Upload By Yelky

中国公共关系业20xx年度调查报告

为反映20xx年度公共关系服务市场的运行态势,正确评价中国公共关系业的发展状况,为专业机构提供积极的行业指引,1月18日至3月10日,中国国际公共关系协会(CIPRA)对中国大陆境内主要公共关系公司进行为期50天的调查活动。该项活动由协会研究发展部具体实施,公关公司工作委员会指导监督。

调研项目组采用问卷与访谈相结合的调查方法对20xx年度京、沪、穗、蓉等四个市场的主要公关公司进行抽样调查,调查内容涉及公司运营、公司业务和市场发展等三个方面。本次调查向CIPRA会员发送问卷100份并在中国公关网发布调查问卷,共收回问卷78份,京、沪、穗、蓉等四个区域有效问卷70份(北京地区54份、上海地区4份、广州地区4份、成都地区8份,其中国际公司13家,本土公司57家)。

调研项目组对问卷和访谈所取得的数据进行了科学统计,依据行业经验和历史数据进行了相关核实和判断,在科学分析基础上形成本次调查报告。本报告由年度排行榜、行业发展状况、TOP公司研究及行业发展预测四个部分组成。

报告说明:

1.本报告所涉及的调查内容仅涉及中国内地的公共关系服务,不包括被访者的广告及其他制作业务;

2.本报告所依据的调查数据为被访者所提供的数据,尽管访问者对这些数据作了相关核实但本报告并不为这些数据的真实性提供保证;

3.本报告所访问的对象为公司主要负责人,他们在接受调查时均声明代表公司的意志,所提供的信息均是真实、准确和有效的;

4.本报告所发表的数据和结论以被访者提交的数据为基础,经过统计分析和行业判断,并加以测试和修正,这些数据不一定完全符合真实情况但能反映行业发展基本面的情况;

5.本报告相信,有关数据和分析确实具有非常好的参考价值,能为中国公共关系市场的健康发展提供积极的引导和推动力。

Upload By Yelky 16

Upload By Yelky

年度排行榜

20xx年度公司排行榜包括TOP公司和潜力公司两个榜单,分别为20家公司。该榜单以自愿参与调查活动、提交完整数据、能够接受考察核实的公关公司为评选对象,以“TOP公司评选标准模型”为评选依据,通过加权指数计算产生最终结果。

评选模型由中国国际公共关系协会公关公司工作委员会于20xx年9月19日年度第二次工作会议审定,榜单统计分析由研究发展部执行,公关公司工作委员会工作会议审定。

20xx年度 TOP 公司榜单

(按公司品牌英文名排序)

AcrossChina APR

BlueFocus D & S

Fleishman Hillard Genedigi HighTeam

Hill & Knowlton Keypoint Linksus

信诺传播 注 意 力 蓝色光标 迪思传媒 福莱国际 际恒公关 海天网联 伟 达 关 键 点 灵思传播

MI MR NTI

Ogilvy PR O & R Push

RuderFinn Shunya Trends

Weber Shandwick

传智整合 嘉利公关 新势整合 奥美公关 东方仁德 普纳营销 罗 德 宣亚国际 趋势中国 万博宣伟

注:安可、博雅、凯旋先驱因未提交问卷或完整数据未能上榜,关键点、嘉利、东方

仁德、趋势为新上榜公司,该榜单最低分值53.5,最低年营业收入超过4000万元。

20xx年度潜力公司榜单

(按公司品牌英文名排序)

1024 Interactive Assyria

China Bright CYTS-Linkage Eastwei Evision

Gollin Harris Hightran Insight

Long Legacy

1024互动 融创公关 华瑞国际 中青旅联科 东方易为 时空视点 高诚国际 海辰传播 智扬公关 龙世嘉蓝

Linksense New Alliance PRAP Preinsight Revo S & W

Saint-tracer Topconsulting

Waggener Edstrom Wendy

联华盛世 新盟国际 普 乐 普 勤致汇合 睿符品牌 宇修公关盛唐传扬 道康传播 万卓环球 温迪传播

注:汉扬、紫天鸿、恒瑞行、豪艺博雅、伟泽、哲基、埃特因未提交问卷或完整数据

未能上榜,融创、中青旅联科、高诚、联华盛世、新盟、勤致汇合、睿符、宇修、万卓环球、温迪为新上榜公司,该榜单最低分值36.5,最低年营业收入超过1200万元。

Upload By Yelky 17

Upload By Yelky

行业发展状况

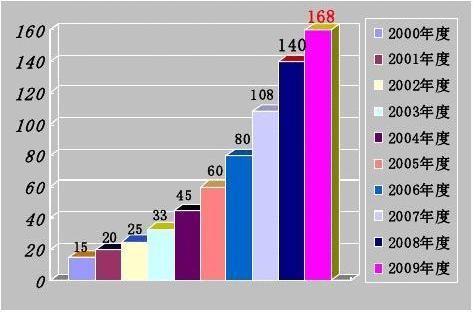

20xx年,由于受全球金融危机的影响,中国内地的公共关系服务市场增速明显下降。据调查,20xx年公共关系服务市场年增长率为20%左右(TOP20公司年营收增长率为19%,潜力20公司为20.7%)。据此估测,整个市场的年营业规模约为168亿元人民币左右。

年度营业额比照(亿元人民币)

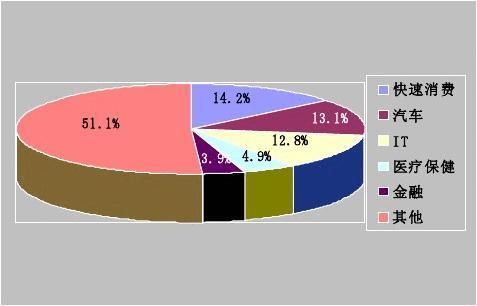

调查显示,快速消费、汽车、IT、医疗保健和金融位列20xx年度公共关系服务市场的前五位,市场份额分别为14.2%、13.1%、12.8%、4.9%和3.9%,其它如通信、互联网、制造业、旅游、文化、体育等占51%左右。

服务市场进一步分散,涉及领域更加广泛。“快速消费”取代“汽车”占据第一位置,政府及非营利组织(2.9%)服务需求旺盛。

行业市场份额构成

鉴于TOP20公司和潜力20公司数据的相对准确性,本报告主要针对这40家公司的业务

Upload By Yelky 18

Upload By Yelky

情况进行分析。

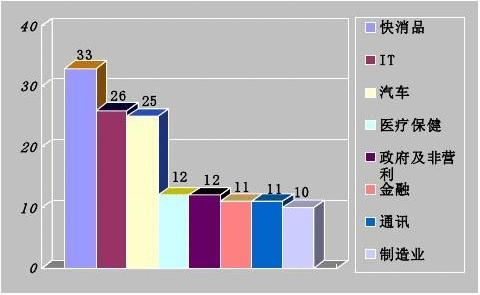

40家被访公司中,33家开展快消服务(82.5%),26家开展IT服务(65%),25家开展汽车服务(62.5%),12家开展医疗保健服务(30%),22家开展政府及非营利机构服务(30%),11家开展金融服务(27.5%)11家开展通讯服务(27.5%),10家开展制造业服务(25%)。开展这些业务的公司比重较上个年度明显提高,表明业务能力有所提升。

主要服务行业构成(公司数量)

40家公司中,20家以传播代理业务为主(50%),8家以整合传播业务为主,5家以顾问业务为主,3家公司以活动代理业务为主,2家以媒体执行为主,1家以活动执行业务为主,1家以网络公关业务为主。上述数据表明,传播代理业务仍是公关公司的主要业务,而整合传播业务越来越受到市场的重视。

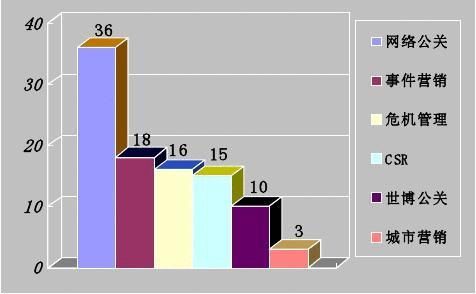

调查显示,网络公关、事件营销、危机管理、CSR以及世博公关等服务成为20xx年度公关服务产品的亮点。据统计,40家公司中36家开展网络公关业务(90%),18家开展事件营销业务(45%),16家开展危机管理业务(40%),15家开展CSR业务(37.5%),10家开展世博业务。另外,城市营销开始受到关注,有3家公司已开展此类业务。

新服务产品(公司数量)

Upload By Yelky 19

Upload By Yelky

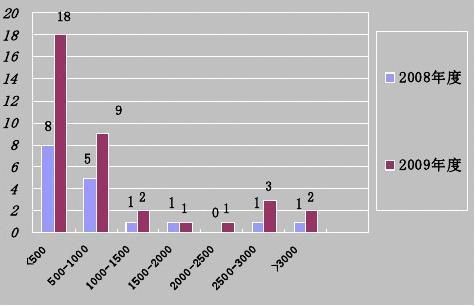

据统计,20xx年网络公关业务又有长足的进步,40家公司中90%的公司开展此项业务,有9家公司年营业规模超过1000万元人民币,比上年度增加3家,其中2家公司超过3000万元人民币。

网络公关收入(公司数量)

调查显示,快速消费、IT、汽车、通讯和互联网仍是网络公关业务最主要的服务市场。产品推广、事件营销、口碑营销、危机处理和舆情监测是客户市场的主要需求。据统计,40家公司中36家提供线上产品推广服务(77.5%),27家提供线上事件营销服务(67.5%),26家提供口碑营销服务(65%),24家提供危机处理服务(60%),24家提供舆情监测服务(60%)。

网络公关服务产品(公司数量)

调查显示,40家被访公司中有37家公司在2个或2个以上城市设办公室,有多家公司在超过5个以上城市设立了分公司或办事处。北京、上海、广州和成都等四大市场仍是公关公司的主要集中地,本次调查中北京公司占了54家(77%),仍占据市场的主要份额。

Upload By Yelky 20

Upload By Yelky

TOP公司研究

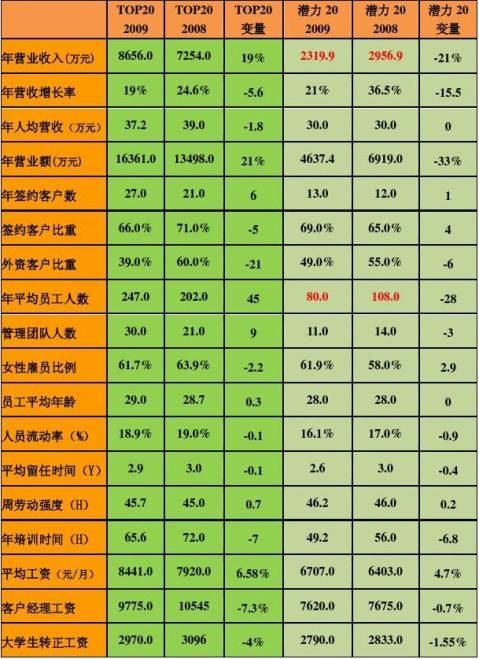

基本数据:

TOP公司及潜力公司统计表

Upload By Yelky 21

Upload By Yelky

营业情况:

? TOP公司平均年营业收入为8656万元,比上年7254万元增长了19%,增长率下降

5.6个百分点(上年为24.6%);平均年营业额为16361万元,比上年13498万元增长了21%;人均年营业收入保持较好水平,达到37万元/年人均。

? TOP主力公司继续保持较好状况,其中灵思传播、蓝色光标、宣亚国际、奥美公关

四家公司年营业收入超过1.5亿元。

? 传播代理仍是TOP公司的主营业务,50%公司以此为主(也包括大量媒体执行业务),

另有20%公司侧重顾问咨询业务,取得较好的毛利润。

? 签约客户数和签约客户比重比较稳定,分别达到27个和66%,属于健康状态。但

外资客户比重下降了21个百分点(由60%下降为39%)。

? 网络公关业务增长迅速,19家开展此项业务,11家公司年营业收入超过500万元,

整体又上了一个台阶。

运营管理:

? 年平均员工人数由上年的202人增加到247人,增加45人,主要来自本土公司;

管理团队平均人数由21人增加到30人,管理效率下降而成本增加。

? 女性雇员继续保持60%以上的比重,达到61.7%,职业平均年龄维持在29岁左右;

人员流动率达到18.9%,平均留任时间为2.9年,反映人才紧缺现象没有改善。 ? 年人均培训时间比上年度有明显减少(减少7小时),周平均工作时数接近46小时

(增加1小时),反映各公司人力资源开发与管理还有待提高。

? 年平均工资水平为8441元/月,比上年的7920元仅增长了6.58%。客户经理平均

月薪9775元(下降7.3%),大学生转正平均月薪2970元(下降4%)。

? TOP公司重视内部管理,强化运营水平,在内部组织架构、运营平台改造、信息化

建设以及人员绩效考核等方面开展工作并取得成效。

Upload By Yelky 22

Upload By Yelky

行业发展预测

20xx年,全球金融危机的影响给各行各业均带来了严重影响,中国公共关系服务市场也遭受了严重的考验,增速明显减缓,由上年度的29.6%下降了9.6个百分点。

与20xx年度报告预测的一样,以外资客户为主要服务对象、以活动传播或事件营销为主营业务、以IT、汽车为主要服务领域的公共关系公司深受危机影响,20xx年上半年出现了明显不景气。但第二季度后半期起,在国家宏观调控和信心恢复的双重影响下,公共关系服务市场迅速回暖,各项业务全面展开,绝大多数公司完成了年度的业务指标,维持了良好的发展势头。调查显示,70%公司基本认可20xx年市场发展,30%公司认为一般或者不好。

20xx年1月9日,中国公共关系市场发展研讨会针对全球金融危机提出了积极的对策建议,鼓励业内企业“开源节流”、“服务创新”,提出了由“大”变“强”的行业发展战略。这一年,中国国际公共关系协会被国家民政部授予行业协会资质,下属公关公司工作委员会成立行业研究、行业监督和行业公益三个工作小组,《公关行业自律公益实施细则》、《公关行业企业社会责任指导纲要》、《TOP公司评选标准模型》等文件出台,预示着中国公共关系行业重要转折点的到来。特别是12月31日,业内著名企业蓝色光标成功登陆创业板,拉开了公共关系公司资本运营、业务整合的序幕。

展望20xx年,公共关系服务市场将继续保持良好的发展势头。调查显示,87.5%的公司看好20xx年的公关市场,只有12.5%的公司认为一般或不太好。

我们预测,20xx年,由于全球经济转暖,特别是我国将继续加大宏观调控,深化经济转型力度,将带来国内市场旺盛的需求;同时,公共关系公司也将加大转型力度,由大到强、由沿海城市向中心城市、由单一服务向整合服务发展;整个市场仍将保持一定的增长速度。

快速消费、汽车、IT、医疗保健、金融等业务市场仍将是主要服务领域,上海世博会、广州亚运会以及家电下乡等产业振兴成为20xx年度的主要市场热点,网络公关、体验营销、城市营销、CSR等新兴服务将继续发扬光大。

蓝色光标成功上市不但拉开了公共关系公司资本运作、业务整合的序幕,而且将会吸引更多的投资和机构进入这一服务领域,促进行业向更大规模化发展,同时也会加剧这一领域的竞争,特别是人力资源方面的竞争将更加剧烈。

结论

本报告认为,由于全球金融危机影响,20xx年度中国公共关系服务市场发展增速明显减缓,但仍保持一定发展势头。

20xx年,公共关系服务市场将加大转型力度,快速消费、汽车、IT、医疗保健、金融等业务市场将是主要服务领域,上海世博会、广州亚运会以及家电下乡等产业振兴成为主要市场热点,网络公关、体验营销、城市营销、CSR等新兴服务将继续发扬光大。

资本运作、业务整合、人才竞争以及规范建设将成为市场关注的焦点。

Upload By Yelky 23

Upload By Yelky

关于CIPRA TOP公司排行榜

CIPRA TOP公司排行榜是中国国际公共关系协会于20xx年创设的年度公关公司榜单。20xx年,“TOP10-int’l”和“TOP10-local”两榜合一,统称“CIPRA TOP20”,即中国公共关系市场“综合实力20强”,上榜公司简称“TOP公司”。

20xx年9月19日,经中国国际公共关系协会公关公司工作委员会年度第二次工作会议审议通过《TOP公司评选标准模型》,正式启动公司评选指标体系。该指标体系针对TOP公司综合实力的内涵(既“大”又“强”),从经营情况、运营管理、专业成果和行业影响等四个维度设计了14项指标和分值,通过加权计算产生最终结果。(详见中国公关网链接)

同时,依据该指标体系对后20名公司进行潜力公司评选。

考虑到本调查不能为参与者所提供的数据提供保证,因此仅根据公司数据和行业判断来统计分析,所以不做具体排名(按公司品牌英文名排序),而且仅在委员会内部公示。

关于“营业收入”注释

本调查中所使用的“营业收入”一词,专指公共关系服务收入(不含广告、制作等业务),Fee或称毛利润。该收入为含营业税的服务收入,须扣除第三方费用(包括外购劳务、媒体购买、车马费等)。

报告撰稿:陈向阳

中国国际公共关系协会副秘书长

公关公司工作委员会常务副主任

20xx年4月6日,北京

Upload By Yelky 24

第二篇:工资调查报告(20xx年度)

LINKS RECRUITMENT

Salary Survey 2009

We are pleased to provide you with an updated salary survey. ??is year we have tried to o??er more opinion and analysis on the sectors in which we specialize in addition to the traditional salary guidelines.

At Links Recruitment we serve MNC and SME clients in the Greater China region through our o??ces in Hong Kong, Shanghai, Macau and Singapore. Operating since 1999, Links o??ers permanent placement recruitment; temporary and contract recruitment; payroll; visa processing and outsourcing.

??is salary survey particularly focuses on Hong Kong. Please phone us for more of an in depth discussion of salary trends in Macau, Shanghai and Singapore.

We hope you ??nd the a??ached data informative and useful as a benchmark in your internal hiring process.

Wishing you every success in 2009.

Deborah Matson Managing Director debbie@linksrecruitment.com

Banking, Finance & Accounting

AboutRECRUITMENT

Links Recruitment’s Banking and Financial services team specializes in recruiting junior to senior level candidates within corporate and commercial banking, private banking, investment banking, fund houses and brokerage companies across front, middle and back o??ce roles. ??e Accounting team specializes in recruiting professionals from junior to senior management levels covering areas including ??nancial accounting, management accounting, investment accounting, audit and tax. Our services are extended to diverse sectors including banking, professional services, FMCG, retail, luxury goods, telecommunications and IT.

Swapna Reddy - Manager

Strategically focused employers will look at 2009 as an opportunity to

streamline and make plans to hire in a targeted manner. Competition for high

quality candidates will still remain strong.

Despite the current economic climate, there is a consistent demand for

candidates with Asian language skills including Mandarin, Korean and

Japanese. Demand is also growing for candidates in compliance, risk, and

internal audit because of increased pressure on companies for be??er e??ciency

and transparency in daily operations.

Employers are showing an increased preference to hire candidates with local language skills and local market experience. ??is could result in limited opportunities for candidates moving from overseas to ??nd jobs here. Expatriate packages are becoming more of an exception than a norm.

??e wage in??ation we saw in 2007-2008 across most positions has stabilized. At large banks and ??nancial institutions base salary growth and bonus payments are expected to be moderate to stable. Bonus pools on average are expected to be down by 50% this year over last year. Guaranteed and sign on bonuses are becoming minimal and increasingly uncommon.

Across di??erent market sectors, new accounting job openings as well as candidates seeking new opportunities decreased in the last few months of 2008. Many candidates who had previously been thinking about a move have instead opted to remain in current roles due to market uncertainty, placing a premium on job security. ??e market itself has been shi??ing rapidly back in favour of employers, reversing the trends of 2007, and Q1 and Q2 of 2008.

January 2009

Banking, Finance & Accounting

RECRUITMENT

Position

Banking

Equity/Derivative Sales Equity/Derivative Sales Equity/Derivative Sales Corporate Banking Sales Corporate Banking Sales Corporate Banking Sales Corporate Banking Credit Analyst Corporate Banking Credit Analyst Corporate Banking Credit Analyst Trader

Junior Trader

Client Services Manager Client Services Specialist

Client Services O??cer Credit Risk Vice President

Credit Risk Associate Vice President Credit Risk Analyst

Market Risk Vice President

Market Risk Associate Vice President Market Risk Analyst

Research Manager / Head of Research Research Analyst Research Associate Middle O??ce Manager Middle O??ce Associate Middle O??ce Analyst Compliance Manager

Compliance Specialist Compliance O??cer

Operations/Se??lements Manager Operations/Se??lements Associate Operations/Se??lements Analyst

No. of years exp

8+ 4-7 2-4 8 + 5-7 2-4 8+ 5-7 2-4 5+ 2-4 8+ 5-7 2-4 8+ 5-7 2-4 8+ 5-7 2-4 8+ 5-7 2-4 8+ 5-7 2-4 8+ 5-7 2-4 8+ 5-7 2-4

Monthly Base Salary

$80K+$60K - 80K$40K - 60K$60K - 80K$40K - 60K$25K - 40K$60K - 100K$40K - 60K$25K - 40K$50K - 100K$30K - 50K$60K - 80K$40K - 60K$25K-40K$80K+$40K - 80K$30K - 40K$80K+$50K - 80K$30K - 50K$60K - 100K$40K - 60K$30K - 40K$70K - 100K$40K - 70K$25K - 40K$60K - 100K$40K - 60K$25K - 40K$60K - 100K$40K - 60K$25K - 40K

Note: All salary ranges are represented in terms of basic salaries exclusive of bonuses, stock options or other variable incentives. Rates will vary depending on industry.

January 2009

Banking, Finance & Accounting

RECRUITMENT

Position

Accounting & Finance - Financial Services

CFO

Financial Controller Finance Manager Accountant

Senior Investment Accountant Investment Accountant Senior Fund Accountant Fund Accountant

No. of years exp

12+ 8-12 6-10 2-5 8+ 2-4 5-7 2-5

Monthly Base Salary

$110K+$75K - 100K$50K - 65K$25K - 35K$45K - 55K$35K - 45K$35K - 45K$25K - 35K

Accounting & Finance - Commercial

CFO/Finance Director Financial Controller

Financial Controller (Regional)

Financial Planning and Analysis Manager Senior Financial Analyst Financial Analyst

Internal Audit Manager Senior Internal Auditor Internal Auditor

Credit Control Manager Senior Credit Controller

Accounting Manager/Finance Manager Senior Accountant Accountant

Junior Accountant

12+ 10-12 10-12 7-10 7-10 4-6 8+ 5-7 2-4 7-10 4-7 8+ 5-7 2-5 1-2

$110K+$75K - 100K$65K - 75K$50K - 60K$55K - 65K$40K - 55K$55K - 75K$40K - 55K$30K - 40K$40K - 50K$25K - 35K$40K - 55K$35K - 45K$25K - 35K$15K - 22K

Note: All salary ranges are represented in terms of basic salaries exclusive of bonuses, stock options or other variable incentives. Rates will vary depending on industry.

January 2009

Commerce

AboutRECRUITMENT

??e Commerce team at Links Recruitment has a strong practice in identifying the ideal candidate in sales, marketing, product development, business development, and retail operations for diverse clientele across many industries. We specialize in placing sales and marketing sta??, PR managers, brand managers, product developers, and business development sta??. In retail our focus includes operations, customer service and merchandising. We focus on quality client service by meeting all of our candidates, identifying their motivators and skill set, and matching them with your company culture and requirements.

Ingrid Wong - Manager

Following two years of strong hiring trends and positive sentiments over the

economy, hiring expectations have fallen in Hong Kong across multiple

industries. New hiring expectations are at a ??ve year low. While there has not

been a notable increase in the proportion of employers cu??ing back employees,

many companies are limiting new hires to replacements. Demand for good

talent is still high and employers have become increasingly selective in their

recruitment process. Professionals within the areas of quality and compliance

in the manufacturing industry, and sales and marketing in professional services

have remained resilient in this economic climate when compared with the

consumer segment. Current hiring sentiments are expected to continue well into 2009. We see no salary growth during Q1 and Q2.

From the employee perspective, employed individuals are wary about the current economic woes and as a result are less likely to leave their jobs. ??ey are also taking on more responsibility in the workplace. Job seekers are expressing more ??exibility in salary ranges and are also widening their job search to include opportunities in industries where they may have been adverse to in the past. Job security and ??nancial stability of companies have become key selection criteria to many candidates in the market.

January 2009

Commerce

RECRUITMENT

Position

Marketing Communications Director Marketing Communications Manager Strategic Marketing Manager

Public Relations Manager/Director General Merchandising Manager Merchandising Manager Retail/Sales Operations Director Retail Operations Manager Retail Merchandising Manager Sales Director Sales Manager

Country Sales Manager

Business Development Director Business Development Manager

Marketing/Brand Director Brand Manager

Product Development Manager/Product Manager Product Development Manager/Product Manager Sales Administration Manager Customer Service/Sales Support

No. of years exp

10+ 5-8 10+ 5-8 10+ 8+ 10+ 8+ 8+ 10+ 5+ 5-8 10+ 5+ 10+ 5-8 10+ 3-6 5+ 8+

Monthly Base Salary

$80K -100K$45K - 60K$50K - 70K$40K - 60K$55K - 65K$40K - 50K$80K - 100K$40K - 50K$50K - 70K$70K - 90K $60K - 70K$40K - 50K$65K - 80K$40K - 60K$100K+$30K - 40K$50K - 70K$30K - 45K$40K - 50K$25K - 30K

Note: All salary ranges are represented in terms of basic salaries exclusive of bonuses, stock options or other variable incentives. Rates will vary depending on industry.

January 2009

Human Resources and Administration

AboutRECR

UITMENT

Links Recruitment’s HR and Administration team celebrates its ninth year providing high quality personnel including o??ce managers, PAs, EAs, company secretaries, legal secretaries, customer service representatives and receptionists. We have selected and placed HR professionals with clients in industries such as banking and ??nancial services, legal, garment, luxury goods and retail. Many of our clients are pleased with our proactive approach in identifying talent with a strong ??t to client’s organization and culture. Ability to consult clients on a broad range of compensation and bene??t issues – market situation, trends and culture.

Ivy Lam - Director

Q4 of 2008 showed a signi??cant slowdown in hiring in Hong Kong as compared

with previous quarters. Due to a disruptive ??nancial market there have been

many uncertainties regarding headcount and salary increments for 2009. Many

companies are wrestling with the realities of cost management and bulk lay o??s.

??is is not just relevant to investment banks or other ??nancial institutions,

many non-banking industries such as retail and manufacturing have also been

a??ected in Hong Kong. Following two years of 20% salary growth we see the

possibility of reduction in salary levels during 2009.

Companies are now being more selective in their recruitment process which is causing the hiring process to take longer. More people are being included in the process and the ba??le for increments in salary is now stronger than ever. We envisage that the most signi??cant challenge for employers in Hong Kong in 2009 will be to a??ract and retain permanent HR professionals to lead the organization, to o??er even be??er planned career paths and opportunities for employees, streamline the recruitment strategies and advise employees to take more job functions instead of hiring more headcount.

January 2009

Human Resources and Administration

RECRUITMENT

Position

HR Director/Regional HR Director HR Manager/Regional HR Manager

Senior HR O??cer/Assistant HR Manager Regional In-house Recruiter Regional Training Director Training Manager Training O??cer

Regional Compensation & Bene??ts Director Compensation & Bene??ts Manager Payroll Manager Payroll Specialist

Visa/Immigration Manager Visa/Immigration Specialist Relocation Manager

Relocation Consultant/Specialist

Customer Service/Call Centre Manager Senior Translator Translator

Research Manager (Executive Search) Senior Researcher (Executive Search) Researcher/Associate (Executive Search) Paralegal

Company Secretary O??ce/Administration Manager Senior Administration O??cer

Executive Assistant/Personal Assistant Secretary

Legal Secretary Receptionist

No. of years exp

10-15+ 6-10 4-6+ 8+ 10+ 6+ 4+ 10+ 5+ 8-10+ 3-5+ 6-8+ 3-6 8-10+ 3-5+ 8+ 6+ 2-5 8-10 5-8 1-4 5+ 5-8+ 8-10+ 3-6+ 8-10+ 5-8 5-8 3-5+

Monthly Base Salary

$80K - 100K+$40K - 60K$25K - 40K$30K - 60K$60K - 80K$30K - 45K$20K - 30K$70K - 90K+$40K - 60K$40K - 50K$25K - 35K $30K - 40K$25K - 30K$35K - 45K$20K - $30K$40K - 60K$40K - 60K$25K - 35K$50K - 60K$30K - 40K+$20K+$35K - 55K$40K - 60K+$35K - 50K+$25K - 35K+$30K - 60K+$25K - 35K+$25K - 35K$18K - 20K+

Note: All salary ranges are represented in terms of basic salaries exclusive of bonuses, stock options or other variable incentives. Rates will vary depending on industry.

January 2009

Temporary & Contract

AboutRECRUITMENT

In our eighth year of providing Temporary and Contract sta??ng to clients, we have continued to source and recruit high caliber candidates within banking and ??nancial institutions. We also have a multitude of multinational companies as clients ranging from professional services, retail, airline, telecommunications, and consumer goods. Our candidates possess a wide range of capabilities, from secretarial, administration and human resources to back o??ce operations analysts, accounting and marketing. One of our key strengths has been to identify suitable candidates with excellent language skills and who possess the right skill set for the job. Ingrid Wong - Manager

Over the past three years, we have seen an increase in employers seeking

temporary sta?? for contract employment. ??e reasons for this vary greatly. For

the most part, temps are hired on the basis of covering annual leave, maternity

leave, or just simply on a project basis. Certain roles require a helping hand and

have a ??nite end date. Others may convert to permanent roles. For employers,

temps provide a low risk contract to "test" the candidate on how well they ??t into

the culture of the company or team they are working with, their performance to

the job, and how valuable their role is to the business.

We have recently seen an increase in available senior level candidates who have unfortunately been a??ected by the recent economic uncertainty. With the ??exibility to entertain the idea of a contract position, these candidates will also maintain and keep their current skill set and still be a part of the workforce.

For 2009, we forecast more needs for contract sta??ng. Vacancies are not typically the lower level support functions anymore but also those on a higher, more quali??ed level. It can be a cost e??ective step for employers to consider contract sta??ng, whereby the needs of the business are met and there is li??le administrative burden.

January 2009

Temporary & Contract

RECRUITMENT

Position

Business Analyst

Client Services Analyst Research Assistant

Compliance/Legal Assistant Operations - Corporate Actions Trade Support/Sales Assistant Recruitment Specialist HR Specialist HR Generalist

Executive Assistant/PA/Senior Secretary Secretary

Company Secretary Legal Secretary

Paralegal /Legal Assistant Finance Manager Accountant

Accounts Clerk/Assistant Accountant Payroll Assistant Marketing Manager Marketing Assistant Administrator

Administrative Assistant Receptionist

No. of years exp

2-5 1-3 0-2 1-3 0-2 1-3 0-3 3-5 3-5 3+ 0-2 5+ 2-4 3+ 3-5 3+ 8+ 5+ 2-4 1-3 10+ 1-3 5+ 3+ 1-3 2+

Monthly Base Salary

$25K - 35K$15K - 25K$15K - 20K$15K - 22K$15K - 25K$15K - 30K$18K - 35K$20K - 35K$25K - 35K$21K - 35K$15K - 20K$25K - 38K$15K - 25K$18K+$20K - 30K$30K - 40K$35K+$26K - 40K$15K - 25K$13K - 25K$38K+$15K - 22K$25K+$16K - 35K$15K - 18K$15K - 22K

Note: All salary ranges are represented in terms of basic salaries exclusive of bonuses, stock options or other variable incentives. Rates will vary depending on industry.

January 2009

Hospitality, Travel, Retail and Customer Service

AboutRECRUITMENT

Links Recruitment o??ers recruitment, payroll and visa services to the hospitality and travel retail sector through our o??ces in Hong Kong, Shanghai and Macau. Our product o??erings range from management level recruitment to bulk recruitment of shop sta?? and temporary and contract human resources sta??.Alan Chan – General Manager

Much of our work in the hospitality sector in 2008 focused on the Macau and

Shanghai markets.

In Macau, Q3 and Q4 experienced a much discussed slowdown in construction

and new openings of hotel and casino projects. ??e outlook by mid-2009

should improve as projects come back on line. A by-product of the slow down

has been a tightening in granting work visas and increased emphasis on hiring

local talent. At the same time, tourist visas have been relaxed in an a??empt to

boost travel and tourism to Macau. For candidates, there are still many

opportunities in Macau. Existing hotels, casinos and retail operations need sta?? of all levels with multiple language skills.

In Shanghai, demand for quality candidates with overseas education, local language skills and cultural understanding is still very high. Employers are more cautious and the hiring process has lengthened. Employers are taking time to ??nd the absolute right ??t.

Employee turnover remains high and talent retention is still an issue. Candidates continue to look for competitive salaries, job satisfaction and career growth opportunities.

??e next six months will see some slowdown in recruitment due to the combined e??ect of Chinese New Year and the global economic realignment. We do not see this situation persisting in either Macau or Shanghai for very long.

January 2009

Hospitality, Travel, Retail and Customer Service

RECRUITMENT

Position

Hospitality

Director of Sales Marketing Manager Marketing Manager

Director of Convention Catering Director of PR PR Manager Events Manager Spa Manager

No. of years exp

8+ 10+ 5-8 10+ 10+ 4+ 5+ 5-8

Monthly Base Salary

$45K - 60K$40K - 60K$28K - 35K$45K+$45K - 55K$28K - 40K$35K - 40K$30K - 40K

Retail

Director of Retail Leasing Manager

Retail Operations Manager Retail Operations Manager Brand Manager Brand Manager

Senior Visual Merchandiser Visual Merchandiser Area Manager Store Manager Senior Sales Sta?? Sales Sta??

8+ 5+ 10+ 5+ 10+ 3+ 8+ 5+ 10+ 3+ 8+ 3+

$65K - 80K$70K - 90K$50K - 80K$30K - 40K$50K - 60K$30K - 45K$40K - 50K$30K$50K - 70K$25K - 35K$18K - 25K$12K - 15K

Note: All salary ranges are represented in terms of basic salaries exclusive of bonuses, stock options or other variable incentives. Rates will vary depending on industry.

January 2009