An Introduction to Techniques

Assessment task 1.1-1.6

Outcome 1

1.1 Report on tow potential finance sources.

In an enterprise, there are two types of funds, the source of short-term and long-term financing sources of funding.

Short-term financing options

Repayment period in the short-term financing is usually less than a year. Credit is an important aspect, entrepreneurs or enterprises must meet before the short-term financing will be granted.

The advantage of short-term financing, the organization can use in different ways, such as bank overdrafts, loans, suppliers, factoring, and invoice discounting, in order to obtain funds in order to obtain the funds quickly and easily. The disadvantage is that this approach, they will lose some discounts or to pay some interest.

Long-term Financing Options

Long-term funds will be adequate resources for the purchase of fixed assets and long-term (10 years) of life or large-scale expansion of subsidized.

Usually there are some significant benefits, the use of long-term funds. Long-term loans through the end of your often lower monthly payments, which often provides a better matching of the savings generated by your renewable energy systems. Secured loans are often enables you to take full advantage of the interest tax. You can be the owner of capital funds, retained profits, loan capital, leasing and hire-purchase, sale and lease back, grants, etc.

The drawbacks of this approach are that many people can have a company and each person s share of profits and assets of the business; they can play the part of the company. Some means to give up any possible value of future earnings of the premise

1.2 Indicate the ways a company would finance a capital purchase. Show at last tow ways this can be done.

Installments

Some long-term use of hire purchase of fixed assets. Leasing and hire-purchase offer ways to achieve this goal rather than simply the purchase of a one-time payment.

Installment payment is the legal term for a conditional sale contract developed in the countries which have adopted the English law concept. In cases where a buyer cannot afford to pay the asked price as a lump sum but can afford to pay a percentage as a deposit, the contract allows the buyer to hire the goods for a monthly rent. When a sum equal to the original full price plus interest has been paid in equal installments, the buyer may then exercise an option to buy the goods at a predetermined price (usually a nominal sum) or return the goods to the owner. If the buyer defaults in paying the installments, the owner can repossess the goods which differentiate Installment payment from other unsecured consumer credit systems and benefit the economy because markets can expand while minimizing the seller's exposure to risk of default.

Similarly, the installment is conducive to both private consumers, because it spread the cost of expensive items over a longer period of time, and, in some commercial consumer balance sheet and employment tax treatment is different from the direct purchase of capital buy.

Adverse installments:

● Required to pay interest.

● Payment of the total expenditure will be higher than the first.

● There is more risk

Full pay

Full payment (such as the purchase of capital assets) is the means to buy things, payment will be. Most of this method can be used to buy, if they need immediately. When you pay all the money, you will receive full ownership of capital.

The advantages of full payment:

● Can be their capital assets and use it immediately.

● May be a discount price.

● Do not need to pay interest

The disadvantage of pay in full:

● To meet cash flow problems.

● To take a lot of money.

● You can not invest in other projects

1.3 Show what the differences are between capital and revenue purchasing and their accounting.

Capital purchase

The use of funds by the company to acquire or upgrade physical assets such as real estate, industrial buildings or equipment. This type of spending by the company to maintain or increase the scope of its operation. These expenses include the repair of the roof from the building of a new factory.

● Expenditures for acquiring fixed assets, the business need to use and not for resale.

● Expenditure on existing fixed assets, in order to enhance their earning capacity (for example, major reform projects in production machinery.).

Revenue purchase

Income, including the purchase of day-to-day operating costs. It does not include capital investment or financing costs. Therefore, operating expenses, including employment costs, electricity, and materials, the cost of hiring and contracts, local authorities, interest rates, insurance, software licenses, vehicle operating costs are also regarded as a bad debt and other operating costs.

● Operating expenses have a direct impact on cost to the customer.

● Expenditure on current assets (for example, stock)

● Expenditure relating to running the business (administration expenses, selling expenses).

● Expenditure on maintaining the earning capacity of fixed assets ( repairs and renewals).

The distinction between capital expenditure and revenue expenditure is in various ways. Revenue purchase refers to expenditure on the day-to-day running of the business; it drives from the fact that, by convention, financial statements are produced on an annual basis. Revenue purchase appears in the trading, profit and loss account as an item of expense, while capital purchase appears in the balance sheet as a fixed asset. Revenue expenditure includes expenditure on current assets, expenditure relating to running the business (such as administration expenses and selling expenses), and expenditure on maintaining the earning capacity of fixed assets (repairs and renewals). Revenue expenditure also includes rent and rates, repairs to machinery, stationery, stock for resale, wages and salaries. And the decision making of purchase revenue is not so complicated; it is easy for the managers to make decision. It aims to transmit the benefits to customers in its way.

1.4 Define a decision making process related to capital purchasing and explain the stages involved.

Steps in the purchase of capital items

The company management should look at why they need capital to buy. For example, the company needs a forklift to handle products in the warehouse shelves.

The cost, delivery, installation and debugging. For most suppliers, the cost-free delivery and installation, so they are considered more competitive market.

The cost of routine maintenance and periodic maintenance should be considered. This is a supplier of after-sales service, in spite of the company's suppliers should pay the maintenance and repair to ensure the efficiency of the machine.

Cost, energy and labor force participation of the machine often. Energy costs and salaries of employees should be taken into account.

Prior to the purchase of capital items. Managers must take a broader perspective, it does not focus on a particular function, but the function of cross-border take a look at the organization as a whole. Can say with certainty that some people will be further argued that even if the boundary between the supply chains should be ignored in order to reduce costs for everyone.

Between the selection of assets and other buyers must take into account the costs and other buyers must take into account the cost of a whole life. These costs include any or all of the following addition to the basic purchase price:

l The cost of delivery, installation and commissioning.

l The cost of routine maintenance and periodic overhaul.

l Energy and labor costs involved in running the machine

l The cost of lost time in failure

l The cost of staff training mechanisms are operating normally.

1.5 Provide a Life Cycle costing for a capital purchase and the benefits from the calculation pf Life Cycle Costing.

Life-cycle cost (life cycle cost), as a "discount the total cost of U.S. ownership, operation, maintenance and disposal of buildings or building systems," after a period of time. Life-cycle cost analysis (LCCA) is a techno-economic evaluation to determine the total cost of ownership and operation of facilities for some time.

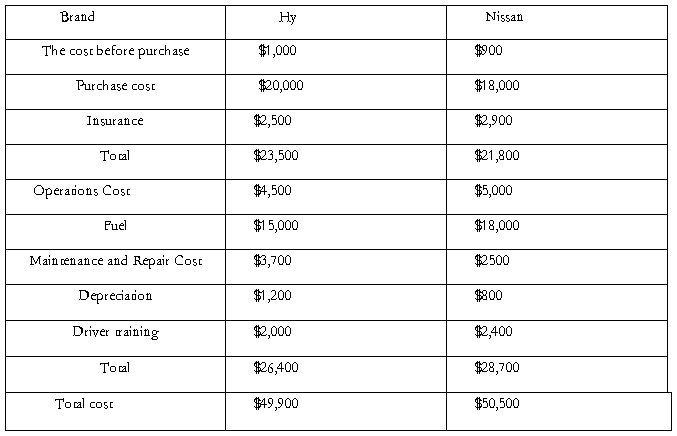

There are two types of cars in the market, so the company will be the contrast between them and calculate the cost of the entire life cycle of two categories.

The $49,900and $ 50,500 is the cost at current rates and prices. The price and cost are almost the same. However, we discount all amounts to today’s value.

The Hy

Total= $ 23,500+ $26,400/150%= $41,100

The Nissan

Total= $21,800 + $28,700/150%= $40.933

So, for this company chose the Nissan truck will be cheaper than use the Hy truck.

1.6 Explain the concept of investment appraisal and show how this can be done using the concepts of.

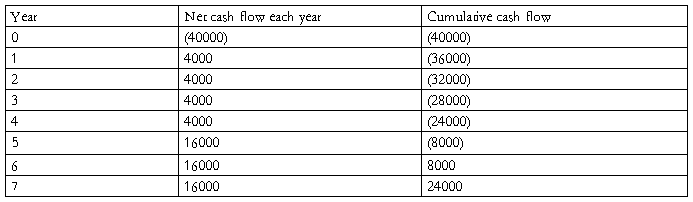

Payback Method

This means that how long a project will pay back the initial investment.

In the benefits of this approach is simple, safe operation and understanding; view, it will be cost recovery and reduce the risk of loss of investment in a short period of time. This is also a good initial screening to exclude a number of projects, a long repayment period.

The disadvantage is that the return on investment is to ignore the outflow of cash flow, the preliminary has been met, while ignoring the risks, the time value of money and the interest of the fact that, from different projects may have an uneven rate.

The model is clear, when the life of the machine to complete a total net cash flow to a positive number of 8,000 pounds of the sixth year.

ARR

For the first item, the total rate of return compared to six years is £ 8000. This means that each year the return of £ 1,333.3 investment £ 40,000, 3% rate of return.

The second project, the total return refers to seven pounds 24000.This annual rate of return of investment is expected to 3429 pounds 40,000 pounds, the rate of return is 8%. Therefore, the second item is desirable.

Discounted cash flow (“DCF”)

DCF method is the focus of the time value of money, the value of £ 100 is more than 100 pounds today in the future. The reason is that it can make the return on investment (even in low-interest, as long as the interest rate is positive).

Discount is calculated as: I / (1 +) n, which for I = investment, the correlation coefficient r = discount rate and N = number of years. So, what is the current value of £ 100, a discount rate of 10% in 3 years.

£100/(1.10) 3 = £75

So that's the discounting methodology, DCF has two methods. It is a way of dealing with inflation.

Advantage of DCF

l Unlike the payback method, DCF takes account of all cash flows over the life of the project, not just those in the early years

l Unlike the ARR method, DCF concentrates on the most relevant factor: actual cash flows rather than accounting profit or loss

l DCF is the only method to take account of the crucial factor of the time value of money