电子商务概论读书报告

经过一学期对于电子商务概论的学习,我自助阅读了很多关于电子商务概论与电子商务概论的书籍。接下来就是我的读书报告。

时光荏苒,转眼已结束了电子商务概论课程的学习,对于自己所不熟悉的电子商务课程有了一定程度的了解和认识,通过老师的面授与上机的实习,更进一步地对电子商务有了身临其境的感受,也感受到了电子商务的发展对会计这个行当带来的冲击与挑战。而立志于为国家金融事业献身的我,怎么不为这一新的学科的崛起而震惊,怎么能不为电子商务的发展带给我们会计业内人士的挑战而思考,我们的路在何方,电子商务的发展是否会将我们从事会计工作的人士扫地出门,诸多的困惑与疑问让我有感而学,所以电子商务的学习收获良多。先说一说我所了解到的电子商务,授课中,我归纳了下,大致可分为三大类,概念类、技术类、应用类。概念类主要是说电子商务的概念,比方说EDI的概念与存在的问题,还有电子商务的定义、特点、结构、功能、分类与模式及应用领域与发展前景。

技术类主要是说:电子商务系统的开发,包括可行性分析、组成规则、组织与项目管理;电子商务网络基础设施的建设,包括网络规划、局域网规划、广域网规划、语音图像网规划、网络安全的规划等等;电子商务应用系统的建设,包括企业资源计划(ERP)系统的建设、供应链管理(SCM)系统的建设、客户关系管理(CRM)系统的建设、办公自动化系统(OA)及知识管理系统(KM)的建设等等;网站的建设与管理,包括网站建设相关技术、门户网站的建设、网站的实施、维护与管理、宣传与推广等等。

应用类主要是说:网络营销,包括概念、调研、营销的环境分析、网络市场的细分与定位、网络营销的组合、广告策略、公关策略等;电子商务物流,包括物流概念的演变、电子物流的技术与应用、其它的电子商务物流技术如全球卫星定位系统等、发展环境现状与趋势;电子银行与电子支付安全,包括网上银行的概述、电子支付工具、电子支付系统;电子政务,包括电子政务的概念、国际电子政务与国内电子政务、电子政务建设的内容、电子政务的体系结构等。

实际上的学习分为的三个方面,系统而且分类清晰,让我们学习的侧重点与抓重点的能力大大加强,再加上老师谆谆的教导与对我们严格的要求,我们更加喜欢上电子商务课程的学习 电子商务(e-business,e-comerce,e-trade)从英文的字面意思上看就是利用现在先进的电子技术从事各种商业活动的方式。电子商务的实质应该是一套完整的网络商务经营及管理信息系统。再具体一点,它是利用现有的计算机硬件设备、软件和网络基础设施,通过一定的协议连接起来的电子网络环境进行各种各样商务活动的方式。这是一个比较严格的定义,说得通俗一点,电子商务一般就是指利用国际互联网进行商务活动的一种方式,例如:网上营销、网上客户服务、以及网上做广告、网上调查等。

电子商务

Internet上的电子商务可以分为三个方面:信息服务、交易和支付。主要内容包括:电子商情广告;电子选购和交易、电子交易凭证的交换;电子支付与结算以及售后的网上服务等。主要交易类型有企业与个人的交易(B to C方式)和企业之间的交易(B to B方式)两种。参与电子商务的实体有四类:顾客(个人消费者或企业集团)、商户(包括销售商、制造商、储运商)、银行(包括发卡行、收单行)及认证中心。

2. 电子商务的分类及模式

2.1 按商业活动运作方式分类

(1)完全电子商务:即可以完全通过电子商务方式实现和完成整个交易过程的交易。(2)不完全电子商务:即指无法完全依靠电子商务方式实现和完成完整交易过程的交易,它需要依靠一些外部要素,如运输系统等来完成交易。 2.2 按电子商务应用服务的领域范围分类。

(1)企业对消费者(也称商家对个人客户或商业机构对消费者即B to C)的电子商务。商业机构对消费者的电子商务基本等同于电子零售商业。目前,Internet上已遍布各种类型的商业中心,提供各种商品和服务,主要有鲜花、书籍、计算机、汽车等商品和服务。(2)企业对企业(也称为商家对商家或商业机构对商业机构即B to B)的电子商务。商业机构对商业机构的电子商务是指商业机构(或企业、公司)使用Internet或各种商务网络向供应商(企业或公司)订货和付款。商业机构对商业机构的电子商务发展最快,已经有了多年的历史,特别是通过增值网络(Value Added Network,VAN)上运行的电子数据交换(EDI),使企业对企业的电子商务得到了迅速扩大和推广。公司之间可能使用网络进行订货和接受订货、合同等单证和付款。

(3)企业对政府机构的电子商务

在企业-政府机构方面的电子商务可以覆盖公司与政府组织间的许多事务。目前我国有些地方政府已经推行网上采购。

(4)消费者对政府机构的电子商务

政府将会把电子商务扩展到福利费发放和自我估税及个人税收的征收方面。

(5)消费者对消费者的电子商务

2.3 按开展电子交易的信息网络范围分类。

电子交易的地域范围较小。本地电子商务系统是利用Internet、Intranet或专用网将下列系统联结在一起的网络系统:一,参加交易各方的电子商务信息系统,包括买方、卖方及其他各方的电子商务信息系统;二,银行金融机构电子信息系统;三,保险公司信息系统;四,商品检验信息系统;五,税务管理信息系统;六,货物运输信息系统;七,本地区EDI中心系统(实际上,本地区EDI中心系统联结各个信息系统的中心)。本地电子商务系统是开展有远程国内电子商务和全球电子商务的基础系统。

(2)远程国内电子商务是指在本国范围内进行的网上电子交易活动,其交易的地域范围较大,对软硬件和技术要求较高,要求在全国范围内实现商业电子化、自动化,实现金融电子化,交易各方具备一定的电子商务知识、经济能力和技术能力,并具有一定的管理水平和能力等。

(3)全球电子商务是指在全世界范围内进行的电子交易活动,参加电子交易各方通过网络进行贸易。涉及到有关交易各。全球电子商务业务内容繁杂,数据来往频繁,要求电子商务系统严格、准确、安全、可靠,应制订出世界统一的电子商务标准和电子商务(贸易)协议,使全球电子商务得到顺利发展。

以上就是我对于最近阅读电子商务相关书籍得到的一些体会。

第二篇:电子商务英文阅读材料

Auctioningsupplycontractswithuncertaindemand

CuihongLi

GraduateSchoolofIndustrialAdministration

CarnegieMellonUniversity

5000ForbesAvenue

Pittsburgh,PA15213

cuihong@andrew.cmu.edu

AlanScheller-Wolf

GraduateSchoolofIndustrialAdministration

CarnegieMellonUniversity

5000ForbesAvenue

awolf@andrew.cmu.eduAnupriyaAnkolekarSchoolofComputerScienceCarnegieMellonUniverity5000ForbesAvenuePittsburgh,PA15213anupriya@cs.cmu.eduKatiaSycaraRoboticsInstituteCarnegieMellonUniversity5000ForbesAvenuePittsburgh,PA15213

katia@cs.cmu.edu

Abstract

Designofthecontractform,togetherwiththenegotiationmechanismandstrategy,comprisethecoredecisionsinane-contractingprocess.Inabusiness-to-businessscenarioabuyer(e.g.,aretailer)usuallyneedstosignacontractwithasupplier(e.g.,aman-ufacturer)tosatisfyademandthatisuncertainatthetimeofcontracting.Thebuyerwouldliketohaveordering?exibilitytorespondtotheuncertaindemandrealization.Butthesupplythatcanbeprovidedmaybeconstrainedbythecapacityinvestmentofthesupplier,whichhastobemadeinadvance.Thecapacityofasuppliermayei-therbeobservableandhencecontractable,orunobservableandhencenotenforcablebyacontract.Weproposetwocontractforms,anoptioncontractforthesituationwithobservablecapacity,andawholesalepricecontractwithafranchisefee(WF)forthesituationwithunobservablecapacity.Inbothcontractsthebuyerplacesher?nalorderafterthedemandisknown.Inanoptioncontractthebuyer?rstpaysapremiumfeeforreservingacertaincapacityfromthesupplierinadvance,andthenanexercisefeeforeachunitthatisordered.InaWFcontractthesupplierchargesawholesalepriceforeachunitorderedbythebuyer,butpaysa?xedfranchisefeetothebuyer.Wepresentoptimalauctionmechanismsindi?erentprotocolsforthebuyertonegotiateanoptioncontractoraWFcontractwithcompetingsuppliers.Bothcontractsgeneratehigherutil-ityforthebuyerthanthecontractinwhichthebuyerprocuresinadvance.Ourresultsshowthattheoptimalauctionsforthesetwocontractshavethesameoutcome.Wealsodiscusstheimplementationofe-contractingbasedonourcontractauctionmechanismswithsoftwareagenttechnologies.

1

1Introduction

Therapiddevelopmentofcomputerandcommunicationtechnologieshasacceleratedthebusinessprocessesfromlaborservicestoelectronic(semi-)automatedprocesses[13].Con-tractingisoneoftheimportantbusinessprocessesthathasrecentlyreceivedmuchattentioninthistrendtowardelectronictransactions.E-contractingaimstoautomatetheprocessofcreating,negotiating,closingandmonitoringtheperformanceofcontracts[2].Theproperdesignofthecontract,andthenegotiationmechanismandstrategy,dependsonthespeci?cbusinesssituation,andisthecoreofthedecisionsinthee-contractingprocess.

Contractinginabusiness-to-consumer(B2C)andinabusiness-to-business(B2B)scenarioaredi?erent.InaB2Cscenario,forexampleoftheauctionsoneBay,theitemstoexchangeareprede?nedinthequantityandotherattributes.Acontractusuallyonlyneedstospecifyaone-shotexchangecondition,forexample,theprice.Astandardcontractformcanthusexist,andthenegotiationissimple,becausetherearefewattributes,usuallyonlytheprice,tonegotiate.Butinabusiness-to-business(B2B)worldthecontractingpartiesareusuallyinvolvedinarelationshipoveranextendedhorizon.Theservice/goodtonegotiateandcontractmaybecon?gurable,andhencethecontractcanbehighlyunstructuredandinvolvemanyattributes,suchastheprice,deliverytime,quantity,etc.ThisnegotiationismorecomplicatedthaninaB2Cscenariobecausemultipleattributesareinvolved,andsometimeseventhecontractformcanbeanobjectofnegotiation.Moreover,thegoalofB2Bcontractingisnotonlytoensureaproperdivisionofpro?ts,butalsotocreatemorepro?t,bycoordinatingandenforcingthebehaviorsofbothparties.DesignofthecontractformandnegotiationmechanismisthusespeciallyimportantinaB2Bscenario,toachievecoordinationandane?cientwin-winsituationforbothparties.

Considerabuyer(retailer)thatwantstosignacontractwithasupplier(manufacturer)tosatisfythedemandinacomingsellingseason.Thebuyermaynotknowtheexactdemandintheseasonwhenshesignsthecontract,asshehastocontractwithasupplierwellinadvancesothatthelatterpartycanprepare,forexample,byprocuringcomponentsandrawmaterialsfromherupstreamsupplier.Thiscapacityset-upmayrequirelongleadtime,leavingnoopportunityforthesuppliertoexpandthecapacityduringtheseason:thecapacityinvestmentofthesupplierconstrainsthesupply.Butwhilethesupplierdoesnotwanttowastemoneyonexcesscapacity,thebuyerdoesnotwantcapacityshortages.Toensureagooddemandsatisfactionlevelthebuyerthushastoprovideincentivesforthesuppliertoinvestinsu?cientcapacity.Therearedi?erentwaystoprovidethisincentive.Onestraightforwardwayisforthebuyerto?xthequantitythatsheisgoingtobuy.Thisisequivalenttomakingadvancedprocurement,leavingnoordering?exibilitytocounterthedemanduncertainty.Anotherwaytoprovideincentivesforcapacityinvestment,whileretainingordering?exibility,istocompletetheprocurementintwostages.Inthe?rststagethebuyerreservescapacityandinthesecondstagethebuyerpurchasestheproductbasedontherealizeddemand.Thisprocesscanberegulatedbyanoptioncontract.Withanoptioncontractthebuyerpaysthesupplierapremiumfeefortherighttobuyacertainamountoftheproduct.Afterthe

2

demandisobserved,thebuyercanplaceordersfortheproductinanamountuptothenumberofoptions,payinganexercisefeeforeachunitthatisordered.Anoptioncontractallowsrisksharing,andhenceinducesbettercoordination,creatingawin-winsituationbetweentheparties.Thebuyerwillordermoreonaveragethanshewouldunderacontractinwhichshehastoperformalltheprocurementbeforethedemandisknown,andthesupplierwillinvestmoreincapacitythanshewouldwithoutcontractinguponcapacityreservation.

Withanoptioncontractthebuyermustbeabletoobserveandverifythecapacitypreparedbythesupplier.Ifthecapacityisnotobservable,thecapacityreservationcannotregulatethecapacityinvestmentofthesupplier.Inthissituationtheincentiveforcapacityinvestmentonlyreliesontheexercisefee,whichisequivalenttoawholesaleprice.Inthiscasepayingapremiumfeemakesnosense,insteadafranchisefee,paidbythesupplier,thatisindependentoftheorderedquantitycanensurebetterpro?tdistributionbetweenthetwoparties.Wecallthiscontractawholesalepricecontractwithafranchisefee(WF).

Typicallyabuyerdoesnotknowthee?ciency,ortheproductioncost,ofasupplier.Whenseveralsuppliersarepossiblecandidatestoprovidetheproduct,competitivebiddingisane?cientmechanismforthebuyertodiscoverthemostcompetentsupplierandnegotiateacontract.Thismaytakeplaceinamulti-attributeauctionthatinvolvesallthenegotiabletermsinthecontract,forexamplethepremiumfee,exercisefeeandcapacityinanoptioncontract,andthewholesalepriceandthefranchisefeeinaWFcontract.Therearetwomainclassesofprotocolsforsuchmulti-attributeauctions:The?rstclassisauctionswithamenuofcontracts,andthesecondclassisauctionswithascoringrule.Inthe?rstclasstheauctioneer,thebuyer,announcesasetofcontractalongwiththepreferenceorderbetweenthecontracts.Thesuppliersbidbychoosingacontract,andtheonewhobidsthehighestrankedcontractisthewinner.Inthesecondclasstheauctioneerannouncesascoringfunction.Thesuppliersbidbysubmittingcontracts,andthewinnerisdecidedbythescoringrule.

Inthispaperwepresentoptimalauctionmechanismsindi?erentprotocolsforbothanoptioncontractandaWFcontract,whenthecostofasupplierisunknowntothebuyer.Wealsodiscusstheimplementationandautomationofthecontractauctionmechanismswithsoftwareagenttechnologies.Althoughonewouldexpectthebuyertolosecertainadvantageswhenasupplier’scapacityisunobservable,surprisinglyweshowthatbyappropriatelydesigningthecontractformandauctionmechanism,thebuyercanactuallyachievethesameoptimalexpectedutilitywithunobservablecapacityaswithobservablecapacity.Inbothsituations,theordering?exibilityinanoptioncontractoraWFcontractresultsinhigherutilityforthebuyerthanpre-specifyinga?xedorderingquantity.

Therestofthepaperisorganizedasfollows:WereviewtherelatedworkinSection2.Section3setsuptheproblem,andprovidestheframeworkforauctionmechanismdesign.WepresenttheoptimalauctionmechanismsforanoptioncontractinSection4,andforaWFcontractinSection5.TheimplementationandautomationofthesupplycontractauctionswithsoftwareagentsisdiscussedinSection6.

3

2Relatedwork

Insupplychainmanagementdesignofcontractshasbeenanactivesubjectaimedatreconcil-ingcon?ictsandachievebettercoordinationbetweenparties:[3]providesagoodintroductionandsurveyonthiswork.Itprovidestheanalysisoftheoptimaloptioncontractandwholesalepricecontract(withoutafranchisefee)betweenabuyerandasupplierwhenthedemandforecastisprivateinformationofthebuyer,butthecostofthesupplierisknownbythebuyer.Thewholesalepricecontractresultsinlesspro?tforthebuyerwhencapacityisun-observable,ascomparedtotheoptioncontractwhencapacityisobservable.Inourpaperwestudyauctionsforsupplycontractswhentherearemultiplecompetingsuppliersandthecostsofsuppliersareunknown.Thewholesalepricecontract,byintroducingafranchisefee,actuallyresultsinthesameoptimaloutcomeasanoptioncontract.Anotherrelatedwork,

[7],investigatestheroleofoptionsinabuyer-suppliersystem,illustratinghowtheyprovide?exibilityandachievechannelcoordination.Thatworkisbasedoncompleteinformation-eachpartyknowstheother’scostorrevenue.

Auctionshavebeenconsideredinprocurementtodiscoverthemostcompetentsupplier,thuscuttingcost.Theauctionmechanismforabuyertoprocurefromoneofmultiplecompetingsuppliersisstudiedin[6]and[5].Theitemtoauctionisasupplycontractwithtwoattributes:theproductquantityandpayment.Inourpaperwestudytheauctiondesignforasupplycontractinwhichtheorderingquantityisnotspeci?edbutdeterminedafterwards,basedontherealizeddemand.Undersuchdemanduncertaintythebuyerachieveshigherpro?twithanoptioncontractoraWFcontractthaninacontractwithapre-speci?edquantity.Indirectmulti-attributeauctionmechanismsarestudiedin[4],whichproposesascoringrulebasedonwhich?rst-scoreandsecond-scoresealed-bidauctionsimplementtheoptimalauctionmechanism.Thetwoattributesinthispaperarethepriceandquality(whichcanalsobeinterpretedasthequantity).Thedesignofthescoringruleinourpaperisinspiredby[4],butourauctionsarebasedondi?erentcontracts,usinganEnglishauctionprotocol.Englishauctiondesignformulti-attributeitemsisconsideredin[9,8,10].Theutilityfunctionofthebuyerandthescoringrulearebothlinearfunctionsoftheattributes.Basedonthislinearfunctionalformtheoptimalweightsoftheattributesinthescoringruleareproposed,andthestrategiesofthebiddersareanalyzed.ThemechanismisonlyoptimalamongEnglishauctionswithlinearscoringfunctions,notwithgeneralscoringfunctionsasweallow.

Inrecentyearstherehasbeengrowingresearchinterestindesigningandimplementingau-tomatedelectronictradingsystemswithsoftwareagents.TheTradingAgentCompetition(TAC)inSupplyChainManagement[1]promotesandencouragesthedevelopmentofintelli-gentsoftwareagentscapableofbuyingorsellingproducts/materialsonbehalfofacompany.ThecompetitionisbasedonaB2Bsituation,andtheinternaloperationsofthecompaniesareintegratedintobiddingdecisions[17].Theseexchangesarebasedonaone-shotrela-tionship:thecontractsspecifytheorderingquantitiesandleavenopurchasing?exibilitytocounterdemanduncertainty.Finally,[20]studiesauctionmechanismdesignforsupplychainformationtoachieveglobale?ciency.Againtheauctionsarebasedonknowndemand.

4

3De?nitionofthemodel

Inthissectionweshall?rstdescribethenotationsandtheproblemsetting,thenintroducetheauctionmechanismdesignframework.Thebuyerhasuncertaindemanddofaproductˉ(·)=1?H(·)withprobabilitydistributionanddensityfunctionsG(d)andg(d).De?neH

forageneralprobabilitydistributionfunctionH(·).Thebuyersourcestheproductfromasupplierwithasupplycontract.Thelead-timeforproductioniszero.Butbeforeproduction(andaftercontracting)thesupplierhastoinvestincapacity,whichconstrainstheamountofsupply.Whenthecapacityisx,theexpectedsatis?eddemandisS(x),whereS(x)=ˉ(x).Ex[min{d,x}]=x?E[(x?d)+]withthederivativeS??(x)=G

Thebuyersellstheproducttoconsumersata?xedmarketpricerthatisexogenouslygiven.Therearensupplierswhocompeteforthesupplycontract.Eachsupplier’scostfunctioniscomposedoftwoparts:thecapacityinvestmentcostandtheproductioncost.Foreachunitofcapacity,whichproducesoneproduct,thecostkis?xedandidenticalforallsuppliers.Thecostisknownbythebuyerandthesuppliers.Theunitproduction

ˉ]dependsonasupplier’se?ciencyandisprivateinformationofthesupplier.costc∈[c

Followingthetraditionineconomicstheunitproductioncostisalsocalledthetypeofasupplier.Withinthepriorknowledgeofthebuyer,theproductioncostofeachsupplierfollowsanindependentandidenticalprobabilitydistributionF(c),withthedensityfunctionf(c).Theprobabilitydensityoftheminimumtypeamongthensuppliersisdenotedbyf(1)(c)=n(1?F(c))n?1f(c).WeassumethatF(c)/f(c)isanon-decreasingfunctionofc1.LetJ(c)=c+F(c)/f(c):J(c)iscalledthevirtualtypeofasupplier.Inadditionweassumethattherevenuerisbigenoughsothatr?J(ˉc)≥k.2

Generallyanauctionmechanism(B,κ,μ)hasthefollowingcomponents:asetofpossiblemessages(or“bids”)Biforeachbidderithatspeci?esthebiddingrule;awinnerdetermi-nationrule(or“allocationrule”)κ:B→PthatdeterminestheprobabilityPithatabidderiwillwinacontract,basedonthemessagesbsubmittedbyallbidders;acontractingruleμspeci?es,againasafunctionofallthemessagesb,thecontractμi(b)∈Tthatwillbeawardedtoeachbidderi[12].Anoptimalauctionmechanismisanauctionmechanismthatbringsthebestexpectedutilitytothebuyeramongallauctionmechanisms.Amechanismisindividuallyrational(IR)iftheexpectedutilityofaplayerinthismechanismisnon-negative.IRisanecessarypropertytoensurevoluntaryparticipation:onecannotforceaplayertoparticipateinthegameandacceptadealthatisworsethantheplayercouldgetoutside.Aswedonotassumeanyrestrictionsonthepossiblemessagesorthebiddingrules,thespaceofmechanismscouldbeenormouslylarge.OnespecialandsimpleclassofmechanismsareManyprobabilitydistributionssuchastheBetadistribution,whichhastheuniformdistributionasaspecialcase,satisfythiscondition.Pleasereferto[16]foranextensivediscussiononthosedistributions2Thisconditionensuresthatitispro?tableforthebuyertocontractwitheventheleaste?cienttypeofasupplier,asisshowninSection4and5.Withoutthisassumption,de?nec?suchatr?J(?c)=k.Thenthebuyerwillonlycontractwithasupplierwithc≤c?.Orequivalentlywecantreatc?astheupperboundcˉofasupplier’stype.1

5

calleddirectmechanisms.Inadirectmechanismeachbidderisaskedtodirectlyreporthertype,whichistheunitproductioncostinoursituation.Inotherwords,themessagespaceisthesameasthetypespaceinadirectrevelationmechanism.Adirectmechanism(L,M)consistsofapairoffunctions:L:[,ˉc]n→PandM:[ˉc]n→T,whereLi(c)istheprobabilitythatiwillwinacontractandMi(c)isthecontractawardedtoi[12],shouldibeoftypec.Amechanismisincentivecompatible(IC)ifitisthebeststrategyforabiddertotruthfullyrevealherprivateinformation:ICimpliesthattheexpectedutilityofasupplierismaximizedbytruthfulbidding,ortruthfulbiddingconstitutesaBayes-Nashequilibrium[11].InadirectICmechanism,eachbidderwillreporthertruetype.

Basedontherevelationprinciple,givenamechanismandanequilibriumforthatmechanism,thereexistsadirectmechanisminwhichitisanequilibriumforeachbiddertoreporthertypetruthfully,andtheoutcomeisthesameasinthegivenequilibriumoftheoriginalmechanism[12].TherevelationprincipleimpliesthattheoptimalmechanismamongdirectICmechanismsisalsooptimalamongallmechanisms.Despitethisfact,directICmechanismsarerarelyusedinpracticebecausetheyusuallyconsistofcomplexandun-intuitivewinnerdeterminationrulesandcontractingrules,sacri?cingtheadvantagesofasimplebiddingruleandbiddingstrategy.Buttheoutcomeofanoptimaldirectrevelationmechanismtellsthebestresultthatthebuyercanachieveinallpossiblemechanisms.

Inanauctionwithamenuofcontracts,thebuyerannouncesamenuofcontractsandeachsupplierbidsbyselectingonecontract.Thebuyerselectsthewinnerasthesupplierwhobidsthehighestrankedcontract,andthewinnerisawardedthatcontract3.

Inanauctionwithascoringrulethesuppliersaretheoneswhoproposecontracts,whichareevaluatedbythebuyerbasedonthescoringrule.Anauctionwithascoringrulecanbeaone-shotauction,inwhicheachsuppliersubmitsacontractonceinasealedbid,afterwhichthewinnerisselectedandthecontractisdecidedbasedonthebids;oritcanbeadynamicauction,inwhichsupplierscanupdatetheirbidsbasedonthecurrentbiddinginformation.AnEnglishauctionisonesuchdynamicauctionprotocolcommonlypracticed.WewillconsiderareverseEnglishauction,inwhichthesellers,seekingacontractwiththebuyer,startwithhigh“prices”anddecreasetheirbidssequentially.WepresentanoptimalauctionwithascoringruleinanEnglishauctionprotocol.Thesamescoringfunctioncanbeusedina?rst-scoreorsecond-scoresealed-bidauction,whichwillresultinthesameoptimaloutcomewithdi?erentbiddingstrategies.4InanEnglishauctionwithascoringrule,thebuyerannouncesascoringruleasafunctionofthenegotiableattributes,andthesuppliersbidbyeachsubmittingacontract.Theprovisionalwinneristhesupplierwhobidsthecontractwiththehighestscore,andthesupplieristentativelyawardedthecontractthatshe

Iftherearemorethanonesupplierwhobidthesamehighestrankedcontract,thetieisbrokenrandomlywithevenprobabilities.

4Thecounterpartsof?rst-priceandsecond-pricesealed-bidauctionsinamulti-attributeworldcanbecalled?rst-scoreandsecond-scoresealed-bidauctions.Inboththeseauctionsthebidderwiththehighestscoredbidwinstheauction.Inthe?rst-scoresealed-bidauctionthewinnerisawardedthecontractthatshebids.Inthesecond-scoresealed-bidauctionthewinnercanchooseanycontractthathasthesamescoreasthesecondhighestscoresubmittedbythebidders.3

6

bid5.Informedofthewinningcontractandscore,ineachroundtheothersupplierswhoarenotthewinnermayupdatetheirbidstooutbidthecurrentwinningcontractwithrespecttothescore6.Thesupplierswhocannotincreasetheirscoresquittheauctionandwillnotparticipateintherestofthebiddingprocess.Ifallsuppliers,excepttheprovisionalwinner,havequit,thentheauctionendsandtheprovisionalwinnerisawardedthewinningcontract.InSections4and5wepresentoptimalauctionmechanismsforaoptioncontractandawholesalepricecontractwithafranchisefee.We?rstderivetheoptimaldirectmechanismasabenchmarktoobtaintheoptimaloutcomethatthebuyercanachieveamongallauctionmechanisms(Section4.1and5.1).Thenweshowhowtheoptimaloutcomecanbeachievedwithanauctionwithamenuofcontracts(Section4.2and5.2)andanauctionwithascoringrule(Section4.3and5.3).

4Auctionsforanoptioncontract

Anoptioncontracthasthreeessentialnegotiableterms:theoptionquantityQO,theoptionpricewoandtheexercisepricewe.TheoptionquantityQOspeci?esthenumberofunitsofthecapacitythatthebuyerwantsthesuppliertopreparebeforetheseason,equivalentlythemaximumnumberofproductunitsthatthebuyercanorder.Foreachunitofcapacity(option),thebuyerpaysthesuppliertheoptionpricewo.Afterobservingthedemand,thebuyerplacesordersfortheproductduringtheseason.Foreachproductunitthatisordered,thebuyeradditionallypaystheexercisepricewe.RecallthatS(QO)isequaltotheexpectedsalesgivenacapacityofQO.

Givenanoptioncontract(wo,we,QO),theutilityofabuyerisequaltotheexpectedrevenue

b(w,w,Q)=(r?w)S(Q)?wQ,andtheutilityofasupplierisequalminusthefees:πOoeeoOOO

totheexpectedtotalpaymentfromthebuyerminusthecostonthecapacityandproduction,

s(c,w,w,Q)=(w?c)S(Q)?(k?w)Q.whichisrelatedtothesupplier’stypec:πOeeoOOOO

4.1Theoptimaldirectmechanism

Inanoptimaldirectmechanisminwhichthereisasinglewinner,themoste?cientsupplier,orthelowestc,mustbeawardedacontract.Otherwisethebuyercouldalwaysselectamoree?cientsupplierandbothcouldachievehigherpro?t.ThereforeanoptimaldirectmechanismisequivalenttodesigningacontractTO(c)=(wo(c),we(c),QO(c))foreachtypec.Atthebeginningoftheauctionthebuyerannouncesthecontractassociatedwitheachreportedtype,thenthesuppliersbidtheirtypes.Thesupplierwhobidsthelowesttypeisselectedasthewinnerandawardedthecontractcorrespondingtothereportedtype.Based

Againiftherearemorethanonesupplierwhobidthesamecontract,thetieisbrokenrandomlywithequalprobabilities.

6Toensuretheauctionterminatesin?nitetime,usuallyabidderisrequiredtoincreasethescoreofherbidbyanincrementnolessthanaspeci?edminimum.5

7

ontherevelationprinciple,wecanrestrictourmechanismstoICmechanisms,andstilldesignanoptimaldirectmechanism.

s(c??,c)betheutilityofasupplierwithtypecwhenshereportsthetypec??andthusLetπOs(c??,c)=[(w(c??)?c)S(Q(c??))+(w(c??)?choosesatypec??contractfromthebuyer.πOeoO????n?1ssk)QO(c)](1?F(c)).Letπ(c)=π(c,c),givenourmodeloftheprobabilitydistributionofsuppliers’types.Lemma4.1givestheconditionforamechanismbeingIC:

Lemma4.1Adirectmechanismisincentivecompatibleifandonlyif

(1)Theexpectedutilityofasuppliersatis?esthat

sπO(c)=u0+??ccˉS(QO(ρ))(1?F(ρ))n?1dρ(1)

whereu0isaconstant.

(2)QO(c)isanon-increasingfunctionofc.

Equation(1)impliesthatπs(ˉc)=u0,andπs(c??)≥πs(c)forc??≤c.Theconstantu0doesnotin?uencethechoiceofasupplier,wecanthushaveu0=0tomaximizethebuyer’sutility(ortominimizeasupplier’sutilitywiththesamecapacityinvestment)whilesatisfyingIR.??cˉˉ??csBasedonLemma4.1,theexpectedutilityofthewinningsupplierisπˉ=ccS(Q(ρ))(1?F(ρ))n?1dρf(1)(c)dc,whichcanbereformed,byinterchangingtheorderofintegration,as

πˉ=s??

ccˉS(QO(c))

??F(c)f(c)dc.f(c)(1)ˉThentheexpectedutilityofthebuyer,πˉb=cc[(r?c)S(Q(c))?kQ(c)]f(1)(c)dc?πˉs,isequal

to??cˉbπˉ=[(r?J(c))S(QO(c))?kQO(c)]f(1)(c)dc.c

Maximizingthebuyer’sexpectedutilityleadstoanoptimaldirectmechanism:

Proposition4.2Inanoptimaldirectmechanism,thenumberofoptionsintheoptioncon-tractis

ˉ?1(QO(c)=Gk),r?J(c)(2)

andtheoptionpricewo(c)andexercisepricewe(c)satisfy

??cˉ

Wo(c)+We(c)=cS(QO(ρ))(1?F(ρ))n?1dρ+cS(QO(c))+kQO(c),(1?F(c))(3)whereWo(c)=wo(c)QO(c)isthetotalpremiumfee,andWe(c)=we(c)S(QO(c))isthetotalexpectedexercisefee.

8

Wecannowcharacterizetheoptimaloutcomeofanoptioncontractauction:

1.Themoste?cientsupplieristhewinner,i.e.,theprobabilitythatthewinnerhasatypecisequaltof(1)(c)=n(1?F(c))n?1f(c).

2.Thecapacityinvestmentofthewinner,shouldshebeoftypec,isequaltoQO(c)=ˉ?1(k/(r?J(c))).G

3.Theexpectedutilityofthebuyerisequaltoπˉb=??cˉ

c[(r?J(c))S(QO(c))?kQO(c)]f(1)(c)dc.

??cˉ

c4.Theexpectedutilityofasupplierisequaltoπˉs(c)=S(QO(ρ))(1?F(ρ))n?1dρ.

Wecancomparethisoutcomewiththeoutcomeofanadvanced-purchasecontractauction.Anadvanced-purchasecontractspeci?esadeterministicnumberofproductunitsthatthebuyerordersfromthesupplier,alongwiththepaymentfromthebuyerfortheorder.Thusthistypeofcontracthasno?exibility.Suchacomparisonbetweenthebuyer’sexpectedutilitiesinbothcontractauctionsisprovidedinAppendix.Itshowsthatthebuyerachieveshigherexpectedutilitybyauctioninganoptioncontractascomparedtoanadvanced-purchasecontract.Anymechanismthatresultsinthesameoutcomeasdescribedaboveisanoptimalmechanism.Wenowusethisfacttoshowournexttwoauctionmechanismsareoptimal.

4.2Optimalauctionwithamenuofcontracts

Inanauctionwithamenuofcontracts,thedesignofthemenu,basedontheexpectationofthebiddingstrategiesofsuppliers,isthekeydecisionofthebuyer.Themenuofcontractscanberegardedascontractcustomizationfordi?erenttypesofsuppliers.Di?erenttypesofsupplierstradeo?thecapacityandpaymentdi?erently.Byo?eringdi?erentcombinationsofthenumberofoptionsandthepayment,thebuyerisabletocustomizethedesignofthecontractswithrespecttothesupplier’stype.Thisallowshertoextractmorepro?tfromthesystemwhenusingamoree?cientsupplier.Intheoptimaldirectmechanismwehavedesignedacontract(wo(c),we(c),QO(c))foreachtypecofasupplier.Givenamenuofthesecontracts,theauctionisoptimalifeachsupplierwillchoosethecontractdesignedforhertypebasedonthebiddingstrategytomaximizeherownexpectedutility.Proposition4.3establishesthatthecontractsintheoptimaldirectmechanismcomposeanoptimalmenuofcontracts.

Proposition4.3GivenamenuofcontractsTOwhereTO(c)=(wo(c),we(c),QO(c))satis-?esEquations(2)and(3),itisaBayes-NashequilibriumstrategyforasupplierctobidthecontractTO(c).TheauctionwiththemenuofcontractsTOresultsintheoptimaloutcome.

9

4.3Optimalauctionwithascoringrule

Inthisprotocolsuppliersbidcontracts,whichareevaluatedwithascoringrule.Letthescoreofacontractbid(wo,we,QO)bedenotedbysO(wo,we,QO).Areasonablescoringrulewillattachahigherscoretoacontractwithlowerpaymentorhighercapacity(optionquantity).Ifthevalueofthecapacitycanbemeasuredwithmonetaryvaluesindependentofthepayment,thenthescoringrulecanbeexpressedasaquasi-linearfunction:sO(wo,we,QO)=uO(QO)?(weS(QO)+woQO),whereuO(QO)isafunctionthatevaluatesthecapacityQOinmonetaryvalue,andweS(QO)+woQOistheexpectedpayment.Withsuchaquasi-linearscoringruletheoptionquantitythatasupplierwillbiddoesnotdependonthescore,butonlythescoringruleandthesupplier’stype[4].

Lemma4.4TheoptimalquantityQO(c)intheoptimalbidofasupplierwithtypecsatis?esdˉuO(QO)=cG(QO)+k.

OnemightthinkthatthebuyercouldsimplydesignthescoringruleaccordingtoherutilityfunctionandletuO(QO)=rS(QO).Thiswouldworkifthepro?tofatypeisindependentofthecapacitydecisionofothertypes,whichisthesituationwhenthebuyerhascompleteinformation.Butifthetypeisprivateinformationofasupplier,thecapacitydecisionofonetypealsoin?uencestheutilityofthetypesthataremoree?cient,andthusalsotheexpectedpro?tofthebuyerfromthosetypes.ThiscanbeseenfromEquation(1),whichsaysthattheexpectedutilityofasupplierisanincreasingfunctionofthelesse?cienttypes’quantities.Thereforeforthebuyerawardinganoptionquantitytoonetypecostssomepro?tfromthemoree?cienttypes.Basedonthisconsiderationthebuyerwillinduceadownwarddistortionofthecapacitydecisionfromthelevelthatwouldbeoptimalbasedonthebuyer’sutilityfunction.Thedownwardfactorinthescoringfunctioncanbedenotedby?(Q)>0,andthescoringruleiss(wo,we,Q)=(r?we)S(Q)?woQ??(Q).Considerthefollowingscoringrule:??QF(c(q))ˉG(q)dq(4)s(wo,we,Q)=(r?we)S(Q)?woQ?hf(c(q))

wherehisaconstant,andc(q)isthetypethatisawardedoptionquantityqintheoptimalˉ(q)=k/(r?J(c)).outcome:G

Proposition4.5WiththescoringruledescribedinEquation(4),theauctionachievesthesameoutcomeastheoptimalauctionmechanism.

ThestrategyofabidderinanEnglishauctionissimple.ThesupplierintypecwillbidtheoptionquantityfollowingLemma4.4,anddecreasewoand/orweeachtimeinthesmallestamounttooutbidthewinningcontract,untilthecontractbringszeropro?t.Thehighestscorethatasupplierccanreachisequaltou(Q)?(cS(Q)+kQ),withthetotalpaymentwoQ+weS(Q)equaltothetotalcostkQ+cS(Q).

10

5Auctionsforawholesaleprice-franchisefee(WF)contractWithanoptioncontractthebuyercanreservecertaincapacityatasuppliertoensuree?cientsupplywhenthecapacityisobservable.Butasupplier’spromiseonthecapacitycannotbeenforcedwhenthecapacityisunobservable.Thereforethecontractwithunobservablecapacityshouldnotinvolveanypromiseorcommitmentonthequantity,asthewholesaleprice,thepricethatthebuyerwillpaythesupplierforeachproductthatisprovided,istheonlycontracttermthatwillin?uencethesupplier’scapacitydecision.Ifthebuyerpromisesahigherwholesaleprice,thesupplierwillbuildmorecapacitybecauseofthehighermargin,butthemarginofthebuyerwillbelower.Thebuyer’sdesignofthewholesalepricehastotradeo?themarginofrevenueandthecapacityincentive.Inadditiontothewholesalepricethesupplycontractcanalsoincludeafranchisefeewhichisindependentoftheamountofsupply.Afranchisefeeallowsthebuyertoextractsome?xedamountofpro?tfromthesupplier.Thefranchisefeewillbehigherifthewholesalepriceislower.Supplierswithdi?erentproductioncostswilltradeo?thewholesalepriceandfranchisefeedi?erently.Combiningthesetwoattributesallowsthebuyertodi?erentiatethesuppliers’typesbyprovidingdi?erentpro?les.Wecallacontractinthisoriginalformawholesaleprice-franchisefee(WF)contract.

LetaWFcontractbedenotedby(w,t),wherewisthewholesalepricepaidbythebuyerandtisthefranchisefeepaidbythesupplier.GivenaWFcontract(w,t),asupplierchastodecidehercapacityQtooptimizeherexpectedutility(w?c)S(Q)?kQ?t,whichgivesˉ(QW(w,c))=k.TheexpectedutilityofthetheoptimalcapacityQW(w,c)satisfyingGssuppliercwiththecontractisπW(c)=(w(c)?c)S(QW(w,c))?kQW(w,c)?t,andthe

b=(r?w)S(Q(w,c)).expectedutilityofthebuyerisπWW

5.1Theoptimaldirectmechanism

InadirectmechanismthebuyerwillannounceaWFcontract(w(c),t(c))foreachtypeofsupplierc,andsuppliersbidbyreportingtheirtypes.Themoste?cientsupplierwillbeawardedthecontractcorrespondingtoherreportedtype.Asintheanalysisforoptioncontractauctions,wewill?rstderivetheconditionofanICmechanism,andthenreformtheexpectedutilityofthebuyerbasedontheICcondition,whichleadstotheoptimalICdirectmechanism.

s(ρ,γ)betheexpectedutilityofasupplierwiththetypeγbyreportingtypeρintheLetπWs(ρ,γ)=(w(ρ)?γ)S(Q(w(ρ),γ))?kQ(w(ρ),γ)?t.Letπs(ρ)=WFcontractauction,πWWWW??2?sssssssπW(ρ,ρ),πW,1(ρ,γ)=πW(ρ,γ),πW,2(ρ,γ)=πW(ρ,γ),andπW,12(ρ,γ)=πW(ρ,γ).Proposition5.1Anecessaryandsu?cientconditionofICisthat

s??(c)=?S(Q(c))(1?F(c))n?1,1.πW

s??2.πW,12(ρ,γ)≥0,whichisimpliedbyw(c)≤0.

11

Basedonthe?rstconditioninProposition5.1,theexpectedutilityofasuppliercinanoptimalincentivecompatiblemechanismis

sπW(c)=??ccˉS(QW(ρ))(1?F(ρ))n?1f(ρ)dρ(5)

whereQW(ρ)isthecapacitythatasupplierwithtypeρwillsetupgiventhecontractintheoptimalWFcontractauction.GivenEquation(5),theexpectedutilityofthebuyeris??ˉb=csπWc[(r?c)S(QW(c))?kQW(c)?π(c)]f(1)(c)dc,whichasbeforeisequalto

bπW=??ccˉ[(r?J(c))S(QW(c))?kQW(c)]f(1)(c)dc.(6)

TomaximizeherutilitythebuyershouldinducethecapacityinvestmentQW(c)bydesigningw(c)sothattheintegratedfunctioninEquation(6)ismaximized,iftheICconditioninProposition5.1canbesatis?ed.Maximizing(r?J(c))S(QW(c))?kQW(c)leadstotheˉ(QW(c))=k.Proposition5.2showsthatsuchcapacityinvestmentQW(c)thatsatis?esGcapacityinvestment,whichisthesameasintheoptimaloutcomewhencapacityisobservable,canactuallybeimplementedbyanoptimalWFcontractauctionwithunobservablecapacity.Proposition5.2AnoptimalWFcontractauctionwithunobservablecapacitiesimplementsanoptimaloptioncontractauctionwithobservablecapacities.InanoptimalWFcontractauction,thedesignofcontracts{(w(c),t(c))}satis?es

kF(c)w(c)=+c=r?f(c)G(Q(c))

??cˉ(7)

t(c)=ξ(Q(c))?cS(Q(ρ))(1?F(ρ))n?1dρ

(1?F(c))(8)

S(q)kˉ?1whereξ(q)=?q,andQW(c)=G()isthecapacitythatasupplierwillvoluntarily

choosestoset.

Onewouldexpectthatwhenasupplier’scapacityisunobservableandhencenotcontractable,theutilityofthebuyerwoulddecreasefromthesituationwithobservablecapacitysinceshehasonelesstermthatthecontractcanregulateupon.ButProposition5.2showsthatbycarefullydesigningthecontractformandtheauctionmechanism,thebuyerdoesnotloseutilitybecauseoflosingthiscontractableterm.Thebuyerinducesthesamecapacityinvestmentwiththewholesaleprice,andensuretheincentivecompatibilityofsuchcapacityinvestmentwiththefranchisefee.Ifthecontractonlyincludesthewholesaleprice,thecapacityinvestmentofasupplierwillbedi?erentbecausethenasuppliermaynotchoosethewholesalepricedesignedforhertype.

12

5.2Optimalauctionwithamenuofcontracts

TheWFcontractsdesignedforeachtypeofasupplierintheoptimaldirectmechanismcomposeanoptimalmenuofcontracts,andwiththismenuofcontracts,asupplierwithtypecwillselectthecontract(w(c),t(c)).

Proposition5.3GivenamenuofcontractsTWwhereTW(c)=(w(c),t(c))satis?esEqua-tion7and8,itisaBayes-NashequilibriumstrategyforasupplierctobidthecontractTW(c).TheauctionwiththemenuofcontractsTWresultsintheoptimaloutcome.

5.3Optimalauctionwithascoringrule

Letthescoringfunctionbede?nedasaquasi-linearfunction:sW(w,t)=?uW(w)+t.TheoptimalbidonthewholesalepricebyasupplierisgiveninLemma5.4,andisindependentofthescoreofthewholebid.

Lemma5.4Thewholesalepricewintheoptimalbidofasupplierwithtypecsatis?esdd[kQW(w,c)?(w?c)S(QW(w,c))]=uW(w)dwdw(9)

Toensurethewholesalepriceandhencethecapacityinvestmentarethesameasintheoptimaloutcome,thebuyerwoulddesignthefunctionuW(w)sothatEquation9issatis?ed

(c)atw=r?F

.Considerthefollowingscoringrule:

sW(w,t)=??w

α?S(QW(?,c(?)))d?+t(10)

whereαisaconstant,andc(w)isthetypecorrespondingtothewholesalepricewinthe

(c(w))optimalmechanism,i.e.,w=r?F

.

Proposition5.5WiththescoringruledescribedinEquation10,theauctionachievestheoptimaloutcome.

Asupplier’sbeststrategyissimple:Inthebeststrategyasuppliercwillalwaysbidthe(c)wholesalepricew(c)=r?F

followingEquation9.Asupplierwillsequentiallyincrease

thefranchisefeeuptothelevelthatbringszeropro?tinexpectationgiventhewholesaleprice.

13

6Electroniccontractingimplementation

Thissectionprovidesanoverviewofanimplementationofthemechanismsdiscussedinearliersections.We?rstpresenttheRETSINAarchitecture[18],amulti-agentplatformthatprovidesmuchoftheinfrastructureforautomatedcontracting.Wethenpresentthecontractnegotiationprocess,asitwouldtakeplacewithinRETSINAanddiscussthedesignofacontractingagent,responsibleforcoordinatingthenegotiationprocessandproducingthe?nal,executablecontract.

6.1TheRETSINAmulti-agentarchitecture

RETSINA(ReusableEnvironmentforTaskStructuredIntelligentNetworkedAgents)[18]providesanenvironmentforalooselycouplednetworkofsoftwareagentstointeracttosolveproblemsthatarebeyondtheindividualcapacitiesorknowledgeofeachproblemsolver.RETSINAenablesheterogeneousagentsthataredistributedacrossnetworkstocollaboratetoperformtasks.Itisthereforewell-suitedasaplatformtoimplementthecontractingmechanismsdiscussedinprevioussectionsofthepaper.

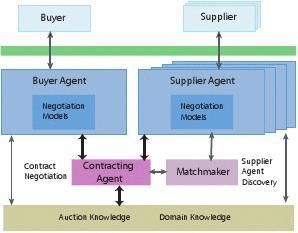

EachRETSINAagento?ersasetofservices,de?nedbytheagent’scapabilities.Inordertoaccomplishitstasks,eachagenthascommunicationandplanningmodules.Thecom-municationmodulesends,receivesandinterpretsmessagesandrequestsfromotheragents.Theplanningmoduletakesasetofgoals,suchassecuringacontract,andproducesaplanortaskstructuretosatis?estheagent’sgoals.RESTINAprovidesseveraldi?erentkindsofagentsthatinteracttocollectivelyaccomplishauser’sobjectives.WedescribetheRETSINAarchitecture,asusedforelectroniccontracting,below(Figure1).

In:Interface

AgentsBuyer/Supplier

Out:

ContractsTaskAgents

MiddleAgents

Information

AgentsFigure1:ElectronicContractingusingtheRETSINAmulti-agentarchitecture

Ourscenarioassumesasinglebuyerandmultiplesuppliers.Throughinterfaceagents,thebuyerandthesupplierssubmittheirpreferencesforcontractstothebuyerandsupplier

14

agentsrespectively.ThebuyerandsupplieragentsareimplementedastaskagentswithinRETSINA.Taskagentshelpusersperformtasks,formulateproblem-solvingplansandcarryouttheseplansbycoordinatingandexchanginginformationwithotheragents.Thebuyerandsupplieragentshaveanadditionalmodule,whichencapsulatesthenegotiationdecisionmodelsdiscussedinthispaper.Thedecisionmodelsusethepreferencesofthebuyertogenerateacontractingmechanism,forexampleamenuofcontractsorascoringrulefortheevaluationofcontracts.Itisthenpassedontoacontractingagent,whichlocatessupplieragentsthroughaMatchmakerandcoordinatesthecontractnegotiationprocess.

TheMatchmakerisaRETSINAmiddleagent[19],helpingmatchagentsthatrequestser-viceswithagentsthatprovideservicesinthesystem.Forexample,thecontractingagentcanquerytheMatchmakerforsupplieragentsthathaveregisteredwiththeMatchmakerpreviously.Thecontractingagentisitselfamiddleagent,inthatitcoordinatestheactualcontractnegotiation,matchingabuyeragentwiththebestsupplieragentanddrawingupanexecutablecontract.

Allagentsinvolvedinthecontractnegotiationprocessmaymakeuseofinformationagents,whichprovideaccesstoinformationfromheterogeneousinformationsources,suchasdatabasesandknowledgebases.Forelectroniccontracting,informationagentsprovidetheagentsin-volvedinthecontractnegotiationwithdomainknowledge,suchasthedemandforecastin-formation,capacitycostandthegeneralproductione?ciencyofsuppliers.Furthermore,theinformationagentsprovidegeneralknowledgeaboutdi?erentkindsofauctionmechanisms,suchasauctionswithamenuofcontracts,withscoringrules,?rstpriceandsecond-pricesealedbidauctions,etc.

Thus,severaldi?erentkindsofagentsparticipateinthecontractnegotiationprocess.Inthenextsection,wedescribethecontractnegotiationprocessindetail.

6.2TheContractNegotiationProcess

Figure2:TheContractNegotiationProcess

15

Thecontractnegotiationisamulti-agenttransaction,involvingabuyeragent,severalsupplieragents,acontractingagentandamatchmaker.Inordertoinitiateacontractnegotiationusingaparticularauctionprotocol,thebuyeragent?rstneedstolocateacontractingagentthatsupportsthedesiredauctionprotocol.ThenegotiationprocessthatfollowsisdisplayedinFigure2andissummarizedinthefollowingsteps:

1.Thebuyeragentcontactsthecontractingagenttoinitiateacontractnegotiation.Itsrequestincludesinformationaboutthesupplyorservicetocontracton,e.g.theproductsupplyforthenextdemandseason,thecontractform(e.g.anoptioncontractorwholesaleprice-franchisefee(WF)contract)andtheauctionprotocol.

2.ThecontractingagentsendsaqueryrequesttotheMatchmakeraboutsupplieragents.

3.TheMatchmakerreturnsalistofsupplieragentstothecontractingagent.

4.Thecontractingagentcontacts(asubsetof)thesupplieragentswithcontractinginformation,suchasthecontractingrequirementanddemand,thecontractformandtheauctionprotocol.

5.Thesupplieragentsinformthecontractingagentoftheirinterestinparticipatinginthecontractnegotiation.

6.Thecontractingagentsendsnegotiationinformationtoallbuyerandsupplieragents.Thenegotiationinformationconsistsofthenumberofbiddersparticipatinginthenegotiationandacontracttemplate,whichdescribesthecontractparameters,suchaspriceofgoods,andwhethertheyareundernegotiation.

7.Thebuyeragentsendsthecontractingagentthemechanism,forexamplethemenuofcontractsorascoringrule,thatwillbeusedforthecontractnegotiation.

8.Thecontractingagentsendsthecontractingmechanisminformationtothesupplieragents.

9.Thesupplieragentsrespondbysubmittingcontractbidstothecontractingagent.

10.Thecontractingagentselectsthewinningbidandinformsallpartiesofthewinningbid.

11.Inthecaseofadynamicauctionwithmultiplerounds,steps9and10(thesupplieragents

submitcontractbidsandthecontractingagentselectsthewinningbid)arerepeated.Afterthelastroundofthecontractingprocess,thecontractingagentconstructsanexecutablecontractfromthecontracttemplateandtheresultsofthecontractnegotiation.Thisexecutablecontractissenttoboththebuyeragentandthewinningsupplieragent.

Thecontractingagentgeneratesacontracttemplatefromthebuyeragent’sinformationinstep1andtheexecutablecontractinstep11,usingitsknowledgeaboutcontractsandtheexecutionenvironmentofthecontract.Aninterestingapproachtotherepresentationofcontractknowledge,contractsandcontracttemplatesisprovidedbytheContractBot[15]framework,whichusesdeclarativerepresentationsofacontracttemplatetonegotiateafullexecutablecontract.ContractBotusesCourteousLogicPrograms(CLP)[14]torepresentcontractsandcontracttemplates.Courteouslogicprogramsenablethespeci?cationofthescopeofpotentialcon?ictwithincontracts,suchasmutuallyexclusivecontractcon?gura-tions,andspeci?cationofpartially-orderedprioritiesbetweenrules,whichisusedtoresolveinconsistenciesbetweentherules.

16

Acknowledgement

ThisworkwassupportedinpartbyAFOSRgrantF49620-01-1-0542andAFRL/MNKgrantF08630-03-1-0005.

References

[1].

[2]S.AngelovandP.Grefen.B2Becontracthandling-asurveyofprojects,papersandstandards.Technicalreport,UniversityofTwente,TheNeterlands.

[3]G.CachonandF.Zhang.Fastdeliverythroughcompetingsuppliers.MSOM2003.

[4]Y.-K.Che.Designcompetitionthroughmultidimensionalauctions.RANDJournalofEconomics,24(4):668–680,1993.

[5]F.Chen.Auctioningsupplycontracts.Technicalreport,GraduateSchoolofBusiness,ColumbiaUniversity,2001.

[6]S.DasguptaandD.F.Spulber.Managingprocurementauctions.InformationEconomicsandPolicy,4:5–29,1989/90.

[7]Y.B.DawnBarnes-SchusterandR.Anupindi.Optimizingdeliveryleadtime/inventoryplacementinatwo-stageproduction/distributionsystem.Technicalreport,UniversityofChicago,2000.

[8]R.A.-S.EstherDavidandS.Kraus.AnEnglishAuctionProtocolforMulti-AttributeItems,volume2531ofAgentMediatedElectronicCommerceIV:DesigningMechanismsandSystems,LNAI,pages52–68.2002.

[9]R.A.-S.EstherDavidandS.Kraus.Protocolsandstrategiesforautomatedmulti-attributeauction.InProceedingsofthe3rdInternationalConferenceonAutonomousAgentsandMulti-AgentSystems(AAMAS2002),July2002.

[10]R.A.-S.EstherDavidandS.Kraus.Bidders’strategyformulti-attributesequential

englishauctionwithadeadline.InProceedingsofthe3rdInternationalConferenceonAutonomousAgentsandMulti-AgentSystems(AAMAS2003),July2003.

[11]D.FudenbergandJ.Tirole.GameTheory.MITPress,1991.

[12]V.Krishna.AuctionTheory.AcademicPress,2002.

[13]D.Lucking-ReileyandD.F.Spulber.Business-to-businesselectroniccommerce.Journal

ofEconomicPerspectives,15(1):55–68,Winter2001.

17

[14]D.M.Reeves,B.N.Grosof,M.P.Wellman,,andH.Y.Chan.Towardsadeclarative

languagefornegotiatingexecutablecontracts.InProceedingsoftheAAAI-99WorkshoponArti?cialIntelligenceinElectronicCommerce(AIEC-99),July1999.

[15]D.M.Reeves,M.P.Wellman,andB.N.Grosof.AutomatedNegotiationfromDeclarative

ContractDescriptions.November2002.

[16]K.Rosling.Inventorycostratefunctionswithnonlinearshortagecosts.Operations

Research,50(6):1007–1017,2002.

[17]J.SunandN.Sadeh.Coordinatingmulti-attributereverseauctionssubjecttotemporal

andcapacityconstraints.InProceedingsof2004HawaiiInternationalConferenceonSystemSciences(HICSS-37),January2004.

[18]K.Sycara,K.Decker,A.Pannu,M.Williamson,andD.Zeng.Distributedintelligent

agents.IEEEExpert,December1996.

[19]K.Sycara,K.Decker,andM.Williamson.Middle-agentsfortheinternet.InProceedings

ofIJCAI-97,January1997.

[20]W.E.WalshandM.P.Wellman.Decentralizedsupplychainformation:Amarket

protocolandcompetitiveequilibriumanalysis.JournalofArti?cialIntelligenceResearch,19:513–567,2003.

Appendix

ProofofLemma4.1:

ssNecessary:Ifthecontractisincentivecompatible,πO(c)=maxc??πO(c??,c).Withoutlossofgenerality

ssssssletc??>c.ICimpliesthatπO(c??,c)?πO(c??,c??)≤πO(c,c)?πO(c??,c??)≤πO(c,c)?πO(c,c??),whichis

ss(c??,c??)≤(c???c)S(QO(c))(1?F(c))n?1,equivalentto(c???c)S(QO(c??))(1?F(c??))n?1≤πO(c,c)?πOsπs(c,c)?π(c??,c??)S(QO(c??))(1?F(c??))n?1≤≤S(QO(c))(1?F(c))n?1.ThereforeS(QO(c))(1?

s??F(c))n?1isadecreasingfunctionofc.Whenc??→??c,theinequalityimpliesthatπO(c)=?S(QO(c))(1?cn?1sssn?1F(c)).LetπO(ˉc)=u0,thenπ(c)=π(ˉc)+c?S(Q(ρ))(1?F(ρ))dρ.ˉ??cssSu?cient:Assumetwotypesc??>c.GivenEquation1,πO(c??)?πO(c)=c??S(QO(ρ))(1?F(ρ))n?1dρ.??c??Buttherighthandsideisnogreaterthan≤c?S(QO(c??))(1?F(c??))n?1dρ=S(QO(c??))(1?

ssF(c??))n?1(c???c),sinceQO(c)≥QO(c??).ThereforeπO(c)≥πO(c??)?S(QO(c??))(1?F(c??))n?1(c?c??)=

s[We(c??)+Wo(c??)?kQO(c??)?cS(QO(c??))](1?F(c??))n?1=πO(c??,c).Hencethecontractisincentive

compatible.

ProofofProposition4.1:Weonlyneedtoprovethatthemechanismisincentivecompatible,sinceQO(c)inEquation2maximizesthebuyer’sexpectedutilitybasedontheassumptionthatthemech-

sssanismisincentivecompatible.WewillproveICbyshowingthatπO(c??,c)≤πO(c).πO(c??,c)=??cˉ

[(we(c)?c)S(Q(c))+(wo(c)?k)QO(c)](1?F(c))??????????n?1=[c??S(QO(ρ))(1?F(ρ))n?1dρ

+(c???c)S(QO(c??))](1?

18

F(c??))n?1=??cˉn?1??????n?1sS(Q(ρ))(1?F(ρ))dρ+(c?c)S(Q(c))(1?F(c)).π(c)=S(Q(ρ))(1?O??cc????cF(ρ))n?1dρ.Thenπs(c)?πs(c??,c)=cS(Q(ρ))(1?F(ρ))n?1dρ?(c???c)S(Q(c??))(1?F(c??))n?1≥??c??S(Q(c??))(1?F(c??))n?1dρ?(c???c)S(Q(c??))(1?F(c??))n?1=0.Thereforeasupplierwillbidctruthfully.??cˉ

Comparinganoptimaloptioncontractauctionandadvanced-purchasecontractauction:

Basedon[5],inanoptimaladvanced-purchasecontractmechanism,thequantityQA(c)thatthe

ˉ(QA(c))=k+J(c),theexpectedutilityofbuyerwillbuyfromawinnerwithtypecsatis?esthatG??cˉsn?1basuppliercisπA(c)=cQA(ρ))(1?F(ρ))dρ,andtheexpectedutilityofthebuyerisπA=??cˉ[rS(QA(c))?(k+J(c))QA(c)]f(1)(c)dc.c

LetIA(QA,c)=rS(QA(c))?QA(c)(J(c)+k)andIO(QO,c)=S(QO(c))(r?J(c))?kQO(c).Then??c??cˉˉbbπO=cIO(QO,c)f(c)dc,πA=cIA(QA,c)f(c)dc.QO(c)≥QA(c)becauseG(QA(c))?G(QO(c))=

bb+J(c)?r)≤0.ThenπO≥πA.ThisisbecauseIO(QO,c)≥IO(QA,c).ButIO(QA,c)?

IA(QA,c)=(QA(c)?S(QA(c)))J(c)≥0.J(c)(k

ProofofProposition4.3:Itsu?cestoprovetheincentivecompatibilityandfollowstheproofofProposition4.2.

ProofofLemma4.4:Foragivenscores,asupplierwillchooseqtomaximize(we?c)S(q)+(wo?k)q

?subjectto(r?we)S(q)?woq??(q)=s.LetW=weS(q)+woq.If((r?c)S(q)?kq??(q))=0,

forexample,rS??(q)????(q)>cS??(q)+k,thenwecanhaveq??=q+??for??>0verysmall,andW??=W+(rS(q??)+?(q??))?(rS(q)+?(q)).WithW??andq??,thescoreisthesame,butthesupplierhashigherutilitybecauseW???W?[(cS(q??)?kq??)?(cS(q)?kq)]=(rS(q??)+?(q??))?(rS(q)+?(q))?[(cS(q??)?kq??)?(cS(q)?kq)]=(rS??(q)????(q))???(cS??(q)+k)??>0.

ProofofProposition4.5:FollowingLemma4.4,asupplierwithtypecwillchoosetheoptionquantity

?QO(c)tomaximize(r?c)S(q)?kq??(q).Thisisbecause((r?c)S(q)?kq??(q))=(r?c?

independentofthescore.

Letsˉ(c)=(r?c)S(QO(c))?kQO(c)??(QO(c))bethemaximumscorethatcanbereachedbyasupplierwithtypec.Atthecontractwiththemaximumscoretheutilityofasupplieriszero.InanEnglishauction,themoste?cientsupplierwillbethewinnerbecausethemaximumscoreofamoree?cientsupplierishigher.Thereforetheprobabilityofbeingthewinner,andthecapacityinvestmentofthewinner,inanEnglishauctionarethesameasintheoptimalmechanism.FollowingtheproofofProposition4in[4],theEnglishauctionwiththescoringruleEquation4implementstheoptimalmechanism.

ProofofProposition5.1:ThecapacitydecisionofasupplierwithtypecisQW(c??,c)ifshereports

stypec??andisselectedasthewinner.πW(c??,c)=[(w(c??)?c)S(Q(c??,c))?kQW(c??,c)?t(c??)][1?

k?s???????????ˉ(QW(c??,c))=ˉF(c??)]n?1,G,πW(c,c)=[(w(c)?c)G(QW(c,c))QW(c,c)?S(QW(c,c))?

?kQW(c??,c)][1?F(c??)]n?1=?S(QW(c??,c))[1?F(c??)]n?1.

Necessary:

?sss??ICimpliesthatc=argmaxc??πW(c??,c).Bytheenveloptheorem,itfollowsthatπW(c)=πW(c??,c)|c??=c.

s??ˉ(QW(c))?QW(c??,c)|c??=c?S(Q(c))?k?QW(c??,c)|c??=c][1?F(c)]n?1=HenceπW(c)=[(w(c)?c)G?S(QW(c))[1?F(c)]n?1andthe?rstconditionshouldbesatis?edinanICmechanism.Actually1F(Q?(QO(c)))ˉO)G(q)?kf(QO(QO(c)))whichiszeroifq=QO(c).ThereforeasupplierwithtypecwillchooseQO(c)

19

ss??ssthe?rstconditionisequivalenttoπW,1(c,c)=0.ItisbecauseπW(c)=πW,1(c,c)+πW,2(c,c),and

s??sn?1sπW(c)=πW,ifπW,2(c,c)=?S(QW(c))[1?F(c)]1(c,c)=0,whichisimpliedbyIC.

ssssIfthemechanismisincentivecompatible,πW(c??,c)≤πW(c,c)andπW(c,c??)≤πW(c??,c??).Adding

ssssupthesetwoinequalitiesgivesπW(c??,c)?πW(c??,c??)≤πW(c,c)?πW(c,c??).Itisequivalentto??c????cssπ(ρ,γ)≤0,andimpliesthesecondconditionπW,12(ρ,γ)≥0.cc??W,12

Su?cient:

ssNowsupposeπW,12(ρ,γ)≥0andπW,1(c,c)=0.IfamechanismisnotIC,

ssπW(c??,c)>πW(c,c)???c??

?

?

?πs(ρ,c)dρ>0c??W,1??css[π(ρ,c)?πW,1(ρ,ρ)]dρc??W,1??c??csπ(ρ,γ)dγdρ>0ρW,12csπW,12(ρ,γ)<0.>0

sItcontradictstheconditionπW,12(ρ,γ)≥0.Thereforethe?rstandsecondconditionsaresu?cient

foranICmechanism.

?sn?1ˉ(QW(ρ,γ))?QW(ρ,γ)(1?F(ρ))n?1+(n?ButπW,]=?G12(ρ,γ)=?[S(QW(ρ,γ))(1?F(ρ))?1n?2??ˉ(QW(ρ,γ))=1)S(QW(ρ,γ))(1?F(ρ))f(ρ).Ifw(c)≤0,thenQW(ρ,γ)≤0becauseG.

Thereforew(c)≤0implies??sπW,12(ρ,γ)≥0.

ProofofProposition5.2:Itsu?cestoprovethatthismechanismisincentivecompatible.Basedon

(n?1)f(c)t??(c)dF(c)??ˉEquation8,?[t(c)?kξ(QW(c))]W=?=w(c).BecauseG(QW(c))=WF(c))(q)g(q)]=?S(QW(c))(1?F(c)),givenξ(q)=S

Therefore(t?kξ(QW(c)))(1?.??cˉsF(c))n?1=cS(Q(ρ))(1?F(ρ))n?1dρ.Thentheexpectedutilityofasuppliercis:πW(c)=[(w(c)?

kn?1c)S(QW(c))?t(c)?kQW(c)](1?F(c))n?1=[=WS(QW(c))?t(c)?kQW(c)](1?F(c))??cˉ[kξ(QW(c))?t(c)](1?F(c))n?1=cS(Q(ρ))(1?F(ρ))n?1.The?rstconditioninProposition5.1

issatis?ed.BasedontheassumptionthatF(c)/f(c)isanincreasingfunctionofc,w??(c)<0,andsothesecondconditionisalsosatis?ed.k??,w(c)n?1=dk+c)(=1+kg(QW(c))Q??W(c).Wn?1??Thesetwoequalitiessuggestd[(t?kξ(QW(c)))(1?

ProofofProposition5.3:Itsu?cestoprovetheincentivecompatibilityandfollowstheproofofProposition5.2.

ProofofLemma5.4:ItissimilartotheproofofseparabilityinLemma4.4.IfEquation9doesnothold,thesuppliercanalwaysincreasewanddecreasetiftherighthandsideisbigger,ordecreasewandincreasetifthelefthandsideisbigger,sothatthescoredoesnotchangebuttheutilitybasedonthecontractisincreased.

ProofofProposition5.5:FollowingLemma5.4,asupplierwithtypecwillchoosethewholesaleprice

(c)d??w(c)=r?F

becauseu(w)=S(QW(w,c(w)))isequalto[(w?c)S(QW(w,c))?kQW(w,c)]=

S(QW(w,c))whenw=w(c).HenceasupplierwithtypecwillbuildcapacityQW(c)thatisequaltotheoutcomeinanoptimalmechanism.Sincethemoste?cientsupplierwillbethewinnerinanEnglishauction,theEnglishauctionwiththescoringruleEquation10implementstheoptimalmechanism.

20