资金管理专题报告

By Van K. Tharp [翻译 by th0ri4, th0ri4@gmail.com]

SPECIAL REPORT ON MONEY MANAGEMENT

Copyright © 1997 by I.I.T.M., Inc. All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission. For information:

International Institute of Trading Mastery, Inc.

519 Keisler Dr., Ste 204,

Cary, NC 27511

(919) 852-3994

(919) 852-3942

Internet http://www.iitm.com

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal advise or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers.

Printed in the United States of America

目录

前言... 2

资金管理专题 – 第一部分... 2

资金管理专题 – 第一部分... 3

Managing Other People's Money. 3

资金管理的定义... 4

资金管理模型... 6

模型 1 –每固定金额单元模型... 6

模型 2 – 等单元/比例l 8

模型 3 –保证金百分比... 8

模型 4 — 波动性百分比... 9

资金管理专题-第二部分... 10

模型 5 — 风险百分比... 10

模型 6 — 周期资金调整s. 11

模型 7 –Group Control 11

模型 8 — Portfolio Heat 12

Model 9 — 多头VS空头头寸... 13

使用资金管理达到你的交易目标... 13

设计一个高风险回报率的资金管理系统... 13

结论... 14

参考... 14

前言

投资成功和做出顶级交易最大的秘密可能就是资金管理。我叫它“秘密”的原因是因为包括很多写这方面书的那些人在内,只有很少人真正理解它。有的人叫它风险控制,有的人叫多样化投资,还有一些人把它叫做“怎样聪明的投资你的资金”。但是,资金管理仅仅是告诉你在任何市场上该持有多少头寸的那部分。Perhaps the greatest secret to top trading and investing success is appropriate money management. I call it a "secret" because few people seem to understand it, including many people who've written books on the topic. Some people call it risk control, others call it diversification, and still others call it how to "wisely" invest your money. However, the money management that is the key to top trading and investing simply refers to the algorithm that tells you "how much" with respect to any particular position in the market.

有很多心理上的偏见导致人们不能做出好的资金管理。另外,也有一些实际的原因比如不理解资金管理或者没有足够的资金来做资金管理。There are many psychological biases that keep people from practicing sound money management. In addition, there are also practical considerations, such as not understanding money management or not having sufficient funds to practice sound money management.

我在这份报告中将会给你一个完整的关于资金管理的解释并且会介绍几种不同的资金管理方法。这份报告可能会是你买过的最好的出版物之一。尽管做了很多的努力让这份报告变得见得一点,它现在可能还是有些复杂。不过当你读完里面的例子并且理解它的时候你就会发现阅读它是值得的。I've written this special report to give you an overall understanding of the topic and show you various models of money management. Enjoy the journey its potentially the most profitable journey you will ever take. The material is quite complex, despite an attempt to make it simple. However, you'll find it well worth your while to go through all the examples until you have mastered it.

资金管理专题 – 第一部分

在过去的三天当中损失了账户的70%的时候,John几乎要休克了。他非常震惊,但是依旧相信自己能够赚回来老本。最后,在市场消灭他之前,他已经损失了200%。他的账户里面最后只剩下4500美元。你将会给John什么样的建议呢?John was a little shocked over what had happened in the market over the last three days - he'd lost 70% of his account value. He was shaken, but still convinced that he could make the money back! After all, he had been up almost 200% before the market withered him down, He still had $4,500 left in his account. What advice would you give John?

你的建议可能是“马上退出市场,你没有足够的资金继续做投机交易”。但是,大多数的人通常在市场中有一个致命的想法,他或者她可以在1年中让自己的账户增长到100万美元。虽然这种业绩是有可能的,不过对于任何想尝试它的人来说,毁灭账户的机会是确定的。Your advice should be, "get out of the market immediately. You don't have enough money to trade speculatively." However, the average person is usually trying to make a big killing in the market, thinking that he or she can turn a $5,000 to $10,000 account into a million dollars in less than a year. While this sort of feat is possible, the chances of ruin for anyone who attempts it is almost certain.

Ralph Vince用40位博士做试验。这些博士都没有统计或者交易背景。40位博士使用一个计算机游戏来交易。他们每个人有一个10000美元的账户并且可以在一个胜率为60%的游戏中做100次交易。当他们赢的时候得到与他们拿来冒险的资金等额的回报,输的时候失去冒险资金。Ralph Vince did an experiment with forty Ph.D.s. He ruled out doctorates with a background in statistics or trading. All others were qualified. The forty doctorates were given a computer game to trade. They started with $10,000 and were given a 100 trials in a game in which they would win 60% of the time. When they won, they won the amount of money they risked in that trial. When they lost, they lost the amount of money they risked for that trial.

这个游戏实际上要比你在拉斯维加斯所能找到的任何一个游戏要好。你猜测一下有多少博士在经过100次的交易以后盈利?当结果公布以后,只有两位盈利了。其余的38位博士都亏损。想象一下,95%的人在玩这个胜率比拉斯维加斯任何游戏都高的游戏的时候都是亏损的。为什么?他们亏损的原因是他们采用了“赌徒的谬论”和拙劣的资金管理技巧。This is a much better game than you'll ever find in Las Vegas. Yet guess how many of the Ph.D's had made money at the end of 100 trials? When the results were tabulated, only two of them made money. The other 38 lost money. Imagine that! 95% of them lost money playing a game in which the odds of winning were better than any game in Las Vegas. Why? The reason they lost was their adoption of the gambler's fallacy and the resulting poor money management.

让我们看一下如何玩这个游戏。你玩了3次并且3次都输掉了-这在游戏是完全可能的。现在你的账户里面还有7000美元了并且你想,“我已经连续输了三次了,下次应该到我赢了吧?”这就是“赌徒的谬论”因为你赢的概率依旧是60%。接下来你又输掉了3次,账户里面只剩下4000美元了,此时在游戏中盈利的机会已经很渺茫了,因为你必须盈利超过150%才能超过前期的初始资金量。尽管你连续输4次的概率很小-0.0256-但是它仍然可能在100次的尝试中发生。Lets say you started the game risking $1,000. In fact, you do that three times in a row and you lose all three times — a distinct possibility in this game. Now you are down to $7,000 and you think, "I've had three losses in a row, so I'm really due to win now." That's the gambler's fallacy because your chances of winning are still just 60%. Anyway, you decide to bet $3,000 because you are so sure you will win. However, you again lose and now you only have $4,000. Your chances of making money in the game are slim now, because you must make 150% just to break even. Although the chances of four consecutive losses are slim — .0256 — it still is quite likely to occur in a 100 trial game.

这里有另外一个导致破产的玩法。让我们用2500美元开始。在连续三次输掉之后,账户里面只剩下了2500美元。现在必须盈利300%才可以恢复元气。在破产之前是不可能做到的了。Here's another way they could have gone broke. Lets say they started out betting $2,500. They have three losses in a row and are now down to $2,500. They now must make 300% just to get back to even and they probably won't be able do that before they go broke.

在前面的例子当中,失败的原因是他们冒了太大的风险。因为心理上的原因-贪婪和对概率的不理解,甚至在某些情况下情愿去输的心理-导致了过度的风险。In either case, the failure to profit in this easy game occurred because the person risked too much money. The excessive risk occurred for psychological reasons — greed, the failure to understand the odds, and, in some cases, even the desire to fail. However, mathematically their losses occurred because they were risking too much money.

这是人们带着少量的钱进入一个非常投机性的市场当中犯的典型的错误。一个低于50000美元的账户已经很小了,但是平均的账户大小却是5000到10000美元。结果就是这些人因为账户太小没有办法进行合理的资金管理。因为过小的账户规模他们失败的数学概率非常高。What typically happens is that the average person comes into most speculative markets with too little money. An account under $50,000 is small, but the average account is only $5,000 to $10,000. As a result, these people are practicing poor money management just because their account is too small. Their mathematical odds of failure are very high just because of their account size.

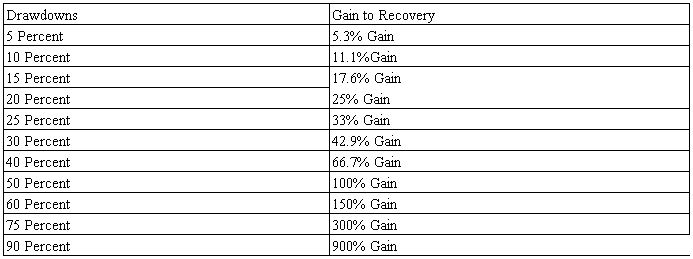

Table 1 Recovery after Drawdowns

请看表格1,主意你的账户从不同程度的亏损当中恢复元气需要产生多大的盈利。举个例子,当你亏损20%d的时候并不需要太多的盈利以使你的账户恢复到远离的水平。但是40%的亏损却需要66。7%的盈利才能恢复,50%的亏损需要100%的盈利恢复。当你亏损超过50%,恢复几乎就是不可能的了。结果是,当你冒了 太大的风险并且损失的时候,你恢复到初始状态的机会就很小了。当中Look at Table 1. Notice how much your account has to recover from various sized drawdowns in order to get back to even. For example, losses as large as 20% don't require that much of a corresponding gain to get back to even. But a 40% drawdown requires a 66.7% gain to breakeven and a 50% drawdown requires a 100% gain. Losses beyond 50% require huge, improbable gains in order to get back to even. As a result, when you risk too much and lose, your chances of a full recovery are very slim.

Managing Other People's Money

管理其他人的资本

In the futures industry, when an account goes down in value, it's called a drawdown. Suppose you open an account for $50,000 on August 15th. For a month and a half, the account goes straight up. On September 30th, it closes at a high of $80,000 for a gain of 60%. At this point, you may still be in all of the same trading positions. But as a professional, your account is "marked to the market" at the end of the month and statements go out to your clients indicating what their respective accounts are worth.

在期货行业,当一个帐户亏损的时候,我们叫做一个drawdown。假设你在8月15号开了一个50,000美元的帐户,经过一个半月的管理它的净值规模增长了一些。在9月30号,它变成了800000美元,盈利60%。在这个时候,你交易的头寸可能仍然是没有变化的。但是作为专业人士,月末的时候你必须将报表分发给你的客户让他们决定继续投资你是否值得。

Now, let's say that your positions start to go down in value around the 6th of October. You close them out around the 14th of October and your account is now worth about $60,000. Let's say, for the sake of discussion, that your account at the end of October is worth $60,000. Essentially, you've had a peak-to-trough drawdown (peak = $80,000, trough = $60,000) of $20,000 or 25%. This may have occurred despite the fact that all of your trades were winners. It doesn't really matter as far as clients are concerned. They still believe that you just lost $20,000 (or 25%) of their money.

现在让我们假设你的头寸在10月6日净值开始回落。在14号你清仓了,并且现在你的帐户净值变为60,000美元。到了月末你的帐户净值变为了60,000美元。尽管你所有的头寸都是盈利的,但是你的客户可不会这么认为,他们会觉得你损失了他们25%的资本。

Let's say that you now make some losing trades. Winners and losers, in fact, come and go so that by August 30th of the following year, the account is now worth $52,000. It has never gone above $80,000, the previous peak. Thus, you now have a peak-to-trough drawdown of $28,000 — or 35%. As far as the industry is concerned, you have an annual rate of return of 4% (i.e., the account is only up by $2,000) and you are labeled as having a 35% peak-to-trough drawdown. And the ironic thing is that most of the drawdown occurred at a time in which you didn't have a losing trade — you just managed to give back some of your profits. Nevertheless, you are still considered to be a terrible money manager. Money managers typically have to wear the label of the worst "peak-to-trough" drawdown that they produce for their clients for the rest of their lives.

如果接下来你做了一些亏损的投资,那么到了第二年8月30号你的帐户只有52,000美元了。它再也没有上涨超过80,000美元。按照行业规则,你现在有只有4%的回报并且有35%的帐户Drawdown。在你没有失手一笔的情况让帐户回落35%已经变成了一个铁一般的事实。尽管你只是试图恢复部分损失的利润,可是你依旧被认为是一个很糟糕的基金经理人。大部分的时候基金经理人不得不带上最糟糕的帐户回落这个帽子。

Think about it from the clients viewpoint — you watched $28,000 of your money disappear, To you its a real loss. You could have asked for your money on the first of October and been $28,000 richer.

从客户的观点来看,你眼睁睁的看着28,000美元从你的帐户里面消失。这是一笔真实的损失。你当初真应该在去年的时候取出你的钱来。

Trading performance, as a result, is best measured by one's reward-to-risk ratio. The reward is usually the compounded annual rate of return, In our example, it was 4% for the first year. The risk is considered to be the peak-to-trough drawdown which in our example was 35%. Thus, this traders reward-to-risk ratio was 4/35 or 0.114 — a terrible ratio.

结论是,风险回报比才是衡量投资绩效的最好的一个指标。回报就是你的年度利润。而风险呢则用最大的帐户回落来衡量。因此你的风险回报比是35比4,一个很可怕的比率。

Typically, you want to see ratios of 2 or better in a money manager. For example, if you had put $50,000 in the account and watched it rise to $58,000, you would have an annual rate of return of 16%. Let's say that when your account reached 553,000, it had drawdown to $52,000 and then went straight up to $58,000. That means that your peak-to-trough drawdown was only 0.0189 (i.e., $1,000 drawdown divided by the peak equity of $53,000). Thus, the reward-to-risk ratio would have been a very respectable 8.5. People would flock to give you money with that kind of ratio.

通常,你期望风险回报比是1:2或者更低。举个例子,如果你的帐户初始资金有50,000美元,并且升值到了58,000美元,这是16%的年收益。现在我们假设你的帐户曾经从53,000回落到52,000美元,然后直接上涨到了58,000美元。这意味着你的帐户Drawdown仅仅只有0.00189.因此此时的风险回报比是非常诱人的1:8.5.此时将会有一大群人想投资你。

Let's take another viewpoint and assume that the $50,000 account is your own. How would you feel about your performance in the two scenarios? In the first scenario you made $2,000 and gave back 528,000. In the second scenario, you made $7,000 and only gave back $1,000.

让我们换一个视角并假设50,000美元就是你自己的。你感觉在那一种情况下投资的业绩更好呢? 第一种情况下你赚了2,000美元并且还给市场了28,000美元。第二种情况你赚了7,000美元,换给市场1,000美元。

Lets say that you are not interested in 16% gains. You want 40-50% gains. In the first scenario you had a 60% gain in a month and a half. You think you can do that several times at year. And you're willing to take the chance of giving all or most of it back in order to to that. You wouldn't make a very good money manager, but you might be able to grow your own account at the fastest possible rate of return if you could "stomach" the drawdowns.

假设你不希望年回报是16%这么少,你期望年回报40-50%。在第一种情况下,你一个半月就赚了60%的利润。你想以后几个月再赚几笔简直就赚翻啦。此时你非常愿意去冒险。你可能不是一个很好的基金经理人,但是在你能接受的巨大Drawdown下,你很有可能让你自己的帐户快速增长。

Both winning scenarios, plus numerous losing scenarios, are possible using the same trading system. You could aim for the highest reward-to-risk ratio. You could aim for the highest return. Or you could be very wild, like the Ph.D.'s in the Ralph Vince game and lose much of your money by risking too much on any given trade.

在以上两种盈利的案例还有其它的亏损案例中可能都用了同样的交易系统。你可以期望高的回报风险比,也可以期望较高的回报。也更有可能的是像Ralph博士的游戏里那样,因为冒的风险过大而损失所有的资本。

Interestingly enough, a research study (Brinson, Singer, and Beebower, 1991) has shown that money management (called asset allocation in this case) explained 91.5% of the returns earned by 82 large pension plans over a ten year period. The study also showed that investment decisions by the plan sponsors pertaining to both the selection of investments and their timing, accounted for less than 10% of the returns. The obvious conclusion is that money management is a critical factor in trading and investment decision making.

You now understand the importance of money management. Lets now look at various money management models, so that you can see how money management works. Many of the examples given are in the futures market. However, the models apply equally well to any investment. When the example says contract or unit or 100 shares, the meaning, for all practical purposes, is the same.

现在你应该理解了资金管理的重要性。接下来让我们继续看各种不同的资金管理模型,以便让你更清楚它如何运作。大部分的例子都是期货市场的,但是同样适用于其它市场。

资金管理的定义

以我的观点来看,资金管理是任何交易系统当中最重要的部分。很多的专业人士和非专业人士都不理解它的重要性。最近我出席了一个关于经纪人应该实用什么投资方法帮助他们的客户的研讨会。这场研讨会很可怕,关于资金管理的主题-我在这里定义的资金管理-根本没有提及到。有一个演讲者确实提到了资金管理,不过我很难把他谈论的内容跟该主题对上号。在会后我问他:“你的资金管理是什么意思呢?”他回答:“这是个好问题,我认为它是关于如何做投资决策”。In my opinion, money management is the most significant part of any trading system. Many professionals, and most amateurs, do not understand how important it is. In fact, I recently attended a seminar for stock brokers that detailed a particular method of investing that they could use to help their clients. While the seminar as a whole was terrific, the topic of money management, as I've defined it here, was not even covered. One speaker did talk about money management, but I could not fit what he was talking about into this discussion at all. At the end of his talk, I asked him, "What do you mean by money management?" His response was, "That's a very good question. I think it's how one makes trading decisions."

资金管理是拙劣的业绩和优秀业绩之前的差别,也是破产者和成功的投资人之间的差别。现在定义它很重要!请记住。Since money management is the difference between poor performance and great performance — the difference between going broke and being a successful professional — it's important that I define it right now. Please take note.

资金管理是你的交易系统当中告诉你“多少”的那部分。在任何时刻,你应该投资多少头寸?你应该承受多少损失?除了个人的心理问题,它是你作为一个交易者或者投资者需要理解的最重要的概念。Money management is that portion of your trading system that tells you "how many" or "how much." How many units of your investment should you put on at a given time? How much risk should you be willing to take? Aside from your personal psychological issues, this is the most critical concept you need to tackle as a trader or investor.

这个概念非常关键,因为“多少”这个问题决定了你的潜在损失和潜在利润。另外,你需要把你的机会扩展到其它不同的投资或者产品上。在你的投资组合当中平衡风险并给与每个投资产品相同的盈利机会。The concept is critical because the question of "how much" determines your loss potential and your profit potential. In addition, you need to spread your opportunity around into a number of different investments or products. Equalizing your exposure over the various trades or investments in your portfolio gives each one an equal chance of making you money.

我被Jack Schwager的华尔街精英访谈-《Market Wizards》所吸引。事实上他们当中几乎所有的人都提及了资金管理的重要性。下面是一些引用:I was intrigued when I read Jack Schwager's Market Wizards in which he interviews some of the world's top traders and investors. Practically all of them talked about the importance of money management. Here are a few sample quotes:

“风险管理是应当被理解的最重要的事情。缩减你的头寸是我的第二个建议。不论你认为应该持有多少头寸,先砍掉一半。”-Bruce Kovner。"Risk management is the most important thing to be well understood. Undertrade, undertrade, undertrade is my second piece of advice. Whatever you think your position ought to be, cut it at least in half" - Bruce Kovner

“决不要在任何的交易上冒超过你总资本1%的风险。对于任何一笔投资我的风险都是1%。保持风险的最小和稳定是绝对重要的。"-Larry Hite。Never risk more than 1% of your total equity in any one trade. By risking 1%, I am indifferent to any individual trade. Keeping your risk small and constant is absolutely critical.” - Larry Hite

“你必须最小化损失并且尽可能的保存你的资本,为了那些在很短的时间内大幅度获利的机会。你不能做的事情就是在不合适的时机扔掉自己的资本”-Richard Dennis。"You have to minimize your losses and try to preserve capital for those very few instances where you can make a lot in a very short period of time. What you can't afford to do is throw away your capital on suboptimal trades." - Richard Dennis

职业赌徒玩的是低期望收益甚至负期望收益的游戏。这些人非常清楚资金管理是他们成功的关键。赌徒的资金管理方法分为两种:输钱加倍加码和赢钱加倍加码系统。Professional gamblers play low expectancy, or even negative expectancy, games. They simply use skill and/or knowledge to get a slight edge. These people understand very clearly that money management is the key to their success. Money management for gamblers tends to fall into two types of systems — martingale and anti-martingale systems.

Martingale系统在输掉一次以后就将筹码加倍。假设你玩轮盘赌。你每冒一美元的风险就得到一美元的回报,但是你赢的概率是低于50%。这个假设是在一连串的输钱之后,你将会赢。然后你每次输了就将筹码加倍。当球落在你押注的颜色上面的时候,你将会从一连串的损失当中赚取1美元。Martingale systems increase winnings during a losing streak. For example, suppose you were playing red and black at the roulette wheel. Here you are paid a dollar for every dollar you risk, but your odds of winning are less than 50% on each trial. However, with the martingale system you think you have a chance of making money through money management. The assumption is that after a string of losses you will eventually win. And the assumption is true — you will win eventually. Consequently, you start with a bet of one dollar and double the bet after every loss. When the ball falls on the color you bet, you will make a dollar from the entire sequence of wagers.

这个逻辑听起来不错。最后你将会赢并且获得一美元。但是有两个因素限制你实用Martingale策略。第一,一连串的损失是非常可能的,特别是在概率小于50%的时候。举个例子,你可能会在1000次的尝试当中出现连续10次的失败。事实上,连续15,16次的损失也是非常有可能的。当你连续输掉10次以后,下一次你必须押上2048美元才有机会赢得1美元,你也可能损失4095美元。你的风险回报率是1:4095The logic is sound. Eventually, you will win and make a dollar. But two factors work against you when you use a martingale system. First, long losing streaks are possible, especially since the odds are less than 50% in your favor. For example, one is likely to have a streak of 10 losses in a row in a 1,000 trials. In fact, a streak of 15 or 16 losses in a row is quite probable. By the time you have reached ten in a row, you would be betting $2,048 in order to come out a dollar ahead. If you lose on the eleventh throw, you would have lost $4,095. Your reward-to-risk ratio is now 1 to 4095.

第二,赌场限制了赌注大小。桌上最小的赌注是1美元,但是他们不许你的赌注超过50或者100美元。结果就是,Martingale系统在这种情况下不好使了。Second, the casinos place betting limits. At a table where the minimum bet was a dollar, they would never allow you to bet much over $50 or $100. As a result, martingale betting systems, where you risk more when you lose, just do not work.

盈利时增加风险的Antimartingale系统确实有效。Antimartingale systems, where you increase your risk when you win, do work. 聪明的赌徒知道在赢的时候,在某些限制下面增加赌注。这对投资或者交易同样适用。资金管理要求你在盈利的时候增加你的头寸。这对投资、交易、赌博都是适用的。Smart gamblers know to increase their bets, within certain limits, when they are winning. And the same is true for trading or investing. Money management systems that work call for you to increase your position size when you make money. That holds for gambling and for trading and for investing.

资金管理的目的是要告诉你,在给定的账户规模下,你可以持有多少单元(股票数量或者和约数量)。比如,资金管理的策略可能告诉你,目前你没有足够的资金持有任何头寸,因为风险太大了。它可以让你确定你的风险回报率。也可以帮你平衡你投资组合当中每笔投资的风险。The purpose of money management is to tell you how many units (shares or contracts) you are going to put on, given the size of your account. For example, a money management decision might be that you don't have enough money to put on any positionsbecause the risk is too big. It allows you to determine your reward and risk characteristics by determining how many units you risk on a given trade and in each trade in a portfolio. It also helps you equalize your trade exposure in the elements in your portfolio.

有一些人认为他们是在通过实用“资金止损”来实现资金管理。这种类型的止损可以让你在损失了一定数额的资金以后平仓所有的头寸--比如1000美元。但是,这种止损并不能告诉你“多少”,所以它并不是资金管理。通过确定亏损出场的数额来控制风险与通过资金管理模型来控制风险是不同的。Some people believe that they are "managing their money" by having a "money management stop." Such a stop would be one in which you get out of your position when you lose a predetermined amount of money — say $1000. However, this kind of stop does not tell you "how much" or "how many," so it really has nothing to do with money management. Controlling risk by determining the amount of loss if you are stopped out is not the same as controlling risk through a money management model that determines the size of your position.

有很多中不同的自己管理策略你可以使用。在本报告的剩余部分,你将会学习到不同的资金管理策略。有一些可能会比其它的方法更适合你的交易或者投资风格。有一些在股票市场上表现良好,另外一些是为期货市场设计的。他们都是Anti-martingale策略,头寸的规模随着你的账户规模的增长而增长。There are numerous money management strategies that you can use. In the remainder of this update, you'll learn different money management strategies that work well. Some are probably much more suited to your style of trading or investing than others. Some work best with stock accounts, while others are designed for a futures account. All of them are anti-martingale strategies in that your position size goes up as your account size grows.

这些材料有点复杂。我会尽量避免采用数学表达式并且给出每种策略的清晰的例子。你只需要反复的阅读这些材料直到完全理解它。The material is somewhat complex. However, I've avoided the use of difficult mathematical expressions and given clear examples of each strategy. As a result, you simply need to read the material carefully and go over it until you understand it.

资金管理模型

你将要学习到的所有模型都跟账户的资本有关。当你意识到有三种确定账户资本的方法以后,这些模型将会马上变得错综复杂。每种方法都会对你在市场中暴露的风险和回报有不同的影响。这些方法包括the core equity method, the total equity method, and the reduced total equity method.

The Core Equity Method很简单。当你开了一个新的头寸,你只需要按照你的资金管理策略确定这个头寸的大小。因此,如果你有四个头寸,你的核心资本就是你的初始资本减去每个头寸占用的资金。

假设你的初始资本为50000美元并且你分配给每个交易10%。你用我们后面将会提到的资金管理方法花费5000美元开了一个头寸。现在的核心资本就变成了45000美元。你用另外4500美元开了第二个头寸,那么你的核心资本就会变成40500美元。所以当你用4050美元开了第三个头寸的时候你的核心资本会变成36450美元。总之,核心资本的计算就是初始资本减去分配给每个头寸的资金然后在你平掉头寸的时候做出调整。所有新开头寸的大小都是你当前核心资本的函数。新开头寸的大小一直都是你当前核心资本的函数。

The Total Equity Method也非常简单。账户资本等于你当前账户的现金加上所有头寸的价值。假设你的账户有40000美元的现金加上一个价值15000美元的头寸,一个7000美元的头寸,一个损失了2000美元的头寸。你的总资本就是账户的现金加上所有头寸的价值。因此你的总资本是60000美元。(老范在这里似乎犯了一个错误,第三个头寸的价值我们不知道,仅仅知道亏损。)

The Reduced Total Equity Method是上面两种方法的结合。它像计算核心资本时那样从初始资本当中减去你开头寸中已经确定的风险。不同的是,在止损价位变化时,你可以加回锁定的利润或者减少风险。因此,Reduced Total Equity是你的核心资本加上所有已经通过止损锁定的利润或者通过止损位调整而减少的风险。

下面将会描述如何计算。假设你有50000美元的账户。你可以资金管理策略分配的5000美元开新的头寸。因此你的核心资本现在变成了45000美元。现在,假设你买入的证券升值了并且你使用了追踪止损。因为新的止损,今天你仅有3000美元的风险。你的Reduced Total Equity就变成了50000美元减去3000美元的风险等于47000美元。

下一天,净值下降了1000美元,但是你的Reduced Total Equity仍旧是47000美元,因为止损离市时你的净值依旧是47000美元。它仅在你通过止损锁定利润、减少风险、平仓时才做出调整。

现在你又用资金管理策略开了第二个4000美元的头寸。第一个头寸升值并且你通过追踪止损锁定了11000美元的利润。那你的Reduced Total Equity现在就变为50000美元的初始资本减去开第二个头寸用的4000美元加上锁定的11000美元的利润。结果是57000美元。

下面的模型都是根据你的资本来调整头寸的。因此,每种计算资本的模型都导致不同的头寸大小计算。通常,我都使用总资本模型来计算除非另外说明。

模型1 –每固定金额单元模型

Basically, this method tells you "how much" by determining that you will trade one unit for every X dollars you have in your account. For example, you might trade one contract per $50,000 of your total equity.

基本上,这个模型是通过确定每多少美元做一个合约来给出你可以持有多少合约的。举个例子,你的帐户可以以50,000美元一个台阶做交易。

When you started trading or investing, you probably never heard about money management. If you knew something about it, your knowledge probably came from some book by an author who didn't understand it either. Most books that discuss money management are about diversification or about optimizing the gain from your trading. Books on systems development or technical analysis don't even begin to discuss money management adequately. As a result, most traders and investors have no place to go to learn what is probably the most important aspect of their craft.

当你开始从事交易的时候,你可能从来没有听说过资金管理。如果你听过一些,那么很可能你也是从一些其他并不了解资金管理的人哪里听来的。大部分讨论资金管理的书都是在讲分散投资或者优化你的投资回报。而关于交易系统和技术分析的书从来都不怎么讨论资金管理。结果就是大家不知道从哪里学习关于交易的最重要的部分。

Thus, armed with your ignorance, you open an account with $20,000 and decide to trade one contract of everything in which you get a signal to trade (an investor might just trade 100 shares). Later, if you're fortunate and your account moves to $40,000, you decide to move up to two contracts (or 200 shares) of everything. As a result, most traders who do practice some form of money management use this model. It is simple. It tells you "how much" in a straight-forward way.

因此,由于你的忽略,你开了一个20,000美元的账户并且决定交易你得到了一个信号的任何合约。然后,如果幸运你的账户增长到了40,000美元,你现在可以交易一次交易2笔合约了。因此大部分的交易者都用这种方法,它很简单,用最直接的方式告诉了你该持有多少合约。

The one unit per fixed amount of money has one advantage in that you never reject a trade because it is too risky. Let me give you an example of a recent experience of two CTAs I know. One trades one contract per $50,000 in equity, while the other limits his risk to 3% of equity and won't open a position in which his exposure is more than that. Recently, each was presented with an opportunity to trade the Japanese Yen contract. The person trading one contract, no matter what, took the trade. The subsequent move in the Yen was tremendous, so this person was able to produce the biggest monthly gain that his firm had ever experienced in their history — a monthly 20% gain.

固定金额每单元模型有一个好处,它绝不会在风险过大的时候拒绝任何一笔投资。让我给你一个很好的例子,是关于我认识的2个CTA(CTA指的是商品交易顾问,用计算机程序来做交易的那些家伙)的例子。其中的一个每50,000美元交易一份合约,而另外一个却限制自己的风险在总资本的3%以内。最近他们都在交易日元合约。那个每50,000美元做一个合约的家伙,不管什么情况都交易。接下来日元的交易行情很火暴,所以这家伙也做除了很大的盈利,他的公司从来没有过的单月20%的盈利。

On the other hand, the other trader couldn't take the trade, even though his account size was $100,000, because the risk involved if the trade went against him exceeded his 3% limit. The second trader didn't have a profitable month.

看看另外一个家伙,他不能交易,尽管这家伙账户有100,000美元,但是因为风险超过了3%的限制,所以这家伙没有任何利润。

Of course, this also works in reverse. The first trader could have taken a large loss if the Yen trade had gone against him which the other trader would have avoided.

当然,在相反的情况下,第一个家伙必然要产生很大的亏损,而第二个家伙就不会。

In presenting the results of all these systems, I've elected to use a single trading system, trading the same commodities over the same time period. The system is a 55-day channel breakout system. In other words, it enters the market on a stop order if the market makes a new 55-day high (long) or 55-day low (short). The stop, for both the initial risk and profit taking, is a 21-day trailing stop on the other side of the market.

为了展示这两种资金管理策略的差别,我选择了一个相同的交易系统,并在同样的时间内交易相同的商品。这个系统是一个55天通道突破的系统。换句话说,就是市场如果突破55天新高或者跌破55天低点就建仓。对于止损或者获利出场就用21天的突破来进行。

To illustrate, if you go long and the market hits a 21-day low, you exit. If you are short and the market makes a new 21-day high, you exit, This stop is recalculated each day, and it is always moved in your favor so as to reduce risk or increase your profits. Such breakout systems produce above average profits when traded with sufficient money.

如果你是多头,但是市场跌破21天低点,那么你就出场。反之亦然。这个止损点每天都要重新计算,不断的移动保护你的利润和减小损失。这个突破的系统在足够的资金下可以产生高于平均收益(大约就是指证券的指数上涨,这是基准,跟基金差不多)的利润。

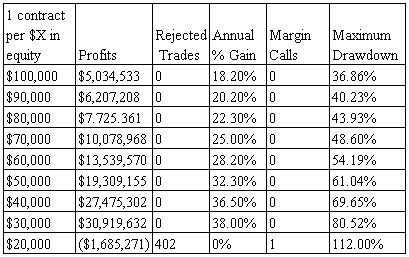

This system was tested with a million dollars in start-up equity with a basket of 10 commodities in the years 1981 through 1991. Whenever data are presented in this report, it is based upon this same 55/21-day breakout system tested over the same commodities over the same years. The only difference between the tables is the money management model used. Table 2 shows the results with this system using the first money management model.

这个系统曾经以100万美元的资本在10个商品上实盘测试,历时10年。(这是著名的海龟试验的系统,译者注)在这个表格当中唯一的区别就在于资金管理策略的不同。 表格2给出了使用第一种资金管理方法的测试结果。

Table 2 55/21 Day Breakout System with 1 contract per $X in equity (Starting Equity is One Million Dollars)

Notice that the system breaks down at one contract per $20,000 in equity. At $30,000, you'd have to endure an 80% drawdown and you'd have to have at least $70,000 if you wanted to avoid a 50% drawdown.

注意这个系统的初始资金少于20,000美元就不可能运作了。在30,000美元的时候还必须忍受80%的Drawdown。如果你要避免50%的Drawdown必须至少有70,000美元的资金。

To really evaluate this money management method, you'll have to compare it with the tables developed from the other models (see Tables 3 and 5).

为了真实的比较它跟其它策略的差异,你必须跟别的策略做比较。

Despite its advantage of allowing you to always take a position, I believe that the one unit per fixed dollars type of money management is limited, because 1) all investments are not alike and 2) it does not allow you increase your exposure very rapidly with small amounts of money. In fact, with a small account, the "units per fixed amount model" amounts to minimal money management. Lets explore both of these reasons.

尽管它可以让你在任何情况下都持有头寸,但是我认为这个模型有很多的限制:1. 所有的合约并不一样。 2. 对于小的账户它并不能让你的筹码快速增加。

All contracts are not alike. Suppose you are a futures trader and you decide you are going to be trading up to twenty different commodities with your $50,000. Your basic money management strategy is to trade one contract of anything in that portfolio that gives you a signal. Lets say you get a signal for both bonds and corn. Thus, your money management says you can buy one corn contract and one bond contract.

所有的合约并不相同。假设你是一个期货交易者,你现在要用50,000美元的账户交易20个不同的商品市场。你的策略就是任意市场给出一个信号就买入。让我们假设你现在同时得到了一个玉米和债券的信号,因此你的策略告诉你现在可以买入一个玉米合约和一个债券合约。

With T-bonds futures at $112 as of August 1995, you are controlling $112,000 worth of product. In addition, the daily range (i.e., the volatility) is about 0.775 so if the market moved three times that amount in one direction, you would make or lose $2,325. In contrast, with the corn contract you are controlling about $15,000 worth of product. If it moved three daily ranges with you or against you, your gain or loss would be about $550. Thus, what happens with your portfolio will depend about 80% on what bonds do and only about 20% on what corn does.

1995年8月的债券期货价格是112美元,你可以控制112,000美元价值的商品。另外每天的价格波动大约是0.775点,如果市场单边连续运行了3天,你可能盈利或者亏损2,325美元。相比之下,玉米合约你可以控制15,000美元的商品。如果连续3天单边波动,你盈利或者亏损550美元。因此,你的投资组合当中债券有80%的影响力而玉米只有20%。

One might argue that corn has been much more volatile and expensive in the past. That could happen again. But you need to diversify your opportunity according to what's happening in the market right now. Right now, based on the data presented, corn has about 20% of the impact on your account that bonds would have.

可能有人会争论玉米合约的波动性和价格已经比以前贵多了。那确实是,但是你现在需要根据市场上发生的事情分散你的机会。根据现在的数据,你的玉米投资对于整个账户有20%的影响力。

Cannot increase exposure rapidly. The purpose of an antimartingale strategy is to increase your exposure when you are winning. When you are trading one contract per $50,000 and you only have $50,000, you will have to double your equity before you can increase your contract size. As a result, this is not a very efficient way to increase exposure during a winning streak. In fact, for a 550,000 account it almost amounts to no money management.

不能快速的增加头寸规模。根据Antimartingale策略,当你盈利的时候你必须增加你的筹码。如果你每五万美元交易一个合约,而且目前账户只有5万美元。你如果要增加筹码就必须先将你的资本翻倍。事实上对于一个50,000美元的账户等于没有资金管理。

Part of the solution would be to require a minimum account size of a million dollars. If you did that, your account would only have to increase by 5% before you moved from 20 contracts (1 per $50,000) to 21 contracts.

其中一个解决的方案就是至少需要一个最小的账户规模,比如100万美元。如果你那么做,如果你要从20个合约增加到21个合约账户至少要增长5%。

One reason to have money management is to have equal opportunity and equal exposure across all of the elements in one's portfolio. You want an equal opportunity to make money from each element of your portfolio. In addition, you also want to spread your risk equally among the elements of your portfolio.

资金管理的一个原因是对于你投资组合里面的每个头寸都拥有相同的机会和收益。对于每个头寸你都会想拥有相同的盈利机会,另外你也会让分散均匀的分散到投资组合的每个头寸里面。

Having equal opportunity and exposure to risk, of course, makes the assumption that each trade is equally likely to be profitable when you enter into it. You might have some way to determine that some trades are going to be more profitable than others. If so, then you would want a money management plan that gives you more units on the higher-probability-of-success trades — perhaps a discretionary money-management plan. However, for the rest of this update, we're going to assume that all trades in a portfolio have an equal opportunity of success from the start. That's why you selected them.

拥有相同的机会和风险暴露是基于每笔投资都具有相同的获利潜力。可能你有其它的办法确定某一些市场更具有获利潜力,那么你需要一个能够给你更多的头寸的资金管理策略。也许是一个模糊的资金管理策略。但是,对于本专题,我们假设所有的机会都是均等的。这也是你选择它的原因。

The "units per fixed amount of money" model, in my opinion, doesn't give you equal opportunity or exposure. But there are a number of methods whereby you can equalize the elements of your portfolio. These include equating 1) the total value of each element of the portfolio; 2) the margin of each element in the portfolio; 3) the amount of volatility of each element in the portfolio; and 4) the amount of risk (i.e., how much you'd would lose when you got out of a position in order to preserve capital) of each element in the portfolio.

等金额每单元模型并不能给你均等的机会和风险暴露。但是也有一些办法可以让你均衡投资组合当中的每个头寸。这些办法将在下面的几个模型中给出。

模型 2 –等单元/比例l

The Equal Units Model is typically used with stocks or other instruments which are not leveraged. The model says that you determine "how much" by dividing your capital up into five or ten equal units. Each unit would then dictate how much product you could buy. For example, with our $50,000 capital, we might have five units of $10,000 each.

等单元模型通常用在股票或者非按金交易市场。这个模型把你的资金分成均等的几份,每一分你可以决定买入多少资产。举个例子,你可以把你的50,000美元分成5份,每一份10,000美元。

Thus, you'd buy $10,000 worth of investment "A", $10,000 worth of investment "B", $10,000 worth of investment "C" and so forth. You might end up buying 100 shares of a $100 stock, 200 shares of a $50 stock, 500 shares of a $20 stock, 1000 shares of a $10 stock, and 1429 shares of a $7 stock. Part of the money management in this strategy would be to determine how much of your portfolio you might allocate to cash at any given time.

因此你可以买10,000美元的A资产,10,000美元的B资产,等等。最终你可能会买100股价格100美元的股票,200股50美元的,500股20美元的,1000股10美元的股票和1429股7美元的股票。

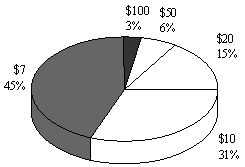

Chart 1: Distribution of Funds as Shares (each unit represents $10,000)

Chart 1 simply illustrates the number of shares, as a percentage of total shares, for each of the five $10,000 units.

图1简单的给出了对于每一份10,000美元所购买的股份在所有股份总额中的比率。

Notice that there is some inconvenience in this procedure. For example, the price of the stock may not necessarily divide evenly into $10,000 — much less into 100 share units.

这个模型有一个很不方便的地方,每一份的资金可能并不能正好整除,还不够买一手(美国好像也跟国内一样,是100股一手)。

In futures, the equal units model might be used to determine how much value you are willing to control with each contract. For example, with the $50,000 account you might decide that you are willing to control up to $250,000 worth of product. And lets say you arbitrarily decide to divide that into five units of $50,000 of each.

在期货市场,这个模型也可以用来确定每种合约你可以买卖多少。举个例子,你有50,000美元的账户,并且只愿意做多买入25,000美元的合约,分成五分就变成了5,000美元。

A bond contract is currently worth about $112,000. You couldn't buy any bonds, using this money management criterion, because you'd be controlling more product than you can handle with one unit.

债券合约当前是112,000美元。在这种策略下你就不可以买入一份合约。

Corn is traded in units of 5,000 bushels. A corn contract, with corn at $3 per bushel, is valued at about $15,000. Thus, your $50,000 would allow you to buy 3 units of corn or $45,000 worth.

玉米每份合约是5,000蒲式耳,每蒲式耳3美元,一份合约的造价就是15,000美元。因此你可以买入3份合约。(这里老范也出错了,似乎是保证金)

Gold is traded in 100 ounce contracts in New York, which at a price of $390 per ounce, gives a single contract a value of $39,000. Thus, you could trade one gold contract with this model.

黄金合约每份100盎司,每盎司390美元,因此你可以交易一笔黄金合约。

The Equal Units Approach allows you to give each investment or futures an approximate equal weighting in your portfolio. It also has the advantage in that you can see exactly how much leverage you are carrying. For example, if you are carrying 5 positions in your $50,000 account, each worth about $50,000, you would know that you had about $250,000 worth of product. In addition, you would know that you had about 5-to-1 leverage, since your $50,000 was controlling $250,000.

等单元模型给予你每一个头寸在投资组合当中相同的权重。他还有一个有点就是可以看出你投资组合的杠杆比率。比如你有一个50,000美元的账户,持有5个头寸,每一个头寸价值大约50,000美元,那么你账户的杠杆比率就是5:1。

When you use this approach you must make a decision about how much total leverage you are willing to carry before you divide it into units. It's such valuable information, so I would recommend all traders keep track of the total product value they are controlling and their leverage. This information can be a real eye opener.

当你使用这个模型的时候必须确定你能够接受的总的杠杆比率。这是一个很有价值的信息,所以我建议所有的交易者追踪所有的合约价值和他们的融资比率。

The equal units approach still has the disadvantage in that it would only allow you to increase "how much" very slowly as you make money. In most cases with a small account, equity would again have to double to increase your exposure by one unit. Again, this practically amounts to "no" money management for the small account.

这个模型也有一个缺点,就是当你盈利的时候加码很慢。在大部分的情况下,小的账户需要将筹码翻倍,这意味着对于小型账户没有资金管理。

模型 3 –保证金百分比

The third model one might use for money management is to control your size according to the margin requirements of the underlying assets. Here, margin refers to the amount of money that the exchange (or your broker) requires that you put up in order to purchase one investment unit. If you have less money in your account than the margin requirements, you'll need to add more money.

保证金百分比模型用来控制你建立头寸是所需的保证金规模。保证金是交易所规定的你建立头寸所必须的资金,如果你的帐户余额不够多,那么就必须得入金了。

The margin on buying most stock is 50%. Thus, you would have to have $25,000 in your account to purchase $50,000 worth of stock. In contrast, the margin on one S&P futures contract is currently $11,250. Thus, you could purchase one S&P contract, controlling stock worth approximately $290,000 at today's (December 1995) price, with only $11,250 in your account. This would give you leverage of almost 25-to-1.

股票市场投资所占用的资金是总资金的50%,因此对于一个50,000美元的帐户你可以用25,000美元投资股票。现在一份标准普尔500指数期货合约所需要的保证金是11,250美元,它代表着290,000美元的证券标的,保证金比率是25:1。

Since leverage can be so high with futures, you might want to control it by limiting your margin to a percentage of your equity. Here's how that would work. You might decide to limit your trades to 5% of margin. In a $50,000 account this would mean that the margin of your first purchase could be no more than $2,500.

由于期货市场的杠杆比率是如此之高,你不得不把你的保证金限制在你总资本的一定百分比以内。你可能决定讲它限制在5%以内,那么对于一个50,000美元的饿帐户,第一笔的投资不能超过2,500美元。

The margin of your second purchase would depend on the equity model you were using. Lets say you have one open position worth $2,500 and $47,500 in cash. With the total equity model, your next purchase could also have a margin of $2,500 — 5% of the total. However, with the core equity model or the reduced total equity model, you could only acquire margin in the second position of $2,375 — 5% of $47.500.

第二笔投资的保证金取决于你采用的资本计算模型。现在你有2,500美元的头寸并且有47,500美元的现金。对于总资本模型,你第二笔仍然可以买入2,500美元的头寸。但是对于CEM或者RTEM模型,第二笔你只能买入2,375美元的头寸。

Lets look at a few examples of additions using the Total Equity Model. Currently, the margin on corn is $675. When you divided $675 into your 5% level of $2,500, you get 3.7 contracts. Thus, you could buy 3 contracts. The margin on silver is currently $2500 so your 5% requirement would allow you to buy one contract. However, the margin on bonds is currently $2,700 so you couldn't buy a bond contract until you had increased your equity.

让我们看一下其它的TEM模型的例子。现在一份玉米期货合约的保证金是675美元。用2,500美元除以675得到3,7,因此你可以买入3份合约。白银期货的保证金恰好是2,500美元,你就只能买入一份了。债券的保证金现在是2,700美元,那你一份也买不了。

You might also limit the total margin of your account to some value such as 30%. If you did that, the margin on your total open positions could never total over $15,000 (i.e., 30% of your $50,000). If you wished to purchase a new position that would increase your total margin over that value, you could not do it.

你也可能限制你总头寸保证金只占到账户的30%。这样的话你所有头寸的保证金总额不得超过15,000美元。如果你想买一份新的合约,那就不可以了。

Method three is the first method that allows the smaller account to begin to increase its exposure as it makes money. It gives you strong control over your account and some control over the probability of margin calls.

保证金百分比模型是第一个可以让小型账户投资的时候控制风险的模型。它可以给你的账户非常强的控制并减少Margin Call的可能性。

However, margin amounts can change daily for each contract, so you will have to keep track of them. In addition, the margin values are arbitrarily set by the exchanges and the brokerage houses. They tend to relate to both the volatility and the leverage in a particular contract, but the amount set is still quite arbitrary. As a result, the margin method of money management doesn't necessarily give you equal exposure across all positions.

但是,每种合约的保证金每天都会变,所以你必须持续的追踪你所有的头寸。另外,有时候交易所和经纪商会强制调整保证金额度。它们取决于市场的流动性和特定合约的保证金比率。所以,这种资金管理的方法不能给你所有的头寸相等的风险暴露管理。

模型 4 —波动性百分比

Volatility refers to the amount of daily price movement of the underlying instrument over an arbitrary period of time. It's a direct measurement of the price change that you are likely to be exposed to — for or against you — in any given position. If you equate the volatility of each position that you take, by making it a fixed percentage of your equity, then you are basically equalizing the possible market fluctuations of each portfolio element to which you are exposing yourself in the immediate future.

波动性的定义是一段时间内某一特定合约的日内价格波动情况。它是你的任何一个头寸所面临的当日价格波动的最直接的衡量值。如果你保持每一笔头寸承受的波动性都等于总资本的一个固定比率,那么你就可以基本上均衡了每一笔投资对于你投资组合的影响。

Volatility, in most cases, simply is the difference between the high and the low of the day. If IBM varies between 115 and 117.5, then its volatility is 2.5 points, However, using an average true range takes into account any gap openings. Thus, if IBM closed at 113 yesterday, but varied between 115 and 117% today, you'd need to add in the 2 points in the gap opening to determine the true range. Thus, today's true range is between 113 and 117% or 4% points.

在大部分的情况下,波动性等于日内最高价和最低价的差值。如果IBM公司股票在115-117.5之间波动,那么它的波动性就是2.5点。但是,必须考虑跳空的因素。如果IBM昨天收盘113,那么今天它的波动性就必须加上跳空高开的2点。如果今天从115上涨到了117,那么今天的波动性就是4点。

Here's how a percent volatility calculation might work for money management. Supposed that you have $50,000 in your account and you want to buy gold. Let's say that gold is at $400 per ounce and during the last ten days the daily range is $3.00. We will use a 4-day simple moving average of the average true range as our measure of volatility. How many gold contracts can we buy?

下面详细的解释这个模型的计算方法。假设你有一个50,000美元的账户,你现在想买入一些黄金。目前的金价是400美元一盎司,过去10天日内波动大约3美元。我们将会使用4天的价格波动区间的平均数作为衡量波动性的指标。我们现在可以买多少个合约?

Since the daily range is 53.00 and a point is worth $100 (since the contract is for 100 ounces), that gives the daily volatility a value of $300 per gold contract. Let's say that we are going to allow volatility to be a maximum of 2% of our equity. Two percent of $50,000 is $1,000. If we divide our $300 per contract fluctuation into our allowable limit of $1,000, we get 3.3 contracts. Thus, our money management, based on volatility, would allow us to purchase 3 contracts.

由于目前的波动性是3点,每一个点的价值100美元,那么一份金合约的波动值是300美元。我们现在限制波动在总资本的2%。50,000美元的2%就是1000美元,那我们可以买入3,3份合约,也就是3份。

Lets do one more example, using a total equity model. Gold is now $405 per ounce, so the value of our open position has increased our equity by $500 per contract or $1,500. Thus our total equity is now $51,500. We now want to buy a bond contract, Lately, bonds have been fluctuating by about 0.75 points per day. Thus, the dollar value of the daily fluctuation is $750 (0.75 times $1,000 per point). Our money management says to limit our risk to 2% of equity, and 2% of $51,500 is $1,030. The daily $750 fluctuation in bonds, divided into $1,030 works out to be 1.37, allowing us to buy one bond contract.

我们多举几个例子。现在金价到了405美元,所以你的账户也增加了500美元,3份合约就是1500美元。现在的总资本就是51,500美元。现在我们想买入一份债券合约,最近它的波动性是0,75点每天,每个点1000美元,也就是每份合约波动值750美元。51,500美元的2%是1,030美元,除以750,我们可以买入1份债券合约。(这里面用的模型是总资本模型)

Notice that the daily fluctuation from bonds ($750) is about two and a half times the daily fluctuation in gold ($300). As a result, we've ended up with three gold contracts compared with only one bond contract. Thus, we can expect about the same amount of price fluctuation, in the short term at least, from both positions.

值得注意的是债券合约的波动性是黄金合约的大约2.5倍。因此,我们买入了3份黄金合约而只有1份债券。通过这种方法,我们可以在短期内保持所有头寸的波动性一致。

If you use volatility in your money management, you might also want to limit the total amount of volatility to which your portfolio is exposed at any one time. Five to ten percent is a reasonable number. Suppose, for example, that your exposure were 10%. Thus, you could have five positions, since your individual position limit is 2%. If all of your positions went against you at once in a single day, and you stayed in the market, it would mean that you could lose as much as ten percent of the value of your portfolio in a single day.

如果你使用波动性模型,那么很可能你也会想限制在任意时间所有头寸的总波动性。5-10%是一个比较合适的值。举个例子,你愿意承受10%。因此你可以最多持有5笔头寸,因为单笔有2%的限制。如果当天市场中所有的头寸都不利于你,那么意味着当天你的投资组合就要贬值10%。

How would you feel if your $50,000 portfolio went down to $45,000 in a single day? If that's too much then 2% and 10% are probably too big for you, you make money and conserve profits. It includes concepts like percent risk, group risk, making daily or hourly adjustments, optimal f, and playing the market's money. I would suggest that you study Part I until you really understand it before you move onto Part II.

当你一天损失10%的时候会感觉如何呢? 如果太多,那么2%,10%的设置可能对你来说太大了。(以下都是废话,不啰唆了,看明白了第一部分再继续第二部分)

Reference Notes for Part 1:

1. Brinson, Singer, and Beebower. Determinants of Portfolio Performance II: An Update, Financial Analysts Journal, 47,May-June, 1991, p 4049.

资金管理专题-第二部分

第二部分将继续本专题。资金管理是你的交易系统当中告诉你在市场中开新头寸时开“多少”的那部分。 第一部分讨论了三种确定资本的模型: total equity, core equity, and reduced total equity. 也讨论了三种资金管理模型: 1) the one unit per so much equity; 2) the leverage model; 3) the percent margin model; and 4) the percent volatility model. 这四种模型可以跟任意资本模型结合变成12种不同的资金管理方法-也许当你自己组合或者加入创新的资金管理方法的时候会更多。

在第二部分,你将会学习到5种类型的资金管理模型。你也会学习到如何利用这些模型设计符合你自己特定目标的交易系统。另外,我们也探讨了创造性的资金管理方法,这将对你的系统开发大有裨益。

模型 5 —风险百分比

当你开一个新头寸的时候,知道在哪个点退出以保存你的资本是基本的。这就是你的“风险”。这是除了滑点和跳空(runaway)以外最坏情况下你的损失。

最常用的一种控制头寸大小的资金管理系统是风险的函数。让我们看一下这种系统如何运作。假设你想以380美元/盎司的价格买进黄金。你的系统告诉你如果价格跌破370美元你必须止损离开。因此,最坏情况下你的风险是每份合约1000美元(10点×100美元/点)。

你有一个50000美元的账户。你想把你在黄金头寸上的最大风险限制在总资本的2.5%大约为1250美元。用你的总风险1250美元除以每份合约的风险1000美元得到1.25个合约。因此,在风险百分比模型下你仅可以买入1份合约。

假设你当天还得到一个放空玉米的信号。黄金的价格依旧是380美元/盎司,所以你的账户目前的资本依旧是50000美元。利用Total Equity Method, 你仍有1250美元可以用来在玉米上冒险。

假设玉米当前价格是3.03美元,你可以接受的最大的风险为每份合约价格上涨5每份至3.08美元。5美分的风险换算一下就变成250美元每张合约(乘以5,000普尔士每张合约)。用1250美元除以250美元,那你可以放空5份玉米合约。

在这些例子当中,我们使用了the Total Equity Model来计算风险,总资本等于账户现金加上所有头寸的价值。为了对比,让我们看一看core equity model的风险情况。在the core equity model下, 所有新开头寸的风险都将从账户现金当中减掉,只有账户当中剩余的现金被用来做计算。

首先我们买入一个黄金合约并且我们的风险暴露是1000美元。在the core equity model下,我们的资本减少了1000美元,资本为49000美元。因此,我们只有49000美元用来计算下一次开头寸的风险。因为我们最大可以冒2.5%的风险,1225美元。

我们以250美元的风险放空玉米合约。如果用250美元除以1225美元,你可以得到4.9份合约。因此,the core equity mode可以让你放空4份玉米合约。值得注意的是,通常我们为了保守不超过我们设定的参数,对计算结果规整。

假设你不在同一天买入玉米。6个星期后你得到一个放空玉米的信号。此时,你买入的黄金合约已经上涨到490美元/盎司。因此,你的头寸有了11000美元的利润,总资本目前变为61000美元。

如果你使用the total equity model,你可以用61000美元的2.5%冒险,也就是说你可以承受1525美元的风险。如果每份玉米合约在发生信号时风险为250美元,你的资金管理策略允许你放空6.1份合约。与此同时,the core equity model依旧基于49000美元的资本让你放空4份合约。

很明显,三种模型当中,最保守的就是the core equity model,其次是Reduced total equity,最后是the total equity model。

风险百分比模型与波动性百分比模型对比的情况如何呢?表格4给出了一个采用了风险百分比模型管理资金的55/21天突破系统。初始资本为100万美元。

Table 4: 22:21 Breakout System with Risk Money Management

如果你对比表格3和表格4,你可以发现不同。If you compare Table 4 with Table 3 from Money Management Part I, you'll notice the striking difference in the percentages at which the system breaks down. These differences are the result of the size of the number (i.e., the current 21-day extreme against you versus the 20-day volatility) that you must take into consideration before using the equity percentages to size positions. Thus, a 5% risk based upon a stop of the 21 day extreme appears to be equivalent to about 1% of equity with the 20 day average true range. These numbers, upon which the percentages are based, are critical. They must be considered before you determine the percentages you plan to use to size your positions.

最大的风险回报率发生在风险为25%的时候,但是你必须忍受84%的账户Drawdown。另外,风险超过10%的时候,便会有追缴保证金的通知出现。

如果你用100万美元和1%的风险交易,你的头寸大小将会和10万美元10%风险的交易一样。因此,在表格4中我们建议你最少以10万美元且不超过0.5的风险交易。但是在0.5%的风险下,系统的回报非常的少。现在你明白为何需要100万美元才能开始交易了。

你应该在每个头寸上承受多大的风险呢?你的总风险取决于你设置的止损的大小和你的交易系统的期望收益。比如,大部分长期走势跟踪系统的追踪止损范围非常的大,是每日价格波动的好几倍。另外,大部分的走势跟踪系统的命中率为40-50%并且盈亏比在2.0-2.5之间。如果你的系统没有落入这个区间,你就需要确定你自己的风险比率。

根据上面的原则,如果你管理别人的资金,你应该在每个头寸上所冒的风险不超过1%。如果你管理自己的资金,你的风险可以取决于你自己能够接受的水平。任何时候低于3%都是没有问题的。如果你冒的风险超过3%,你就是一个枪手,最好能够明白为了你的预期利润你所冒的风险到底有多大。

如果你的交易系统使用非常小的止损,你必须利用比较小的风险水平。比如,如果你的止损小于每日的平均价格波动,你就需要考虑把风险控制在我们这里提到参考值的一半以下。另一方面,如果你有比较高的期望收益,(你的风险回报比大于3且命中率高于50%),占资本总额较高比率的风险也是比较安全的。那些利用紧密止损的交易者或许可以考虑波动百分比模型来调整头寸。

大部分的投资者这都不考虑这些模型。相反,他们总是趋向于使用等单元模型。让我们看一下这些模型如何在股票交易中使用。

假设你想买入IBM的股票并且拥有一个50000美元的账户。IBM每股的价格目前是111美元。你退出止损的价位在107美元,每股承受4美元的下跌风险。你的资金管理策略允许你冒2.5%(1250美元)的风险。1250除以4得312.5股IBM。

如果你在111美元的价位处买入了312股IBM,这将花费你34632美元的资金,超过了你账户资金的一半。为了不至于超过你账户保证金的限制,你最多可以买2次。事实上,如果你在100美元处止损卖出,那么2.5%的风险下,你可以买入1250股。但是,这将花费你128750美元的资金,在保证金的方式下你的账户也难以支付得起。 Nevertheless, you are still limiting your risk to 2.5%. The risk calculations, of course, were all based upon the starting risk — the difference between your purchase price and your initial stop loss.

模型 6 —周期资金调整s

Consider monitoring your money management on a periodic basic — weekly, daily, or even hourly — to maintain a fairly constant exposure. Think about the potential here. You could monitor each position and make sure that your exposure was always 1% or less. 这意味着,除了一些巨幅波动的市场,你的最大风险始终应该在1%。

Your exposure could be monitored using any of the money management models given or any of the equity models suggested. However, I would suggest that you consider monitoring both ongoing risk and ongoing volatility with a total equity calculation.

下面将讲述如何进行每日的风险和波定性监测。假设你有一个200000万美元的账户并且持有黄金和玉米的头寸。你的资金管理策略要求你保持初始风险在总资本的2%以内,持仓风险保持在3%以内。你已经在400美元/盎司的价格买入了4个黄金的多头合约,止损价位在390美元,所以你每份合约的风险为1000美元,总风险为4000美元。Here's how daily monitoring for risk and volatility might work. Lets suppose you have a $200,000 account and you have open positions in gold and corn. Your money management says you will keep your initial risk to 2% of equity and your ongoing risk at 3% of equity. You've purchased four long gold contracts at $400 per ounce with a stop at $390, so you now have open risk of $1,000 (i.e., 10 points times $100 per point) per contract, or $4.000.

第二天收盘的时候你重新监控你的头寸。假设黄金的价格上涨到了440美元。你现在的止损变为410美元。现在你有了16000美元的利润。因此你的总资本变为216000美元。你在黄金头寸上的风险变为30美元每份合约。总风险变为12000美元。The next day at the close you monitor your open risk. Lets say gold has jumped to $440 overnight. Your gold stop is now $410. The $40 increase in gold has increased your equity by $16,000 (i.e., 4 contracts times 40 points times $100/point). Thus, your total equity is worth $216,000. Your open risk for gold is now at $30 (i.e., $440 less $410) per contract. The total value of that open risk is $3000 (i.e., 30 times $100 per point) per contract or $12,000.

你已经决定要每天检查你的头寸并且将最大的风险保持在总资本的3%以内。更重要的是,You have decided to monitor your open risk on a daily basis and keep it at 3% of total equity. Doing so still allows you to follow your trading model. More importantly, it reduces the chances of any large declines in equity occurring in a short period of time. 由于216000美元的3%是6480美元,你现在仅可以持有2分黄金合约。现在你必须卖出2份黄金合约。

可能你会说:“为什么不提止损价位来达到继续持有4份合约?”记住,资金管理是交易系统当中独立的、仅仅告诉你“多少”的那部分。如果你改变了你的止损价位,你就不可能继续遵循你的交易系统,它现在告诉你止损价位在410美元-你的离市策略和自己的资金管理已经开始合并了。通过卖出2份合约,你减少了头寸的风险并将最大风险维持在自己可接受的范围之内。在黄金继续上涨的过程中你依旧有头寸可以用并且如果市场行情不好,你也不会一下子就损失自己所有的利润。因此,你做了一个资金管理的决定让你的投资组合维持固定的风险。

接下来说明波动模型上如何做同样的调整。假设你有一个200000美元的账户并且决定以3.00美元的价格买入玉米合约。你的模型告诉你必须买入足够的合约以确保日价格波动只占总资本的1%。另外,你的日波动性决不能超过总资本的2%,每周一你检查一次头寸。

假设当你买入的时候日波定性为8美分。转换成价格就区间就变成了400美元/天(5000 bushels×8 cents)。你决不让波动超过你总资本的1%或者2000美元,所以你可以买入5份合约。

假设玉米下个月上涨到了4.00美元,持有的合约带来了25000美元的利润。日波动性现在变为20美分。由于你的总资本现在已经变为225000美元,现在你可以承受的波动性变为总资本的2%即4500美元。但是现在玉米每份合约的波动性是1000美元。你持有5份合约,总波动性为5000美元。结果就是你必须按照你的自己周期波动性管理模型卖出1份合约。

Generally, when something begins to increase in price dramatically the volatility will also go up dramatically. If you are in such a move, you might find that you have a $100,000 starting account that's now worth $500,000. In addition, because of the large increase in the daily price volatility, you might find that your account changes value by as much as $100,000 each day. By keeping a volatility adjustment as part of your money management, you protect your open profits and prevent such large daily fluctuations in your account.

通常当一些东西使价格快速上涨的时候,波动性也会随之上涨。如果你遇到这种情况,很可能10,000美元的账户已经变成了50,000美元。另外,由于日波动性的大幅增加,你可能会发现你的账户净值日变化也会达到惊人的100,000美元。通过周期性的波动性百分比调整,你就可以保护你的利润并防止如此巨大的账户净值日波动。

I've shown examples of periodic monitoring of your money management for the risk and volatility models. However, you can do periodic monitoring with all of the models mentioned. You can even do a combination of them, such as monitoring risk and volatility simultaneously. Are you beginning to see the possibilities?

我已经给出了对于风险百分比和波动性百分比模型的周期行调整案例。但是你可以对所有的这些模型运用周期调整。你也可以做一些组合,同时调整波动性和风险。你看到了这种可能性了吗?

模型 7 –Group Control

One of the most important factors in risk control is having a diversified portfolio. Trading a number of items generally spreads your risk around, provided that price changes in those items have a low-correlation.

控制风险最重要的一个因素就是多样化的投资组合。交易一定数量的商品通常可以分散你的投资风险,如果这些市场具有较低的相关性的话。

Here's how Group Control works. Suppose you are trading a system that makes money in 5 of 12 trades. The average winning trade is about 2.5 times the size of the average losing trade. In addition, the system only generates about one trade per month per investment vehicle. If you only traded one instrument you would have about one trade each month. This means your chances of having a winning month are only about 41.7%. You could easily have six months of losses and become discouraged.

假设你有一个系统同时交易5-12个市场。风险回报比大约是2.5:1,另外这个系统每周大约只产生2比交易。

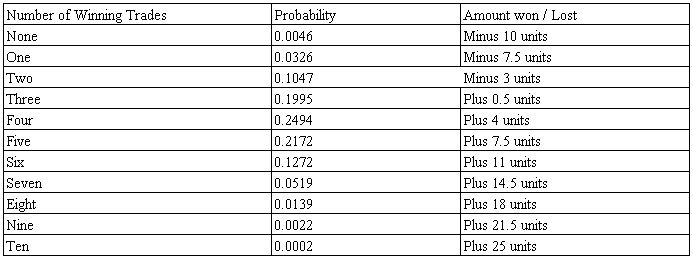

Suppose that you trade 10 different instruments that are all independent of each other. Each one of them, let's say, is likely to generate a trade each month. Table 5 (on the next page) shows 1) the number of losing trades out of 10 you might have, 2) the chances of that happening, and 3) the amount of money you'd make or lose on that combination assuming an equal unit risk on each trade and a 2.5-to-l reward-to-risk ratio.

假设你同事交易10个相互独立的市场。每个市场大约每个月产生一笔交易。表格5显示:

(1) 每10笔交易中失败、成功的次数。

(2) 发生的概率

(3) 当前投资组合的盈利或者亏损(假设所有的投资组合成分具有相同的风险和1:2.5的风险回报比。

Notice that you would need to have less than three winning trades out of ten in order not to make money. The chances of that occurring on a given month (in which you have 10 trades) is the sum of the first three probabilities or 14.2%. Thus, with 10 independent markets, you only have a 14% chance of having a losing month.

注意你必须至少有3次成功的投资才能不至于亏损。低于3次的概率是14.2%,因此在10个相互独立的市场当中你只有14%的概率当月亏损。

Table 5: Possible Results with 10 Independent Units

When you try to put this plan into effect, however, you run into the difficulty that most trades are not independent. Stocks tend to go up and down together. During bull markets, there are tendencies for certain groups of stocks to move together. For example, much of the stock market move in 1995 was due to technology stocks. When the move was over, technology stocks tended to fall as a group — and, as early as 1996, many of them already have.

但是当你运用这个策略的时候会遇到困难,因为大部分的市场都是有关联的。股票更趋同于一起涨跌。在牛市当中,是板块轮动涨跌。举个例子,1995年上涨的大部分股票都是技术股。而牛市结束的时候,技术股又集体下跌。

Commodities also tend to have groupings that are highly correlated. Grains, metals, meats, stock indices, currencies, energies, etc. might each tend to move as a group in the same direction at the same time.

商品期货市场大部分时候也具有相同的特性。谷物,金属,肉类,股票指数期货,外汇,能源等都可能在同一时间整体向同一个方向运动。

Thus, your goal through money management is to minimize the number of highly correlated positions in your portfolio at any given time. You could do this by preselecting a limited number of vehicles in which to invest or trade. This is the portfolio selection part of system design.

因此,你资金管理的目标是最小化高度相关的市场头寸的风险。你可以通过实现设置一个帐户的风险限制。这也是系统设计中投资标的选择的一部分。

However, you can also accomplish this diversification by having a money management algorithm limiting your total group exposure by using one of the methods presented so far. For example, you could limit the amount of leverage in any one group. You also could limit the amount of risk, volatility, leverage, margin, or total number of units of exposure that you have in any one group. This has the advantage of limiting your group exposure, while avoiding the possibility of missing a good opportunity because it is not part of the portfolio which you have preselected to trade.

但是,你也可以通过前面讲过的资金管理策略来限制某一组头寸的总的风险暴露。比如说,你可以限制风险百分比,波动性,保证金比例等等。这可以让你不错过机会同时又限制了你的风险。

Suppose your overall money management algorithm is to limit the new risk on any given position to 1% of equity. Your model calls for you to trade any liquid commodity that tends to fit your trading model. When you do that, however, you might find yourself with a portfolio of US bonds, 10 year notes, t-bills, eurodollars, munibonds, German Bunds, etc. That wouldn't be prudent, because your entire portfolio would be controlled by interest rate fluctuations. As a result, you decide to limit your total group risk to 3%. Based upon your initial risk allocation, the most you could have is three 1% positions in any one commodity grouping.

假设你的策略要求对于任意新开头寸的风险限制是总资本的1%。你的系统告诉你交易出现入场信号的任何市场。如果你那么做,你可能发现自己投资组合里面有10年期债券,国债,T债,德国债券等等。这不是一个谨慎的策略,因为所有的头寸都会收到利率变动的影响。最后你决定把所有这几个高度相关市场的群体风险限制在3%。

Note that your group money management model could be based upon any of the first five models presented — the one unit per so much equity model, the leverage model, the margin model, the volatility model, or the risk model.

群组策略可以运用到前面提到的任意一种资金管理模型上。

模型 8 — Portfolio Heat

It's also important to limit the total risk to which your portfolio is exposed. This value has been called portfolio heat by Ed Seykota and Dave Druz2. Most great traders would argue that 20-25% is probably a maximum level for your portfolio heat. However, portfolio heat should also depend upon how good your system is. For example, a 60% system with average gains that are 4 times the size of average losses could have a much greater portfolio heat than a 50% system with a 2-to-1 gain-to-loss ratio

限制你投资组合的总风险同样非常重要。这个总的风险被Ed Seykota和Dave Druz叫做Portfolio Heat(简称PH值)。大部分的投资人可能认为20-25%的PH值比较合适。但是,PH也取决于你的交易系统,一个命中率60%风险回报比在1:4的一个系统应该要比一个50%命中率风险回报比在1:2的系统采用更大的PH值。

A good rule of thumb for determining your portfolio heat is to calculate the Kelly criterion for your system (see page 50). The Kelly criterion gives you a good approximation for the maximum risk possible for your system. Eighty percent of that value is probably a good number to pick for your total portfolio risk. However, if 80% of the Kelly criterion for your system is still above 25%. you could be flirting with danger.

一个好的计算PH值的方法是用Kelly公式(译者注:Kelly公式大家可以查阅Wiki百科,上面有详细的利弊介绍)。Kelly公式可以计算出可能使你的系统产生最大利润的头寸规模。18%可能是一个比较合适的数字。

Once you have a number in mind for your portfolio heat, work backwards to determine the individual risk on any given position. How many positions are you likely to have on at any given time? Take your maximum number of positions and divide that into the number you've just calculated for your portfolio. That's probably a good estimate for the maximum amount of risk you should assume for a single position. However, these guidelines also make the assumption that you are going for maximum gains in your portfolio.

一旦你头脑当中对你的投资组合总的风险有了概念,你就可以反推你每一笔单独的头寸所承受的风险。如何确定呢?用你最大的头寸数量去除计算出来的PH值。这可能是你确定单笔投资能够承受的最大风险的最好的办法。但是这些计算的基础是你希望得到最大的回报。

Portfolio heat was a term coined for the total risk of your portfolio. However, you could apply any of the first five models, or a combination of them, to your total portfolio. Notice how money management is getting more complex and more sophisticated as we add more models.

PH值是关于你投资组合总风险的一个创新性的术语。但是,你可以应用到前面所讲的5个模型或者他们的组合当中。我们引入的模型越来越多,资金管理就会变得越来越复杂和精细。

Model 9 —多头VS空头头寸

Several famous traders have distinguished between long and short positions in considering group risk and portfolio heat. They believe that they somewhat counteract each other, so that one long position and one short position — each at your desired market money management level -would just need to be counted as one unit. In other words, a 1% risk in a long corn position and a 1% risk in a short bond position might be grouped together as one 1% unit of risk. This puts an interesting twist to many of the money management models already presented.

基于PH值和群组策略,有一些很著名的交易员是把多头和空头头寸一起考虑。他们认为有些市场是相互影响的,就把一个多头头寸和一个空头头寸当作一个整体。比如一个1%风险的多头和1%风险的空头头寸最终会被合并成一个1%风险的群组。这样就可以把前面提到的不同的资金管理策略进行有趣的捆绑。

Equating different long and short positions, of course, can only be used with those models which equate your exposure. Thus, it would not be applied to Model 1, but you could apply it with Models 2 through 5.

当然,均衡不同的多头和空头头寸必须是在相同的风险暴露的前提下。因此你不可以将它用到模型1上,但是可以用到2-5上。

使用资金管理达到你的交易目标

Given the models and ideas in money management presented in this special report, it is now possible for you to design a system to meet your objectives — such as trading a high-reward-to-risk ratio system for managing other people's money or getting a very high rate of return trading your own money. You just have to know what you want to accomplish and then focus on that. You also need to realize that money management is the area of your system that will have the greatest impact on the bottom line - your profits, your drawdowns, and your reward-to-risk ratio.

上面已经给出了本报告所有的资金管理模型,现在是你设计你的系统完成你投资目标的时候了。设计一个高回报低风险的系统来管理别人的资金或者是设计一个高回报的系统来管理你自己的资金。你需要理解资金管理是对你的投资系统的drawdown,利润,风险回报比影响最大的因素。

设计一个高风险回报率的资金管理系统

The first part of your system design should focus on building the highest possible expectancy into your system, where expectancy is defined by the following formula:

交易系统设计的第一部分集中在了高的期望收益上,期望收益的计算公式如下:

期望收益=(盈利的概率*平均利润)-(亏损的概率-平均亏损)

Expectancy =(Probability of Winning * Average Win) Minus (Probability of Losing * Average Loss)

The main variables in developing a high expectancy system are to find: 1) an entry technique that will give you the highest possible percentage of winning trades; 2) an initial stop loss that will preserve your capital; and 3) an exit (or multiple exits) that will capture as much money as possible from the market. Once you've developed the highest possible expectancy, I would suggest that you take the following steps in order to develop the best reward-to-risk ratio using money management.

开发一个高期望收益的系统的关键是找到:1. 成功率比较高的入市技术。 2. 合适的止损保护你的资本。 3. 可以让你赚到足够的利润的出场点。一旦你完成了这些开发,我建议你通过以下的步骤来开发出一个高回报低风险的系统。

1. In a given period of time, the more trades you have with the same expectancy, the less likely it will be that you will have a loss. Consider developing a high expectancy system that generates lots of trades during the minimum time period in which you must be profitable. One trade might only have a 30-40% chance of being profitable. But 50 such trades with a high expectancy over a similar time period are highly likely (i.e., 75% or better) to be profitable - especially if the trades are non-correlated.

在一个给定的时间段内,相同期望收益的系统交易的频率越多你亏损的可能性越小。一个在很小的时间段内产生大量交易的高期望收益系统的盈利性是非常可观的。一笔投资可能只有30-40%的命中率,但是连续50笔高期望收益的系统就会产生很大的利润。

2. Examine the concept behind your idea and determine if there is a money management model presented that logically fits the system you've developed. For example, if you use very tight stops, then a percent risk model would be very dangerous unless you use very low risk (i.e., 0.1% risk). Consequently, a model such as percent volatility might fit you better.

检查你系统背后的理念,确定本文提到的一些模型是不是符合你的系统。举个例子,如果你使用一个紧密的止损,那么风险百分比模型就比较危险。波动性百分比模型可能比较适合你。

3. Determine what fits best? Test your system with all of the models presented, using different percentages of equity and different equity models. Determine which model and what percentage gives you the best reward-to-risk ratio.

确认那一种模型更适合。用上面所有的模型来测试你的交易系统,不同的百分比模型搭配各种资本计算法。看看那一种组合能带给你最好的回报比。

4. Consider using daily money management adjustments. This means limiting the maximum exposure of your total system and any given positions. For example, what if you calculated your risk per position hourly and never let it go beyond 2%? It would, tend to smooth out both your equity fluctuations and your peace of mind — knowing it was always 2%.

考虑每天使用周期策略。它可以控制你投资组合和任意头寸的风险暴露。如果你的每笔头寸每个小时的风险都不超过2%,你就可以保持头脑的平静和资金波动的平稳。

5. Think about using multiple trading systems with different money management models. Perhaps the most sophisticated method of keeping a high reward-to-risk ratio is to employ several non-correlated trading systems. Each system should have its own money management parameters, depending upon what you are trying to do with that system. When using multiple systems in this manner, you should be able to generate a lot of high-expectancy trades that are non-correlated. As a result, you should have profitable trading months as long as you have markets in which at least one of your systems can make money.

考虑使用多种交易系统并配之不同的资金管理策略。可能最好的获得高回报低风险比的方法就是同时使用几个不相关的交易系统。每种系统都有自己的风险管理参数。如果使用这样的策略,你应该产生大量不相关的高期望收益的交易。最后的结果就是,当你至少有一个系统在市场中赚钱的时候,你的投资组合就可以当月盈利。

6. Use some creative money management to make your system unique. The models presented have all given been linear. If your portfolio goes up, you risk more. If your portfolio goes down, you risk less. Consider using creative money management. I'll show you examples of creative money management in the next section, but creative money management mostly depends upon your creativity If you put as much effort into creative money management as most people put into figuring out how to enter the market, your trading methodology should be superb.

使用创造性的资金管理策略使你的系统独一无二。上面所有的模型都是线性的。如果你的投资组合增长了,你冒的风险可以更多,反之亦然。考虑一些创造性的策略。下一个部分里面我讲给出几个创造性的资金管理策略的例子,但是这些策略取决于你的创造性。如果你像大部分投资者投入巨大的精力寻找入场点那样研究创造性的资金管理策略,那么你的交易方法将会是卓越的。

结论

我写这份专题的本意是让你能够用思考资金管理(特别是创新的资金管理方法)代替仅仅寻找入市技术。资金管理是一个交易系统当中最重要的部分。因为心理上的原因大部分的人根本就不考虑资金管理。这些资金管理的方法要比你正在研究的最新的入市方法更能对你的账户利润(或者损失,如果误用的话)产生影响。

参考

1. 这是一个基本的海龟系统。回报率的不同也因为资金管理方法和海龟的资金管理方法不同。For information about the Turtle systems contact Russell Sands at 305-895-2951. Mr. Sands currently says he trades 1 contract per $30,000 in his proprietary account and 1 contract per $100,000 in his fund. That suggests that either Mr. Sands doesn't understand the original Turtle money management (as presented in his manual) or he's given up on it.

2. Ed Seykota and Dave Druz. Determining Optimal Risk. Technical Analysis of Stocks and Commodities, March 1993, p. 46-49.

3. Ralph Vince The New Money Management. New York: Wiley, 1995.

4. Ralph Vince Portfolio Money Management. New York: Wiley, 1995.

5. Vince的假设-他的大部分观点基于这些假设-显示了人类心理上的天真理解。比如,Vince不理解人们为何有了一丁点的小利润的时候就想保护它,亏损的时候却又敢冒险。

6. 据我所知,已经有人用这种资金管理方法产生了1000%每年的回报(使用一种在本专题中提到的类似55-21天通道突破的交易系统)。

7. 期权是另一种非常好的风险控制方式,但它已经超出了本专题的讨论范围。