decision making.

Discussion on internal expansion

a). Impact of issuing debt on Shareholders

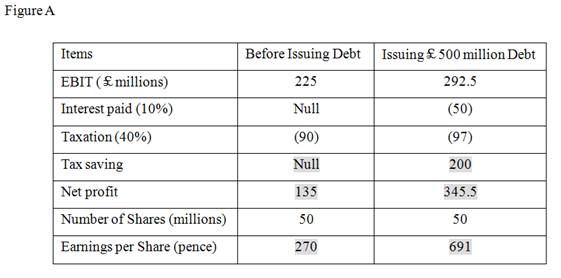

To begin with, If the required capital£500 million all financed by issuing debt, shareholders would obtain much higher earnings due to the tax exemption . Based on the formula:

We can get the EPS ratios of Tyneside Electronics (Figure A) without considering inflation. On one side, our shareholders can be delighted by the sharply increased EPS ratios if we raised all of the capital by issuing debt. On the other side, the new debt could increase the level of financial gearing (Atrill and Mc Laney, 2008), which also increase the risk of the firm’s shares. According to Modigliani and Miller’s theory, ‘the risk increase exactly offsets the increase in expected return, leaving stockholders no better or worse off’ (Allen, Myers, and Brealey, 2008).

b). Profitability Ratio Analysis

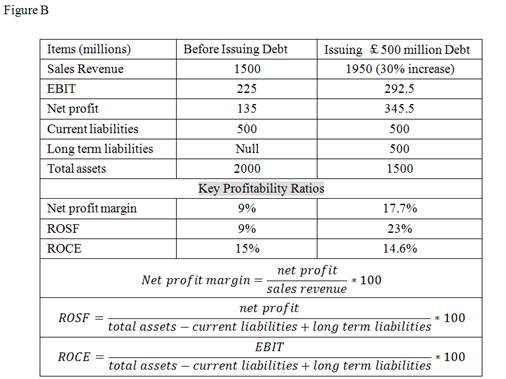

Comparing the key profitability ratios, we can find that both net profit margin and ROSF would improve significantly if we raise all of the capital by issuing debt (Figure B). The results can attribute to £200 million tax benefits under the debt cap. However, ROCE would decline slightly due to the increase in long term liabilities outstripped the increase in operating profit. Therefore, those risk-averse shareholders may leave if the risk increase exactly offsets the increase in expected return.

c). Discussion on Capital Structure

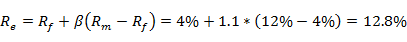

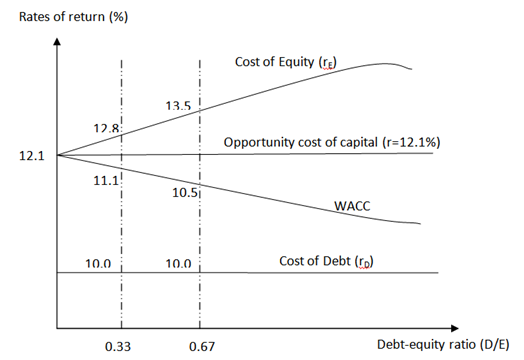

Then, let’s discuss the effect of changes in the capital structure. Before calculating the changes of the weighted average cost of capital, we have to get the expect return on stocks. If we supposed that TE’s beta is estimated at 1.1, treasury bills are yielding 4%, market index expected return is 12% and the corporate tax is 40%, according to the formula:

we can get the expected return on stocks which is 12.8%.

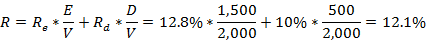

If we suppose the firm’s debt is £500 million, equity £1,500 million, according to the formula:

the  is estimated to 11.1%. Then, the opportunity cost of capital should be:

is estimated to 11.1%. Then, the opportunity cost of capital should be:

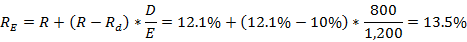

Furthermore, If we suppose the firm’s debt is £800 million, and the equity is £1,200 million, according to the formula:

the new costs of equity is estimated to 13.5%.

Finally, the  would be:

would be:

From above calculation and figure we can find that, if the cost of each component stays constant, the weighted average cost of capital is reduced when we increased the debt in the firm’s capital structure. It means that the debt to equity ratio has negative relationship with the WACC. Also, the value of the firm would increase when debt ratio increased with corporate tax (which will be proved in section d). Furthermore, ‘the particular capital structure which maximises the value of firm is usually viewed as determined by a trade-off of the costs and benefits of borrowing, holding the firm’s assets and investment plans constant’ (Stewart C. Myers, 1984). ‘This optimal debt to equity ratio is reached when the present value of tax savings due to debt is equal to the increases in the present value of costs of distress’ (Allen, Myers, and Brealey, 2008). However, in practice, many CFOs usually choose to preserve financial flexibility as the goal rather than minimize the company’s weighted average cost of capital (Graham and Harvey, 2002). Especially, they expressed the reluctance on issuing equity, unless their share prices were at a high level. Because issuing common equity could dilution their EPS, which has negative influence on the share price.

d). Modigliani and Miller’s Propositions I and II

According to Modigliani and Miller’s proposition I with corporate tax, the value of levered firm equal to the value of unlevered firm plus the value of tax shield:

I.

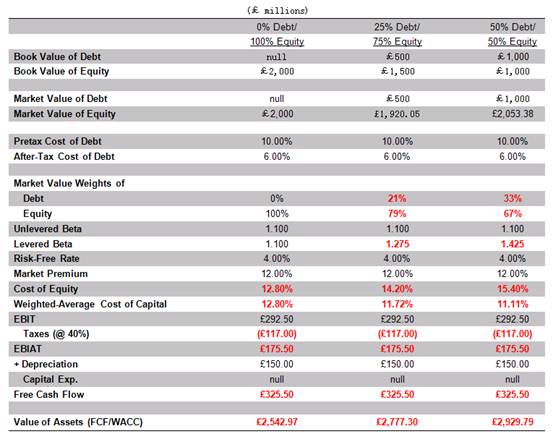

For explaining above formula, we can use the free cash flow method to calculate the value of our company in different capital structure scenarios as following,

Table 1

Following the same procedure in section c, we can get the WACC in each capital structure, and find that the higher debt ratio is in the firm’s capital structure, the higher firm value will be. Table 1 shows if there is 25% debt in the firm, the value of the levered firm (£2,777.3m) is approximately equal to the unlevered firm (£2,542.97m) plus value of tax shield (£200m). On the other hand, the MM’s proposition II has been used in the calculation, which not only made the equation of the proposition I, but also proved that the increasing in debt proportion will cause a higher proportion of tax shield, and eventually a lower weighted average cost of capital.

Discussion on dividend policy

f). Suggestion on Stop Paying Dividend

I noticed the disputes of dividend policy on our broad meeting. Firstly, let’s discuss whether should we stop the payment of dividends. In practice, a majority of companies are willing to pay dividends for their shareholders, which is result from the following reasons: Broyles (2003) stated that paying dividends to shareholders can be seen as a method of motivation, since shareholders prefer a steady growth in dividends. Moreover, Feldstein and Green (1973) pointed that some companies in the maturity period are very hard to find new project, beside the retained incomes are far more enough to conduce reinvestment, thus shareholders in such companies can get regular dividends. In addition, dividend is a signal of firm’s growth and represents a firm’s health. (Bortz, 1984) For example, management can use change dividends to signal information of company’s performance to the market, and accordingly influence the share price. For our company, we have paid the steadily increasing dividends s for 3 years, it is impossible for us to stop the dividend immediately, which has great negative influence to our shareholders. Due to the new project financing situation, I suggest that we can use the residual dividend policy accompanied by a repurchase of our stocks to reschedule our dividends policy.

e). Dividend Calculation under Different Capital Structure Scenarios

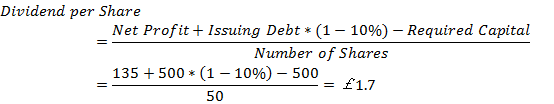

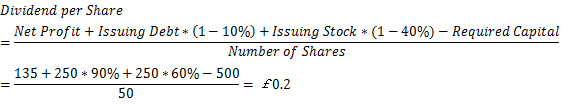

In my proposed plan, the dividend per share can be calculated according to the residual dividend policy as follow:

Supposed all of the required capital is financed by issuing debt, the dividend per share should be:

Supposed the required capital are financed by both issuing debt and equity equally (50% Debt, 50% Equity), the dividend per share should be,

g). Residual Dividend Policy Accompanied by a Repurchase of Stock

Obviously, comparing with our current dividends per share (80 pence), the proposed dividends could change significantly due to different debt ratio. It would sharply increase to 1.7 if all of the required capital are financed by debt, or it would drop to

1.7 if all of the required capital are financed by debt, or it would drop to 0.2 if the debt to equity ratio is 1. As above mentioned, signalling problem could rise due to the significant changes in dividend policy. ‘Empirical studies by Asuith and Mullins (1983), Healy and Palepu (1988), Michaely, Thaler and Womack (1995), showed share price increases with the announcement of dividend increases and falls when firms reduce dividends’ (H.Kent Baker, 2002). So we cannot simply and rigidly use the residual dividend policy to smooth dividends. On one side, we should use the debt to equity ratio to keep a high proportion of dividend per share for a positive signal influence. On the other side, we cannot simply distribute the high dividends to our shareholders. According to Miller Modigliani’s (1961) residual theory of dividends, firms should pay lower dividends if they face the higher debt and have less financial flexibility (Aivazian, Booth, and Cleary, 2006). So we could use the additional proportion of dividends to repurchase our stocks. This combined dividend policy could avoid signal problems, transfer shareholders’ earnings to investment and minimize the new stock issues and flotation costs.

0.2 if the debt to equity ratio is 1. As above mentioned, signalling problem could rise due to the significant changes in dividend policy. ‘Empirical studies by Asuith and Mullins (1983), Healy and Palepu (1988), Michaely, Thaler and Womack (1995), showed share price increases with the announcement of dividend increases and falls when firms reduce dividends’ (H.Kent Baker, 2002). So we cannot simply and rigidly use the residual dividend policy to smooth dividends. On one side, we should use the debt to equity ratio to keep a high proportion of dividend per share for a positive signal influence. On the other side, we cannot simply distribute the high dividends to our shareholders. According to Miller Modigliani’s (1961) residual theory of dividends, firms should pay lower dividends if they face the higher debt and have less financial flexibility (Aivazian, Booth, and Cleary, 2006). So we could use the additional proportion of dividends to repurchase our stocks. This combined dividend policy could avoid signal problems, transfer shareholders’ earnings to investment and minimize the new stock issues and flotation costs.

Suggestion on the takeover of Productos Reunidos

h). Reasons For and Against Takeover

As the alternative strategy of the internal expansion, the takeover plan should be also assessed cautiously. From one side, the source of synergy from acquisition could generate much more net incomes from various aspects, such as revenue enhancement, cost reduction, lower taxes, and lower cost of capital (Ross, Westerfield and Jaffe, 1988). For instance, the increased revenues may come from marketing gains. Our company’s market is mainly concentrated in Northern Europe and North America, but Productos Reunidos has an established market in Southern Europe. After the acquisition and integration, we can use the PR’s established market and distribution channels, which can reduce our market expansion costs. Also, tax benefits can come from the use of tax losses from net operating losses; the use of unused debt capacity and the use of surplus funds (Ross, Westerfield and Jaffe, 1988). Especially, the diversification benefits could strengthen our sustainable competitive advantages as well as the market position. In addition, our shareholders wealth can be enhanced if we use stock exchange to purchase the acquisition. It will be analyzed later in the ‘relative P/E game’ section. From the other side, uncertainty factors and risks are also involved in the takeover plan. Culture conflict is one of the significant challenges for integrating two combined firms. Especially, the Spanish company had a very centralized organisational structure, and unfortunately, their CEO who made most of the strategic decisions retired recently. Therefore, it is a great challenge for us to integrate the two firms. If we cannot manage it well, we would suffer great loss in the acquisition.

i). Relative P/E game

If we assume the stock exchange rate is one share of TE for every four Productos Reunidos’ shares, and the combined net income is the sum of their net incomes, the following figure tells market value changes and earnings per share changes before and after the acquisition.

From figure C we can find that, the ex-shareholders of Firm TE had originally market value of £1500m, after the acquisition, the value of their shares in the new group increased to £1633.27m (£2041.59* ). On contrary, the ex-shareholders of PR firm hold 20% shares of the new group was worth only £408.32, which was slightly lower than their previous value of £424.5. It seemed there was a money transaction from Firm PR to Firm TE in the acquisition. However, the new combined firm’s P/E ratio and earnings per share ratio would be much higher than previous Firm PR. If the new company could run well through acquisition, ex-shareholders of Firm PR can get higher market value than before. For our company, although the P/E ratio decreased slightly after the acquisition, both market value and earnings per share would increase. Especially, our shareholders’ value can increase to£1633.27m. In addition, ‘the higher a company’s P/E multiple, the more attractive it is for the company to make acquisition’ (Quiry, Dallocchio, Fur, and Salvi, 2005). Due to our higher valued stock price than Firm PR, we can use the relatively low costs to carry out the acquisition by stock purchase.

). On contrary, the ex-shareholders of PR firm hold 20% shares of the new group was worth only £408.32, which was slightly lower than their previous value of £424.5. It seemed there was a money transaction from Firm PR to Firm TE in the acquisition. However, the new combined firm’s P/E ratio and earnings per share ratio would be much higher than previous Firm PR. If the new company could run well through acquisition, ex-shareholders of Firm PR can get higher market value than before. For our company, although the P/E ratio decreased slightly after the acquisition, both market value and earnings per share would increase. Especially, our shareholders’ value can increase to£1633.27m. In addition, ‘the higher a company’s P/E multiple, the more attractive it is for the company to make acquisition’ (Quiry, Dallocchio, Fur, and Salvi, 2005). Due to our higher valued stock price than Firm PR, we can use the relatively low costs to carry out the acquisition by stock purchase.

j). Maximum offer price

If we use the stock acquisition, the maximum offer price for our company in making for PR could be calculated under certain assumptions as follow:

Assuming exchange rate of 1 Euro to GBP is 0.88, and then the maximum offer price in making for Productos Reunidos would be calculated as follow:

Value of Productos Reunidos (PR) to TE = Value of PR + PV of Synergy

Where Value of PR = PR’s share price * number of shares

= £8.488*50m=£424.4m

PV of Synergy = Incremental cash flows/WACC

= £15m/12.8%

=£117.19m

Value of PR to TE =£424.4m+£117.19m=£541.59m

(Note: PR’s share price= PR’s P/E ratio* PR’s EPS= 8*€1.2= €9.6*0.88=£8.488)

The maximum offer price = VPR to TE/Number of shares of PR

=£541.59m /50m

=£10.83

k). Cash versus Stock Acquisition

Comparing with the cash payment, I prefer a stock acquisition for several reasons. Firstly, as above mentioned, stock acquisition can be less costly due to our relative high stock price and P/E ratio. Moreover, stock acquisition can avoid the tax in the transaction. In addition, we could share gains as well as the risks with the Firm PR in the stock acquisition. However, the stock acquisition may dilute reported earnings and potential negative shareholders response (Wansley, Lane and Yang, 1983). On the other hand, if we use the cash payment, we have to issue debt, which not only involved high transaction costs, but also reduce our financial flexibility. In addition, we have to entirely burden the risks and suffer the loss if the deal is bad. If we use the NPV method to calculate the stock acquisition under the assumption of the exchange rate is one share of TE for every four Productos Reunidos’ shares, From Figure C, we can get the value of share after acquisition is £32.67, total shares given to Firm PR is 12.5m, and Value of PR to TE is £541.59m, then the NPV of stock acquisition can be calculate as following,

Cost of acquisition = 125,000,000 shares *£32.67=£ 4,083,750,000

NPV of stock acquisition = Value of PR to TE – Cost of Acquisition

= £541,590,000,000 –£4,083,750,000= £537,506,250,000

The calculations show that the stock acquisition method can be accepted since it would have a positive net present value.

l). Discussion on Firm TE’s Share Price Affected by the Acquisition

Many empirical researches has attempted to assess the impact of takeovers on stock prices of both the acquiring and acquired firms. From Jensen and Runback’s (1983) numerous studies we can find that, the bid firms normally get 4% abnormal return in tender offer and 0% abnormal return in mergers associated with successful takeovers (Ross, Westerfield and Jaffe, 1988). It means that we can get a higher premium in the unfriendly tender offer than the friendly merger. On the other hand, according to Wansley, Lane and Yang’s (1983) study, if the merger under the pure cash transaction, it will involve higher premiums than mergers involving securities. From the empirical evidences, we can conclude that if we choose the stock acquisition, we could get certain abnormal return on and around the offer announcement date.

m). Diversification Benefits

The takeover will offer some diversification benefits, but the benefits are limited in certain conditions. For instance, as above mentioned, the Spanish Company has an established market in Southern Europe, which could expand our market from Northern to the entire Europe. However, the market channel can be accessed only if we can process a successful integration. On the other hand, not all risks can be diversified away through the acquisition. Only the unsystematic risks can be eliminated by diversification (Ross, Westerfield and Jaffe, 1988). Systematic risks such as the Credit Crunch cannot be eliminated by diversification strategy. In addition, the unsystematic risks can be reduced and thereby our firm’s debt capacity can be increase by diversification.

Recommendations

To conclude, I believe that we should choose the stock acquisition rather than the internal expansion strategy to secure our competitive position as well as keep the sustainable growth.

If we choose the internal expansion strategy, we have to raise the £500m required capital by issuing debt. As above mentioned, issuing debt can not only increase the earnings per share by tax shield, but also reduce the weighted average cost of capital. However, the financial leverage will be enhanced by debt financing. Furthermore, in this growth period, we have limited cash holdings and volatile cash flows. So the issuing debt could lower our financial flexibility. Financial flexibility is significant for corporate managers to mobilize the financial resources to maximize the firm value. Therefore, we cannot sacrifice our financial flexibility to raise the capital for internal expansion. On the other hand, although our shareholders earnings could be increased through the internal expansion project, the risk also increased due to the decreased ROCE. Those risk-averse investors may leave for securing themselves. Thus, we have to reject the internal expansion plan.

For the takeover plan, stock acquisition is more advanced than cash payment. As above mentioned, the high debt ratio will have negative influence on the firm’s financial flexibility, which is significantly important in the firm’s growth period. Also, we have the comparatively higher P/E ratio and higher stock price than Firm PR, so we can purchase the Firm PR at a low price and win an increase in the earnings per share as well as the ex-shareholders value in the new firm (Figure C). Although our P/E ratio may slightly decrease in the acquisition, numerous empirical studies show that the bidder firm’s share price will increase in a successful stock acquisition. Also, the stock acquisition plan can generate more money from shareholders to investment under my suggested dividend policy than the debt financed internal expansion. Although the high debt ratio could cause a high dividend per share for the repurchase of stock in the debt financing internal expansion, the residual earnings in the internal expansion strategy (e) is much less than the residual earnings in a stock acquisition (figure C), which result the more proportion of dividend per share can be generated for repurchase our stock. In addition, diversification benefits of the takeover can reduce the firm’s unsystematic risks, increase the debt capacity and diversify our market channels.

Reference

Atrill, P. and McLaney E. (2008) ‘Financial Management for Non-Specialists’, 9th Edition, Prentice Hall

Bortz, Gary A.; Rust, John P, (1984) ‘Why do Companies Pay Dividends: Comment’, Journal of American Economic Review, Vol. 74 Issue 5, pp:11-35

Feldstein, Martin; Green, Jerry, (1973) ‘Why Do Companies Pay Dividends’, American Economic Review, Vol. 73 Issue 1, p17

H. Kent Baker and David M. Smith (2002), ‘In Search of a Residual Dividend Policy’, JEL classification G35, American University, pp 1-35.

Tomas E. Copeland, J.Fred Weston and Kuldeep Sharstri (2005), ‘Financial Theory and Corporate Policy’, 4th Edition, Pearson Addison Wesley.

Jack Broyles (2003) ‘Financial Management and Real Options’, 1st Edition, John Wiley & Sons Ltd, England

James W. Wansley, William R. Lane, and Ho C. Yang (1983), ‘Abnormal Returns To Acquired Firms By Type of Acquisition and Method of Payment’ Journal of Financial Management, Autumn 1983, pp16-22

John Graham and Campebell Harvey (2002), ‘How Do CFOs Make Capital Budgeting and Capital Structure Decisions’, Journal of Applied Corporate Finance, Spring 2002, Volume 15.1, pp:8-23

Joel M. Stern and Donald H. Chew, Jr (1998), ‘The Revolution in Corporate Finance’, 3rd Edition, Blackwell Business.

Michael C. Jensen and Richard S. Ruback (1983) ‘The Market for Corporate Control, the Scientific Evidence’ Journal of Financial Economics 11, April 1983, pp 7-8

Pascal Quiry, Maurizio Dallocchio, Yann Le Fur, and Antonio Salvi, (2005), ‘Corporate Finance Theory and Practice’ 6th Edition, John Wiley & Sons, Ltd.

Richard A. Brealey, Stewart C. Myers and Franklin Allen (2008) ‘Principles of Corporate Finance’ International Edition 2008, McGraw-Hill

Ross, Westerfield and Jaffe (1988), ‘Corporate Finance’ 3rd Edition, R.R. Donnelley & Sons Company

Stephen A.Ross, Randolph W. Westerfield and Jeffrey F. Jaffe (1988) ‘Corporate Finance’, 3rd Edition, Times Mirror/Mosby College Publishing

Stewart C. Myers (1983) ‘The Capital Structure Puzzle’, Journal of Finance, Vol. 39. No.3, pp:575-592

Soku Byoun (2007), ‘Financial Flexibility, Leverage, and Firm Size’ Hankamer School of Business, Baylor University, One Bear Place 98004, Waco, TX 76798

Varouj A. Aivazian, Laurence Booth, and Sean Cleary, (2006), ‘Dividend Smoothing and Debt Rating’, Journal of Financial and Quantitative Analysis. Vol. 41, No. 2 June 2006, pp:439-453