XX大学

毕业设计(论文)开题报告

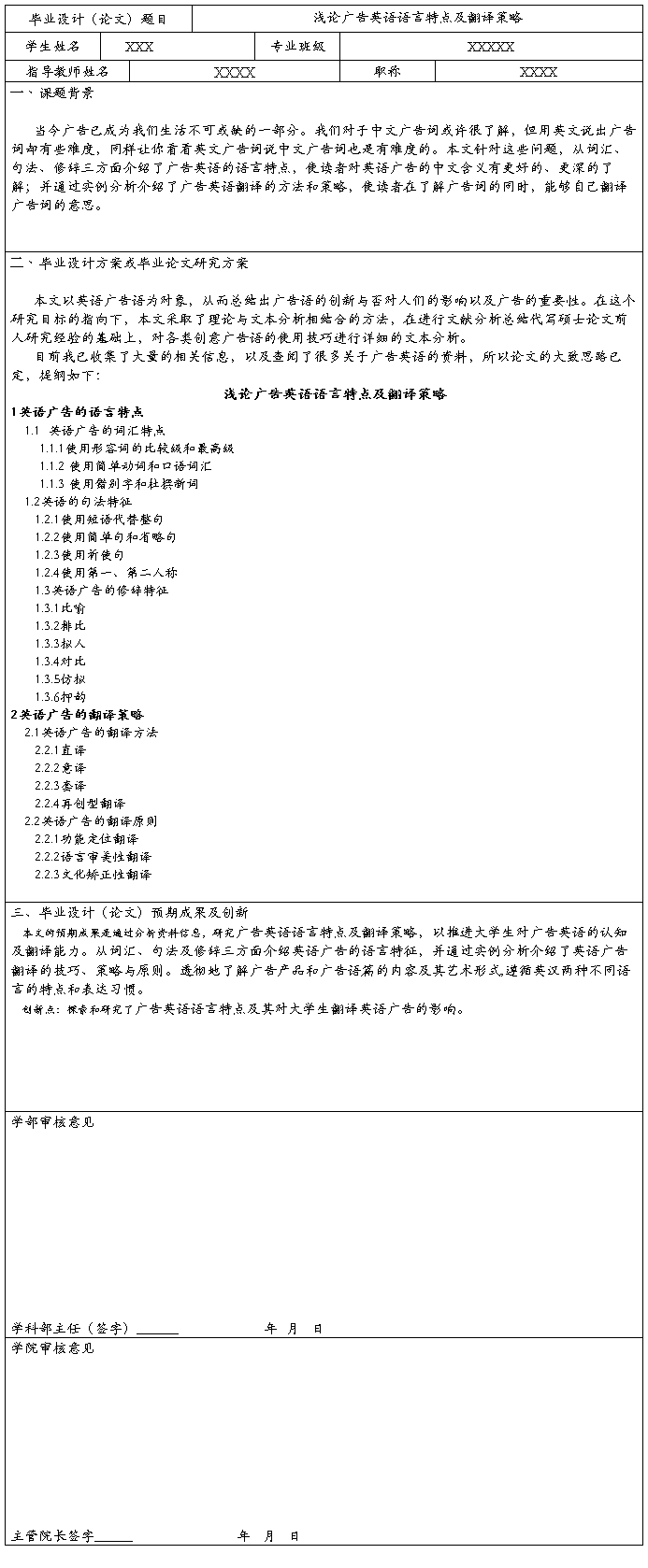

课题名称 浅论广告英语语言特点及其翻译策略

使用专业 商务英语

开题教师 XXXXX

职 称 XXXXX

20##年 月 日

XXXXXXXXXXXXX大学

2010 届毕业设计(论文)开题报告

注:此表中的一、二、三项,由学生在教师的指导下填写。

第二篇:商务英语论文

About Influences 0n our import and export trade and Countermeasures of Long-term Appreciation of RMB

中文摘要:自20xx年7月21日起,我国开始实行以市场供求为基础、参考一篮子货币进行调节、有管理的浮动汇率制度;与此同时,人民币汇率调整为1美元=8.11元,升值2%。由此,人民币在经历亚洲金融危机以来的稳定和实际升值以后,终于拉开了正式升值的序幕。根据各方面的分析,到20xx年以前,人民币将处于长期升值的趋势之中。众所周知,汇率对进出口贸易具有较大的影响,因为汇率反映的是一种货币相对于另一种货币的价格,所以汇率的改变将直接传导给进出口商品和服务的价格,从而影响到进出口数量。本文研究的范围是人民币升值给进出口贸易带来的影响,重点研究2007 年以来人民币加速升值对进出口贸易带来的影响,包括正面影响、负面影响、出口、进口、进出口商品结构、贸易方式等。本研究基于权威部门的统计数据,利用国际贸易相关理论,采用实证和分析相结合的方法,试图全面分析人民币升值尤其是加速升值对我国进出口贸易的影响,以及面对人民币升值应该的一些措施。

Abstract

Since July 21, 2005, China began to implement a managed floating exchange rate system based on market supply and demand, with reference to a basket of currencies. At the same time, RMB exchange rate adjusts to $1 = 8.11 RMB with an appreciation by 2%. Thus, after the Asian financial crisis in the experience of the stability and a real appreciation, RMB finally starts the prelude of appreciation. According to the analysis, by 2020, the RMB will be long before the upward trend. As is known, rate of exchange has great influence on import and export trade, because the exchange rate is a kind of currency reflects the relative to another currency exchange. So the change of exchange rate will directly affect import and export prices of goods and services, thus affecting import and export quantity. This research is about the influence of RMB appreciation for import and export trade, including the impact of positive effects and negative effects, import, export, import and export commodity structure and ways of trade, etc. This research is based on the authority of the statistics department, using the theory of international trade, empirical and analysis using the method of combining, attempts to comprehensively analyze the appreciation of RMB appreciation on China in particular, to accelerate the import and export trade, and some of the measures should be taken to handle RMB appreciation.

INTRODUCTION

In different period of economic development, China's RMB exchange rate mechanism adopted different. In July 2005, China's RMB exchange rate formation mechanism was reformed with a reference to basket of currencies of mediation to implement a managed floating exchange rate system. Since then, RMB went in to a long-term slow appreciation track. Especially since 2007, the RMB appreciation has accelerated the pace of record highs. To December 24, 2007, the RMB against the U.S. dollar breakthrough 7.3315:1and has appreciated 6.09%. And China's import and export trade has also experienced a tortuous history. Since the reform and opening up policy, China's import and export went into the track of healthy development, especially in recent years, China's foreign trade volume, quality and structure have achieved degrees of improvement. In 2002, China became the world's fifth largest trading nation. In 2004 China made it 6years earlier to implement a long term goal to gain a 10000 billon foreign trade, and finally the total number was 1.15477 trillion U.S. dollars. China’s foreign trade shares of 12% of the world as the world's third largest trading power, behind the United States and Germany. Since then, China's import and export trade continues to lead a double-digit growth. In 2006, China's foreign trade volume reached 1.7604 trillion U.S dollars, in 2007 breaking two trillion U.S dollars, the total foreign trade reached 2.167 trillion U.S. dollars.

How much impact on China's import and export trade does RMB appreciation have? What are the positive effects and negative effects? What kind of influence does RMB appreciation have on China's import and export quantity, quality, amount, structure and ways of trade? This article will focus in January 2007 since the revaluation, for example, from the perspective of empirical and statistical to make an analysis of RMB appreciation on China's import and export trade.

As is known, rate of exchange has great influence on import and export trade, because the exchange rate is a kind of currency reflects the relative to another currency exchange. So the change of exchange rate will directly affect import and export prices of goods and services, thus affecting import and export quantity. RMB appreciation on China's import and export trade can be divided into positive and negative effects of both.

ⅠRMB appreciation’s positive impact on the import and export trade

1.1 To some extent to improve the trade environment in China

For a long time, China implements mercantile system, that is to bring down production costs, expand product in the international market share and exports to earn more foreign exchange. Under the guidance of this line of thought, China's trade surplus grows, foreign exchange reserves have risen steadily, and only years of effort China became the

world's first, and its amount is larger and larger than the second one. To some extent, surplus and foreign exchange reserves indicates that national prosperity and the improvement of China's international status. However, from another perspective, a long time high trade surplus and foreign exchange reserves, means China's foreign trade environment can easily deteriorate and become the object of attack countries, and even become a scapegoat for economic problems abroad and a tool for foreign political force. Value of the RMB is undervalued is the general view of the international community. And if RMB appreciates, China's export growth will slow down some and the import growth will be accelerated, which can benefit the balance of external and within economy and release the rub between trading partners, at the same time, it will not lead to a greater negative impact on national economic growth. RMB appreciation can ease the pressure of the trade balance and reduce the risk of macroeconomic possible. Appreciation of the RMB is conducive to lowering the excess of domestic exports of low-efficiency products, the release of the expected appreciation, slowing growth rate of foreign exchange reserves, reducing macroeconomic potential inflationary, excess liquidity and the risk of U.S. dollar assets.

1.2 Enhance the trade competitiveness of enterprises and promote trade growth mode

After revaluation, the dollar price of exports increased, foreign

consumers to buy products from China have to pay a higher cost. The competitive advantage of cheap Chinese products will gradually disappear and the profit margins of exporters will be reduced and instead, companies will seek new competitive advantages and create new core competencies. In this case, those corporations with low-tech and low added value, poor management, high cost and low efficiency of enterprises and products will be pushed out of overseas markets, and competitive enterprises will actively improve the operation and management, in pursuit of technology, brand and marketing strategy to win, relying on science and technology, brand design and product quality for competitive advantage. Meanwhile, the RMB appreciation would reduce the cost of imports of advanced equipment, cost of funds to purchase of advanced equipment continues to lower, so our ability to buy more advanced equipment increased and that equipment can help to promote China's export manufacturing sector and export of technical progress in upgrading of the structure. RMB appreciation has reduced the cost of Chinese Enterprises Overseas Investment, which is beneficial for enterprises going abroad to do industry transfer and technology learning, and enlarge the proportion of trade, meanwhile, help less developed areas of the processing trade and spur domestic industrial structure and the structure of export trade to upgrade.

RMB appreciation reduced the cost of Chinese enterprises in

overseas investment, which will help enterprises to go abroad to carry out industrial transfer and technological learning, and expand the proportion of general trade, driven in less developed areas of processing trade, promote domestic industrial structure and export trade, upgrading of the structure. China's processing trade is facing industrial upgrading and regional transfer of dual task. In the eastern coastal areas, especially the Pearl River Delta and Yangtze River Delta region, the processing trade is very well developed, In many areas almost to the saturation-free development, through industrial and technological upgrading, improving the grades and value-added processing trade rate; But in Midwest the development of processing trade were relatively stagnant, need to expand trade scale, promote local economic development. Moderate appreciation of RMB, total processing trade will be echoed and promote the upgrading and regional metastasis.

1.3 control Low-end exports and curb vicious competition, and promote the sustainable development of China's import and export trade

Such problems like high cost in energy and resource, high pollution, low added value, deteriorating terms of trade exist in China's foreign trade growth in exports and foreign investment. At the same time, resources and elements concentrate excessively to export industries and

national economic growth is too dependent on external demand. And domestic demand, especially consumption growth is relatively slow. These problems exist in large part due to the elements of production for export in China, including energy, resources, labor and public input prices, cost of pollution, are underestimated.

If RMB appreciates, those products with low value-added price-sensitive commodities (especially in textiles led) and the SMEs with thin profit will suffer the greatest damage. Therefore, through the adjustment of RMB exchange rate reform can help to adjust the enterprise exports (especially textiles export order), change the current situation of vicious price competition, to a certain extent, the allocation of resources will achieve survival of the fittest.

Moderate appreciation of RMB equivalent to enhance the export-related factor prices, A lot of resources to rely largely on such factors as inputs and low-cost competition, lower value-added exports, will play more than the inhibition of high value-added exports effect. At the same time, it is equivalent to lowering the price of imported elements, for the greater use of foreign resources in China is to some extent encouraged. Therefore, an appropriate appreciation of the RMB will benefit the overall optimization of the import and export commodity structure.

ⅡRMB appreciation on import and export trade may have

negative effects

2.1 Reduce China's export competitiveness

RMB appreciation will damage, a certain extent, China's export competitiveness, have influence on national economic growth and employment. "Economic Observer reported" August 23, 2007 reported that if costs and RMB appreciation, China's export price advantage will be diminished, thus reducing China's export competitiveness .It is reported that the rising costs, slow appreciation of the RMB have brought more heavy margin pressure to the Chinese manufacturers and reduced Chinese exports’ price advantage in overseas markets.

2.2 Increase the gap between regions and labor force

In the long run, RMB appreciation will increase inequalities between the regions as well as between skilled labor and unskilled labor. Assume that the dollar price of the global agricultural market remains unchanged, then the RMB appreciation will depress domestic agricultural prices, thus reducing the real income of farmers. In addition, labor migration will lead to income disparities between skilled labor and unskilled labor of the industrial sector. Resources products, part of the staple agricultural products and low value-added manufactured exports growth slowed down or even declining, may have greater adverse effects on the Midwest, where has a higher degree of resource and agriculture dependence , part of the agriculture-based income of peasants and the

employment of low skilled workers .

2.3 If the RMB appreciate too fast, it will result in the decline in exports and affect the steady growth of national economy.

If the rate of the RMB appreciates too rapidly or too large, then the impact of its export and import growth may not be so mild. First, export growth rate will lead a substantial drop or fall, which will have a great strike not only on resource and low value-added products but also on the entire export processing industries and employment. Second, it will stimulate part of the goods imported in large and have impact on domestic market and even cause some deflation.

2.4 other negative effects

Due to sharp appreciation of the RMB, exports will inevitably reduce the impact on economic growth, and deepen unemployment. Significant appreciation of RMB will have nearly all export industries hit. But to those enjoy low-interest export loans, export tax rebates, export subsidies and even domestic industry has not been such favorable than the industry, they will suffer relatively light. Those who enjoy the benefits are from the less competitive industries, related industries or local governments to seek subsidies as income to maintain production, the competitiveness of these industries can not rely on subsidies to barely survive. To those who were not favorable, there are many competitive industries, but because there is no government subsidies to affect their

production and export, the results lead failure, resulting in reverse out, resulting in the industrial structure deteriorated.

Though sharp appreciation of the RMB can makes trade imbalances getting resolved, to the overall economy the damage is serious. After the sharp appreciation in the RMB, the low efficiency industries, due to policies to protect local industries, suffer little or even not affected. Highly efficient industries, because of the lack of protection, were eliminated by the big blow. That is, bad money driving out good money there, reverse the economic struture adjustment, the relative efficiency of the overall industry decline, increased unemployment, which is not conducive to long-term economic sustainability.

ⅢMeasures to long-term appreciation of the RMB

Since the formal appreciation of the RMB in July 2005, China's export enterprises have faced difficulties in costs, but the country exports continue to maintain the strong momentum of rapid increase. This shows a slight appreciation of the RMB will not have that great impact on China's exports and trade surplus may also increase due to cheaper imports. Therefore, faced of long-term upward pressure on the RMB, RMB exchange rate reform must adhere to the initiative, controllability and gradual nature of the principle and the key is insist on an upgrade to actively promote foreign trade structure. In addition, calmly handle long-term appreciation of the RMB’s influence and impact, is also

essential

.

3.1 Actively promote foreign trade structure upgrade

At present, resources and labor-intensive, low value-added products have a great part in China's export products while capital and technology-intensive and high-tech products, the proportion of independent R & D and innovation is not very high and high energy consumption, high pollution and resource products export grow obviously. Appreciation of the RMB would weaken the company's labor cost advantage, lower profit margin and form a negative impact on export trade. Therefore, we should actively promote trade in the export structure. States should actively encourage independent intellectual property and high value-added high-tech exports and to transform the traditional export industries by promoting high-tech development and improve the technological content combined with added value and vigorously introducing advanced technology and key equipment to transform the traditional export industries. Enterprises should strengthen technological innovation, management innovation and brand innovation, and improve labor productivity, and fundamentally improve the export competitiveness of enterprises.

3.2 continue to improve Managed floating exchange rate system . After 20 years of China's reform and opening up, although we have

basically established a market economic system, but is far from perfect with the market economy market mechanism. The decision in the RMB exchange rate also remains to implement a managed floating exchange rate system. There is no doubt that the direction of economic reforms now adopt a managed floating exchange rate system should be shifted entirely to the market mechanism of the floating exchange rate system. However, faced with the failure of more speculative foreign exchange market, a slight appreciation of the RMB, in current time we must continue to uphold and perfect the managed floating exchange rate system.

3.3 To calmly deal with the negative effects of Long-term appreciate of the RMB

As a developing country, China was suffering from trade deficit before 1980’s and has pursued balance between import and export and a slight surplus. However, the appreciation of the RMB becomes a long-term process, there may be a deficit situation from time to time. We should not be panic for the potential future trade deficit, for the foregoing positive impact of RMB appreciation. As long as we raise the level of industrial technology and international competitiveness of enterprises as soon as possible, even if there is a temporary trade deficit, it is not a bad thing, but a good thing.

3.4 Expanding domestic demand is resolved to solve the fundamental contradictions of RMB appreciation.

Any production company must be based on the expected demand of the people. Thus needs have a major impact on production ,shrinking demand will lead to a lower output and have a bad influence on industry. We are a populous developing country, a vast market is our biggest advantage. China's undervalued exchange rate lead to strong growth in exports and distort the allocation of resources. Capital, labor and other production factors influx of export sectors, thus inhibiting the development of domestic production and service industries, and finally Insufficient domestic demand. Currently, china’s economic growth is heavily dependent on external demand growth. China can support the exchange rate regime only by increasing foreign exchange reserves. This situation and the realities in China's economy and economic power, its influence in the world are not commensurate. First, on one side China has strong economic strength, but on the other side China's foreign exchange reserves have to be increased again, unwilling to let the RMB appreciate. It itself is a contradiction. China should loosen the RMB floating range, by using the appropriate value to stimulate imports. Based on the domestic demand could make more room for our economy and strengthen the capacity of resisting external risks. In the long run China's economic growth can not blindly rely on export-oriented economy, it must be based on domestic demand .

3.5 Make full use of WTO rules to safeguard the proper rights

and interests of China's exports

Join the WTO has brought not only the chance to accelerate the development of China's foreign trade but also great challenge. In addition to their own efforts, the state should make good use of exchange rates and interest rate policy exception and WTO rules to guide the export enterprises adjusting the product structure, and gradually improve the quality of export products and the technical level to enhance the export competitiveness of Chinese products. We should try to become a trade power to provide a strong physical protection to healthy development of the national economy .

CONCLUSION

In summary, to a certain extent , the RMB appreciation have impact on China's import and export trade, especially in 2007 during the process of faster appreciation of the RMB China's import and export trade suffered a certain influence. These effects are both positive and negative. Accelerate the appreciation of RMB, China's exports, imports, commodity structure and trade patterns are affected. Accelerate the appreciation of the RMB caused fluctuation to the import and export trade and increased the industrial commodity import and export of other

trade and general trade's growth rate. It also helps to promoting core-competitiveness and enhancing our trade management capabilities.

Over the years, the main mode of China's import and export is simple processing trade, divided into processing and feed processing, and use of our resources and cheap labor advantage, simple processing of raw materials after the export; or imported raw materials from abroad and mechanical equipment, processing or assembly in China will be manufactured exports. This processing trade is simple with a low starting point, only in the early stage of development of a country's trade, processing trade is used. However, it is unreasonable to recognize the existing social division of labor as the premise, at the expense of the development of my country at the expense of the environment and resources, the end result can only be the behind will always lag behind. For a long time, China gains little profit in the low-end processing trade, China's trade surplus are mostly from using resources. Therefore ,It is urgent to Improve China's trade structure, increase the technological content of export products.

The rapid appreciation increased prices and costs of processing trade, ,further reducing the competitiveness and advantage, forcing foreign companies to change in business direction, to improve trade patterns, to facilitate survival in the new environment and development. This transformation of foreign trade enterprises will promote the

country's trade patterns and trade structure, mainly from the processing trade to the general trade-based asymptotic changes in trade structure, and speed up the process.

General trade and other trade’s growth and expansion, is the only way for China to become a powerful trading country, and is the only choice for China to develop into a powerful economic country. At present, China has a deeper degree of integration into the global economy, continued to strengthen international competitiveness, China's industry in international value chains and the international division of labor may also be assigned the value of seeking a stronger position to play a more important role. We have every reason to believe that with the development of trading enterprises and our growing economic strength, China's general trade and other trade will exceed the processing trade, as import and export trade in the mainstream.

References

1. 赖勇明,出口贸易与经济增长[M].成都:上海三联书店出版社,2002

2 .杨长江.人民币实际汇率长期调整趋势研究[J].上海:上海财经大学出版社,2002.

3.季风.我国加工贸易发展的特点及前景分析[M].黑龙江:1 黑龙江对外经贸,2005

4. 刘昌黎,论人民币升值对中国经济的影响及其对策,<日>彦根论

丛2004.09。

5. 张斌、何帆,人民币是否应该升值?国际经济评论2003.08-09。 6. 张锦东,人民币是否应该升值?-关于人民币升值的争论,经济学动态2004.01。

7. .张建勇刘益平.人民币升值对我国经济的影响[J].南京:中国周刊出版社2004

8. 10.商务部课题研究组,外经贸发展如何应对人民币升值[M].北京:中国对外贸易杂志社,2007